chapter 12 – financial statement analysis problem solutions

advertisement

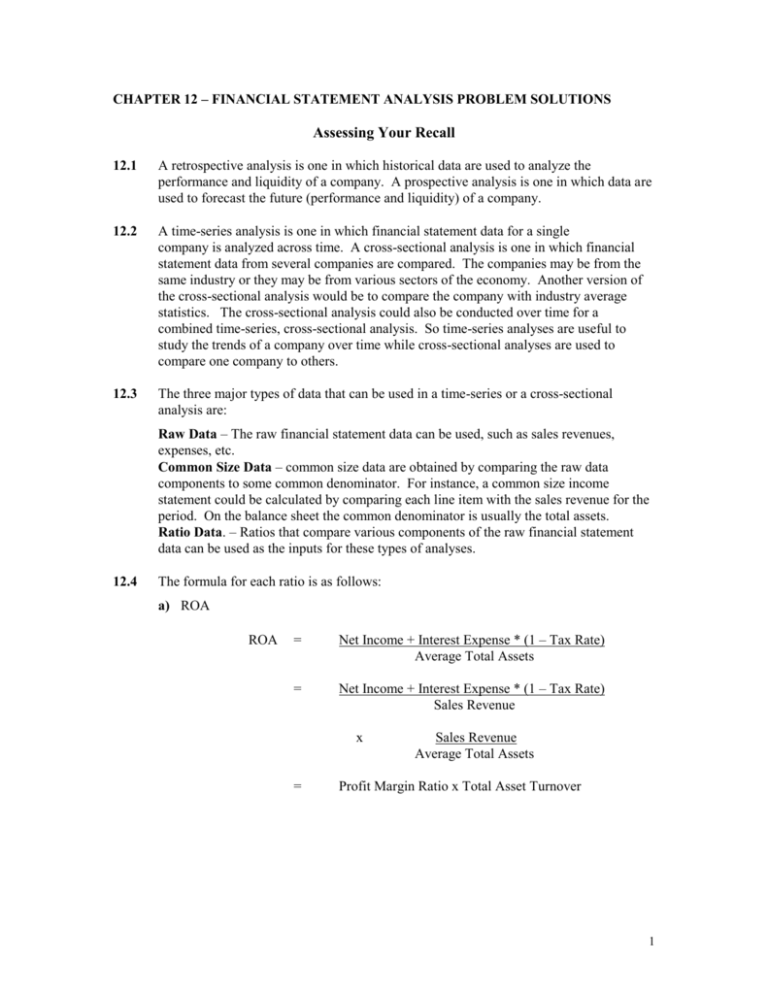

CHAPTER 12 – FINANCIAL STATEMENT ANALYSIS PROBLEM SOLUTIONS

Assessing Your Recall

12.1

A retrospective analysis is one in which historical data are used to analyze the

performance and liquidity of a company. A prospective analysis is one in which data are

used to forecast the future (performance and liquidity) of a company.

12.2

A time-series analysis is one in which financial statement data for a single

company is analyzed across time. A cross-sectional analysis is one in which financial

statement data from several companies are compared. The companies may be from the

same industry or they may be from various sectors of the economy. Another version of

the cross-sectional analysis would be to compare the company with industry average

statistics. The cross-sectional analysis could also be conducted over time for a

combined time-series, cross-sectional analysis. So time-series analyses are useful to

study the trends of a company over time while cross-sectional analyses are used to

compare one company to others.

12.3

The three major types of data that can be used in a time-series or a cross-sectional

analysis are:

Raw Data – The raw financial statement data can be used, such as sales revenues,

expenses, etc.

Common Size Data – common size data are obtained by comparing the raw data

components to some common denominator. For instance, a common size income

statement could be calculated by comparing each line item with the sales revenue for the

period. On the balance sheet the common denominator is usually the total assets.

Ratio Data. – Ratios that compare various components of the raw financial statement

data can be used as the inputs for these types of analyses.

12.4

The formula for each ratio is as follows:

a) ROA

ROA

=

Net Income + Interest Expense * (1 – Tax Rate)

Average Total Assets

=

Net Income + Interest Expense * (1 – Tax Rate)

Sales Revenue

x

=

Sales Revenue

Average Total Assets

Profit Margin Ratio x Total Asset Turnover

1

b) ROE

ROE =

Net Income – Preferred Dividends

Average Shareholders’ Equity

c) Accounts Receivable Turnover

Accounts Receivable

Turnover

=

Sales On Account

Average Accounts Receivable

d) Inventory Turnover

Inventory Turnover

=

Cost of Goods Sold

Average Inventory

=

Cost of Goods Sold

Average Accounts Payable

=

Current Assets

Current Liabilities

=

Current Assets – Inventories

Current Liabilities

e) Accounts Payable Turnover

Accounts Payable

Turnover

f) Current Ratio

Current Ratio

g) Quick Ratio

Quick Ratio

2

h) D/E (I)

D/E (I)

i)

=

Total Liabilities

Total Liabilities + Shareholders’ Equity

or

Total Liabilities

Total Assets

=

Total Liabilities

Total Shareholders’ Equity

D/E (II)

D/E(II)

j) D/E (III)

D/E(III)

=

Total Long-term Liabilities

Total Long-term Liabilities and Shareholders’ Equity

k) Times Interest Earned

Times Interest Earned

(TIE)

=

=

12.5

Income before Interest and Taxes

Interest Expense

Net Income + Taxes + Interest Expense

Interest Expense

The amount of cash produced from operations depends upon several factors. Three of

those factors are the accounts receivable, inventory, and accounts payable policies. The

leads and lags between the cash outflows for production and the cash inflows from

collections on sales are important in understanding the company’s cash generating

capabilities. The turnover ratios, when converted into the “number of days” form,

provide some insight into how long these lags are for a company. Changes in these ratios

also provide information about whether there have been significant changes in these

policies or in enforcing these policies. The accounts receivable turnover, for instance,

tells you how long, on average, it takes to collect an account receivable. Comparing this

ratio with a company’s stated receivables policy allows you to assess whether or not they

are doing a good job of collecting.

3

The shareholders of the company leverage their investment when they borrow some of

the money needed to invest in the assets of the company. This works to the advantage of

the shareholders if the cost to borrow the money is less than the return that they can earn

by investing in the assets of the company. It works to their disadvantage if the cost to

borrow exceeds the return on the assets invested. ROA provides a measure of the return

on the assets of the company. As long as this return is higher than the after tax cost of

the debt the shareholders’ return (ROE) should be higher than the ROA. This higher

return will be evidenced by a higher ROE for the company (higher than ROA). If the

after tax, cost of borrowing exceeds the ROA then ROE will be lower than ROA.

12.6

The ROA ratio can be broken down into two ratios: a profit margin ratio and a total

asset turnover ratio. The ratios are as follows:

ROA

= Net Income + Interest Expense * (1 – Tax Rate)

Average Total Assets

= Net Income + Interest Expense * (1 – Tax Rate)

Sales Revenue

x

=

Sales Revenue

Average Total Assets

Profit Margin Ratio x Total Asset Turnover

A retail clothing store could employ two different strategies of obtaining a particular

ROA. One strategy would be to set prices to achieve a relatively high profit margin.

