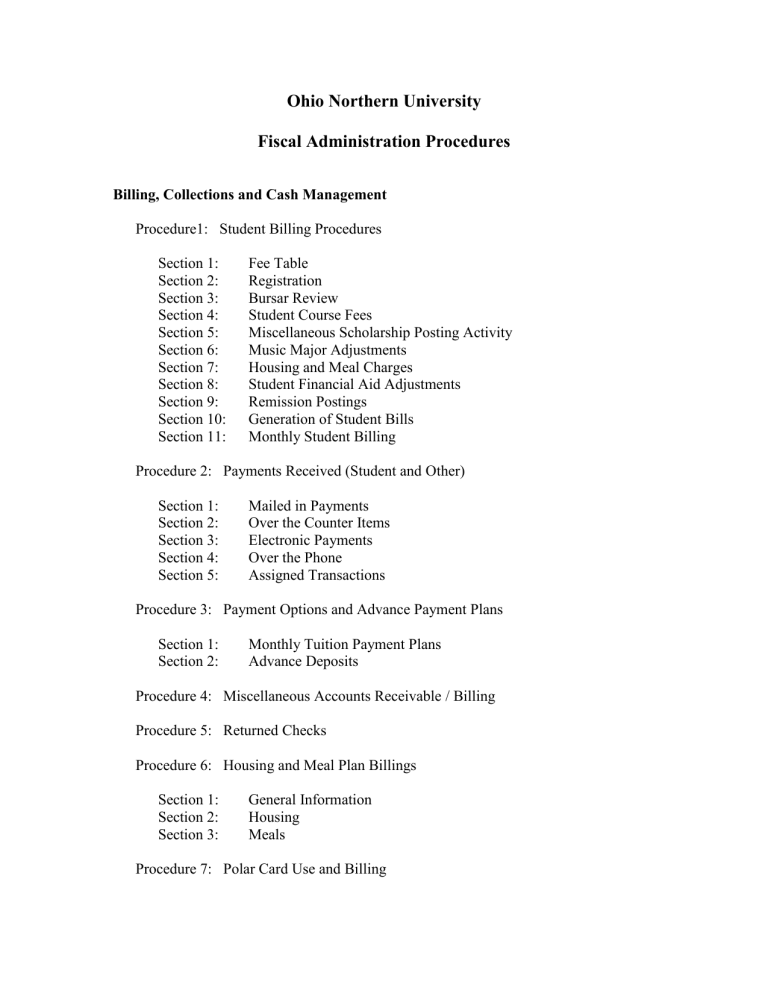

- Ohio Northern University

Ohio Northern University

Fiscal Administration Procedures

Billing, Collections and Cash Management

Procedure1: Student Billing Procedures

Section 1: Fee Table

Section 2: Registration

Section 3: Bursar Review

Section 4: Student Course Fees

Section 5: Miscellaneous Scholarship Posting Activity

Section 6: Music Major Adjustments

Section 7: Housing and Meal Charges

Section 8: Student Financial Aid Adjustments

Section 9: Remission Postings

Section 10: Generation of Student Bills

Section 11: Monthly Student Billing

Procedure 2: Payments Received (Student and Other)

Section 1: Mailed in Payments

Section 2: Over the Counter Items

Section 3: Electronic Payments

Section 4: Over the Phone

Section 5: Assigned Transactions

Procedure 3: Payment Options and Advance Payment Plans

Section 1: Monthly Tuition Payment Plans

Section 2: Advance Deposits

Procedure 4: Miscellaneous Accounts Receivable / Billing

Procedure 5: Returned Checks

Procedure 6: Housing and Meal Plan Billings

Section 1: General Information

Section 2: Housing

Section 3: Meals

Procedure 7: Polar Card Use and Billing

Procedure 8: Student Refunds

Procedure 9: Late Fees, Finance Charges and Holds

Section 1: Tuition Related

Section 2: Graduate Holds

Section Related Forms

Budgeting and Accounting

Procedure 1: Operational Budget Preparation Process

Procedure 2: Capital Budgeting

Procedure 3: Project and Construction Budgeting

Procedure 4: Tuition and Fee Annual Increases

Procedure 5: Budget Monitoring

Procedure 6: Capital Carryover

Procedure 7: Gift Acceptance and Processing

Section 1: Monetary Gifts

Section 2: Gifts in Kind

Section 3: Day End Processing

Procedure 8: University Investments

Section 1: Investment Types

Section 2: Investment Processing

Procedure 9: Day, Month, Quarter, Semi-Annual and Year End Processing

Section 1: Daily Cashiering Sessions and Cash Drawers

Section 2: Daily Reconciliations and Subsequent Reviews

Section 3: Month End Processes

Section 4: Quarterly Processes

Section 5: Semi Annual Processes

Section 6: Year End Processes

Section Related Forms

Procurement and Other General Services

Procedure 1: Procurement

Section 1: General Purchasing Process

Section 2: Open Purchase Orders

Section 3: Purchase Under Price Agreement

Section 4: Credit Cards in Purchasing Department

Section 5: Office Supply Purchasing

Section 6: Reference Number System

Procedure 2: Credit Card Administration and Processing

Section 1: Credit Card Administration

Section 2: Credit Card Processing

Procedure 3: Accounts Payable

Section 1: Establishing a New Vendor

Section 2: Processing Requests for Payment

Section 3: Check Runs

Procedure 4: Manual Check Processing

Procedure 5: Petty Cash

Procedure 6: Travel Expenses

Procedure 7: Moving Expenses

Procedure 8: Faculty Enrichment

Procedure 9: Electronic Banking Transactions

Section Related Forms

Payroll and Human Resources

Procedure 1: Payroll Processing

Section 1: Hourly Employee Time Sheets

Section 2: Student Payroll

Section 3: Monthly Payroll Processes

Procedure 2: Human Resources Processing

Section 1: New Hires

Section 2: Change in Wage Rates, Benefit Status, etc.

Section Related Forms

Financial Aid

Procedure 1: Scholarships

Section 1:

Dean’s and Invitational Scholarships

Section 2: Outside Scholarships

Procedure 2: FAFSA Review

Procedure 3: Award Letters

Procedure 4: Returning Student Scholarship Review

Procedure 5: Student No-Shows

Procedure 6: Student Course Add/Drops

Procedure 7: Student Withdrawal

Procedure 8: Student Loan Processing

Procedure 9: Parent PLUS Loan Processing

Procedure 10: Perkins and Health Professional Loans

Procedure 11: Partial Student Loan Refunds

Procedure 12: University Loans

Section 1: General University Short Term Loans

Section 2: Pierstorf Loans

Section 3: Schell or Schmidlapp Loans

Section 4: Elzay Loans

Section 5: Bonfiglio and Schertzer Pharmacy Loans

Section 6: Law College Loans

Procedure 13: Other Loans

Procedure 14: School as Lender

Procedure 15: Student Award Draw Downs

Procedure 16: Federal Work Study Monitoring

Procedure 17: Non-Traditional Pharmacy Testing

Section Related Forms

IT

Procedure 1: Software in Use

Section 1:

Section 2:

Section 3:

Adirondak

CBORD

Banner

Section 4: Touchnet

Billings, Collections and Cash Management

Table of Contents

Procedure 1: Student Billing Procedures .........................................................................

Procedure 2: Payments Received (Student and Other) ....................................................

Procedure 3: Payment Options and Advance Payment Plans ..........................................

Procedure 4: Miscellaneous Accounts Receivable/Billing ..............................................

Procedure 5: Returned Checks .........................................................................................

Procedure 6: Housing and Meal Plan Billings .................................................................

Procedure 7: Polar Card use and Billing ..........................................................................

Procedure 8: Student Refunds ..........................................................................................

Procedure 9: Late Fees, Finance Charges and Holds .......................................................

