Quarterly Report (Q4)

advertisement

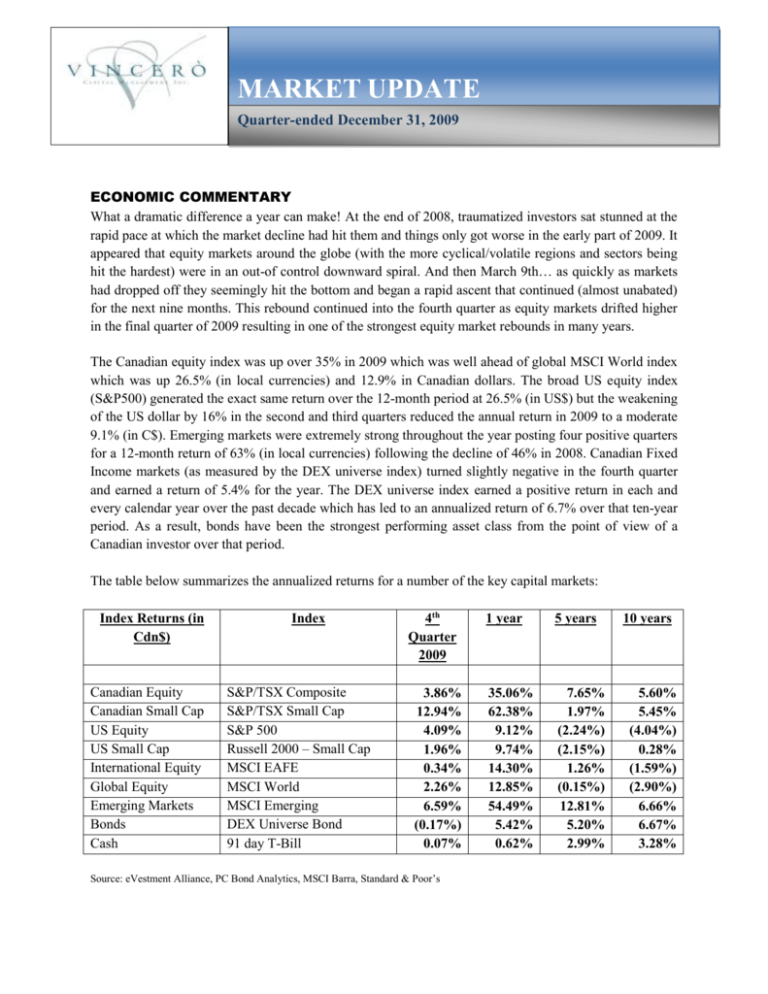

MARKET UPDATE Quarter-ended December 31, 2009 ECONOMIC COMMENTARY What a dramatic difference a year can make! At the end of 2008, traumatized investors sat stunned at the rapid pace at which the market decline had hit them and things only got worse in the early part of 2009. It appeared that equity markets around the globe (with the more cyclical/volatile regions and sectors being hit the hardest) were in an out-of control downward spiral. And then March 9th… as quickly as markets had dropped off they seemingly hit the bottom and began a rapid ascent that continued (almost unabated) for the next nine months. This rebound continued into the fourth quarter as equity markets drifted higher in the final quarter of 2009 resulting in one of the strongest equity market rebounds in many years. The Canadian equity index was up over 35% in 2009 which was well ahead of global MSCI World index which was up 26.5% (in local currencies) and 12.9% in Canadian dollars. The broad US equity index (S&P500) generated the exact same return over the 12-month period at 26.5% (in US$) but the weakening of the US dollar by 16% in the second and third quarters reduced the annual return in 2009 to a moderate 9.1% (in C$). Emerging markets were extremely strong throughout the year posting four positive quarters for a 12-month return of 63% (in local currencies) following the decline of 46% in 2008. Canadian Fixed Income markets (as measured by the DEX universe index) turned slightly negative in the fourth quarter and earned a return of 5.4% for the year. The DEX universe index earned a positive return in each and every calendar year over the past decade which has led to an annualized return of 6.7% over that ten-year period. As a result, bonds have been the strongest performing asset class from the point of view of a Canadian investor over that period. The table below summarizes the annualized returns for a number of the key capital markets: Index Returns (in Cdn$) Canadian Equity Canadian Small Cap US Equity US Small Cap International Equity Global Equity Emerging Markets Bonds Cash Index S&P/TSX Composite S&P/TSX Small Cap S&P 500 Russell 2000 – Small Cap MSCI EAFE MSCI World MSCI Emerging DEX Universe Bond 91 day T-Bill 4th Quarter 2009 3.86% 12.94% 4.09% 1.96% 0.34% 2.26% 6.59% (0.17%) 0.07% Source: eVestment Alliance, PC Bond Analytics, MSCI Barra, Standard & Poor’s 1 year 5 years 35.06% 62.38% 9.12% 9.74% 14.30% 12.85% 54.49% 5.42% 0.62% 7.65% 1.97% (2.24%) (2.15%) 1.26% (0.15%) 12.81% 5.20% 2.99% 10 years 5.60% 5.45% (4.04%) 0.28% (1.59%) (2.90%) 6.66% 6.67% 3.28% MARKET COMMENTARY Having briefly summarized the state of affairs in equity markets in the preceding paragraphs, we now delve deeper into the drivers of performance in the past quarter, the past year and even the past decade. A large part of the rebound that occurred in 2009 was driven by investors that realized that we were not in the midst of another depression and that not all companies were on the verge of bankruptcy (though this appeared to be the mindset in 2008 when everything seemed to fall in tandem). However, not only did investors reverse their view on the probability of the recovery, they once again displayed a reduction in risk aversion – they began to ‘pile in’ to some of the stocks that had fallen most dramatically. Also contributing to the recovery was the increased optimism that the policy measures taken by federal banks around the globe had returned a measure of stability to the global financial system. After a movement to a very risk averse stance in 2008, the risk trade was certainly back in full effect in 2009 as evidenced by some of the top performing asset classes, geographic regions, commodities, market capitalizations and sectors. That is, in each of these categories, the components that would have historically been deemed the most volatile were those that experienced the largest gains. For instance, equities were well ahead of bonds in 2009 and within the equity markets, emerging markets were well ahead of developed markets. Within developed markets, small cap stocks outperformed large cap stocks by a wide margin and the more cyclical sectors of the economy (Materials, Energy, Consumer Discretionary) beat the defensive sectors handily. Within the Fixed Income