Third Quarter in Review

advertisement

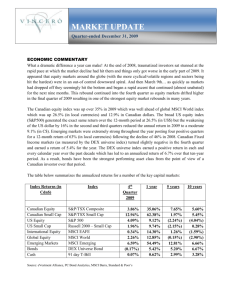

THIRD QUARTER IN REVIEW By Joseph M. Valicenti, Chief Operating Officer Joseph M. Valicenti For the first time in three years, the S&P 500 Index has recorded back-to-back positive quarterly returns. Through nine months of 2003, the major indices have returned 14% for the S & P 500, 13.29% for the Dow Jones Industrial Average and 33.8% for the NASDAQ Composite. This is a positive, broad based trend that has touched most industries and sectors. The interest rate environment continues to provide optimism both on the short end and the long end for “Easy Money” monetary policy, although the 30-year Treasury rates strongly advanced from roughly 4.6% to 5.45% during the first part of the quarter. The Federal Reserve at its latest meeting remained neutral on interest rates, which drove long-term rates below 5% at the end of the quarter. This indicated that the economy may need more help than just a strong equity market. Consumer sentiment is starting to waiver in the University of Michigan Survey Index but consumers seem eager to spend and the month of September finished with a strong week of retail sales bucking the sentiment numbers. Consumer debt and savings rates have been areas of concern, but according to BCA Research, personal savings rates are higher than those of the last three years and the ability to get loans has been made easier over the last two years. (See graph below) For now, consumers are not overextended financially. Continued on Page 3 September 2003 INTERNS EXPANDING OUR WORLD TOGETHER! INVESTOR SENTIMENT – DOES IT INDICATE THE BULL IS BACK! By Michael V. Valicenti, Director of Marketing By Lawrence P. Tolbert, Portfolio Manager A s the summer winds down, the hot and hazy temperatures turn to calm, cool breezes, and the colors of autumn begin to appear, we send our summer interns Jeffrey Benesh and Andrew Clark back to school. We would like to recognize their contributions to the firm. Over the past 19 years, we have provided an opportunity for both high school and college students to have an “on the job” work experience. It allows the students to obtain an in depth view of a business setting, while giving us the chance to hear new thoughts. Jeff returned to us this year. He is in his senior year at Syracuse University, studying for his bachelor of science in finance and accounting at the Whitman School of Management, where he has maintained a position on the Dean’s List since 2000. His intentions are to attend law school after graduation and we wish him the best in all his endeavors. Andy is also a senior, seeking his bachelor of science in financial economics from SUNY Binghamton. He has maintained a place on the Dean’s List for the spring 2002 semester as well as both 2003 semesters. Andy plans to join us during his winter break. This summer presented many challenges for Jeff and Andy as well as the firm. They were involved in statistical, political, economical, and financial discussions with the Investment Committee. We were very pleased to observe their enthusiasm, the sharing of knowledge, and their participation. We feel that this experience is rewarding and valuable for their personal and professional lives and provide refreshing points of view for our staff. We are, Expanding Our World – Together! A lthough we've had a terrific year in the market, it's too early to predict if this rally is sustainable for the long run. One factor that we look at to determine if a rally is sustainable is investor sentiment. If investors are buying more stocks and less bonds, there's positive momentum in the equity market place. If they're buying more fixed instruments and less stocks, there's a negative vibe in the equity market place. During the month of August, investors purchased $22.91 billion in equity mutual funds, representing the sixth straight month of inflows into stock funds. Bond funds have experienced the opposite with $12.59 billion of outflows in August and $10.84 billion in July. August numbers represent the largest outflow since January 2000 when $12.77 billion was withdrawn from fixed income funds. For the year, stock funds have added $79.75 billion in net new inflow. This is a remarkable achievement considering that in 2002 investors pulled $26 billion out of stock funds. As positive as these numbers are, there is still plenty of room to grow. In 2000, investors added $309 billion to stock funds. While investor sentiment is just one of many indicators, we feel positive momentum will continue throughout the remainder of the year and into 2004. With money markets and bond yields at all time lows, we should continue to see growing interest in the equity market. We may indeed be at the starting line for the next “bull run”. It's early, but investors are positioning their portfolios for increases in equity prices. September 2003 NOTE FROM THE PRESIDENT By Vincent R. Valicenti, President and CEO e are pleased to announce that the AIMR Board of Governors has awarded the right to use the Chartered Financial Analyst (CFA®) designation to Sean M. Dwyer. Sean, a cum laude graduate of St. Bonaventure University with a bachelor degree in business administration in finance and accounting, joined the firm in 2001. He serves as a member of the firm’s Investment Committee