Because of the high prices the total asset turnover might not be as high as it would

otherwise be because the company may have to invest more in its stores to attract the

kind of clientele that will pay the high prices. The volume of sales per dollar of

investment (total asset turnover) may, therefore, be lower. Another store in the same

industry may adopt a different strategy in which it charges lower prices (lower profit

margin ratio) but make up for it by not investing as much in its stores and, hopefully,

makes up for the lower profit margin with a higher volume per dollar of investment.

12.7

The advantage of common size statements are that they make it easy to make

proportionate comparisons that are not as easy using the raw data. For instance, in a

given year both the revenues and the cost of goods sold may increase, as evidenced by

the raw data. If, however, the cost of goods sold increases faster than the revenues the

profit margin of the company will decline. This decline could easily be seen in a

common size set of statements.

4

12.8

The current ratio is subject to manipulation because at year-end the company can adjust

its spending and payment patterns to produce a current ratio that is desired. Paying off

accounts payable with cash at year-end will improve the current ratio, for instance, but

may not be a sign of improved liquidity.

12.9

The accounts payable turnover ratio is ideally calculated as follows:

Accounts Payable

Turnover

=

Credit Purchases

Average Accounts Payable

The problem with this calculation is that credit purchases is not a readily available

number. As a surrogate for credit purchases the cost of goods sold number is often used.

How good a surrogate this is depends on the type of company and its credit policies. In a

retail company the cost of goods sold number will be a good surrogate for the credit

purchases if most goods are bought on credit and there is relatively little change in the

balance of accounts payable from the beginning of the period to the end. If not all goods

are purchased on credit this surrogate will tend to overstate the turnover. There is a

further problem with this ratio in a manufacturing company. In this case, the cost of

goods sold number includes many costs other than those associated with purchases

during the period. For example salaries, amortization, etc. Therefore, in a manufacturing

company this ratio tends to be overstated.

12.11

The earnings per share of a company is calculated by dividing the earnings of the

company by the average number of shares that were outstanding during the period. In

some companies there exists the possibility that more shares may be issued (other than

those currently outstanding) due to agreements such as stock option plans and

convertible securities (securities such as convertible debt or convertible preferred shares)

that can, at the option of the holder, be converted into common shares. Because of the

potential to issue more shares the calculated earnings per share based on the actual

number of shares outstanding may not truly reflect the earnings per share of the company

since it may be likely that some investors will exercise their options or convert their debt

or preferred shares into common shares. This will have the effect of diluting earnings

per share. The purpose of basic and fully diluted earnings per share is to give the reader

of the financial statement some idea of the effect that these conversions might have on

the earnings per share number. Basic earnings per share is a reflection of the current

earnings and fully diluted earnings per share is a reflection of the worst case scenario

assuming outstanding issuances or conversions occurred.

5

12.12

The lower the times interest earned ratio, the greater is the credit risk of the

company. This relationship exists because a company that is experiencing difficulties

meeting its interest payments on existing debt has a greater potential to default on an

additional loan. From the perspective of lenders, this greater default risk translates into a

higher assessed credit risk.

Applying Your Knowledge

12.13

a)

Year 1:

Year 2:

Year 3

Year 4

Current Ratio

$1,500 / $1,000 = 1.5

$2,000 / $1,250 = 1.6

$2,500 - $1,485 = 1.7

$3,000 / $1,500 = 2.0

Quick Ratio

($1,500 - $600) / $1,000 = 0.9

($2,000 - $1,100) / $1,250 = 0.7

($2,500 - $1,700) / $1,485 = 0.5

($3,000 - $2,200) / $1,500 = 0.5

b) The current ratio has shown an increasing trend over the four years and

can be considered respectable as seen in year 4. However, this 4 year upward trend has

been at the cost of stocking more inventory and this has resulted in a downward trend in

the quick ratio, which has become 0.5 in Year 4.

12.14

a)

Current Ratio

20x1

$300,991 / $239,789 = 1.3

20x2

$310,739 / $160,345 = 1.9

b)

Quick Ratio

20x1

($62,595 + $96,242) / $239,789

= 0.7

20x2

($67,834 + $98,666) / $160,345 = 1.0

c) Sundry incurred a net loss in 20x2 because the balance in retained earnings

decreased, although no dividends were declared. The amount of the net loss is equal to

the change in retained earnings from the prior year, or $1,461.

d)

Debt / equity

20x1

$532,764 / $866,036 = 62%

20x2

$549,130 / $885,194 = 62%

e) Declaring a dividend is possible because the company has a reasonable cash balance,

and is in a comfortable position regarding short-term liquidity. This can be seen from

the current and quick ratios. The debt to equity ratio is unchanged from the prior year,

and indicates that 62% of the company’s assets are financed through debt. However,

6

because long-term debt increased in 20x2, interest payments can be expected to rise in

the future. In addition, since the company incurred a net loss for the year, declaring a

dividend is not recommended.

12.15 a) Accounts receivable Turnover

Campton Electric:

$3,893,567 / [($542,380 + $628,132) / 2 ] = 6.65

Johnson Electrical:

$1,382,683 / [($168,553 + $143,212) / 2] = 8.87

b) Average number of days required to collect Accounts Receivable:

Campton: 365 / 6.65 = 55 days

Johnson: 365 / 8.87 = 41 days

c) Given that these companies are in the same industry, Johnson would appear to be

more efficient in collecting its accounts receivable.

d) In order to assess management’s handling of the collection of accounts receivable, it

would be helpful to know the credit terms that each company offers to its customers.

This could then be compared against the turnover in days to determine whether the credit

terms are being enforced.

12.16 a) Accounts receivable Turnover

20x0: $3,218,449 / $350,672 = 9.18

20x1: $3,585,391 / [($350,672 + $362,488) / 2] = 10.05

20x2: $3,988,432 / [($362,488 + $358,562) / 2] = 11.06

b) Average number of days required to collect Accounts Receivable:

20x0: 365 / 9.18 = 40 days

20x1: 365 / 10.05 = 36 days

20x2: 365 / 11.06 = 33 days

c) Accounts receivable turnover is increasing each year, and collection seems to be

occurring faster. To help understand these trends, information regarding changes in

credit terms, the sales mix, or the types of customers would be helpful.

7

12.17

a)

Year 1:

Year 2:

Year 3

Year 4:

Year 5:

Inventory Turnover

$463,827 / $65,537 = 7.08

$511,125 / $81,560 = 6.27

$593,350 / $110,338 = 5.38

$679,686 / $166,672 = 4.08

$708,670 / $225,895 = 3.14

Number of days

365 / 7.08 = 52 days

365 / 6.27 = 58 days

365 / 5.38 = 68 days

365 / 4.08 = 89 days

365 / 3.14 = 116 days

b) The inventory Turnover has decreased over the 5 year period suggesting a periodic

increase in the time that the inventory is held. This is not favorable. It is possible that

this change could be due to a change in the type of inventory that is being sold by the

company and, therefore, might not indicate a major problem. Information on such

changes is needed in order to comment on the management of inventories.

12.18 a) Inventory turnover:

Green Grocers:

$8,554,921 / [($582,633 + $547,925) / 2] = 15.13

Fast Lane Foods:

$2,769,335 / [($174,725 + $195,446) / 2] = 14.96

b) Average number of days inventory is held:

Green Grocers: 365 / 15.13 = 24 days

Fast Lane Foods: 365 / 14.96 = 24 days

c) The inventory turnover for a food store should be high because food is perishable,

and must be turned over frequently so that spoilage does not occur. Therefore,

considering that inventory for these companies is held for less than one month, this

appears to be reasonable. Both companies appear to be managing their inventory to more

or less the same degree, although Green Grocers has a slightly higher turnover.

d) Fast inventory turnovers could be an indication that not enough inventory is being

held. Because inventory is held in order to support the sales function, potential sales can

be lost or shortages might result in the loss of current customers if not enough inventory

is maintained.

