9.4 Linear programming and m x n Games: Simplex Method and the

advertisement

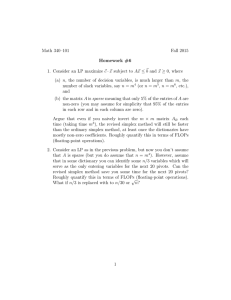

9.4 Linear programming and m x n Games: Simplex Method and the Dual Problem In this section, the process of solving 2 x 2 matrix games will be generalized to solving m x n matrix games. The procedure will be essentially the same as the process for the 2 x 2 case, but the solution of the linear programming problem will incorporate the simplex method and the dual. Procedure: Given the non-strictly determined matrix game M, free of recessive rows and columns, r1 r2 r3 q1 * to find P p1 p2 Q * q2 q3 proceed as follows: 1. s2 s3 If M is not a positive matrix, add a suitable positive constant k to each element of M to get a new matrix M1 a1 a2 M1 b1 b2 and v M s1 a3 b3 If v1 is the value of game M1 , then the value of the original game M is given by v = v1 – k Procedure continued: 2. Set up the two linear programming problems ( maximization problem is always the dual of the minimization problem) : A) Minimize subject to : y x1 x2 a1 x1 b1 x2 1 a2 x1 b2 x2 1 a3 x1 b3 x2 1 x1 , x2 0 B) Maximize: y z1 z2 z3 a1 z1 a2 z2 a3 b3 1 subject to: b1 z1 b2 z2 b3 z 3 1 z1 , z2 , z3 0 Procedure continued: Step 3. Solve the maximization problem, part (B) , the dual of part (A), using the simplex method as modified in section 5.5. [You will automatically obtain the solution of the minimization problem, Part A, as well, by following this process. ] Step 4. Use the solutions from the third step to find the value of the game , v1 for game M1 and the optimal strategies and value V for the original game, 1 1 v1 y z1 z2 z3 v v1 k M. P* v1 x1 v1 x2 v1 z1 Q * v 2 z2 v 3 z3 An example Suppose that an investor wishes to invest $10,000 in long and short term bonds, as well as in gold, and he is concerned about inflation. After some analysis he estimates that the return (in thousands of dollars) at the end of a year will be indicated in the following payoff matrix: Inflation rate up 3% down 3% 3 3 long term bonds 3 2 short-term bonds 1 1 gold Example continued Assume that fate is a very good player that will attempt to reduce the investor’s return as much as possible. Find the optimal strategies for both the investor and fate. What is the value of the game? 1. We start with the payoff matrix and need to make all entries positive so we choose to add a constant k = 4 to each entry: 3 3 3 2 1 1 7 1 2 6 3 5 Example continued 2. Write the corresponding linear programming problems: min y x1 x2 x3 subject to: 7 x1 2 x2 3 x3 1 1 x1 6 x2 5 x3 1 x1 , x2 , x3 0 Maximize: y z1 z2 subject to: 7 z1 z2 1 2 z1 6 z2 1 3 z1 5 z2 1 z1 , z2 0 Example continued: 3. Introduce slack variables and form the simplex tableau and solve the second linear programming problem: 7 z1 z2 x1 1 2 z1 6 z2 x2 1 3 z1 5 z2 x3 1 z1 z2 y 0 z1 7 2 3 1 z2 x1 x2 x3 y 1 1 0 0 0 1 6 0 1 0 0 1 5 0 0 1 0 1 1 0 0 0 1 0 Solution: After performing the steps, the final solution is displayed below: The value of the game is zero, which means it is a fair game. P * 0.25 0 0.75 0.5 Q 0.5 v0 *