Section Related Forms……………………………………………………………………

BILLINGS, COLLECTIONS and CASH MANAGEMENT

Procedure 1: Student Billing Procedures

1.

Fee Schedules a.

Ohio Northern University’s tuition and fee schedules are updated annually and are made available to the students through college catalogs and other publications. b.

Once the tuition and fee schedule has been approved by the Board, it is issued to the Bursar. The Bursar submits a request to the Registrar’s Office to update the fee tables with the approved fees for the year.

2.

Registration a.

Students complete and get approval on their course registration form register during a defined two-week period. Traditionally, students are assigned a registration period.

Online registration: Students may register online at any time during the registration period as long as there is not a hold placed on their account.

Online registrations occur in LUMINUS which performs a direct information feed to Banner. Online registrations require no input by the Registrar’s

Office.

Registrar’s Office registration: Students go to the Registrar’s Office.

Personnel in the Registrar’s Office input the information from the course registration form on to Banner. When registration input has been completed, the student is given the pink copy of the registration form as indication their courses were input into Banner.

Late Registration: Registration that occurs after the two week window has closed and bills have been generated and issued. In the event a late registration occurs, the Registrar’s Office sends the yellow copy of the course registration form to the Bursar to initiate processing of a bill.

Registration for an overbooked course: Students must obtain a registration override form, signed by the course instructor before the Registrar’s Office will place the course on the system.

3.

Bursar Review a.

Upon the completion of the two week student registration process, the Bursar begins obtaining and reviewing the information that is being utilized to generate student billing statements. The Bursar runs the following reports to start the process of building the bill:

Procedure Date: February 2007

Approved by: Vice President of Financial Affairs

NOTE: There are two clear differences in the bills generated. The first billing generated at the end of a defined registration period is generated for and distributed to each and every student enrolled at the University. Subsequent monthly billings are only generated for students with outstanding balances.

Banner report indicating the number of students registered and what their proposed tuition charges are (includes both full time and part time students).

The report remains in ‘audit mode’ throughout the review process. Once the report is received, the Bursar selects three students from each of the colleges

(law, pharmacy, etc) and performs recalculations to ensure tuition based upon their enrollment is calculating correctly. If an error is identified, the Bursar corrects the rate code listed in Banner.

Banner report to obtain a list of all part time students (established as students with less than 12 credit hours). The Bursar selects three students from each of the colleges and performs recalculations to ensure tuition based upon their enrollment is calculating correctly. If an error is identified, the Bursar corrects the rate code listed in Banner.

Banner report (Billed vs. Credit Hour) that indicates all students with differences in their billed hours in comparison to the number of hours they are registered for. The review of this report is critical for subsequent student financial aid processing. The system does not currently consider enrollment in courses such as choir or band as a true credit hour in the billing system – that way, anyone with a heavy full time load of traditional courses, would not be required to pay for ‘overload’ credit hours simply to participate in the choir. On the other hand, in the event a student is enrolled for 11 credit hours of traditional courses and enrollment in choir or some other ‘light’ course were to place the student at the full time 12 credit hour mark, the student will

4.

be enrolled as a full time student, but billed as a part time student. The Bursar accesses this student’s account and alters the account manually to reflect full time student billing status. This process brings the student up to a full time student status on the system and the student would then be automatically eligible for full time student financial aid status. Manual changes to student accounts are subsequently reviewed by personnel in Student Financial Aid.

Student Course Fees a.

The Bursar’s office establishes a table of specific courses and related fees. This table is established prior to the defined two week registration period. As students enroll for courses, student course fees will automatically post to their student account based upon the fee table. b.

The Bursar’s Office forwards any fee table change requests to the Registrar’s

Office. Personnel in the Registrar’s Office update the course fees as requested.

c.

When the enrollment period has ended, the Bursar runs the Batch Fee Assessment in update mode. This process prompts the system to update student accounts with the respective course fees. d.

Once the course fees have been distributed to student accounts, the Bursar compares the total amount of course fees that were identified in the audit mode to the total amount of course fees that exist once updates occur to ensure all fees listed appropriately hit the student accounts. e.

After the fee update has been performed successfully, the Bursar changes the

Banner Fee Indicator to ‘Online’ so that any future student account changes that affect fees for that particular quarter / term will automatically update when the change hits the system.

5.

Miscellaneous Scholarship Posting Activity

NOTE: Scholarship funds generally are not hard posted to student accounts until the funds are received. When the University is aware of an award it is entered into Banner as an expected award and is listed as such (unless received prior to the tuition billing process). a.

Student Financial Aid forwards a copy of each scholarship award notice to the

Controller’s Office. b.

Either Financial Aid or the Controller’s Office will place a comment on the student account indicating the expected award. c.

The award notices are retained in a file in the Controller’s Office and as awards come in, either through the mail or via electronic transfer, they are matched up to the award notice and posted to the respective student account. d.

If payment for the award is received through the mail, a Senior Bookkeeping

Specialist checks to see whether there is a comment on the student account, if the award is expected, the Specialist posts the award to the student account, receipts in the check, and forwards support for receipt of the funds to Financial Aid. If payment was not expected, the Senior Bookkeeping Specialist determines whether the entire payment should be posted to one term (if $1,000 or less) or whether it should be disbursed among all terms for the year ($1,001 and above). The Senior

Bookkeeping Specialist posts to the student account accordingly and receipts in the funds. If the funds were posted to one term, the support is routed to the student file. If the funds are to be posted to multiple terms, the documentation is retained in the Controller’s Office file to ensure subsequent postings occur.

e.

In the event the source of funds requests a bill or an invoice to support payment made or to prompt subsequent payment, the Senior Bookkeeping Specialist creates, prints, and sends invoices / billing statements. f.

The Senior Bookkeeping Specialist generates an invoice for any expected awards that have not been funded. g.

If a student has received a late fee posting prior to receipt of scholarship money, and would not have experienced that fee if the scholarship payment had been received, the processor will adjust the student’s associated late fees. h.

Types of Scholarships and nuances of processing:

Bureau of Vocational Rehabilitation : The Senior Bookkeeping Specialist receives award reports from each county. The report lists the student and the dollar amount of the award the student will receive each quarter. In order to obtain the funds, the Senior Bookkeeping Specialist generates a billing statement after the 6th week of the term. The statement includes a list of students and the courses each is enrolled in. The statement prompts payment from the respective county. When payment is received, the Senior

Bookkeeping Specialist posts the payment to the respective student accounts and retains documentation to prompt subsequent quarterly processing.

Army, Airforce, ROTC, National Guard, VA and Armed Forces Tuition

Assistance: the Senior Bookkeeping Specialist prepares an invoice, along with a description of courses and any other requested information to the appropriate funding party. When funds come in, the Senior Bookkeeping

Specialist posts the funds to the respective student accounts. This information is retained in a notebook in the Bursar’s area for further quarterly processing.

US Embassy: The Controller’s Office receives an authorization from the U.S.

Embassy and posts to the student account based upon the authorization. In the sixth week of the term, the Senior Bookkeeping Specialist prepares an invoice with a list of students, registration information and indicator noting whether the student is involved in a bridge program, and sends the invoice out to the appropriate party. Once payment is received, the Senior Bookkeeping

Specialist posts it to the general ledger account.

Hauss Helms and George J. Records: the Controller’s Office receives a list of eligible students with dollar amounts of their awards. The Senior

Bookkeeping Specialist posts authorized amounts to student accounts. After the sixth week, the Bursar’s area of the Controller’s Office prepares an invoice with registration information and sends it out. Once payment is received, it is posted to the general ledger. Documentation is retained for subsequent quarterly postings.