8

12.19

a) Current liabilities are $664,892, using the current ratio to compute the amount:

Current ratio = Current assets / Current liabilities

Current ratio x Current liabilities = Current assets

Current liabilities = Current assets / Current ratio

Current liabilities = $1,462,763 / 2.20 = $664,892

b) Total debt is $2,073,399, using the debt to equity ratio (I) to compute the amount:

Debt to equity ratio (I) = Total debt / Total assets

Total debt = Debt to equity ratio (I) x Total assets

Total debt = .58 x $3,574,825 = $2,073,399

c) Total equity is, $1,501,426 using total assets minus total liabilities ($3,574,825 $2,073,399).

d) The company has a quick ratio of only 0.89 compared to a current ratio of 2.20. This

indicates that the company has a significant amount of inventory or prepaid assets as a

current asset on its balance sheet. Financial institutions tend to have larger balances in

cash and near cash items, which would tend to result in a higher quick ratio and normally

do not carry large balances of inventory. This would appear to rule out classifying the

company as a financial institution. It also appears that the company is not a service

organization. Service organizations normally do not have large amounts invested in

noncurrent assets. Since only $497,645 of the $1,431,123 increase in total assets is

attributable to an increase in current assets, $933,478 has been added to noncurrent

assets during the year. Because of the increase in noncurrent assets and the large

inventory balance, it appears the company is a merchandising or manufacturing

company.

e) Net income for the year was $247,530 (1,650,200 shares x $0.15 earnings per share).

f) The company’s liquidity is largely dependent upon the nature of the inventory it

holds, and the speed at which this inventory can be sold, and the cash collected. If the

inventory is liquid, then the current ratio of 2.20 indicates that the company is in good

shape for the short-term. If the inventory is not liquid, then the quick ratio of 0.89

suggests that cash might not be present to extinguish the current liabilities as these fall

due. The overall financial position of the company appears to be deteriorating. The

quick ratio and earnings per share have declined. The amount of debt relative to assets

and equity has increased, indicating a larger proportion of debt financing which increases

the riskiness of the company. A more thorough analysis would be necessary to

determine if the company is in serious financial trouble.

g) Significant changes from Year 1 to Year 2 include the discrepancy between the

current and quick ratios, the use of debt to finance total assets, the increase in noncurrent

assets, and the decline in earnings per share. The quick ratio declined although the

current ratio increased. This indicates that the company has increased its investment in

inventory or prepaids, also apparent from the large increase in current assets. The

company’s use of debt has also increased in Year 2 such that debt is being relied upon to

a greater extent than equity, which is not the case in Year 1. This is the result of

increased debt financing, and possible share redemptions. Noncurrent assets also

increased, and were likely financed through the issuance of additional debt. Finally,

earnings per share decreased. While the gross margin on sales did not change

significantly, the increased debt burden undoubtedly had a major impact, resulting in a

reduction in net income and earnings per share.

9

12.20 a) Return on Shareholders’ Equity:

Year 1:

Year 2:

Year 3:

Year 4:

ROE

$200 / $6,278 = 3.2%

$503 / $9,614 = 5.2%

$1,105 / $13,619 = 8.1%

$2,913 / $24,729 = 11.8%

b) Return on assets:

Year 1:

Year 2:

Year 3:

Year 4:

Profit Margin Ratio

[$200 + $50(0.6)] / $15,472 = 1.5%

[$503 + $55(0.6)] / $19,558 = 2.7%

[$1,105 + $96(0.6)] / $21,729 = 5.4%

[$2,913 + $89(0.7)] / $28,493 = 10.4%

Total Asset Turnover

$15,472 /$19,745 = .78

$19,558 / $25,227 = .77

$21,729/ $33,146 = .66

$28,493 / $67,185 = .42

ROA

1.17%

2.08%

3.56%

4.37%

c) ROA and ROE have been positive and increasing over the four year period. This

would indicate improved performance over time. The actual performance depends upon

what other companies in the same industry have been able to do in the same time period.

The improvement has come from improved profit margins for the four years, although

the asset turnover has been declining over the same period. The company has effectively

applied leverage since the ROE exceeds the ROA in all four years.

10

12.21 a) Return on Shareholders’ Equity:

ROE

$1,533 / $24,664 = 6.2%

$3,830 / $32,415 = 11.8%

$6,755 / $51,415 = 13.1%

Year 1:

Year 2:

Year 3:

b) Return on assets:

Year 1:

Year 2:

Year 3:

Profit Margin Ratio

[$1,533 + $896(0.75)] /

$42,798 = 5.2%

[$3,830 + $1,441(0.7)] /

$54,061 = 9.0%

[$6,755 + $2,112(0.7)] /

$76,023 = 10.8%

Total Asset Turnover

$42,798 / $48,744 = 0.88

ROA

4.6%

$54,061 / $65,258 = 0.83

7.5%

$76,023 / $98,654 = 0.77

8.3%

c) ROA and ROE have been positive and increasing over the three year period. This

would indicate improved performance over time. The actual performance depends upon

what other companies in the same industry have been able to do in the same time period.

The improvement has come from improved profit margins as evidenced from the change

in the profit margin ratio and the slightly declining asset turnover. The company is also

effectively applying leverage since the ROE exceeds the ROA.

ROE

=

ROA

Net Income

400,000

=

NI + [($200,000 x 0.08) x 0.7]

$600,000

$600,000 x NI

$600,000 x NI

$200,000 x NI

Net income

=

=

=

=

$400,000 x [NI + $11,200]

$400,000 x NI + $4,480,000

$4,480,000

$22,400

b) ROE = $22,400 / $400,000 = 5.6%

c) After tax income

= $22,400

Before tax income ($22,400 / 0.7)

Interest = $200,000 x 8%

Income before interest and taxes

d) ROA

=

0.056 =

NI + [($300,000 x 0.06) x 0.7]

$600,000

Net income

=

ROE =

$21,000 / $300,000 = 7.0%

=

=

$32,000

16,000

$48,000

NI + [Interest expense x (1 - tax rate)]

Average total assets

$21,000

11

e) Under the original assumptions, the ROA is 5.6%. In the second set of assumptions

the company can borrow at an after-tax interest cost of 4.2% (6% x 0.7). Because the

company is borrowing at a cost of 4.2% to invest in assets that generate a return of 5.6%,

the ROE climbed to 7.0%.

12.23a)

Year 1:

D/E (I)

$1,025 / $2,225 = 46%

D/E (II)

$1,025 / $1,200 = 85%

Year 2:

Year 3:

$1,525 / $3,325= 46%

$2,150 / $4,350 = 49%

$1,525 / $1,800 = 85%

$2,150 / $2,200 = 98%

Year 1:

Year 2:

Year 3:

D/E(III)

$600 / $1,800 =

33%

$1,000 / $2,800 = 36%

$1,400 / $3,600 = 39%

Times Interest Earned

$500 / $80 = 6.3

$800 / $100 = 8.0

$1,000 / $135 = 7.4

b) The company seems to be in a fairly comfortable position with regard to its long-term

debt/equity ratio (D/E III), which is increasing slightly over the years, but not at a

significant rate. There would be some concern if this trend continues and if it

accelerates. The times interest earned ratio also indicates that the company is earning a

sufficient amount of income to meet its interest obligations. There is no trend in either

direction with the TIE ratio.

