Format for doing proposals

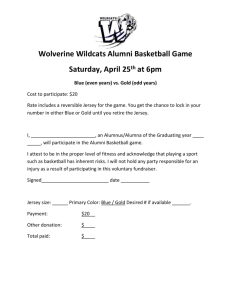

advertisement

HUMAN SERVICES DIVISION OF FAMILY DEVELOPMENT Child Support and Paternity Program Proposed Readoption with Amendments: N.J.A.C. 10:110 Proposed New Rule: N.J.A.C. 10:110-7.3 Authorized on September 4, 2008 by: Jennifer Velez, Commissioner, Department of Human Services Authority: N.J.S.A. 30:1-12; 44:10-58; 47:1A-1, et seq. as amended by P.L. 2001, c. 404, Public Access to Government Records; 42 U.S.C. §§601, 654, 654(22), 658, 666(a)(17) and (a)(19), and 669A, as amended in accordance with Public Law 104-193, the Personal Responsibility and Work Opportunity Reconciliation Act of 1996 (PRWORA); and 45 CFR 260.50-59, and 301 through 310; Public Law 105-34, The Taxpayer Relief Act of 1997; Public Law 105-149, The Balanced Budget Act of 1997; Child Support Performance and Incentive Act of 1998, P.L. 105-200; P.L. 1998, c. 1, the New Jersey Child Support Program Improvement Act (NJCSPIA); and P.L. 1998, c. 2, the New Jersey Uniform Interstate Family Support Act; 42 U.S.C. §§651 through 669B; the New Jersey Rules of Court (Rule 5:6A and Appendices IXA through IXH), and the Deficit Reduction Act of 2005 (P.L. 109-171). Calendar Reference: See Summary below for explanation of exception to calendar requirement. Proposal Number: PRN 2008-330 Submit comments by December 5, 2008 to: Miguel Mendez, Administrative Practice Officer Division of Family Development P.O. Box 716 Trenton, New Jersey 08625-0716 The agency proposal follows: Summary As the Department is providing a 60-day comment period on this notice of proposal, this notice is excepted from the rulemaking calendar requirement pursuant to N.J.A.C. 1:30-3.3(a)5. In accordance with N.J.A.C. 1:30-6.4, the Department of Human Services proposes to readopt N.J.A.C. 10:110, which will otherwise expire on July 28, 2009, pursuant to N.J.S.A. 52:14B-5.1c. N.J.A.C. 10:110 establishes the policies necessary for the orderly provision of child support services on a Statewide basis. These policies are binding on those entities or partners in New Jersey’s Child Support Program that administer any of the services of the Child Support Program or support the function of the Program and include, but are not limited to: the Office of Child Support Services (OCSS), the New Jersey Division of Family Development (DFD), the Department of Human Services (DHS); county welfare agency child support units (CWA/CSUs) and attorneys; county sheriffs’ officers; the Judiciary: the Administrative Office of the Courts; Probation Division Child Support Enforcement; Family Division Intake Units; Finance Division; local vicinage finance units; child support hearing officers; the courts; other departments and agencies with which OCSS shares information; contracted vendors of the New Jersey Child Support Program; attorneys; and other states through the interstate processes. The policies of N.J.A.C. 10:110 comport with Federal and State statutes and rules that affect the Child Support Program, including the requirements of the applicable sections of the Social Security Act (42 U.S.C. §§651 through 669B), 45 CFR 301 through 310, the New Jersey statutes and New Jersey Court Rules and directives of the Federal Office of Child Support Enforcement. - 2 The following is a description of the subchapters of N.J.A.C. 10:110: N.J.A.C. 10:110-1 describes the general provisions of the Child Support Program. This includes the purpose and scope of the Program as defined by Title IV-D of the Social Security Act. It introduces the Office of Child Support Services located in DFD, DHS, as the designated entity of the State responsible for supervising the New Jersey Child Support Program. The subchapter also defines the child support services that are provided, provides that there shall be no discrimination in the administration of these services, and delineates how both public assistance and non-public assistance applicants/recipients can access services. The subchapter describes how requests for information shall be addressed and provides for confidentiality of information and privacy of custodial and non-custodial parents and their children. N.J.A.C. 10:110-1A defines the words and terms used within this chapter, unless the content of the subchapters clearly indicates otherwise. N.J.A.C. 10:110-2 addresses the administration of the Child Support Program. This subchapter authorizes the OCSS to enter into cooperative agreements and contracts for IV-D services. The subchapter provides for the processing of interstate cases in accordance with the Uniform Interstate Family Support Act (UIFSA) and gives full faith and credit to other states’ and eligible foreign jurisdictions’ child support orders. N.J.A.C. 10:110-3 addresses the continuing responsibilities of all entities involved in the delivery of child support services. This includes the OCSS; CWA/CSUs and attorneys; the Judiciary: the Administrative Office of the Courts; Probation Division Child Support Enforcement; Family Division Intake Units; Finance Division; local vicinage finance units; child support hearing officers; and the courts. N.J.A.C. 10:110-4 delineates the rights and responsibilities of both the