Church funded portions of church matching grants: the Senior Bookkeeping

Specialist receives the notifications for these matching grants. The notifications are placed in a notebook file and posted to the student account only when payment is received from respective churches. Typically these checks contain payment for one quarter only, so once they are processed, the posting support is sent to the student file. If payment is for multiple quarters, the information is retained in the notebook for future quarterly payments. The most the school will provide for a match in the Church matching grant program is $2,000.

529 plans – after the add/drop period, the Senior Bookkeeping Specialist submits an invoice to each state participating including the student schedules for the quarter. This prompts payment and once the check is received, payment is posted to the student account.

Putnam Investments: the Bursar receives these checks without having to first prepare and submit an invoice. Once the check is received, it is posted to the student account and either forwarded to the student file or held in the Bursar’s area for subsequent quarterly postings.

Ohio Tuition Trust electronic credits: the Controller’s Office receives a fax listing of student names and amounts of Ohio Tuition Trust wire transfers.

After receipt of electronic funds has been verified, the Senior Bookkeeping

Specialist posts the amounts to student accounts.

Ohio Choice, Ohio Instructional Grant, Ohio College Opportunity Grant, Ohio

Academic Scholarship, War Orphans, and Pennsylvania Higher Education

Grant: the Senior Bookkeeping Specialist receives notification that funds are to be expected by wire transfer. Once funds are verified, she posts the wired amounts to the appropriate general ledger accounts. These awards are prefunded to student accounts. Michigan Education Trust – posted to student accounts once funds are received.

Robert Byrd Scholarship – the funds are posted to student accounts as they are received. Support for the awards is then sent to the student file.

Michigan Merit Award – this award is pre-funded to student accounts by

Student Financial Aid, so once the funds are received, the Senior

Bookkeeping Specialist deposits the funds and posts them to the ONU general ledger account.

6.

7.

c.

If errors are identified, the Bursar places a call to Residence Life and requests appropriate changes. d.

The Bursar will not close / clear the cashiering session until all of the housing and meal charges appear to be correct. e.

When the cashiering session is closed, the housing and meal charges are automatically posted to the general ledger.

8.

Student Financial Aid Adjustments a.

Student Financial Aid contacts the Bursar when financial award postings have been made to student accounts. b.

The Bursar reviews the cashiering report for this activity and performs a broad review to ensure all aid codes have been included in the report.

Music Major Adjustments a.

Prior to the final bill generation process, the Bursar obtains a list of all current music majors. Each person on the list is manually assessed a $75.00 term fee. b.

Once the music majors have been assessed a fee, the Bursar runs a student list for every student enrolled in individual music lessons. Each non-music major enrolled in each course is identified. The Bursar then accesses each of the nonmusic major’s accounts and assesses a $150 fee for each music lesson identified in the review.

Housing and Meal charges a.

The Bursar is notified of housing and meal charges when the cashiering session titled ‘Housing Manager’ is received. b.

The Bursar reviews the session by scrolling down through the information to be sure the rates appear correct and correspond to the rates published by the

University. The Bursar also reviews the session total to ensure it is a round figure. In the event there is anything but a round dollar total, further review of the file is performed to identify any small rounding errors. c.

If a code is missing, the Bursar phones Financial Aid to follow-up. d.

When the Bursar is confident all of the awards are included in the cashiering session, the session will be closed and all of the awards will be automatically fed to the general ledger.

9.

Remission Postings a.

ONU offers a tuition assistance package to employees and their dependants. b.

Each employee or dependant who intends on taking classes fills out a form to request remission. c.

The request is sent to the Bursar who reviews and approves the form. d.

Once the request is approved, the form is forwarded to the Senior Bookkeeping

Specialist who calculates the total amount due the student – which is $25.00

(2006-2007) per credit hour in tuition, plus any related fees. e.

The Senior Bookkeeping Specialist also posts the remission amount to the student account to adjust what they owe based on their credit hours. f.

Remission students are only allowed a refund of tuition for dropping a class on of the first day of classes, no refund is provided after that time. g.

Employees may add classes during the established add period and would then be assessed the $25 per credit hour tuition fee.

10.

Generation of Student Bills a.

The Bursar accesses the Billing Control Form on Banner. This form allows message entries. Any information included on the form will appear on each one of the student bills. For example: ‘This is your statement for Winter Quarter.

Payments are due on X/XX/XXXX.’ The Bursar updates the message and reviews it for accuracy. b.

The Bursar accesses the Billing Form and runs bills for the respective term; this process creates all student tuition billing statements. The Bursar performs a review of the bills that were generated by scrolling through the file. Two primary functions of the review include ensuring all student loan totals appear in the

‘anticipated’ credit column as these are subject to change and to ensure the number of bills created corresponds to the number of students with fees to ensure a bill exists for everyone. c.

The Bursar uploads the billing file to the Touchnet E-Bill system. If there is an error in the process, the Bursar receives an error notification stating ‘bill is not loaded’. Research is performed and the process is re-run. d.

When all of the bills have completed uploading, the Bursar ties the number of bills successfully uploaded from the E-Bill system to the total number of bills on the billing form report.

e.

While bills are uploading, students receive an email stating their bill is available for viewing. All students are given a primary ONU email account – where the messages are sent. Students access their billing statement by logging onto their

ONU Luminus account and clicking on the e-bill tab. Students may also include additional accounts for receipt of billing statements, but the ONU account must remain the primary account. f.

The return email for these email messages is established as Controller@ONU.edu

.

Both the Controller and the Bursar receive all auto-replies, account bounce backs, and inquiries from the email process. Messages that require response are delegated staff in the Bursar’s area for follow up.

11.

Monthly Tuition Billings a.

Monthly tuition billings are only sent to students with existing account balances. b.

After late payment, finance charges, or other miscellaneous manually fee postings are processed, the Bursar generates a billing file, reviews it for reasonableness and loads the file to Touchnet. (See initial tuition billing process as well.) c.

Once the file has fully uploaded to Touchnet, the Bursar ensures the number of bills recognized by Touchnet corresponds to the number listed in the Banner billing file. d.

Billing notifications are then submitted via email as stated previously.

BILLINGS, COLLECTIONS and CASH MANAGEMENT

Procedure 2: Payments Received (Student and Other)

Payments may come in to the University in one of four ways: mail, over the counter, electronically or over the phone.

1.

Mailed In Payments a.

Mail is first received by the Mail Room. b.

The received items are either routed to the Controller’s Office or to University

Advancement for primary processing. c.

Mail received by University Advancement is processed and input by that department before it is routed to the Controller’s office for final processing and ultimate deposit. d.

The Administrative Assistant in the Controller’s Office receives mail three times each day from the Mail Room and is sorted.

All student payments are forwarded to a Cashier in the Bursar’s area of the

Controller’s Office.

Financial related items such as investment proceeds are forwarded to the

Controller.

Invoices are forwarded to Accounts Payable.

University credit / procurement card information is forwarded to the Senior

Bookkeeping Specialist or the Accountant. e.

Items sent to the Cashier

The Cashier sorts the mail received from the Controller’s Office.

Scholarship information is forwarded to a Senior Bookkeeping

Specialist for processing.

Perkins Loan, Heath Professional Loan and short term loan information is also forwarded to a Senior Bookkeeping Specialist for processing.

The Accounting Assistant retains all items that should be posted to student accounts.

Procedure Date: February 2007

Approved by: Vice President of Financial Affairs

Investment transactions, budget information, grant related items, some gifts and other general miscellaneous items are forwarded to the Controller.

2.

In the event the Cashier receives payments related to University Advancement activities, they are sent directly to the University Advancement Office for initial processing.

Over the Counter Items a.

These are payments, made in person. All in-person transactions are collected by

Cashiers in the Bursar’s area of the Controller’s Office. b.

Each item is receipted in as it is received; funds are placed in a cash drawer with supporting documentation.

There are two cash drawers located at the over the counter area (miscellaneous and banner-student tuition).