12.24 a)

Year 1:

D/E (I)

$1,090 / $2,590 = 42%

D/E (II)

$1,090 / $1,500 = 73%

Year 2:

$1,530 / $3,030 = 51%

$1,530 / $1,500 = 102%

Year 3:

$1,720 / $3,520 = 49%

$1,720 / $1,800 = 96%

Year 1:

Year 2:

Year 3:

D/E(III)

$700 / $2,200 =

32%

$1,100 / $2,600 =

42%

$1,200 / $3,000 =

40%

Times Interest Earned

$1,000 / $120 = 8.3

$1,300 / $150 = 8.7

$1,600 / $165 = 9.7

b) The company seems to be in a fairly comfortable position with regard to its long-term

debt/equity ratio (D/E III), which has increased 10% in Year 2 and then decreased

slightly. There would be concern if the ratio continued to increase in future years as the

rate that it did in Year 2. The times interest earned ratio also indicates that the company

is earning a sufficient amount of income to meet its interest obligations. Since Year 1,

the TIE has increased to 9.7 in Year 3, the company can quite comfortably pay the

interest out of earnings.

12

12.25Key:

Decrease

Increase

No Effect

Transaction

1

2

3

4

5

6

7

+

NE

Current

Ratio

*

+

*

+

+

-

Quick

Ratio

Inventory

Turnover

+

*

+

+

+

+

NE

NE

NE

NE

+

ROE

D/E(I)

NE

+

NE

NE

+

-

+

+

+

* The ratio will be affected, but the direction of the effect cannot be

determined from the information given. Since the same amount will be added or

subtracted from the numerator as well as the denominator; the change in the ratio will

depend on what the ratio was to begin with.

12.26

Transaction

1

2

3

4

5

6

7

Current

Ratio

+

NE

*

+

NE

+

ROA

+

NE

NE

-

AR

Turnover

+

NE

NE

NE

NE

NE

ROE

+

NE

NE

NE

NE

-

D/E (I)

NE

+

+

+

NE

-

*The ratio will be affected but the direction of the effect cannot be determined from the

information given. Since the same amount will be added or subtracted from the

numerator as well as the denominator, the change in the ratio will depend on what the

ratio was to begin with.

12.27 a) The amount that should be reported as basic earnings per share for the

year is

Calculation of earnings per share:

Net income

Less preferred share dividends

[100,000 x $1.00]

Earnings available to common

Number of common shares

$720,000

(100,000)

$ 620,000

900,000

13

Earnings per share

$0.69

b) The convertibility of the preferred shares has relevance for reporting earnings per

share because the preferred shares might be converted to common shares. This means

that the company’s net income might have to be spread over more common shares. This

possible effect is called dilution of earnings per share. If all of the preferred shares

converted, net income would not need to be reduced by the preferred dividends and the

number of common shares would increase by 200,000. The fully diluted earnings per

share would be $0.65 ($720,000/1,100,000).

12.28 a) Net income for 2000 = $0.46 per share x 28,500 shares = $13,110

b) Earnings per share for 2001 = $14,800 / 28,500 = $0.52 per share

c) Earnings per share figures are usually included in the annual report on the face of the

income statement for each year reported. They are usually reported just below net

income. They could also be reported in the notes to the financial statements although

very few companies will report earnings per share in this manner.

d) If Signal decides to split its common shares 2 for 1, then the earnings per share must

also be split in 2, because the same net income must be spread out over twice as many

shares. The 2000 earnings per share amount is also affected, because the comparative

income statement must present both earnings per share figures as though the split had

occurred in 2000. This retroactive treatment is provided so that comparability is

maintained.

14

12.29a) Working capital = ($218,000 + $320,000 + $32,000) - $165,000 = $405,000

The working capital is quite high, and indicates that there are more than enough current

assets to satisfy current liabilities. In addition, since the company maintains a reasonably

high cash balance of $218,000, cash required to finance operations is not a concern.

b) Current ratio = $570,000 / $165,000 = 3.5

Quick ratio = ($218,000) / $165,000 = 1.3

The quick ratio assumes that the other assets are prepaid assets.

Both the current ratio and the quick ratio exceed the criteria of 2.0 and 0.8 respectively.

Based on these ratios, the company’s current asset position is strong, and short-term

liquidity is not a concern. In fact, these ratios suggest that perhaps the company’s

investment in current assets is more than what is required in order to support the sales

function and finance operations.

c) A change from cash to credit sales would not affect the current ratio or quick ratio if

previous cash sale customers now purchased on account. The cash balance would

decrease, and a receivable balance would be created. In reality, if the company starts to

sell on credit, its total sales are likely to increase as it attracts new customers who would

not buy before because of the cash only policy. This would cause both the current ratio

and the quick ratio to increase. The company will now have to manage collection of its

receivables, and establish credit terms for its customers. The accounts receivable

turnover ratio, which indicates how quickly accounts receivable are collected, will now

be affected.

d) If these balances existed following the completion of the primary business, then most

of the current assets held would be unnecessary, and reflect poor cash and inventory

management. Cash and inventory are short-term investments that a company must make

in order to facilitate sales to customers. If sales are decreasing, then the company should

decrease its current assets.

15

12.30a) Ratios for A-Tec and B-Sci:

A-Tech

(1)

(2)

(3)

(4)

(5)

(6)

Current ratios

Working capital

Rec. turnover

Inv. Turnover

Asset turnover

Total debt to

total assets

(7) Sh. Equity to

total assets

(8) Gross margin ratio

(9) Return on sales

(10) Return on assets

(11) Return on equity

Bi-Sci

2001

1.16

$11

31.7 times

16.6 times

2.4 times

2000

.95

($2)

45 times

22.5 times

3.2 times

2001

2.25

$30

30 times

15 times

3.6 times

2000

2.17

$28

30 times

15 times

3.8 times

86.9%

81.7%

14.2%

15.4%

13.1%

30%

10%

24.5%

186.3%

18.3%

33%

11.9%

38.5%

210.5%

85.8%

25%

10%

35.5%

41.4$

84.6%

25%

10%

38.5%

45.5%

Supporting calculations:

A-Tech:

(1) Current ratio (current assets/current liabilities)

(2) Working capital (current assets – current

Liabilities)

(3) Acc. receivables turnover (sales-net acc. rec.)

(4) Inventory turnover (cost of goods sold/inv.)

(5) Asset turnover (sales/total assets)

(6) Total debt to total assets (total liab./total assets)

(7) Sh. equity to total assets (Sh. equity/total assets)

(8) Gross margin ratio [(sales – cost of goods sold)

/sales]

(9) Return on sales (net income/sales)

(10) Return on assets (net income/total assets)

(11) Return on equity (net income/Sh. Equity)

2001

78/67

2000

38/40

78-67

950/30

665/40

950/388

337/388

51/388

(950-665)

/950

95/950

95/388

95/51

38-40

675/15

450/20

675/208

170/208

38/208

(675-450)

/675

80/675

80/208

80/38

Bi-Sci:

(1) Current ratio (current assets/current liabilities)

(3) Working capital (current assets – current

Liabilities)

(3) Acc. receivables turnover (sales-net acc. rec.)

(4) Inventory turnover (cost of goods sold/inv.)