custodial and the non-custodial parents in the child support process. The subchapter provides that both the custodial and the non-custodial parents shall be provided with easy access to an application for child support services, and once the case is established, to notice of actions that significantly impact the status of the case. The subchapter also delineates the responsibilities of the custodial and non-custodial parents that include the duty to cooperate in providing information to establish paternity and to establish an order for monetary and medical support, which includes the obligation to provide any changes in information concerning addresses, employment or custody. The parents must respond to subpoena(s) with respect to child support matters. The non-custodial parent must ensure that sufficient funds are available to meet the child support payment due, and make good on any returned payment(s) and/or penalties charged for such bad payments. N.J.A.C. 10:110-5 provides that child support services are delivered through administrative subpoena and administrative enforcement whenever possible. The subchapter details the use of the administrative subpoena and the penalties for refusal to comply. The subchapter also authorizes the use of administrative enforcement to gain compliance with established child support orders for both in-State and interstate cases. This subchapter confers authorization on the Program to petition the court to have a non-custodial parent (both those with a child(ren) receiving public assistance and those that are non-assistance cases) participate in work activities for the non-payment of child support. N.J.A.C. 10:110-6 discusses child support authorizations granted to agencies providing certain services to children. It delineates that an assignment of child support rights to the CWA is automatic upon application for or receipt of Work First New Jersey/Temporary Assistance for Needy Families (WFNJ/TANF) benefits on behalf of a child, or upon referral of a case by the Division of Youth and Family Services (DYFS) for a child receiving such services. Moreover, an assignment of medical support rights to the Division of Medical Assistance and Health Services is automatic upon application for Medicaid. The subchapter also provides that any - 3 application for child support services by a non-public assistance individual is authorization by that individual to have the Child Support Program locate or assist him or her in establishing parentage and establishing, modifying, or enforcing child and medical support for his or her child(ren). N.J.A.C. 10:110-7 deals with the application process and fees for child support services. The subchapter provides that there is no fee for public assistance recipients. Applications are to be made accessible to the public. The fee for non-public assistance recipients is six dollars. N.J.A.C. 10:110-8 describes case action procedures to initiate child support services for WFNJ/TANF applicants/recipients who must cooperate in order to receive public assistance benefits, and for non-public assistance applicants/recipients requesting those services. N.J.A.C. 10:110-9 concerns cooperation rules for WFNJ/TANF and Medicaid applicants/recipients and is the same as the rules at N.J.A.C. 10:90-16.2 through 16.5. Applicants and recipients of WFNJ/TANF are required to cooperate with the child support agency to establish parentage and establish, modify and enforce child and medical support orders. If the applicant/recipient of WFNJ/TANF fails to cooperate by not providing the necessary information, the child support agency shall send notice to the applicant/recipient that a determination of noncooperation shall be made, unless he or she takes specified actions to cooperate. The subchapter includes the handling of cases requesting good cause exceptions to cooperation with child support requirements. N.J.A.C. 10:110-10 deals with service of process in the establishment, modification and enforcement of orders. The subchapter also discusses diligent efforts to serve process, including making inquiries of government agencies such as the United States Postal Service, the New Jersey Motor Vehicle Commission, the New Jersey Department of Labor and Workforce Development, the New Jersey Department of Corrections and the Division of Taxation, in the New Jersey Department of the Treasury. N.J.A.C. 10:110-11 provides the timeframes for conducting location efforts in pursuing non-custodial parents or alleged fathers and/or their assets. The subchapter provides that all local, State and Federal resources shall be utilized during location investigations. N.J.A.C. 10:110-12 delineates paternity establishment policies. It identifies the timeframes for commencing a paternity establishment action. Before initiating proceedings to establish paternity, an allegation of paternity shall be obtained. The subchapter provides for the voluntary establishment of paternity through the Certificate of Parentage. In cases where paternity is not voluntarily established, a complaint shall be filed in a court of competent jurisdiction. Where genetic testing is warranted, it shall be scheduled with a State-approved facility. If genetic