Chapt23

advertisement

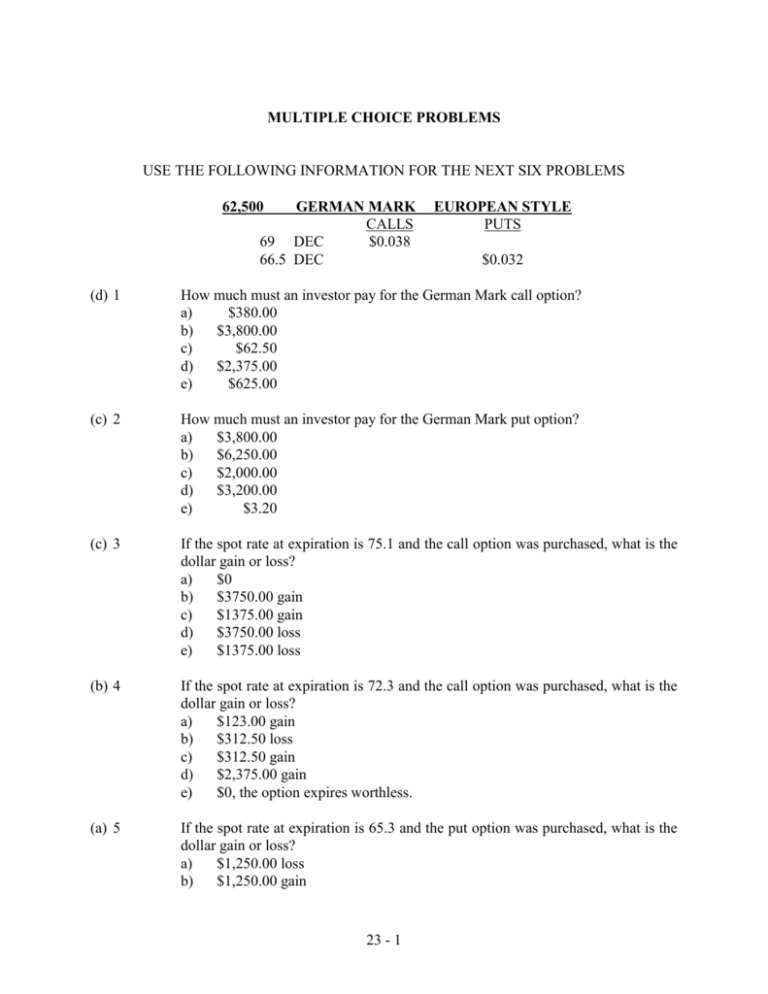

MULTIPLE CHOICE PROBLEMS USE THE FOLLOWING INFORMATION FOR THE NEXT SIX PROBLEMS 62,500 GERMAN MARK CALLS 69 DEC $0.038 66.5 DEC EUROPEAN STYLE PUTS $0.032 (d) 1 How much must an investor pay for the German Mark call option? a) $380.00 b) $3,800.00 c) $62.50 d) $2,375.00 e) $625.00 (c) 2 How much must an investor pay for the German Mark put option? a) $3,800.00 b) $6,250.00 c) $2,000.00 d) $3,200.00 e) $3.20 (c) 3 If the spot rate at expiration is 75.1 and the call option was purchased, what is the dollar gain or loss? a) $0 b) $3750.00 gain c) $1375.00 gain d) $3750.00 loss e) $1375.00 loss (b) 4 If the spot rate at expiration is 72.3 and the call option was purchased, what is the dollar gain or loss? a) $123.00 gain b) $312.50 loss c) $312.50 gain d) $2,375.00 gain e) $0, the option expires worthless. (a) 5 If the spot rate at expiration is 65.3 and the put option was purchased, what is the dollar gain or loss? a) $1,250.00 loss b) $1,250.00 gain 23 - 1 c) d) e) (d) 6 $750.00 gain $750.00 loss $2,000.00 loss If the spot rate at expiration is 61.4 and the put option was purchased, what is the dollar gain or loss? a) $0, the option expires worthless. b) $2,000.00 loss c) $2,000.00 gain d) $1,187.50 gain e) $1,187.50 loss 23 - 2 USE THE FOLLOWING INFORMATION FOR THE NEXT TEN PROBLEMS XYZ CORP CALLS PUTS EXERCISE DATE PRICE OCT 85 OCT 90 OCT 95 OCT 85 OCT 90 OCT 95 NYSE PRICE CLOSE 16 3/4 101 11/16 12 101 11/16 7 5/8 101 11/16 1/8 101 11/16 3/8 101 11/16 13/16 101 11/16 (a) 7 If you establish a long straddle using the options with an 85 exercise price, what is your dollar gain or loss if at expiration XYZ is still trading at 101 11/16? a) $18.75 loss b) $18.75 gain c) $1,668.75 gain d) $1,668.75 loss e) $1,687.50 loss (d) 8 If you establish a long strap using the options with an 85 exercise price, what is your dollar gain or loss if at expiration XYZ is still trading at 101 11/16? a) $1,687.50 loss b) $3,362.50 loss c) $3,675.50 gain d) $13.00 gain e) $13.00 loss (e) 9 If you establish a long strip using the options with an 85 exercise price, what is your dollar gain or loss if at expiration XYZ is still trading at 101 11/16? a) $1,668.75 gain b) $1,700.00 gain c) $1,700.00 loss d) $31.25 gain e) $31.25 loss (a) 10 If you establish a long straddle using the options with an 90 exercise price, what is your dollar gain or loss if at expiration XYZ is still trading at 101 11/16? a) $68.75 loss b) $68.75 gain c) $37.50 loss d) $1,200.00 loss e) $1,200.00 gain 23 - 3 (c) 11 If you establish a long strap using the options with an 90 exercise price, what is your dollar gain or loss if at expiration XYZ is still trading at 101 11/16? a) $37.50 loss b) $37.50 gain c) $100.00 loss d) $100.00 gain e) $2,437.50 loss (b) 12 If you establish a long strip using the options with an 90 exercise price, what is your dollar gain or loss if at expiration XYZ is still trading at 101 11/16? a) $106.25 gain b) $106.25 loss