(5) Asset turnover (sales/total assets)

(6) Total debt to total assets (total liab./total assets)

(7) Sh. equity to total assets (Sh. equity/total assets)

(8) Gross margin ratio [(sales – cost of goods sold)

/sales]

(9) Return on sales (net income/sales)

(10) Return on assets (net income/total assets)

(11) Return on equity (net income/Sh. Equity)

2001

54/24

2000

52/24

54-24

600/20

450/30

600/169

24/169

145/169

(600-450)

/600

60/600

60/169

60/145

52-24

600/20

450/30

600/156

24/156

132/156

(600-450)

/600

60/600

60/156

60/132

16

b) The following analysis is separated into liquidity, solvency, leverage and profitability

analysis.

Liquidity: Bi-Sci appears to be in a better liquidity position. Its current ratio is much

higher than A-Tech’s and its working capital is also higher. A-Tec’s current ratio and

working capital have improved but they are still lower. The accounts receivable turnover

and inventory turnover also measure liquidity because they measure the amount of time

before these items will be converted to cash in the operating cycle. Both of these ratios

remained constant for Bi-Sci in 2001. A-Tec’s ratios declined in 2001 and are now

closer to Bi-Sci’s. It may be that A-Tec’s ratios in 2000 were unusually high and are

now closer to those of other companies.

Solvency: Bi-Sci is in a much better solvency position as measured by the total debt to

total assets and total shareholders’ equity to total assets ratios. Bi-Sci is financed mostly

by shares while A-Tec is financed mostly by borrowing.

Leverage: A-Tec is using much more leverage than Bi-Sci. Since A-Tec is financed

mostly by debt, its return on equity (net income/shareholders’ equity) will be much

higher when the rate of earnings exceeds the interest rate on the debt. Leverage is best

measured by comparing the return on assets to the return on equity. With high leverage,

and a return on assets in excess of interest rates, the return on equity for a company like

A-Tec will be very high. The returns of the two companies are computed as follows:

Return on assets

Return on equity

A-Tech

2001

2000

24.5%

38.5%

186.3%

210.5%

Bi-Sci

2001

35.5%

41.4%

2000

38.5%

45.5%

Profitability: The companies are very similar in profitability measures. The return on

sales is about the same both years for both companies. While the return on assets is the

same in 2000, Bi-Sci is a little better in 2001. However, A-Tec increased its sales by

40% in 2001 to go along with the expansion in assets and Bi-Sci had no growth in 2001.

Determining which company is the better investment for a shareholder depends on the

amount of risk the shareholder is willing to absorb. The return on equity for A-Tec is

very high. As long as the return on assets stays high, there will be a good return to

shareholders. An important question is will the growth in sales continue. On the other

hand, the high leverage makes A-Tec much more risky for shareholders. Bi-Sci appears

to be a much better credit risk from a lender’s standpoint. It has a much better liquidity

and solvency position, less leverage, and less risk that debts will not be paid.

17

Management Perspective Problems

12.31

The debtholder is very interested in the ability of the company to pay off its

debts. The debt/equity ratios measure the extent to which the company utilizes debt to

finance its operations. The more debt it incurs the higher the risk of default on a

particular loan. The debtholder would be interested in restricting the level of debt in the

company to limit the risk of default. The current ratio measures short-term liquidity and

is a measure of the company’s ability to pay its debts in the short-term. The debtholder

would be very interested in assuring that this ratio is maintained at some minimum level

to insure that payments are made on a timely basis.

12.32

Perhaps the easiest way to influence the ratio is to try to increase net income. A change

in the revenue recognition method to recognize revenue earlier in the company’s cash to

cash cycle could have this impact. Accelerating the recognition of revenue under

existing methods could also cause an increase in net income. Companies might speed up

shipments of goods, for instance, if revenues are recognized at the time of shipment.

Management could also decide to delay the acquisition of new capital assets. When new

assets replace old ones, total assets usually increases which lowers the ROA.

12.33

From the perspective of a potential investor, the following four ratios might be helpful:

a) ROE: This ratio indicates the rate of return that the company is earning for its

common shareholders. Potential investors should compare the ROE for the company to

the rate of return that could be earned on a similar risk investment in another company.

b) Current ratio: This ratio tells potential investors whether the company is likely to

experience financial difficulties in the short-term.

c) Debt to equity (I): This ratio reflects the extent of debt in the company’s capital

structure. Debt use imposes additional risk on shareholders, because the company is

contractually committed to making fixed interest and principal repayments at definite

points in the future. Such commitments assume that the company is able to generate

sufficient cash from operations. In addition, as a potential investor, a large amount of

debt means that assets of the company must first be distributed to debtholders, creating

the potential that no assets remain to satisfy the claims of shareholders. On the other

hand, the use of debt can result in increased returns to shareholders through the use of

leverage.

d) Price earnings ratio: This ratio indicates the market price of a share per one dollar of

earnings that the company generates. For a potential investor, a high price-earnings ratio

means that the market price is based on future predicted earnings, rather than on current

earnings. Thus, the greater the price-earnings ratio, the higher earnings must be in the

future in order to justify the current market price.

18

12.34

From the perspective of an auditor, the following ratios might be helpful in

identifying abnormalities:

a) ROA: This ratio reflects the rate of return that a company earns on all assets. If this

ratio is significantly different from that of other companies in the same industry,

abnormalities or fraud might exist. This ratio should be examined through its

component parts - the profit margin ratio and the asset turnover.

b) Accounts receivable turnover: This ratio indicates the speed at which receivables are

collected. If the company has created fictitious sales, then turnover would be much

lower than expected, because the accounts receivable associated with the fake sales are

not collected. This can alert the auditor to fraud.

c) Accounts payable turnover: This ratio reflects the speed at which payables are paid. If

the company is creating fictitious sales, then this ratio would be much higher than

expected, because the cost of goods sold associated with the fake sales does not

correspond to a portion of accounts payable.

In general, auditors use both time-series analysis and cross-sectional analysis to alert

them to irregularities or fraud. Auditors focus on areas where significant changes

occurred from the prior year, and on those areas that differ materially from industry

averages.

12.35

Being a potential supplier that grants 30 day credit terms, you would be most interested

in the ability of the dealership to generate cash in the short-term to satisfy its current

liabilities. Thus, ratios that might be helpful include the current ratio, quick ratio, times

interest earned ratio, and accounts payable turnover.

