ACcounting theory assignment #2

advertisement

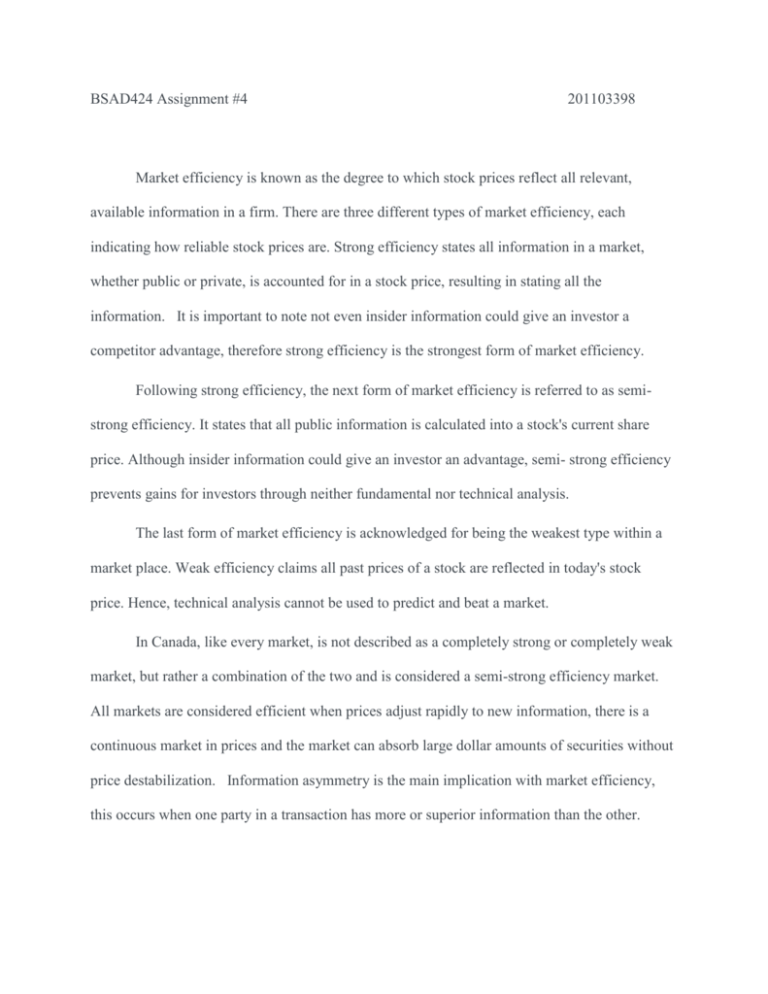

BSAD424 Assignment #4 201103398 Market efficiency is known as the degree to which stock prices reflect all relevant, available information in a firm. There are three different types of market efficiency, each indicating how reliable stock prices are. Strong efficiency states all information in a market, whether public or private, is accounted for in a stock price, resulting in stating all the information. It is important to note not even insider information could give an investor a competitor advantage, therefore strong efficiency is the strongest form of market efficiency. Following strong efficiency, the next form of market efficiency is referred to as semistrong efficiency. It states that all public information is calculated into a stock's current share price. Although insider information could give an investor an advantage, semi- strong efficiency prevents gains for investors through neither fundamental nor technical analysis. The last form of market efficiency is acknowledged for being the weakest type within a market place. Weak efficiency claims all past prices of a stock are reflected in today's stock price. Hence, technical analysis cannot be used to predict and beat a market. In Canada, like every market, is not described as a completely strong or completely weak market, but rather a combination of the two and is considered a semi-strong efficiency market. All markets are considered efficient when prices adjust rapidly to new information, there is a continuous market in prices and the market can absorb large dollar amounts of securities without price destabilization. Information asymmetry is the main implication with market efficiency, this occurs when one party in a transaction has more or superior information than the other.