One of the drawers is for Banner related cash and the other is for all other cash related items.

As payments are received, they are receipted, dated and the cash is placed in the respective cash drawer. c.

If checks are received, the transaction is receipted, and the checks along with the supporting documentation are placed in the cash drawer. d.

Cash drawers are balanced the following morning. e.

Once balanced, supporting documentation is routed for processing. Student payment related support is issued to the staff member who is primarily responsible for that item.

3.

f.

All other miscellaneous collections are processed by any cashier that is available.

Electronic Payments a.

Electronic payments are received daily via Touchnet. Touchnet is a third party service provider that accepts electronic based payments online and routes them to

ONU. b.

Touchnet payments automatically post to Banner daily. On a daily basis, the

Accounting Assistant receives the Touchnet electronic file each day, reviews the file information and balances the electronic Touchnet activity to Banner.

c.

A Senior Bookkeeping Specialist receives notifications for electronic funds transfers – typically wire transfers. If the transfer is for a student payment, the

Bookkeeper verifies funds have been received by the bank, posts the payment to the student account and forwards the wire support to the Accounting Assistant for daily balancing purposes.

4.

5.

d.

If notification of a wire transfer is related to University Advancement, the Senior

Bookkeeping Specialist verifies the transfer has been received by the bank, contacts University Advancement to obtain the appropriate posting information, posts the transaction and forwards posting information to the University

Advancement Office. A copy of the wire transfer information is also forwarded to the Accounting Assistant for daily balancing purposes.

Over the Phone a.

In some instances when the Touchnet site is down, a Cashier in the Bursar’s area will accept credit card payment over the phone. The caller provides their credit card information and the cashier runs it through the credit card terminal in the

Controller’s Office manually, posts the payment to the appropriate account and retains the support for daily balancing purposes.

Assigned Transactions a.

The Accounting Assistant manually receipts and posts the following payments to either Banner or Quick Books:

Student tuition

Advance Deposit payments

Northern Commitment options

Student fees

Rent for University Owned property

Retiree monthly insurance premium payments

Catering (Sodexo)

Facility rental

Child Development Center (CDC)

Student parking ticket payments – Banner b.

The Advanced Accounting Assistant posts the following items in Banner:

Student loans from various lenders to student accounts

Parent PLUS loans from various lenders to the general ledger c.

A Senior Bookkeeping Specialist manually receipts, tracks and posts the following items to student accounts:

Foreign wires for tuition payments

Parent PLUS loan funds to student accounts

Gifts and donations received that are related to student accounts are posted to an account that is directed by University Advancement

2.

BILLINGS, COLLECTIONS and CASH MANAGEMENT

Procedure 3: Payment Options and Advance Payment Plans

1.

Monthly tuition payment plans: a.

Students and families are given an opportunity to select a monthly tuition payment plan. The University offers two plans, a 10-month plan and a quarterly plan. Families are able to set up monthly payments to hit their credit cards or may opt to remit payment to the University monthly by check or Touchnet transfer. b.

In the event a family requests monthly payments to be assessed to their credit card, the Senior Bookkeeping Specialist retains a copy of their request at her desk.

Each month, credit card payments are manually input into a credit card terminal and payments are posted to the respective student accounts. c.

Payments received by check are posted and processed in the usual manner. (see above) d.

Payments received through Touchnet are processed in the usual manner. (see above)

Advance Deposits: a.

Students provide ONU with an advance deposit which is used to reserve their place in their college. b.

When student’s come in to make a $200 Advance Deposit, the Advanced

Accounting Assistant is responsible for creating a four part form with the payment information.

One form goes to the student, along with a receipt for payment

One form is sent along with the payment to the Accounting Assistant for input

One is sent to admissions to notify them of the commitment

One is sent to the college the student is entering

Procedure Date: February 2007

Approved by: Vice President of Financial Affairs

5.

3.

4.

BILLINGS, COLLECTIONS and CASH MANAGEMENT

Procedure 4: Miscellaneous Accounts Receivable / Billing

1.

Generally miscellaneous monthly billings are generated from information housed in

Banner, Quick Books or information received from various University departments.

2.

The miscellaneous billing process generally occurs on a monthly basis, but not all bills are prepared on the same day of the month.

Most miscellaneous billing information is retained in a bill book and on Quick Books.

Invoices for most items listed are generated in Quick Books.

Miscellaneous receivable billings are generated in the Controller’s Office. a.

Advanced Accounting Assistants are responsible for the following miscellaneous billings:

Unpaid parking tickets : any ticket that is five or more days old is delivered to the Advanced Accounting Assistant from Campus Security. The Advanced

Accounting Assistant posts the ticket to the student account based on the information posted on the ticket and adds an additional $5.00 late fee.

Ticket recipients may appeal a ticket. If an appeal is filed, the

Advanced Accounting Assistant reverses the ticket from the student account until a decision is made.

If the appeal is denied, the Advanced Accounting Assistant places the ticket charges back on the student account.

Voided unpaid parking tickets : if a student brings a void slip for a parking violation that is signed by Campus Security, the Advanced Accounting

Assistant reverses the charge from the student’s account.

W-Coil internet services: internet service charges for off campus users are posted to student accounts quarterly for undergrad and other quarter based students and twice per year for students running under the semester system.

Service is terminated after 3 months of non-payment. The University holds the account in QuickBooks for 3 additional months – assessing a 1.5% per month finance charge on the outstanding balance. If at the end of the 6 th month, the receivable is not being paid down, the account is charged off of

QuickBooks and is sent to Collections (outsourced).

Procedure Date: February 2007

Approved by: Vice President of Financial Affairs

Student insurance premiums : charges are posted to student accounts with the fall quarter batch billing, and any changes in the insurance assessments are posted each quarter or semester after the enrollment period has expired.

Students may opt out of participation in student insurance if they fill out the Student Medical Plan waiver form and send it back with the policy number of their current insurance and a statement that they are currently insured.

As the Advanced Accounting Assistant receives insurance waivers, she manually removes the charges from student accounts.

Acordia billings – ONU receives health care charges from MediLab, the lab that processes results for the campus based Health Center. ONU pays

MediLab for the lab charges. After the Accounting Assistant pays the

MediLab bill, she prepares a bill for Acordia (ONU insurance provider) for reimbursement. b.

The Accounting Assistant is responsible for preparing and sending out bills for the following:

Child Development Center (CDC) – charges are based upon a report received from the CDC indicating the students and attendance for the month. These bills are generated in Quick Books on the 20 th

of each month and are due within 30 days. If not paid timely, a 1.5% finance charge on the outstanding balance is applied. If the balance is outstanding past the second billing period, the Accounting Assistant prepares a written notice to the party indicating attendance is no longer available to them. The Accounting Assistant routes a copy of this notice to the CDC. Receivables stay in aging until they are between 90-180 days past due. They are then charged off in QuickBooks and sent to Collections (outsourced).

Retiree Health Insurance Monthly Premiums – most participants do not receive monthly billing statements. There is a list of retirees who have requested monthly billing statements. The Accounting Assistant prepares invoices for the individuals who have requested them. In the event any retiree’s monthly health insurance premium payment is 15 days past due, the

Accounting Assistant prepares and sends out payment reminders.

Monthly rental payments – are established based upon a rental contract. No monthly statements are sent to renters. Monthly receivable aging reports are sent to Human Resources for tracking.

Miscellaneous small billings: the documentation for these items is retained in a bill book on the Accounting Assistant’s desk. At the end of each month, the

Accounting Assistant obtains the information from the bill book and bills for all items included. Items that are billed include: catering charges, facility

rentals, long distance telephone bills, camp fees and parking tickets for non students . These are due within 15 days or will be assessed a 1.5% finance charge on the outstanding balance. If the receivable ages to between 90-180 days, it is charged off and sent to Collections (outsourced). c.