12.36

Ratios that would help the decision maker in arriving at a decision or to identify areas for

further analysis include:

a) Decrease in net income from:

1. a decrease in sales or an increase in cost of sales:

Gross Profit Margin

2. an increase in total operating expenses:

Gross Profit Margin and Return on Sales

Horizontal and Vertical Analysis

3. an increase in an individual operating expense:

Horizontal and Vertical Analysis

b) Sufficient cash to pay dividends and make debt payments:

Dividends to Cash Flow from Operations

Current Ratio

Quick Ratio

c) Long-term debt higher than the industry as a whole:

Debt to Equity

Long-term Debt to Assets

19

d) Comparison of profitability in relation to invested capital:

Return on Equity

e) Whether the decline in economic activity affected accounts receivable collections:

Accounts Receivable Turnover

f) Whether the company was successful in reducing inventory investment:

Inventory Turnover

g) Determining which company provides more earnings per share:

Earnings Per Share

Price/earnings Ratio

h) Efficient management of inventory:

Inventory turnover

Reading and Interpreting Published Financial Statements

12.37 a)

ROA

=

Net income + [Interest expense x (1 - Tax Rate)]

Average Total Assets

=

Net income + [Interest expense x (1 - Tax Rate)]

Sales Revenue

X

Sales Revenue

Average Total Assets

=

{[$10,105 + $27,559(1-0.43)] / $354,125} X {$354,125 /

[($616,027 + $500,748) / 2]}

0.0729 x 0.6342

4.6%

=

=

ROE

=

Net Income - Preferred Dividends

Average shareholders’ equity

=

=

$10,105 / [($158,173 + $104,664) / 2]

7.7%

Inventory turnover = Cost of goods sold

Average inventory

=

=

Accounts receivable =

turnover

($300,935 x 50%) / [($116,770 + $87,477) / 2]

1.47

Sales

Average accounts receivable

=

=

$354,125 / [($74,812 + $56,292) / 2]

5.4

20

b)

1. Current ratio

2. Quick ratio

3. D/E (I)

4. Times interest

earned

1998

$233,793 / $141,614

= 1.65

($684 + $74,812) / $141,614

= 0.53

($616,027 - $158,173)/ $616,027

= 74%

$46,162 / $27,559

= 1.68

1997

$169,107 / $110,710

= 1.53

($883 + $56,292) / $110,710

= 0.52

($500,748 - $104,664) / $500,748

= 79%

$45,391 / $26,114

= 1.74

c) CHC is using leverage to its benefit, as reflected in the fact that its ROE exceeds its

ROA. This means that the after-tax cost of borrowing is less than the return it is able to

generate through investing in operating assets. The resulting benefit accrues to

shareholders in the form of a higher ROE.

d) The pros of investing in CHC include the fact that it is generating cash from

operations and net income has increased slightly from 1997. The cons are that it could

encounter financial difficulties in the short-term because of its weak quick ratio and low

inventory turnover. Combined, these ratios signal that because its inventory turns over

less than 1.5 times a year, the quick ratio is a better predictor of short-term liquidity.

Also, the debt to equity ratio is high which imposes additional long-term risk upon

shareholders. Although the company appears to be currently using leverage to the

benefit of shareholders, this could quickly change if its cost of borrowing increases or if

it is unable to generate enough of a return in order to meet debt obligations.

e) If the Canadian dollar continues to fall relative to other currencies, CHC can maximize

profits by paying expenses in Canadian dollars and earnings revenues in foreign

currencies. Similarly CHC should hold monetary assets in foreign currencies and owe

liabilities in Canadian dollars. Of course, financial institutions in other countries may

not want to have debt repaid in Canadian dollars. If CHC could achieve these holdings,

it would benefit from the falling Canadian dollar.

21

12.38 a)

ROA

=

Net income + [Interest expense x (1 - Tax Rate)]

Average Total Assets

=

Net income + [Interest expense x (1 - Tax Rate)]

Sales Revenue

X

Sales Revenue

Average Total Assets

=

$324 + [$21,189 x (1 - .251)] X

$1,552,272

$1,552,272

($783,124 + $734,080)/2

=

.01 x 2.0462

=

2%

1

Tax rate was calculated from 1997 at 25% ($11,325/$45,315)

ROE

=

Net Income - Preferred Dividends

Average shareholders’ equity

=

$324

($228,117 + $230,931)/2

=

0.14%

Inventory turnover = Cost of goods sold

Average inventory

=

$1,423,248

($237,312 + $182,157)/2

=

6.79

Accounts receivable =

turnover

Sales

Average accounts receivable

=

$1,552,272

($201,218 + $203,196)/2

=

7.68

b)

1. Current ratio

2. Quick ratio

3. D/E (I)

4. Times interest

earned

1998

$536,038 / $383,039

= 1.40

$286,385 / $383,039

= 0.75

$555,007/ $783,124

= 71%

$19,298 / $21,189

= 0.91

1997

$510,024 / $309,771

= 1.65

$316,246 / $309,771

= 1.02

$503,149 / $734,080

= 69%

$53,464 / $8,149

= 6.56

22

c) Western Star Trucks does not appear to be in particularly good financial condition. The

company incurred a net loss before taxes, compared to a net income of $33,990 and $36,523 in

1997 and 1996 respectively. The reasons for the sharp decline in income seem to be large selling

and administrative expenses and a large interest expense. The times interest earned ratio reflects

this increase in interest expense, and earnings before interest and taxes are insufficient to make

interest payments in 1998. The quick ratio has also declined in1998, serving as a further

indication of possible cash flow problems. This is also confirmed through an examination of the

cash flow statement, which reveals a net decrease in cash of $92,027.

d) Assuming a tax rate of 25%, the ROA is 2% whereas the ROE is .14%. The fact that

the ROE is lower than the ROA is an indication of negative leverage. Western Star

Trucks is earning 2% on its assets. Because its cost of borrowing is more than 2%, the

ROE is less than 2%.

e) If the Canadian dollar were to strengthen relative to the U.S. dollar, the Canadian

production with Canadian dollar costs would increase relative to foreign currencies. As

it exports much of its products, these products would tend to be priced higher and

Western Star could lose markets and sales. These trends would tend to be reduced by the

parts purchased outside Canada, and they would cost less in Canadian dollar terms. If

the Canadian dollar weakened relative to the U.S. dollar, the exact opposite would occur.

The Canadian production costs would be relatively cheaper and sales in foreign

currencies would be worth more. These trends would be reduced by the parts purchased

outside Canada.

23

12.39 a)

ROA

ROE

=

Net income + [Interest expense x (1 - Tax Rate)]

Average Total Assets

=

Net income + [Interest expense x (1 - Tax Rate)]

Sales Revenue

X

Sales Revenue

Average Total Assets

=

$6,754,540 + ($2,112,129 x .72) X $76,022,656

$76,022,656

($105,654,710 +$71,257,880)/2

=

0.1089 X 0.8594

=

9.4%

=

Net Income - Preferred Dividends

Average shareholders’ equity

=

$6,754,540

($51,414,975 + $32,460,890)/2

=

16.1%

Inventory turnover = Cost of goods sold

Average inventory

=

$34,574,580

($11,972,472 + $8,466,950)/2

=

3.38

Accounts receivable =

turnover

Sales

Average accounts receivable

=

$76,022,656

($10,298,798 + $10,341,943)/2

=

7.37

b)

1. Current ratio

2. Quick ratio

3. D/E (I)

4. Times interest

earned

1998

$23,573,581 / $24,774,714

= 0.95

$10,298,798 / $24,774,714

= 0.42

$54,239,735/ $105,654,710

= 51%

$11,448,881 / $2,112,129

= 5.42

1997

$19,281,998 / $18,131,277

= 1.06

$10,341,943 / $18,131,277

= 0.57

$38,796,990 / $71,257,880

= 54%

$6,182,659 / $1,441,847

= 4.29

c) Sleeman Breweries appears to be in very good financial condition. It is making high

profits and its net income nearly doubled from 1997 to 1998. Its risk from debt appears

24

to be quite moderate, since it is able to pay its interest expense 5.4 times from beforeinterest operating income in 1998. It is, however, operating without any cash. Instead, it

appears to be making use of a line of credit. It is generating a positive cash flow from

operations, $6,901,849 but it is spending more than that on acquisitions. Its debt has

therefore increased. To decide if we should invest in this company, we would want to

know the future prospects of its industry, including new products and competition.

d) Sleeman breweries uses leverage well, as its ROE is 16.1% compared to an ROA of

9.4%. This means that the company is able to borrow at a lower rate than it earns

through investing in operating assets. The resulting benefit accrues to shareholders in

the form of a higher ROE. The company’s average interest rate is 3.89% ($2,112,129 /

$54,239,735). Since it is able to earn 9.4% on its assets, it is beneficial for the company

to include debt in its financial structure.

