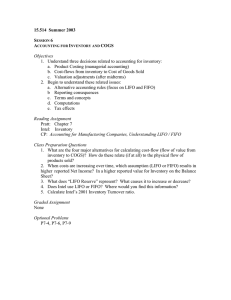

Chapter 9 Inventory (stock) valuation

advertisement

Chapter 9 Inventory (stock) valuation Inventory (stock) valuation A good estimate of closing stock is provided by three methods of stock valuation: First-In-First-Out (FIFO) Method Last-In-First-Out (LIFO) Method Average Cost (AVCO) Method First-In-First-Out (FIFO) Method In this method we assume that the first set of inventory received is the first to leave the warehouse. The resulting ending inventory will be valued at current prices. First-In-First-Out (FIFO) Method Stock valuation schedule (FIFO) January 1, 2006 - June 30, 2006 Last-In-First-Out (LIFO) Method In this method we assume that the last set of inventory received is the first to leave the warehouse. The resulting ending inventory will be valued at older prices. Last-In-First-Out (LIFO) Method Stock valuation schedule (LIFO) January 1, 2006 - June 30, 2006 Average Cost (AVCO) Method In this method, each time goods are purchased we calculate a new average cost of inventory. The average cost is calculated using the equation Average cost of inventory= Total value of goods on hand ÷ Quantity of goods on hand The resulting ending inventory will be valued at the last calculated average. Average cost (AVCO) Method Stock valuation schedule (AVCO) January 1, 2006 - June 30, 2006 2006 Receipts Issues Average Jan 200@10 0 $10.00 200@10=2000 Feb 300@14 0 $12.40 500x12.40=6200 Apr 0 $12.40 250@12.40=3100 June 450@15 $14.07 700@14.07=9850 250@12.40 0 Balance