c) $1,275.00 loss d) $1,275.00 gain e) $75.00 loss (d) 13 If you establish a long straddle using the options with an 95 exercise price, what is your dollar gain or loss if at expiration XYZ is still trading at 101 11/16? a) $668.75 gain b) $668.75 loss c) $94.56 gain d) $94.56 loss e) $81.25 loss (d) 14 If you establish a long strap using the options with an 95 exercise price, what is your dollar gain or loss if at expiration XYZ is still trading at 101 11/16? a) $81.25 loss b) $1,606.25 gain c) $1,606.25 loss d) $268.75 loss e) $268.75 gain (a) 15 If you establish a long strip using the options with a 95 exercise price, what is your dollar gain or loss if at expiration XYZ is still trading at 101 11/16? a) $256.25 loss b) $256.25 gain c) $925.00 loss d) $668.75 gain e) $668.75 loss (b) 16 If XYZ were trading at $90/share and you formed a bull money spread, what is your profit if XYZ is trading at $110 at expiration? a) $912.50 loss b) $87.50 gain c) $87.50 loss d) $1,000.00 gain e) $1,000.00 loss 23 - 4 THE FOLLOWING INFORMATION IS FOR THE NEXT TWO PROBLEMS A stock currently trades for $120 per share. Options on the stock are available with a strike price of $125. The options expire in 30 days. The risk free rate is 3% over this time period, and the expected volatility is 0.35. (d) 17 Use the Black-Scholes option pricing model to calculate the price of a call option. a) $5.935 b) $4.935 c) $3.935 d) $2.935 e) None of the above (a) 18 Calculate the price of the put option. a) $7.623 b) $8.623 c) $9.623 d) $10.623 e) None of the above (a) 19 Assume that you have just sold a stock for a loss at a price of $75, for tax purposes. You still wish to maintain exposure to the sold stock. Suppose that you buy a call with a strike price of $70 and a price of $6.75. Calculate the effective price paid to repurchase the stock if the price after 35 days is $65. a) $71.75 b) $76.75 c) $58.25 d) $81.75 e) None of the above (d) 20 Assume that you have just sold a stock for a loss at a price of $75, for tax purposes. You still wish to maintain exposure to the sold stock. Suppose that you buy a call with a strike price of $70 and a price of $6.75. Calculate the effective price paid to repurchase the stock if the price after 35 days is $80. a) $81.75 b) $73.25 c) $86.75 d) $76.75 e) None of the above 23 - 5 (d) 21 Assume that you have just sold a stock for a loss at a price of $75, for tax purposes. You still wish to maintain exposure to the sold stock. Suppose that you sell a put with a strike price of $80 and a price of $7.25. Calculate the effective price paid to repurchase the stock if the price after 35 days is $70. a) $77.75 b) $87.25 c) $82.25 d) $72.75 e) None of the above (a) 22 Assume that you have just sold a stock for a loss at a price of $75, for tax purposes. You still wish to maintain exposure to the sold stock. Suppose that you sell a put with a strike price of $80 and a price of $7.25. Calculate the effective price paid to repurchase the stock if the price after 35 days is $85. a) $77.75 b) $87.25 c) $82.25 d) $72.75 e) None of the above. USE THE FOLLOWING INFORMATION FOR THE NEXT 12 QUESTIONS Consider the following information on put and call options for Citigroup Strike Price $32.50 Put Price Call Price $2.85 $1.65 (b) 23 Calculate the net value of a protective put position at a stock price at expiration of $20, and a stock price at expiration of $45. a) $6.35, $18.85 b) $29.65, $42.15 c) $21.65, $34.15 d) $8, $8 e) -$8, -$8 (b) 24 A protective put is an appropriate strategy if a) An investor wishes to generate additional income. b) An investor wished to insure against a decline in share values. c) An investor expected share prices to be volatile. d) An investor expected share prices to remain in a trading range. e) An investor expected share prices to be volatile, but was inclined to be bullish. 23 - 6 (c) 25 Calculate the net value of a covered call position at a stock price at expiration of $20, and a stock price at expiration of $45. a) $6.35, $18.85 b) $29.65, $42.15 c) $21.65, $34.15 d) $8, $8 e) -$8, -$8 (a) 26 A covered call is an appropriate strategy if a) An investor wishes to generate additional income. b) An investor wished to insure against a decline in share values. c) An investor expected share prices to be volatile. d) An investor expected share prices to remain in a trading range. e) An investor expected share prices to be volatile, but was inclined to be bullish. (d) 27 Calculate the payoffs of a long straddle at a stock price at expiration of $20 and a stock price at expiration of $45. a) $6.35, $18.85 b) $29.65, $42.15 c) $21.65, $34.15 d) $8, $8 e) -$8, -$8 (c) 28 A long straddle is an appropriate strategy if a) An investor wishes to generate additional income. b) An investor wished to insure against a decline in share values. c) An investor expected share prices to be volatile. d) An investor expected share prices to remain in a trading range. e) An investor expected share prices to be volatile, but was inclined to be bullish. 23 - 7 (e) 29 Calculate the payoffs of a short straddle at a stock price at expiration of $20 and a stock price at expiration of $45. a) $6.35, $18.85 b) $29.65, $42.15 c) $21.65, $34.15 d) $8, $8 e) -$8, -$8 (d) 30 A short straddle is an appropriate strategy if a) An investor wishes to generate additional income. b) An investor wished to insure against a decline in share values. c) An investor expected share prices to be volatile. d) An investor expected share prices to remain in a trading range. e) An investor expected share prices to be volatile, but was inclined to be bullish. (a) 31 Calculate the payoffs of a long strap at a stock price at expiration of $20 and a stock price at expiration of $45. a) $6.35, $18.85 b) $29.65, $42.15 c) $21.65, $34.15 d) $8, $8 e) -$8, -$8 (e) 32 A long strap is an appropriate strategy if a) An investor wishes to generate additional income. b) An investor wished to insure against a decline in share values. c) An investor expected share prices to be volatile. d) An investor expected share prices to remain in a trading range. e) An investor expected share prices to be volatile, but was inclined to be bullish. 