Chapter 4 NOTES

advertisement

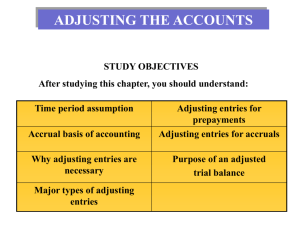

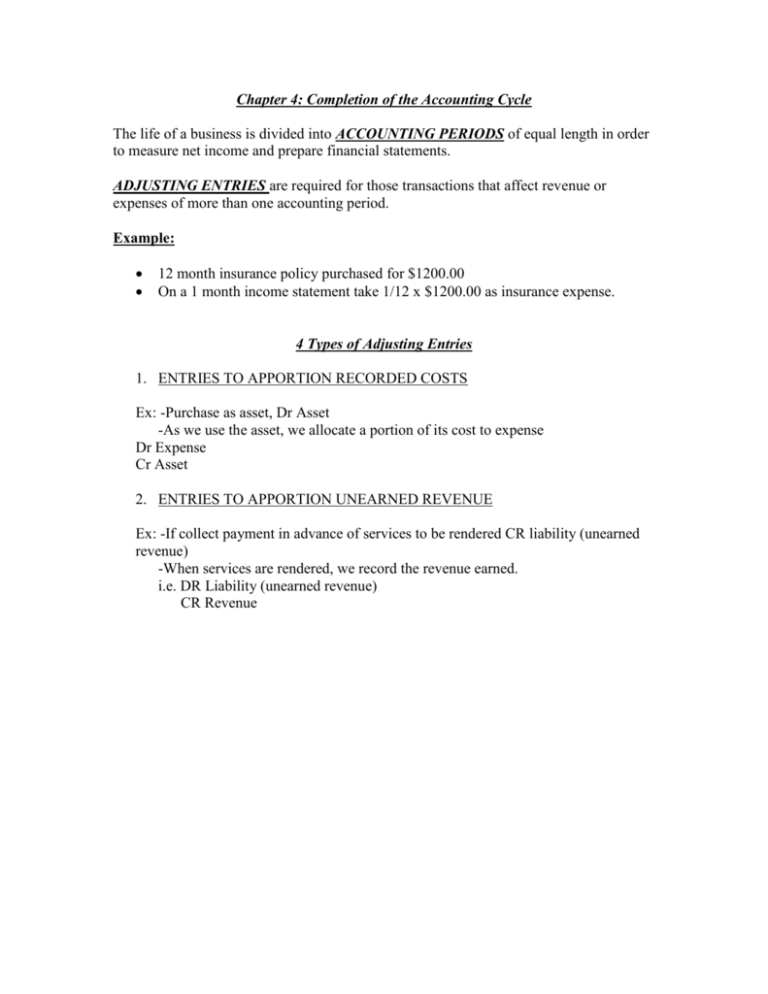

Chapter 4: Completion of the Accounting Cycle The life of a business is divided into ACCOUNTING PERIODS of equal length in order to measure net income and prepare financial statements. ADJUSTING ENTRIES are required for those transactions that affect revenue or expenses of more than one accounting period. Example: 12 month insurance policy purchased for $1200.00 On a 1 month income statement take 1/12 x $1200.00 as insurance expense. 4 Types of Adjusting Entries 1. ENTRIES TO APPORTION RECORDED COSTS Ex: -Purchase as asset, Dr Asset -As we use the asset, we allocate a portion of its cost to expense Dr Expense Cr Asset 2. ENTRIES TO APPORTION UNEARNED REVENUE Ex: -If collect payment in advance of services to be rendered CR liability (unearned revenue) -When services are rendered, we record the revenue earned. i.e. DR Liability (unearned revenue) CR Revenue 3. ENTRIES TO RECORD UNRECORDED EXPENSES 1. Ex. 2. Ex. Bills not yet received Interest owing, but not paid Year-----------------------------------------------------------Receive Bill Repair To Truck Repair Expense, in this case, should be recorded as a year one expense. (An adjusting entry will be made in order to do this- when bill is received) i.e. DR Repair Expense CR Account Payable Or Dr Interest Expense CR Interest Payable 4. ENTRIES TO RECORD UNRECORDED REVENUE i.e. Revenue earned but not yet billed Legal fees receivable 1000 Legal fees earned 1000 READ pg. 148-160 Pg. 188 Ex. 4-5, 4-6, 4-8, 4-11 Q 1-7 pg. 183 THE WORKSHEET A large columnar sheet of paper to arrange in a convenient systematic form all of the accounting data required at the end of the period. Not part of the permanent accounting records, it is only a worksheet for the accountant. Can serve to minimize errors as it catches many errors Prepared after posting all entries to ledger and before preparing financial statements at the end of an accounting period HEADING: WHO, WHAT, WHEN 5 Steps: 1. Enter ledger acct balances in t/b column 2. Enter adjustments in adjusting column 3. Enter adjusting acct balances in adjusted t/b column 4. Extend amounts to i/s or t/b 5. Total i/s + t/b columns. Enter net income or loss as balancing figure + total again. USES FOR THE WORKSHEET 1. Preparing Financial Statements On worksheet, capital is still beginning capital Changes have been recorded in temporary accounts, R, E, D Statement of owner’s equity 2. Recording Adjusting Entries to: Journal Ledger 3. Recording Closing Entries Close i/s credit column Close i/s debit column Close balancing figure to capital Close drawings to capital REVERSING ENTRIES WHEN TO USE: -on the first day of the next accounting period, with adjustments that create and accounts receivable or a short term liability. WHY USE: -to simplify the recording of certain cash receipts and payments in the following period. In this case all weekly salary payments are $3000. ACCOUNTS USED: -it contains the same accounts and dollar amounts as the related adjusting entry, but the debits and credits are reversed, and the date is the first day of the next accounting period EXAMPLE Salaries $600 per day x 5 days per week Weekly Journal Entry Salaries Expense 3000 Cash 3000 If the end of the fiscal year falls on a Wednesday, an adjusting entry is required to record the salaries expense and the related liability to employees for the 3 days they have worked since the last payday. Adjusting Entry Salaries Expense Salaries Payable 1800 1800 Reversing Entry Salaries Payable 1800 Salaries Expense 1800 This reversing entry closes the Salaries Payable account and puts the account in an abnormal credit balance of $1800. On Friday of this first week of the new fiscal period, the regular journal entry for salaries will be made. CLOSING ENTRIES MANUALLY: 1. Dr Revenue, Cr Income Summary 2. Dr Income Summary, Cr Expenses 3. Dr Income Summary, Cr Capital (Net Income situation) 4. Dr Capital, Cr Drawings (CLOSING ENTRIES) CONTRA-ACCOUNTS: -A contra-account is one that has a balance opposite to the normal balance assigned to its classification. All normal balances to an account are entered as positive number and all balances that are not normal (Contra) are entered as negative amounts in the trial balance.