ANSWER KEY ACCOUNTING 610 Fall, 2000 Interim Exam

advertisement

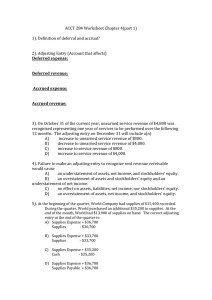

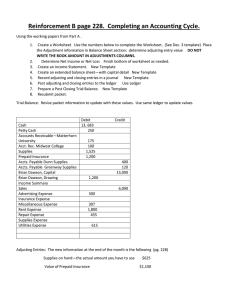

ACCOUNTING 610 Fall, 2000 Interim Exam ANSWER KEY Prof. Steve Matsunaga Student Name ___________________ Section 1 Adjusting entries Section 2 Income statement Section 3 Revenue recognition Section 4 Statement of C.F. Total Each section is weighted equally. You must show supporting calculations in order to receive partial credit. Section 1: 1) Prepare all necessary end-of-the-year adjusting entries. Dr/Cr Account Amount Dr |Peformer expense |24,000 | Cr |Prepaid expense |10.000 | Cr |Performer payable |14.000 | Dr |Unearned admission revenue |40,000 | Cr |Admission revenue |40.000 | | | | 2) Prepare the necessary adjusting entries. Assume the company closes its books non an annual basis and has a December 31 year-end. A) Office space rental 10/1/99 Dr./Cr. Account Name Dr. Cash Cr. Unearned rent Cr. Deposits payable B) Mr. Z's contract 10/1/99 Dr./Cr. Account Name Dr. Prepaid wages Cr. Cash C) Plumbing services 10/1/99 Dr./Cr. Account Name No entry Amount 25,000 20,000 5,000 Amount 120,000 120,000 Amount 12/31/99 Dr./Cr. Account Name Dr. Unearned rent Cr. Rent Revenue Amount 12,000 12,000 12/31/99 Dr./Cr. Account Name Dr. Wage expense Cr. Prepaid wages Cr. Accrued wages Amount 22,500 15,000 7,500 12/31/99 Dr./Cr. Account Name Dr. Plumbing expense Cr. Accrued plumbing Amount 3,000 3,000 Section 2: ABC Co. Income Statement for the year ended December 31, 1999 Amount Net Sales 700,000 Cost of goods sold (350,000) Gross profit 350,000 SG&A (160,000) Loss from settlement litigation (20,000) Gain on disposal of equipment 40,000 Income before tax from Continuing operations 210,000 Tax expense (63,000) Income from continuing operations 147,000 Income from discontinued operations Operating income 14,000 Loss on disposal of assets (70,000) Income before cumulative effect of Changes in accounting principal and Extraordinary items Cumulative effect of a change in Accounting principal Income before extraordinary items Extraordinary gain on early Retirement of debt Net Income 91,000 (35,000) 56,000 210,000 266,000 Section 3: 1) i) 1999 Journal entries. Dr/Cr Dr. Cr. Dr. Cr. Dr. Cr. Dr. Dr. Cr. Account Name Construction in progress Cash, etc. Accounts receivable Billings Cash Accounts receivable Construction in progress Cost of construction Revenue on construction contract Amount 1,450,000 1,450,000 1,400,000 1,400,000 1,200,000 1,200,000 334,615 1,450,000 1,784,615 (4,000,000 - (1,800,00+1,450,000))*(1,450,000/3,250,000) = 334,615 1) ii) 2000 journal entries. Dr/Cr Dr. Cr. Dr. Cr. Dr. Cr. Dr. Dr. Cr. Account Name Construction in progress Cash, etc. Accounts receivable Billings Cash Accounts receivable Construction in progress Cost of construction Revenue on construction contract Amount 950,000 950,000 2,600,000 2,600,000 2,000,000 2,000,000 174,476 950,000 1,124,476 (4,000,000 - 3,300,000) * (2,400,000/3,300,000) - 334,615 = 174,476 1) iii) Balance sheet presentation Accounts receivable Construction in progress Net of billings Billings in excess of construction costs and Gross profit 1999 200,000 2000 800,000 384,615 1,090,909 2) Software revenue recognition. For each sale of the software and the upgrade package, the company should Allocate a portion of the revenue between the original sale and the upgrade. Because the upgrade will double the value the fair values of the original Software and the upgrade are equal and the revenue should be split 50/50. Therefore, $60 of revenue should be recorded. Section 4: change in AR change in ppd insurance change in inventory change in payables change in unearned revenue change in utility accrual CF from operations Amount 52,500 30,000 12,000 94,500 -20,500 5,000 -41,000 5,000 -4,000 -3,000 36,000 Proceeds from sale of FA Purchase of FA CF from investments 58,000 -80,000 -22,000 Financing activities Proceeds from sale of note Repayment of note Payment of dividends CF from financing 45,000 -25,000 -25,000 -5,000 Net Income Depreciation expense Loss on sale of fixed assets Net Cash Flow Beginning cash balance Ending Cash balance 9,000 6,000 15,000