101 CPEs

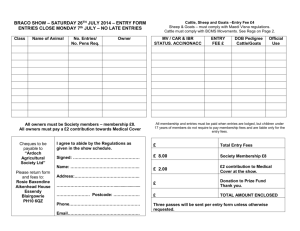

advertisement

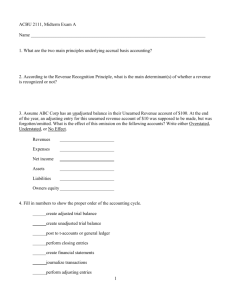

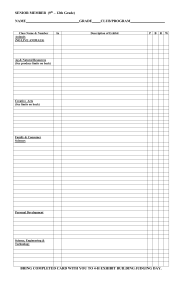

Chapter Preparation Exercises: **Should always be done on just the front side of one piece of paper. Chapter two: Take the below accounts and 1) Make a T account for each one and put it in the fundamental accounting equation under the correct type of account. 2) Indicate the increase and decrease side on the T account 3) Indicate the normal balance on the T account 4) Indicate which financial statement each account will appear on. 5) Describe what the account is used for. E.g. Accounts receivable “Used when a seller extends credit to a buyer” Accounts Payable Accounts Receivable Cash Common Stock Consulting Revenue Dividends Equipment Insurance Expense Prepaid Insurance Rent Expense Rental Revenue Retained Earnings Salaries Expense Supplies Supplies Expense Unearned Consulting Revenue Utilities Expense Chapter three: Part One There are four types of adjusting entries: a) deferred/prepaid expense. Supplies are an example. b) deferred/unearned revenue. Unearned Consulting Revenue is an example. c) accrued expense. Salaries expense is an example. d) accrued revenue. Consulting revenue is an example. For each of the four adjusting entries above: 1) write out the two accounts that would used in the adjusting entry. 2) then, using T accounts in the fundamental accounting equation format, illustrate/post the journal entries you did in step 1. Part Two 1) Above each type of account you used in the fundamental accounting equation in step 2, indicate if that type of account is permanent or temporary and left opened or closed during the closing process. For example: ASSETS would be the first type of account listed..so it would end up looking like this: Permanent/open ______Assets_ | | Chapter four: Go to my handouts webpage and look for chapter four. To the right you will see Period vs. Perpetual JE, print it out. On the left side are transactions with the accounts we used in Accounting 100. On the right side, re-do the journal entries, but use the accounts that we will use from chapter four of the 101 book . A lot of the accounts are the same as we used in Accounting 100, but a number of them are different. Chapter six: 1) Go my handouts webpage. Find chapter six PowerPoints. Go to slide 6-33. Create a blank bank reconciliation form, in good format, using all of the items on slide 6-33. Look at the book for formatting, etc. 2) The bank reconciliation has two sides, the bank’s side and the company’s side. Which side do we do journal entries for: the bank side, the companies side, or both? Clearly indicate your answer on your bank reconciliation done in step 1. 3) List the common journal entries that are done as a result of the bank reconciliation. Chapter seven: There are five primary journal entries that important in piecing together the accounts receivable allowance method: 1) Sales on account. 2) Collection of account. 3) Establishing/update the allowance account. 4) Writing off an account. 5) Re-instating an accounting Required: A) Write these journal entries on a study guide. B) Each account that is used in the journal entries should be put in the accounting equation in T account format with its increase and decrease side. C) Identify when we use each of the five journals entries. For instance Sales on Account, we use on a daily basis as we invoice customers. For journal entry number three, we can use the A/R Aging Method or the Sales Method. Does it matter if we use one or the other? Why? Why not? Chapter five: 1) We can assume that inventory’s cost flows several ways: FIFO, LIFO, Weighted Average, and Specific Identification. There are several components in our financial data that are potentially affected by this: cost of sales, cost of goods available for sale, and ending inventory. Look in the chapter and figure out if the method selected (FIFO, LIFO, Weighted Average, and Specific Identification) affects cost of sales, cost of goods available for sale, and ending inventory. Why? 2) Draw an example that helps you understand the difference between FIFO and LIFO. 3) What is LCM and why do we apply it? Chapter eight: A. Clearly label and write out the formulas for the following cost allocation methods: 1) Straight-line 2) Units of Production 3) Double-declining balance 4) Natural resources+ B. Write out the journal entry (just the account names) for: 1) Ordinary repairs 2) Betterments and Extraordinary Repairs Chapter nine: A. Write out the journal entry (just the account names) for: 1. Converting an accounts payable into a notes payable. 2. Recording a notes payable at maturity. 3. Accruing interest for a notes payable at year-end. 4. For payroll with the employEE deductions. 5. For payroll with the employER deductions.