The Senior Bookkeeping Specialist is responsible for:

Shared faculty salary : a quarterly billing statement is generated for a portion of a shared faculty member’s salary. Academic Affairs provides the necessary information for bill preparation. The bill is prepared and sent to Lima

Memorial Hospital. d.

All recipients of miscellaneous billings are subject to the 1.5% finance charge if their bill becomes past due more than 30 days. The Controller is made aware of past due accounts once they hit the 3 to 4 month outstanding time frame. At that point, the Controller prepares and issues a last chance letter with an expected ‘pay by’ date. If payment is not made by that date, the Bookkeeper places the account with a third party collection agency.

BILLINGS, COLLECTIONS and CASH MANAGEMENT

Procedure 5: Returned Checks

1.

The Administrative Assistant receives returned check notifications from the

Accountant.

2.

From the notification, the Administrative Assistant prepares a notification letter to the remitter of the check.

3.

Personnel with access and ability to waive a returned item fee include the Bursar and the Controller.

4.

Any fee waiver is included in the daily cashiering sessions and each cashiering session is reviewed by the Bursar on a daily basis.

Procedure Date: February 2007

Approved by: Vice President of Financial Affairs

2.

BILLINGS, COLLECTIONS and CASH MANAGEMENT

Procedure 6: Housing and Meal Plan Billings

1.

General Information a.

Residence Life is primarily responsible for student room and board related assessments. Data is input and retained in the Housing Director (Adorondak software tool). b.

There are fee tables within Housing Director that are automatically assessed based on the room and board combination code. c.

The Bursar contacts Residence Life and informs them of any changes to the fee schedule that need to be made. d.

Ann Niese makes the change in the system.

Housing a.

Students are required to access their LUMINIS account where they have access to their housing choices. b.

All eligible housing and meal choices are listed for them. The student then makes their selections based upon the options provided. c.

LUMINIS information directly feeds to Housing Director. d.

Housing Director ties the respective selections to a code and ties the related fees to the code. e.

When the Controller’s Office needs the information for billing purposes, Ann

Niese phones IT and asks them to export the information to Banner, where it may be accessed by the Controller’s Office. f.

Once the traditional two week enrollment period has ended and initial bills have bee sent out, any changes to the Housing Director software appear in real time on

Banner with no review or holding periods. g.

Residence Life also actively tracks for students who are not going to show up for the semester (no-shows).

Thee department obtains expected student rosters at least weekly prior to the expected final check in date, typically the Saturday before classes begin for the term/semester.

Procedure Date: February 2007

Approved by: Vice President of Financial Affairs

The department generates a final roster prior to the Saturday mandatory check in. Packets sent to students indicate the check in is to be performed by

Saturday afternoon, so the department has a relatively good idea of who is on the no-show list by Saturday afternoon.

At that point, the department begins phoning missing students to check on their safety and determine whether they are late or not planning on attending and then the list is updated.

A list of no-shows is then prepared and sent out to Admissions, Registrars,

Deans, VPs, etc.

When the Controller’s office is made aware of student no-shows, the Senior

Bookkeeping Specialist pulls up each student account to determine whether federal (and all other) aid has been applied to the account balance. In the event it has, the Senior Bookkeeping Specialist in the Controller’s Office performs the no-show return of all funds to their origins. h.

Residence Assistants, Senior Residence Assistants and Head Residents are required to maintain contact with all residents in their assigned housing locations on a weekly basis. i.

Information for any identified check-out is forwarded to the department administration, Justin Courtney and Ann Niese.

3.

j.

The department then emails notification of early check-outs to necessary departments.

Meals a.

Students access their LUMINIS account at the two week registration period to select their meal plan. b.

Meal plans are available to all students in University housing, even if it is an offcampus apartment. c.

Freshmen are required to have the 19 meal plan for their first quarter/term. Meal plans may be changed between quarters. d.

LUMINIS directly feeds the information to Banner and Banner will automatically change the rate to correspond with the meal plan selection made. e.

If there are changes during the year to a student’s meal plan, the department forwards an email notification to the Advanced Accounting Assistant in the

Controller’s Office so she may adjust the information that is housed on CBORD.

BILLINGS, COLLECTIONS and CASH MANAGEMENT

Procedure 7: Polar Card Use and Billing

1.

Polar Card Processing a.

The Polar Card is a pre-paid card system that allows students or University departments to make purchases in the campus book store and in dining services. b.

The Advanced Accounting Assistant is responsible for Polar Card processing.

All Polar Card activity is handled on the CBORD system. c.

Students may add to the balance of their card by making check or cash payments at the counter in the Controller’s Office, or may phone in an increase to their card by charging it to a credit card. d.

University departments may enhance their card balance with a cash transfer, credit card posting or with a charge to their departmental account. e.

Regardless of how the transaction is received, each transaction is documented on a triplicate receipt.

One receipt is placed in the cash drawer

One is submitted to the student or department

One is forwarded to the Advanced Accounting Assistant f.

The Advanced Accounting Assistant posts the amount of the received funds to the appropriate account on CBORD; the posting automatically increases the balance of the respective Polar Card. g.

As purchases are made, the CBORD system allows an automated information feed from the point of sale that decreases the balance on the card used for the amount of the purchase. h.

On a weekly basis, the Advanced Accounting Assistant obtains a report that indicates the week’s card activity by location and retains the report. i.

The Advanced Accounting Assistant also receives a weekly invoice from

Sodexo (dining service provider). j.

The Advanced Accounting Assistant matches the amount of the invoice to the amount listed on the CBORD report. k.

Once balances are verified, the Advanced Accounting Assistant prepares a check request for the outstanding balance, and forwards it to Accounts

Payable for processing. Payment is made to Sodexo.

Procedure Date: February 2007

Approved by: Vice President of Financial Affairs

BILLINGS, COLLECTIONS and CASH MANAGEMENT

Procedure 8: Student Refunds

1.

2.

Refunds of credit balances are performed weekly.

Banner performs an automated run of the ‘Applications of Payments’ report every day at 5 p.m. This process takes all information from cashiering sessions and other inputs that have been closed out for the day, applies the information to the respective accounts.

3.

On a weekly basis, the Bursar implements the ‘Applications of Payment’ prior to 5:00 p.m.

4.

This process subsequently generates a report that indicates all students with an outstanding application of payments – meaning a payment has been made, but has not been applied to a specific charge on the student account.

5.

The Bursar then initiates a process in Banner that removes the tie between the charges on the account and the quarter/term it is tied to. a.

This is only performed on student accounts that have payments that have not been applied to account charges. b.

It ties all accounts receivable in a student account to all payments received. Prior to this process Banner ties winter quarter charges to winter quarter payments, etc.

The process performed by the Bursar ties charges in the academic year to payments made in the academic year.

6.

c.

This process nets all receivables against all payments made and reflects a current balance in each student account.

The Bursar then runs two separate reports: a.

All students with credit balances b.

All students with ‘No Refund’ holds placed on their accounts (those who should not receive a refund for a variety of reasons – students on payment plans, in the advance payment plan, or who have requested to retain their ONU credit)

7.

The Bursar merges the two reports to obtain a list of students with credit balances that can actually receive a refund.

8.

The Bursar enters the name of this file into Banner in audit mode, reviews it, and then places it in update mode.

9.

Banner then automatically posts refunds to the student accounts and the Bursar issues a report to Accounts Payable for processing.

Procedure Date: February 2007

Approved by: Vice President of Financial Affairs

2.

BILLINGS, COLLECTIONS and CASH MANAGEMENT

Procedure 9: Late Fees, Finance Charges and Holds

1.

Tuition related: a.

Tuition payments have an established due date, but the University also allows a

10 day grace period, fee free, beyond the due date. b.