25

e) Big Rock Brewery

ROA

=

Net income + [Interest expense x (1 - Tax Rate)]

Average Total Assets

ROE

=

Net income + [Interest expense x (1 - Tax Rate)]

Sales Revenue

X

Sales Revenue

Average Total Assets

=

($556,745) + ($661,640 x .554) X

$26,466,241

=

-0.0072 X 0.8665

=

-0.62%

=

Net Income - Preferred Dividends

Average shareholders’ equity

=

($556,745)

($16,447,657 + $17,731,383)/2

=

-3.3%

$26,466,241

($29,165,835 +$31,919,676)/2

Inventory turnover = Cost of goods sold

Average inventory

=

$7,691,231

($2,050,703 + $2,270,909)/2

=

3.56

Accounts receivable =

turnover

Sales

Average accounts receivable

=

$16,644,881

($1,548,486 + $1,302,336)/2

=

11.7

26

1. Current ratio

2. Quick ratio

3. D/E (I)

4. Times interest

earned

1999

$4,115,116 / $2,294,778

= 1.79

$1,630,628 / $2,294,778

= 0.71

$12,718,178/ $29,165,835

= 44%

($123,605) / $661,640

= -0.19

1998

$4,887,382 / $1,972,393

= 2.48

$2,213,275 / $1,972,393

= 1.12

$14,188,293 / $31,919,676

= 44%

$1,347,546 / $841,565

= 1.60

Because of the loss suffered by Big Rock in 1999, its ROE and ROA are both negative.

On this measure alone, Sleeman Breweries appears to be doing much better. The

inventory turnover for the two companies is very similar. Big Rock appears to be more

efficient in its collection of accounts receivable with a ratio of 11.7 compared to

Sleeman’s 7.37.

Big Rock’s short-term liquidity is better at 1.79 and .71 for its current and quick ratios

compared to Sleeman’s at .95 and .42. Both companies carry similar amounts of debt

with Big Rock at about 44% and Sleeman just over 50%. Sleeman’s times interest

earned ratio is much healthier than Big Rock’s although Big Rock has been trying to

remedy this situation by paying down its debt. Its interest expense dropped

approximately 25% in the last year.

At the time of the financial statements Sleeman Breweries was healthier. It had positive

earnings and a good use of leverage. Big Rock, because of its net loss for the year, needs

to do some financial rebuilding.

27

12.40 a)

ROA

ROE

=

Net income + [Interest expense x (1 - Tax Rate)]

Average Total Assets

=

Net income + [Interest expense x (1 - Tax Rate)]

Sales Revenue

X

Sales Revenue

Average Total Assets

=

$14,455 + ($4,045 x .554) X

$328,565

=

0.0508 X 1.1431

=

5.8%

=

Net Income - Preferred Dividends

Average shareholders’ equity

=

$14,455

($126,456 + $114,073)/2

=

12%

$328,565

($347,339 + $227,525)/2

Inventory turnover = Cost of goods sold

Average inventory

=

$254,441

($45,376 + $37,082)/2

=

6.17

Accounts receivable =

turnover

Sales

Average accounts receivable

=

$328,565

($81,394 + $56,966)/2

=

4.75

b)

1. Current ratio

2. Quick ratio

3. D/E (I)

4. Times interest

earned

1998

$137,914 / $119,398

= 1.16

$89,799 / $119,398

= 0.75

$220,883/ $347,339

= 64%

$29,503 / $4,045

= 7.29

1997

$110,722 / $53,432

= 2.07

$71,946 / $53,432

= 1.35

$113,452 / $227,525

= 50%

$23,556 / $1,311

= 17.97

28

c) Tritech appears to be in fairly good financial condition. It is earning 5.8% on total

assets, which, with good use of leverage, results in a return on shareholders’ equity of

12%. It does not appear to have high risk from liabilities as evidenced by the 7.29 times

interest earned ratio. Both the current and quick ratios are reasonable, and the operating

activities are producing a net inflow of cash. Tritech has a net cash shortage for1998

which appears to result from investing in fixed assets. We should learn more about the

company’s industry, its products, plans, markets, and competition before we decide to

invest.

d) Tritech currently has positive benefits from leverage, which increases its ROA of

5.8% to an ROE of 12%. The interest rate paid on long-term debt in 1998 appears to be

$3,652 / ($69,682 + $10,924) = 4.5%. Interest on current bank indebtedness appears to

be $393 / $39,257 = 1%.

e)

(i.) If the Canadian dollar strengthened against the US dollar by 5%, and if the product

prices remained the same, the effect would be to lower the Canadian value of the US

sales. The effect would be to lower sales and Income before Minority Interest and

Income Taxes by (75% x $328,565) x 5% = $12,321.

(ii) If the Canadian dollar weakened against the US dollar by 5%, and if the product

prices remained the same, the effect would be to increase the Canadian value of the US

sales. The effect would be to increase sales and Income before Minority Interest and

Income Taxes by (75% x $328,565) x 5% = $12,321.

29

12.41 a)

ROA

=

Net income + [Interest expense x (1 - Tax Rate)]

Average Total Assets

=

Net income + [Interest expense x (1 - Tax Rate)]

Sales Revenue

X

Sales Revenue

Average Total Assets

Note: Since interest expense is not disclosed separately, it is assumed to be zero for the

purposes of this calculation.

ROE

=

$22,568 x

$314,496

$314,496

($159,506 + $142,727)/2

=

0.0718 X 2.0811

=

15%

=

Net Income - Preferred Dividends

Average shareholders’ equity

=

$22,568

($100,056 + $86,965)/2

=

24%

Inventory turnover = Cost of goods sold

Average inventory

=

$244,065

($45,094 + $26,057)/2

=

6.86

Accounts receivable =

turnover

Sales

Average accounts receivable

=

$314,496

($54,125 + $66,096)/2

=

5.23

b)

1. Current ratio

2. Quick ratio

3. D/E (I)

1998

$99,219 / $43,190

= 2.30

$54,125 / $43,190

= 1.25

$59,450/ $159,506

= 37%

1997

$111,731 / $53,760

= 2.08

$85,674 / $53,760

= 1.59

$55,762 / $142,727

= 39%

30

c) Enerflex appears to be in strong financial condition. However, net income decreased

slightly from 1997 to 1998, which is attributable to a decline in revenues. Other than

this, the company is healthy. The current ratios and quick ratios are strong, indicating

that short-term liquidity is not a concern. The debt to equity ratios are also low, and

interest expense is more than offset from interest income on investments. The

company’s cash position is negative in 1998, mainly as the result of investments in

property, plant, and equipment. Before investing in Enerflex, we would want to know

more about its markets, products, and competitors. Furthermore, the reason for the

decline in revenues should be identified to determine whether this is a trend.

d) If Enerflex had used common shares rather than long-term debt, it would have issued

an additional 7,922,078 shares [Average issue price is $34,678,000 / 15,019,000 =

$2.31. Additional shares = $18,300,000 / $2.31 = 7,922,078]. Total common shares

would have been 7,922,078 + 15,019,000 = 22,941,078. New earnings per share would

be $22,568,000/22,941,078 = $0.98. This compares to the actual EPS of $1.50. With a

multiple of 20, the market price per share would have been reduced by ($1.50 - $0.98) x

20 = $10.40. Thus, Enerflex appears to have made a decision to use some long-term debt

financing instead of common shares and that decision results in a higher market price per

share of its stock.