and his duties include security analysis and security trading as well as assisting the firm’s Portfolio Managers. Sean’s contribution to the firm as an Security Analyst provides invaluable independent research to our Portfolio Managers and the Investment Committee, therefore, benefiting our clients’ portfolios. We are very pleased with his abilities and contributions and we are very proud of his achievements within the firm and the industry. Congratulations, Sean!! W YEAR END TAX PLANNING By Ralph H. Roberts, Jr., Client Services A lthough tax planning should be an all year activity, unfortunately many of us are guilty of waiting until the end of the year to take the necessary actions. By reminding you now, perhaps the appropriate consideration will reduce your tax liability for 2003! We suggest that the following items be reviewed: Capital Gains and/or Losses Charitable Deductions Other Deductions Gifts Income Tax Rate Reduction Paying Off Credit Card Debt Retirement Account Contributions Withholding Adjustments Accelerated Property Taxes Alternative Minimum Tax Should you have any questions, need advice regarding the above listed items, or require tax planning in general, please call one of our client services representatives, Ralph Roberts or Mike Valicenti. We will be happy to research your concern and provide a response or have one of our other professionals contact you directly. THIRD QUARTER IN REVIEW (Continued from Page 1) The United States has moved from a manufacturing economy to a service economy over the past 20 years. Even though the population of the United States has grown in the last 20 years, manufacturing jobs are roughly at the same level as those in the 1960s. This indicates that the growth in the job market has been in the service area rather than manufacturing. The service area includes not only retail and business services, but also technology such as software and information technology (IT) consulting. One of the economic statistics, capacity utilization for manufacturing, currently at a rate of 73% does not necessarily reflect the demand for capital spending for computers, software, or September 2003 IT consulting. This demand is now expanding for two reasons; deferred spending on equipment since 2000 and companies desire for higher productivity without increased employment. Companies like Intel and Microsoft have forecasted increased sales for the fourth quarter and for the year 2004 for hardware and software applications. Wal-Mart, Lowe’s, and Home Depot as well as other retail companies have not only anticipated expanding the size of their individual stores, but also the total number of stores. New technology and capital items will be added to the new expansions. On the energy front, even before the “Blackout of 2003” and with the deregulation of energy, the need to update the grid system while also meeting new demand for energy in a recovering economy will add to capital expenditures in the year 2004. The pullbacks are normal, although there is cause for concern with some of the economic numbers as we “bump” our way out of the recent recession and slow growth period. The monetary policy and fiscal policy put in place early in the year is continuing to set the investment performance pace. The Fed will continue to keep short-term interest rates low in order to facilitate liquidity and to keep equity prices stable in the face of economic strength. The next year may present many hurdles because it is a presidential election year, the threat of worldwide terrorism continues, and the growing cost of transitioning Iraq to a democratic society. INVESTMENT STRATEGY By Jeffrey S. Naylor, Chief Financial Officer T he third quarter continued to show both strength and recovery in the economy. Corporate earnings also show improvement and company managements continue to forecast higher earnings. The previous interest rate decreases were sufficient for the Federal Reserve to keep interest rates low and unchanged for the foreseeable future. The markets for both the third quarter and the year continue to improve. The S & P 500 Index is up 2.57% for the quarter and 14% for the year. More stocks are advancing than are declining resulting in signs of improvement in the market. Taking advantage of the new tax law for dividend income, which became effective earlier this year, we have noticed corporations raising their dividends. Our fixed income strategy is to invest in investment grade bonds with higher coupons. Since money markets remain below one percent, any cash should be used for investment opportunity. With the improved economic and market conditions, our asset mix is 60% stocks, 35% bonds, and 5% cash. The asset mix could change based on client specific directives, need for income, and risk levels. Asset Allocation 5% Pass it on… If you think we do a good job for you, please refer your friends and family. We’ll make sure they can’t wait to thank you! 35% 60% Stocks Bonds Cash This material is intended for the clients of Valicenti Advisory Services, Inc. The information contained herein is based on sources believed reliable; however, its accuracy cannot be guaranteed. This publication is not an offer to buy or sell securities. Past performances are no guarantee of future results. © Valicenti Advisory Services, Inc., September 2003. September 2003