On the 11 th

day after the tuition due date, the Bursar runs a report to list the students with outstanding balances. The Bursar then runs a late fee assessment in

Banner that will automatically post the established $10.00 late fee to all students that appear on the outstanding balances listing. c.

On the 31 st

day from the due date, the Bursar runs the outstanding balances listing again. d.

The Bursar then opens the late fee assessment form in Banner and changes the charge field to reflect a 1.5% finance charge (on the outstanding balance) and the charge is automatically applied to all listed student accounts. The fee assessment process is performed prior to sending out the monthly billing statements. e.

This process is repeated on the 61 st and 91 st day.

Graduate holds: a.

The Senior Bookkeeping Specialist periodically receives a graduation listing. b.

She reviews student accounts for all individuals listed to determine whether they have any outstanding obligations to the University including loan exit interviews, outstanding tuition or fees balances, library fines or parking tickets. c.

In the event the student has an obligation to the University, the Senior

Bookkeeping Specialist places a hold on the student account and creates a list of the students for whom holds were placed. d.

This list is forwarded to the Registrar’s Office so they can pull the student’s diploma. The student will not receive their diploma until the hold has been removed from their student account.

Procedure Date: February 2007

Approved by: Vice President of Financial Affairs

Billing, Collection and Cash Management

Section Related Forms

Table of Contents

1.

Course Request Form

2.

Application for Remission of Tuition and General Fee

3.

Sodexho Marriott Corporation Tuition Discount agreement

4.

Barnes & Noble Bookstore Employee Tuition Discount agreement

5.

Advance Payment Discount form

6.

Monthly Payment Plan form

7.

Violations of Motor Vehicle Regulations form

8.

Traffic Control Fine Adjustment form

9.

Traffic Control Declaration of Appeal

10.

Student Medical Plan brochure

11.

Student Account Internet Sign-up Form

12.

Child Development Center weekly Registration Form

13.

Refund Request Form

14.

Request to Mail Refund Check Form

15.

Request to Retain Credit on Account Form

Budgeting and Accounting

Table of Contents

Procedure 1: Operational Budget Preparation Process ....................................................

Procedure 2: Capital Budgeting .......................................................................................

Procedure 3: Project and Construction Budgeting ...........................................................

Procedure 4: Tuition and Fee Annual Increases...............................................................

Procedure 5: Budget Monitoring ......................................................................................

Procedure 6: Capital Carryover ........................................................................................

Procedure 7: Gift Acceptance and Processing .................................................................

Procedure 8: University Investments ...............................................................................

Procedure 9: Day, Month, Quarter, Semi-Annual and Year End Processing ..................

Section Related Forms……………………………………………………………………

BUDGETING AND ACCOUNTING

Procedure 1: Operational Budget Preparation Process

1.

The budgeting process each year is based primarily on the strategic plan and the established planning parameters. a.

The parameters are obtained through review of historical expenses and earnings figures and expected enrollment data that is obtained from Admissions, the

Registrar and the Bursar. b.

The expected enrollment data is utilized to estimate the number of students that will be in attendance and project the tuition increase for the upcoming year.

2.

The VP of Financial Affairs instructs the Controller to apply the parameters to the salary and fringe benefit lines of the budget. a.

This portion of the budget is not created by the individual areas, but by the

Controller. b.

Once the Controller has completed this process, the budgeted total salaries – including expected new positions, along with fringe benefits, and insurance expenses are established.

3.

Non discretionary items are input at the Controller’s level and are not editable by departments – non-discretionary items include insurance costs, utility charges, telephone charges, etc.

4.

Departments are then required to complete an estimate of their discretionary budget line items. a.

Once the parameters have been established by the VP of Financial Affairs and the

Budget Advisory Committee, budget packets are prepared and sent out to each department. b.

The budget planning process for operational budgeting starts in October

(establishing parameters) and the Controller’s Office rolls the packages out to departments sometime in January. c.

Budget packets that are sent out to each department contain 4 years of actual information, current year’s budget, and current years spending to date. The packages also contain the written parameters that they are required to follow while addressing their discretionary spending account budget line items.

Procedure Date: February 2007

Approved by: Vice President of Financial Affairs

d.

Department’s prepare their budgets on paper and interoffice them back to the VP of Financial Affairs who sends them to the Controller’s Office for input.

5.

The Accountant in the Controller’s office manually loads all budget information by account number and department into Banner.

6.

Once all budgets are loaded, the Controller analyses the data to ensure it meets the established parameters and includes all necessary budget lines.

7.

The Controller’s Office posts any necessary budget adjustments. Departments are not notified of the budget adjustments made during this process, but departments may pull up the budget information on Banner to see if adjustments were made.

8.

The Controller then populates the Appendix A and B documents. a.

Appendix A contains prior and current year budget and actual operating revenues and expenses. b.

Appendix B contains enrollment, total revenue and expense information by category. It contains 4 years of historical data and current year budget and year to

9.

date figures along with the percentage of the current budget that has been realized or utilized by category.

The Controller then forwards Appendix A and B to the VP of Financial Affairs for review.

10.

Once the annual operating budget and appendices have been reviewed, they are presented to the Board of Trustees for review and approval. This typically occurs during the May Board meeting.

11.

Once the University is comfortable with the upcoming fall enrollment numbers and related tuition revenue, budgets may be revised if numbers are more favorable than were utilized in the projection.

BUDGETING AND ACCOUNTING

Procedure 2: Capital Budgeting

1.

The Capital budget process is initiated by the VP of Financial Affairs who sends out a request to the Dean’s of departments for their capital plans for the year.

2.

Each department with capital spending plans submits a written plan to their respective

Vice President and the Vice President of Financial Affairs. The departmental plans contain the types of items they wish to purchase, the reason for the purchase and the estimated cost.

3.

The VP of Financial Affairs and the President’s Cabinet prioritize the requested items and create a list of capital projects that will fit into the capital project spending parameters for the upcoming year.

4.

The prioritized list is submitted to the Board of trustees for approval at the February meeting.

5.

Once budgets are revised, they are submitted to the October Board of Trustees meeting for approval.

6.

Once approved, the capital budget is loaded into Banner by the Accountant in the

Controller’s Office.

7.

The capital budget stands alone and is not combined with the operating budget.

Procedure Date: February 2007

Approved by: Vice President of Financial Affairs

2.

3.

BUDGETING AND ACCOUNTING

Procedure 3: Project and Construction Budgeting

1.

Project and construction budgets are based primarily on planned projects and construction in progress projections.

The VP of Financial Affairs prepares this information and updates it over time.

All major construction projects are well-planned and are approved by the Board of

Trustees prior to initiation.

4.

Budgets are established by the Board on a project by project basis.

BUDGETING AND ACCOUNTING

Procedure 4: Tuition and Fee Annual Increases

1.

Annual tuition and course fee increases are established through review of the following: a.

Estimated enrollment figures b.

Estimated capital needs c.

Estimated increase to non-discretionary items d.

Estimated increase to discretionary spending

2.

e.

Estimate of total operating expenses.

Proposed tuition and fees are submitted to the Board of Trustees for approval at the

February meeting – along with the capital budget.

3.

Approved tuition and fees are forwarded to the Controller’s Office so Banner may be updated.

Procedure Date: February 2007

Approved by: Vice President of Financial Affairs

5.

3.

BUDGETING AND ACCOUNTING

Procedure 5: Budget monitoring

1.

The VP of Financial Affairs performs a monthly budget monitoring process. a.

He receives a report from the Controller each month and reviews it for income and expense by organization for month to date actual figures and budget figures. b.

He compares the information to the information obtained for the same period during the prior year. c.

This information is provided to him monthly from the Controller’s office and is included in the monthly Board packet of fiscal information. (This information is reviewed through the use of Appendix A and B of the Board packet.) d.

