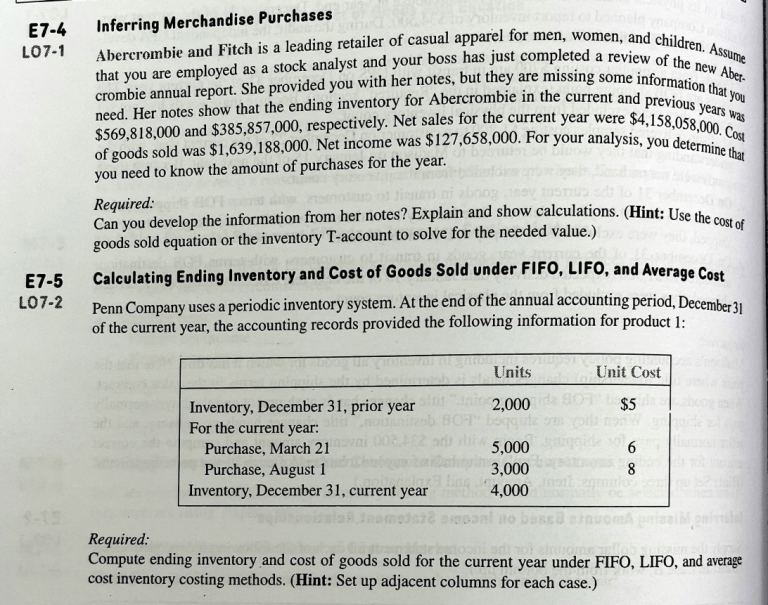

E7-4 L07-1 Inferring Merchandise Purchases Abercrombie and Fitch is a leading retailer of casual appar~l for men, women, and children that you are employed as a stock analyst and your boss has JUSt completed a review of th · Assurne crombie annual report. She provided you with her notes, but they some infor mation newth Aber. . are . missing h b Ab need. Her notes show that the ending inventory fior ercrom 1e m t e current and previous at You $569,818,000 and $385,857,000, respe~t~vely. Net sales for the current year were $4,lS&,OS&,~~ars Was of goods sold was $1639188,000. Net mcome ' ' . was $127,658,000. For your analysis • you determ·0. Cost you need to know the amount of purchases for the year. ine that Required: Can you develop the information from her notes? Explain and show calculations. (Hint·. usethe co goods sold equation or the inventory T-account to solve for the needed value.) st of E7-5 L07-2 Calculating Ending Inventory and Cost of Goods Sold under FIFO, LIFO, and Average Cost Penn Company uses a periodic inventory system. At the end of the annual accounting period D of the current year, the accounting records provided the following information for product,!: ecemberJJ Inventory, December 31, prior year For the current year: Purchase, March 21 Purchase, August 1 Inventory, December 31, current year Units Unit Cost 2,000 $5 5,000 3,000 4,000 6 8 Required: Compute ending inventory _and cost of goods sold for the . cost inventory costing methods (ff t· S d' current year under FIFO, LIFO, and average . . . m . et up a ~acent columns for each case.)