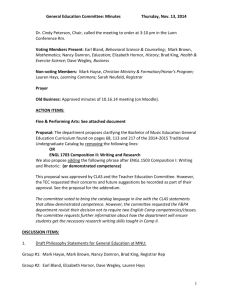

desicion tree example

advertisement

SYST 473 1. Precocious Toys, a maker of intellectually challenging toys for children, has decided to put its catalog online on the Internet. To do this, the company must purchase computer hardware and software. After screening the possible systems, two configurations from the same vendor have been selected for further consideration. These two configurations are identical except for cost and capacity. Precocious Toys is measuring cost in thousands of dollars and capacity in terms of months of useful life before the demand will become too great for the configuration, and hence a new system will be needed. Configuration 1 costs $10,000, and Configuration 2 costs $15,000. The useful life for each of the two configurations is uncertain because the demand for an online catalog is uncertain, and it is also uncertain exactly how much load of the type generated by an online catalog can be handled by each configuration. Precocious Toys believes there is a 0.3 probability that the online catalog will be a Wild Hit and a 0.7 probability that it will be a Modest Success. These probabilities do not depend on which configuration is selected. The probability distribution for the useful life of a configuration depends on whether the online catalog is a Wild Hit or a Modest Success. If it is a Wild Hit, then the useful life of Configuration 1 could be 12 months, 14 months, or 18 months. If the catalog is a Modest Success, then these useful lives are 26, 32, and 86 months, respectively, for Configuration 1. For Configuration 2, if the online catalog is a Wild Hit, then the useful life of the configuration is 37 months, 40 months, or 46 months. On the other hand, if the catalog is a Modest Success, Configuration 2 will have a useful life of at least 48 months. After 48 months, configuration 2 that is purchased will be replaced because of advances in technology. The single dimensional value function over useful life is exponential, greater levels are more preferred, and the mid-value of the range from 12 to 90 months is 21months. Draw a decision tree for this problem. 2. A real estate investor is faced with the following situation for investment over the next 10 years: She must decide if she should buy an apartment building ($800,000) or a piece of land ($200,000). If the apartment building is purchased, 2 states of nature are possible. The town may experience population growth with probability .6, or the population might not grow, and might even decline with probability .4. If the population grows, the investor will get a payoff of $2,000,000. If the population does not grow, the investor will only make $225,000. If the investor purchases the land instead, the same two states of nature as before will be possible. If population grows for the next 3 years, no payoff will occur, but the investor can then decide to develop the land. She can build an apartment building at the cost of $800,000, or sell the land at $450,000. If no population growth occurs, the land can be developed commercially at a cost of $600,000 or the land can be sold for $210,000. If an apartment building is built there are two states of nature possible. The population might grow with probability .8, or not with probability .2. The payoffs for these states of nature are $3,000,000 for the case of population growth, or $700,000 for the case of no growth. If the land is developed commercially, then two things might happen. Population grows with probability .3, achieving a payoff of $2,300,000, or the population will not grow with probability .7, achieving a payoff of $1,000,000. a. Build a decision tree and analyze by solving this situation. Make a recommendation to the investor.