sector, corporate bonds dramatically outpaced ‘safe’ federal government bonds and with lower quality, higher yielding bonds generating the strongest returns from the market bottom. It is fair to say that stocks deemed as lower quality performed very well for the year as this type of stock not only led the early stages of the rally but appeared to pick up momentum throughout the year (slowing down only late in the fourth quarter). However, despite the strong returns in 2009 detailed in the previous paragraphs, equity markets remain well below their peaks from various points in 2008. That is, the rebound that took place in 2009 was not nearly enough to offset the dramatic declines that occurred in the previous year. An investor fully invested for the two full year period in the Canadian equity index would have seen their $1 decline to $0.90 (requiring 11% to reach December 31, 2007 levels). Even though markets have rebounded 55% from the trough on March 9th, the index is still well below the peak that preceded the 50% decline that began in June 2008. To return to this June 2008 peak would require an additional 28% return from the year-end index level. On the global equity front, an unhedged Canadian investor would have had $0.82 at the end of the two-year period meaning a further 22% return would be needed to return to the level at December 31, 2007. While stock market volatility is not uncommon during periods of economic uncertainty, we have experienced these sharp moves in a very condensed period of time. The swings have been rapid and have been bolstered even further by the tremendous momentum that can carry the market (in either direction). This has been clearly seen over the past two years where the herd mentality has pushed prices first to unreasonable levels at the peak until the bubble bursts but then drives prices to equally irrational levels on the way down. The last market correction in the early 2000s was more drawn out as was the market recovery. We have seen two major bear markets and two major bull markets in the past decade – up and down moves of greater than 50% over short periods of time. The drivers behind the bubbles were entirely different, but the behavioural psychology of the underlying investors that led to the extreme moves were similar. The result has been a decade in which most major equity markets generated negative annualized returns. In the US, this marks the first decade ever that the S&P500 earned a negative return for the full period. Prices fell in the 1930s, but dividends boosted the index slightly into positive territory. Global markets also generated a negative return for the 10-year period. For the most part, the regions that were able to generate positive equity returns since 1999 were those that are more natural resource-dependent due to the rising demand from emerging markets. Clearly, Canada is one of these regions with nearly 50% of our market index represented by resource stocks (Energy and Materials). The equity markets have resumed their upward trend but the question remains - will it continue? While the past two years have been extreme and momentum has played a large role in carrying the market to both highs and lows, a more normalized environment could be around the corner. However, while the pullback of 2008 may have been justified the extent to which it occurred was probably not. Similarly, in 2009, markets valuations were extremely cheap and a large component of the rebound was simply an increase off of all-time lows. In order for the positive markets to continue, data will need to improve in terms of corporate earnings and profitability and not only as a result of drastic cost cutting measures. Many would argue that equities have already priced in the current earnings estimates for 2010 and therefore further expansion must be the result of additional real revenue growth and upwards earnings estimate revisions. Investors may have been satisfied with the ‘hope-driven’ rally in 2009 but that type of rally cannot last and investors will be seeking a ‘growth-driven’ rally if things are to persist in 2010. The other pressing issue is of course the fear that the economy and the markets have simply been propped up by the massive government stimuli and once these are withdrawn there will be another major pullback. Volatility is therefore to be expected for some time to come.