Financial Affairs is not concerned about a department’s budget unless it has been overspent in total. e.

If budget overspending does occur, either the department that incurred the overspending or the Controller contacts the VP of Financial Affairs and requests a budget override.

2.

Financial Affairs relies on departments to manage and monitor their own discretionary spending. University departments are expected to review the budget to actual spending, but it is not a formal process prompted by the Controller’s Office.

Departments have incentive to actively monitor their discretionary accounts. a.

In the event a department encounters an unspent balance of discretionary funds at the end of the year, they would be able to roll those funds into a capital surplus account. b.

Capital surplus may be retained and held by a department until it is needed. c.

All funds held in capital surplus must be used for future capital purchases. d.

Any budget surplus identified at year end must be offset by any capital project overspending in their department during the same year. The net amount is placed in their capital surplus account.

4.

The Accountant in the Controller’s Office reviews budget information on Banner monthly to identify deficits.

The Accountant informs Accounts Payable of any existing deficits.

Procedure Date: February 2007

Approved by: Vice President of Financial Affairs

6.

Accounts Payable contacts departments to notify them that they will need to submit a request for budget transfer.

7.

Departments may not make budget transfers from their salary and related fringe accounts.

8.

Overages in budget line spending are also automatically identified by Banner as accounts payable processing occurs. a.

Accounts payable personnel are required to override the system when a deficit occurs. b.

The Banner identification of deficits also prompts Accounts Payable to contact the department.

BUDGETING AND ACCOUNTING

Procedure 6: Capital Carryover

1.

As a part of the year-end closing process, the Controller performs a review of budget to actual spending in discretionary accounts.

2.

Remaining balances are netted against any overspending that occurred in the department’s capital budget and any remaining balance is placed in the department’s capital carryover.

3.

Departments may build up their capital carryover balances and utilize it for a future capital purchase.

Procedure Date: February 2007

Approved by: Vice President of Financial Affairs

BUDGETING AND ACCOUNTING

Procedure 7: Gift Acceptance and Processing

1.

Monetary Gifts: a.

University Advancement is responsible for generating and subsequently receiving gifts and donations to the University. b.

The department performs two annual telephone drives primarily for the Northern

Fund.

The telephone drive will lead to either a pledge (promise for a future contribution) or a gift.

Gifts, in the telephone drive process, consist of over the telephone credit card payments.

As each call is made, a pledge form is prepared by the caller indicating either the name of the party and the amount of their pledge; or the name of the party, the amount of the gift, the respective credit card information and any special designation of funds – if for something other than the Northern Fund.

Once this information is obtained by the student workers, it is forwarded to the Annual Giving Secretary. c.

University Advancement also receives gifts through the mail.

The Annual Giving Secretary separates all mailed in gift information into categories.

She receipts in all items received.

She photocopies all of the checks.

Enters all mailed in credit card payments into the credit card terminal and obtains credit card receipts.

She separates the original credit card receipt from the duplicate copy.

She prepares all copies for the Gift Records Clerk to process and retains all originals – including checks.

She then tallies all information for the day.

Procedure Date: February 2007

Approved by: Vice President of Financial Affairs

d.

The Gifts Records Clerk then picks up the information from the Annual Giving

Secretary for processing.

The information includes the check copies and credit card receipt copies as originals are retained by the Annual Giving Secretary until they are ready for deposit.

The Gift Records Clerk tears off the bottom portion of the pledge form, enters the pledge information into Banner, and mails the bottom portion of the pledge form to the proper person requesting payment for the pledge.

If the item is a gift by phone, the Gift Records Clerk takes all credit card payments and enters them into the credit card terminal and obtains an original and a copy of the receipt.

Once payment is accepted by the credit card terminal, she enters the information into Banner to either the Northern Fund or as designated on the form.

Payments by check are entered into banner by the designated fund.

Once payments are entered, the Gift Records Clerk attaches the copy of the credit card slip as receipt or a departmentally prepared receipt to a thank you note and mails it out to the donor. e.

Before the Gift Records Clerk closes out her cashiering session for the day, she obtains a total of the work performed and ensures it corresponds with the Annual

Giving Secretary’s tally sheets. f.

The Gift Records Clerk then closes out her cashiering session and runs the finance feed report. She obtains a printout of this report from the Computer Center. g.

The Gift Records Clerk bundles all checks, cash, and credit card slips along with the finance feed report and brings the package to the Controller’s Office. h.

Once the package gets to the Controller’s Office it is routed to the Accounting

Assistant for further processing. i.

When the package has been processed, the Controller takes the deposit to the bank and returns with the deposit slip. j.

In the event the department was to receive a large gift, instead of holding it for processing the next day, they would remit the check to the Controller for deposit first and then process the information into Banner the following day.

2.

Gifts in Kind: a.

The University receives items such as art, property, books, stocks, bonds and life insurance policies as gifts in kind. b.

Tangible gifts are received by various University departments.

The department is responsible for informing University Advancement of any item received.

The department provides a description of the item and an approximate value of the gift.

The Gift Records Clerk enters this information into Banner and submits a receipt that identifies a description of the gift only, not a value, and a thank you note to the donor.

The donor is responsible for an appraisal of the item for tax purposes. c.

Gifts of property are handled in a similar fashion; however, the deed is held by the

Vice President of Financial Affairs. d.

Gifts of stocks or bonds are handled a bit differently.

A copy of the stock certificate or bond is made and the information is posted to Banner along with the specific date of receipt.

The copy of the certificate is retained by University Advancement and the original is forwarded to the Controller’s Office.

The receipt is generated with the date of transfer, the number of shares outstanding and the market value as of the date of transfer.

It is the University’s practice to liquidate stocks and bonds as they are received if at all possible. Once received, the Controller packages all required information (separated into 2 different packages to make it difficult for someone to conduct the transaction and leave with the money) to A.G.

Edwards and requests a sale transaction.

Stock certificates are held in rare circumstances (not issued for a publicly traded company). b.

These stock certificates are maintained in the safe deposit box at the bank.

c.

The Controller and the VP of Financial Affairs are the only two individuals with access to this particular safe deposit box. d.

Each time the safe deposit box is accessed, the Bank obtains the signature of the party accessing the box on a safe deposit box access log.

Receipt of Life insurance is processed similarly.

The Controller holds the original life insurance policies.

Life insurance premium payments are collected from the donor, deposited, and payment of the premium is made by the University who is listed as the owner of the account.

3.

Day End Processing a.

At the end of each day’s transactions, University Advancement items are placed in their own cashier envelope. b.

University Advancement transactions are balanced by the Accounting Assistant and the Advanced Accounting Assistant. c.

The Accounting assistant also separates the deposit items, and prepares a deposit slip for the University Advancement transactions. d.

The Controller performs secondary review of the cashier envelope. e.

The Controller forwards the information to the Senior Bookkeeping Specialist for posting. f.

The Controller takes the University Advancement deposit to the bank.

BUDGETING AND ACCOUNTING

Procedure 8: University Investments

1.

Investment Types a.

The University has three types of investment opportunities.

Long term endowment based investments that are managed by a third party broker.

Fixed investments managed in-house with transactions performed by a third party broker.

Annuity trust endowments managed internally, but held by a safekeeping agent.

2.

Investment Processing a.

The University has hired a consultant to oversee and recommend investment direction for the long term endowment investments.

The consultant makes recommendations based on the University’s established investment guidelines and communications with the Investment Committee

(subset of the Board of Trustees).

The Controller is informed of necessary investment activity and requests the transfers from the broker (A.G. Edwards) and prepares necessary wire transfers or ACH transactions for purchases.

Each year end, the Controller reviews the investment activity to validate net investment income. She then prepares a transfer of 3% of the net investment income to the University’s general operating account – per policy. b.