23 - 8 CHAPTER 23 ANSWERS TO PROBLEMS 1 ($/DM)(.038)(62,500 DM) = $2,375.00 2 ($/DM)(.032)(62,500 DM) = $2,000.00 3 Cost = $2,375.00 Payoff = (.751 - .690)(62,500) = $3,750.00 Net gain = $3750.00 - $2,375.00 = $1,375.00 4 Cost = $2,375.00 Payoff = (.723 - .690)(62,500) = $2,062.50 Loss = $2,062.50 - $2,375.00 = -$312.50 5 Cost = $2,000.00 Payoff = (.665 - .653)(62,500) = $750.00 Loss = $750.00 - $2,000.00 = -$1,250.00 6 Cost = $2,000.00 Payoff = (.665 - .614)(62,500) = $3,187.50 Gain = $3,187.50 - $2,000.00 = $1,187.50 7 Long straddle: purchase one OCT 85 put and one OCT 85 call Cost of one call = 16 3/4(100) = $1,675.00 Cost of one put = 1/8(100) = $12.50 Total cost = $1,687.50 Payoff on one call = 100(101 11/16 - 85) = $1,668.75 Payoff on one put = 0, expires out of the money Net gain/loss = $1,668.75 - $1,687.50 = $18.75 loss 8 Long strap: purchase two OCT 85 calls and one OCT 85 put Cost of 2 calls = 2(16.75(100) = Cost of one put = 1/8(100) = Total cost = $3,350.00 $12.50 $3,362.50 Payoff on 2 calls = 2(100)(101 11/16 - 85) = $3,375.00 Payoff on one put = 0, expires out of the money 23 - 9 Net gain/loss = $3,375.50 - $3,362.50 = $13.00 gain 9 Long strip: purchase one OCT 85 call and two OCT 85 puts Cost of one call = 16 3/4(100) = $1,675.00 Cost of two puts = 2(1/8)(100) = $25.00 Total cost = $1,700.00 Payoff on one call = 100(101 11/16 - 85) = $1,668.75 Payoff on two puts = 0, expires out of the money Net gain/loss = $1,668.75 - $1,700.00 = $31.25 loss 10 Long straddle: purchase one OCT 90 put and one OCT 90 call Cost of one call = 12(100) = $1,200.00 Cost of one put = 3/8(100) = $37.50 Total cost = $1,237.50 Payoff on one call = 100(101 11/16 - 90) = $1,168.75 Payoff on one put = 0, expires out of the money Net gain/loss = $1,168.75 - $1,237.50 = $68.75 loss 11 Long strap: purchase two OCT 90 calls and one OCT 90 put Cost of 2 calls = 2(12.00(100) = Cost of one put = 3/8(100) = Total cost = $2,400.00 $37.50 $2,437.50 Payoff on 2 calls = 2(100)(101 11/16 - 90) = $2,337.50 Payoff on one put = 0, expires out of the money Net gain/loss = $2,337.50 - $2,437.50 = $100.00 loss 12 Long strip: purchase one 90 call and two OCT 90 puts Cost of one call = 12(100) = $1,200.00 Cost of two puts = 2(3/8)(100) = $75.00 Total cost = $1,275.00 Payoff on one call = 100(101 11/16 - 90) = $1,168.75 Payoff on two puts = 0, expires out of the money Net gain/loss = $1,168.75 - $1,275.00 = $106.25 loss 13 Long straddle: purchase one OCT 95 put and one OCT 95 call Cost of one call = 7 5/8(100) = Cost of one put = 13/16(100) = Total cost = 23 - 10 $762.50 $81.25 $763.31 Payoff on one call = 100(101 11/16 - 95) = $668.75 Payoff on one put = 0, expires out of the money Net gain/loss = $668.75 - $763.31 = $94.56 loss 14 Long strap: purchase two OCT 95 calls and one OCT 95 put Cost of 2 calls = 2(7 5/8)(100) = $1,525.00 Cost of one