31

12.42 a)

ROA

=

Net income + [Interest expense x (1 - Tax Rate)]

Average Total Assets

=

Net income + [Interest expense x (1 - Tax Rate)]

Sales Revenue

X

Sales Revenue

Average Total Assets

Note: Since interest expense is not disclosed separately, it is assumed to be zero for the

purposes of this calculation.

ROE

=

$5,211

$40,672

=

0.1281 X 0.7449

=

9.5%

=

Net Income - Preferred Dividends

Average shareholders’ equity

=

$5,211

($47,041 + $41,435)/2

=

11.8%

Accounts receivable =

turnover

X

$40,672

($60,751 + $48,456)/2

Sales

Average accounts receivable

=

$40,672

($9,489 + $11,250)/2

=

3.92

b) There is no Finished Goods Inventory as Mosaid designs for custom orders. Thus it

does not produce for inventory, it only produces for specific orders. As soon as the chips

are finished, they belong to the customer and become expenses. Thus inventory turnover

is not meaningful. Inventory turnover is meaningful only for companies that produce for

stockpiling for later sale.

c)

1. Current ratio

2. Quick ratio

3. D/E (I)

1998

$39,105 / $7,407

= 5.28

$33,117 / $7,407

= 4.47

$13,710/ $60,751

= 23%

1997

$38,309 / $6,308

= 6.07

$33,243 / $6,308

= 5.27

$7,021 / $48,456

= 14%

d) Mosaid uses very little leverage, as evidenced by the ROA being 9.5% and ROE

11.8%. In contrast, Enerflex has a relatively higher leverage, with ROA of 15% and

32

ROE of 24%. Note that Mosaid does not need debt as it has substantial cash and shortterm marketable securities. Enerflex is in a cash deficit position. The comparison

between the two companies may not be appropriate because they are not manufacturing

the same products.

e)

(i.) If Mosaid will earn that same ROA, it cannot pay a higher interest rate than its ROA,

so it should not pay more than 9.5% after tax.

(ii.) To raise $10,000,000 from new shares, assuming a multiple of 20, it should be able

to sell these shares at 20 x $0.73 earnings per share = $14.60 each. Thus Mosaid would

need to sell $10,000,000 / $14.60 = 684,932 shares at $14.60.

(iii.) New net income would be 9.5% x (60,751 + 10,000) = $6,721 with shares and

$6,721 - [(10% x 10,000) x (1 - 3,012 / 8,560)] = $6,073 with 10% debt. New ROE

would be $6,721 / [(47,041 + 6,721 - 5,211 + 10,000) + 41,435] / 2 = $6,721 / $49,993 =

13.4% with shares and $6,073 / [(47,041 + 6,073 - 5,211) + 41,435] / 2 = $6,073 /

$44,669 = 13.6% with debt. Thus the new debt would increase the leverage to the

benefit of shareholders. To decide if new equity or debt should be used is not an easy

choice in this case. It appears to be slightly preferable to use debt to benefit from the

additional leverage.

12.43 a)

ROA

=

Net income + [Interest expense x (1 - Tax Rate)]

Average Total Assets

=

Net income + [Interest expense x (1 - Tax Rate)]

Sales Revenue

X

Sales Revenue

Average Total Assets

=

=

$13,525 + ($135,191 x .31) X

$783,800

.07 x 0.2774

=

1.9%

Accounts receivable =

turnover

$783,800

($3,201,224 + $2,450,201)/2

Sales

Average accounts receivable

=

$783,800

($59,632 + $45,550)/2

=

14.9

b) Inventory turnover would not be meaningful as Shaw Cable does not produce for

inventory. Its main business is distributing cable television signals. Inventory turnover

is meaningful only for companies that produce for stockpiling for later sale.

c)

1. Current ratio

1998

$116,838 / $306,143

1997

$62,582 / $261,123

33

2. Quick ratio

3. D/E (I)

= 0.38

$85,686 / $306,143

= 0.28

$1,785,627/ $3,201,224

= 56%

= 0.24

$45,550 / $261,123

= 0.17

$1,870,825 / $2,450,201

= 76%

d) This company appears to be a risky investment from a short-term perspective because

its current and quick ratios are very poor, and indicate that the company might

experience cash flow problems when its current liabilities become due. In particular, the

total of its current assets are insufficient to cover either accounts payable and accrued

liabilities or the current portion of long-term debt. This means that additional short-term

financing must be obtained for the company to remain solvent. In addition, the return on

assets of 1.9% is unlikely to compensate debtholders and shareholders for the risk that

they bear. Finally, cash provided from operations of $128,737 does not even offset the

interest expense of $135,191, meaning that the company could have difficulty meeting its

contractual obligations relating to debt.

Beyond the Book

12.44

Answers to this question will depend on the company selected.

Critical Thinking Questions

12.45

General Comments

The purpose of this question is to increase the students’ awareness that the current

GAAP guidelines that allow alternative ways of recording transactions and reporting

elements reduce the comparability between entities. Students are asked to discuss the

prop and cons of comparability with reference to financial statement analysis.

Solution Outline

One of the benefits of the comparability occurs in ratio analysis. If you are analyzing the

financial statements of two or more companies by undertaking a ratio analysis, the ratios

will be comparable among the companies only if the original data are comparable. The

original data will be comparable only if they were produced using the same accounting

methods. Thus, for accounting information to be most useful to users, companies must

be forced to use the same set of accounting methods.

However, if all companies are forced to use the same accounting methods, the resulting

accounting numbers may not give an accurate portrayal of the underlying economic

events. No two companies have identical sets of economic transactions, so their

financial statements, which are intended to be summarized numeric portrayals of a

company’s activities, cannot be expected to be identical. Different economic

transactions require different accounting treatments, so restricting the accounting

methods that companies are permitted to use will inevitably result in some transactions

not being portrayed accurately in the financial statements. This situation would result in

comparable ratios that are misleading as the accounting information that produced the

ratios may not be properly portraying the underlying economic events.

34

On the basis of this argument, regulators should not attempt to restrict the number or

types of accounting methods that companies can use.

12.46

General Comments

The purpose of this question is to require students to examine nonfinancial issues that

may impact the interpretation of the analysis of financial statement amounts. The

specific issue addressed in this question is the creation of captive finance subsidiaries

and their impact on the leverage that the company can achieve.

A major reason that a company forms a finance subsidiary is the potential for increasing

leverage at both the time of formation and in subsequent years. Upon forming a finance

subsidiary, the probability that a parent company will exceed the limits imposed by

existing debt covenants will be lessened. In fact, a parent company should be able to

borrow more because it is further from violating debt covenants than before the finance

subsidiary was formed. Furthermore, the initial increase in leverage from forming a

finance subsidiary is continued beyond the term of existing debt because the parent

company transfers much of its debt (usually only short-term) and high quality short-term

receivables to the subsidiary. The parent company reduces its debt/equity ratio in this

transfer and the subsidiary is able to sustain a “high” or higher than “normal” debt/equity

ratio because it now has higher quality assets dedicated solely to service that debt.

A captive finance subsidiary primarily finances its own parent company’s operations.

35