The Controller is primarily responsible for the fixed income investments.

She prepares a quarterly transfer analysis based upon cash available at the time of the review and forwards the analysis to the VP of Financial Affairs and the investment consultant for review.

Once consensus as to investment direction is obtained, the Controller instructs

AG Edwards to move the invested funds to the appropriate location(s).

Three times each year, the Controller prepares investment breakdown reports listing book and market values for each investment and has the information included in the Board package for review.

Procedure Date: February 2007

Approved by: Vice President of Financial Affairs

c.

The University also maintains investments in the form of UniTrust and Gift

Annuities as well as Life Income.

These are invested through a broker at 5/3 rd

Bank.

All new gift trusts or annuities are established separately with 5/3 rd

.

There are a handful of these that the University prepares annual tax returns for

– approximately four or five.

As new accounts are received, the tax preparation responsibility is that of

5/3 rd

. d.

Negotiable paper (life insurance policies, stock certificates, and related) are housed in a safe deposit box at Liberty Bank.

Typically, stocks are sold immediately.

The VP of Financial Affairs and the Controller are the only two individuals with authority to access the safe deposit box.

The Controller inventories the box alone each year during the month of May.

The Controller retains support of the box contents verification, and will submit it to the VP of Financial Affairs if he requests a copy.

Sometimes this document is also provided to the auditors for review.

BUDGETING AND ACCOUNTING

Procedure 9: Day, Month, Quarter, Semi-Annual and Year End Processing

1.

Daily Cashiering Sessions and Cash Drawers a.

Miscellaneous Cash drawer:

The Accounting Assistant pulls everything from the Miscellaneous Cash drawer, obtains all supporting receipts and sorts the information based on how it is supposed to be posted.

She then separates all sales tax for separate posting.

All day’s receipts are placed together based upon the account the transactions are to be posted to and a tally sheet is prepared for bulk entry to the account.

Some accounts require each item to be posted separately and those remain separate.

Once all miscellaneous cash items have been sorted and tallied twice, the

Accounting Assistant reconciles the amount on the tally slip to Advanced

Accounting Assistant’s daily balance.

The daily package is then forwarded to the Controller for review and sign off.

Once the review is performed, the package is forwarded to the Senior

Bookkeeping Specialist for input.

The Advanced Accounting Assistant is responsible for reviewing the individual daily cashiering sessions performed and balancing the activity in the miscellaneous cash drawer.

Once the balancing process is performed, it is forwarded to the Accounting

Assistant for secondary review. b.

General cashiering sessions:

All daily cashiering totals are summarized for the daily cashiering session report.

Once secondary review processes have been completed, the cashiering package is submitted to the Bursar for final review and then to the Senior

Bookkeeping Specialist in the Controller’s Office for input.

Procedure Date: February 2007

Approved by: Vice President of Financial Affairs

The report, along with all support is forwarded to the respective reviewer.

Once the secondary review and verification is performed, the packages are forwarded to the Senior Bookkeeping Specialist for final posting.

The Senior Bookkeeping Specialist ties the package cash totals to the respective bank deposit receipts to ensure all funds made it to the bank.

The Senior Bookkeeping Specialist then pulls together all cashiering package information by department, and makes bulk postings into the Banner system.

Once postings are made, the cash receipt packages and credit card slips are filed.

In the event the bank identifies a returned item for non-sufficient funds (NSF), the bank notifies either the Bursar or the Controller.

If the returned item is related to a Touchnet originated payment, the Bursar posts a return to the student account and posts a $25.00 returned payment fee.

The Bursar then submits an email to the student notifying them of the returned item.

2.

If the returned item was due to an error in the online entry process, the Bursar notifies the student and makes a request for another attempt at posting the payment online.

Daily reconciliations and subsequent reviews a.

The Bursar reviews all daily cashiering sessions, which include detail of all entries processed by cashiers (Bursar support staff). Cashiering sessions primarily include Touchnet, Cashiers, Financial Aid and the Registrar. b.

The Registrar’s session is reviewed for tuition reversals.

When a tuition reversal is identified, the Bursar meets with the Senior

Bookkeeping Specialist to see if a withdrawal slip was received and a R2T4

(return of student financial aid funds) calculation was performed.

The Bursar then places a hold on the student’s account to ensure no money is refunded to the student until all required information and entries have been processed. c.

Once all cashiering sessions have been reviewed, the sessions are closed. Closure of the session permits automated posting of activity included in the session to the general ledger.

d.

The Bursar then runs a Cashier Review Report to identify any remaining open cashiering sessions for which she did not receive a session package.

3.

If cash is involved in the session, the Bursar leaves the session open and requests a daily balancing sheet from the respective cashier.

Month End Processes a.

The Controller retains a list of accounts and the individuals responsible for the reconciliations. : b.

Bursar month end responsibilities:

Reviews the monthly reconciliations performed by Bursar support staff.

Ensures all cashiering sessions are closed and processed prior to 5:00 p.m. so the 5:00 auto post process will include all data processed for the month.

If any are identified, the Bursar reviews the activity.

If no cash based transactions were included in the session and all transactions appear reasonable, the session is closed.

Generates an accounts receivable aging report and the accounts receivable reconciliation report and ensures the amounts listed on each report match one another.

Reviews the over 90 day column on the receivables report. The Bursar identifies whether the individual listed is still registered or not.

If the individual is not registered and has prior term balances that are over 90 days old, the account is placed on a list for charge off processing.

The list is forwarded to the Senior Bookkeeping Specialist. c.

Controller month end responsibilities:

Reviews reconciliations performed by her support staff.

The Controller is responsible for preparing all financial reports that are requested by the VP of Financial Affairs on a monthly basis including:

Board report preparation

Appendix A and B

Financial ratio analysis

Medical report

Appendix G

Appendix D d.

The Administrative Assistant receives a monthly report from Financial Aid with a report indicating the student workers in the Controller’s Office.

The report indicates the student name with the dollar amount and hours remaining before they exhaust their Federal Work Study Award.

The Administrative Assistant monitors the report to ensure student work hours do not exceed their award.

This process occurs in every department with student workers receiving

Federal Work Study. e.

The Senior Bookkeeping Specialists’ month-end processes:

One Specialist receives a list of accounts past due over 90 days from the

Bursar.

From the list, she prepares and sends letters to students that indicate the student has 30 days to pay or to establish payment arrangements.

If the student does not respond, the Senior Bookkeeping Specialist places the student account on a collection listing, sends the collection listing to the

Bursar for review and approval and then submits the listing to collections

(outsourced).

One Specialist is responsible for preparing monthly check requests for lease payments.

Lease payments are made for Northern on Main, a veterinarian and the legal clinic. f.

One Senior Bookkeeping Specialist is responsible for inputting all journal entries. g.

The Accountant is responsible for the following month end processes:

Preparing month end journal entries, including:

American Express fee assessment (information is obtained from the credit card statements)

Discover card fee assessment

Visa / MasterCard fee assessment (these companies auto debit ONU’s account for payment, this journal entry is simply a transfer to cover the fees)

NSF charges (information obtained from the bank statement)

Student side NSF (clears out the return check account)

Monthly salary accrual for 12 month and 9 month faculty and all other salaried employees (from spreadsheet prepared by Controller at the beginning of the year)

Workers compensation expenses (data is from the workers comp checking account)

Retiree insurance premium (from spreadsheet prepared by the Controller)

Academic remission allocation (the Bursar tracks the remission of ONU funds necessary for employee and related party tuition reimbursements and this journal entry applies the amounts to the employee benefit line)

Fringe benefit allocation (for items such as the Wellness Fair, Medical insurance, Disability Insurance, FICA, Workers compensation, prizes, ONU picnic, Christmas party, etc. – this entry allocates all such expenses to ONU departments based upon department salary as a percentage of total salaries)