put = 13/16(100) = $81.25 Total cost = $1,606.25 Payoff on 2 calls = 2(100)(101 11/16 - 95) = $1,337.50 Payoff on one put = 0, expires out of the money Net gain/loss = $1,337.50 - $1,606.25 = $268.75 loss 15 Long strip: purchase one 95 call and two OCT 95 puts Cost of one call = 7 5/8(100) = Cost of two puts = 2(13/16)(100) = Total cost = $762.50 $162.50 $925.00 Payoff on one call = 100(101 11/16 - 95) = $668.75 Payoff on two puts = 0, expires out of the money Net gain/loss = $668.75 - $925.00 = $256.25 loss 16 Bull money spread = buy the in-the-money call, i.e., OCT 85 and sell the out-ofthe-money call, i.e., OCT 95 Cost of buying OCT 85 call = 100(16 3/4) = Proceeds from selling OCT 95 call = 100(7 5/8) = Net cost Payoff on OCT 85 call = 100(110 - 85) = $2,500.00 Payoff on OCT 95 call = 100(110 - 95) = ($1,500.00) Net payoff = $2,500.00 - 1,500.00 = $1,000.00 Total gain/loss = $1,000.00 - 912.50 = $87.50 gain 17 Price using the B-S option pricing model d1 = ln(120/125) + [(.03 + 5(.352))(.0833)]/(.35(.0833.5)) = -0.3288 d2 = -0.3288 - (.35(.0833.5)) = -0.4298 N(d1) = 0.3712 N(d2) = 0.3337 23 - 11 $1,675.00 $762.50 $912.50 Call price = Pc = 120[0.3712 – 125(e-.03(.0833))(0.3337] = $2.935 18 Put price = 2.935 + 125(e-.03(.0833)) – 120 = $7.623 19 The effective price is 65 + 6.75 = $71.75 The option expires worthless so your effective price is the current price plus the option premium. 20 The effective price is 70 + 6.75 = $76.75 The option is exercised so your effective price is the strike price plus the option premium. 21 The effective price is 80 – 7.25 = $72.75 The option is exercised so your effective price is the strike price less the option premium. 22 The effective price is 85 – 7.25 = $77.75 The option expires worthless so your effective price is the current price less the option premium. 23 At S = 20 Net value of protective put = (32.5 – 20) – 2.85 + 20 = 29.65 At S = 45 Net value of protective put = – 2.85 + 45 = 42.15 24 This strategy is appropriate if an investor wished to insure against a decline in share values. 25 At S = 20 Net value of covered call = 1.65 + 20 = 21.65 At S = 45 Net value of covered call = -(45 – 32.5) + 1.65 + 45 = 34.15 26 This strategy is appropriate if an investor wished to generate additional income. 27 At S = 20 Net payoff on a long straddle = (32.5 – 20) -1.65 – 2.85 = 8 At S = 45 Net payoff on a long straddle = (45 - 32.5) -1.65 – 2.85 = 8 28 This strategy is appropriate if an investor expected share prices to be volatile. 29 At S = 20 Net payoff on a short straddle = -(32.5 – 20) + 1.65 + 2.85 = -8 23 - 12 At S = 45 Net payoff on a long straddle = -(45 - 32.5) + 1.65 + 2.85 = -8 30 This strategy is appropriate if an investor expected share prices to remain in a trading range. 31 At S = 20 Net payoff on a long strap = (32.5 – 20) – (2)(1.65) – 2.85 = 6.35 At S = 45 Net payoff on a long straddle = (2)(45 - 32.5) – (2)(1.65) – 2.85 = 18.85 32 This strategy is appropriate if an investor expected share prices to be volatile. 23 - 13