test results show the alleged father meets the 95 percent or higher threshold of probability, a rebuttable presumption of paternity is created and is the basis for entry of a judgment of paternity. In cases of adoption, an action to establish paternity against an alleged biological father shall not be initiated, unless a court of competent jurisdiction overturns the adoption. Similarly, in cases of artificial insemination, where the mother is inseminated with sperm donated anonymously to a sperm bank or similar institution, an action to establish paternity shall not be initiated. N.J.A.C. 10:110-13 provides the establishment of support obligations in accordance with the New Jersey Child Support Guidelines. The subchapter provides the timeframes for establishing child and medical support obligations in cases where parentage has been legally established, but where a support order does not exist. The Child Support Guidelines of the New Jersey Supreme Court Rule 5:6A are incorporated into this subchapter, by reference. A deviation from them may be made by the court, in establishing an order on a case, only when good cause is demonstrated. - 4 N.J.A.C. 10:110-14 provides for the triennial review and possible adjustment/modification of cases. All WFNJ/TANF, foster care and Medicaid cases on which a support order has been established, or which were last reviewed or adjusted in the prior three-year period, shall have a review initiated by the Program for possible adjustment before the three-year anniversary date. Upon written request of either party, non-public assistance cases on which the support order was established, last reviewed, or modified three years prior, shall also be reviewed for possible adjustment. The subchapter also identifies situations in which a review shall not be initiated. In addition, the review process and appropriate notices concerning the review are described. N.J.A.C. 10:110-15 identifies the timeframes for enforcing support obligations and delineates the remedies available to enforce obligations, including: income withholding; unemployment compensation benefits intercepts; workers’ compensation benefits intercepts; financial institution data matches (FIDM); Federal income tax refund intercepts; New Jersey Lottery winnings intercepts; license suspensions, denials, or revocations; credit bureau reporting; Internal Revenue Service full collections; State Income Tax/Homestead/Saver Rebate intercepts; judgments for child support liens against net proceeds; denials, revocations, or limitations of the passport; the Uniform Fraudulent Transfer Act; and work requirements for nonpayment of support. The remedies available to enforce support obligations are not limited to the foregoing list. N.J.A.C. 10:110-16 provides for the distribution of excess child support payments and the timeframes for distribution of the amounts collected. N.J.A.C. 10:110-17 identifies how payments on past due support amounts (also known as arrearage payments) shall be used to satisfy claims where payment is made. Arrearage payments are distributed in accordance with the Federal provisions at 42 U.S.C. §657(a)(2)(B). Exceptions to these provisions are those payments from Federal tax intercepts. N.J.A.C. 10:110-18 provides for the distribution of incentive payments received by the IV-D Program of the State under section 458(f) of the Social Security Act and 45 CFR 304.12. These funds supplement monies spent on the State IV-D Program. The subchapter describes the methodology for distribution of incentive funds to improve the effectiveness and efficiency of the State Program. N.J.A.C. 10:110-19 provides that the State Case Registry shall be maintained in accordance with the Personal Responsibility and Work Opportunity Reconciliation Act (PRWORA) of 1996 (P.L. 104-193) and the New Jersey Child Support Improvement Act as cited above. N.J.A.C. 10:110-20 provides that all Federal requirements and timeframes for closure of IV-D cases are followed in accordance with 45 CFR 303.11. The subchapter provides details on when child support cases should be closed for administrative purposes to maintain a caseload that includes only those cases for which adequate information is available and that, therefore, have a greater likelihood of resulting in provision of support to children. Such procedures enable the Program to be more responsive to those families and children it can assist, while being administratively efficient in establishing paternity and securing support. The subchapter also discusses case record retention and the re-opening of closed cases. Since the last readoption, there have not been any changes to N.J.A.C. 10:110. As a result of a continuous review process, the following amendments are being proposed as part of the proposed readoption of N.J.A.C. 10:110: Summary of Proposed Amendments: Proposed amendments throughout the chapter replace “country(ies)” and “state(s)” with the term “jurisdiction(s)” to better reflect the broader definition within the Title IV-D Program as found in Federal regulations at 45 CFR 300 et seq. The - 5 Glossary of Common Child Support Terms published in 2007 by the Federal Office of Child Support Enforcement (OCSE) defines “jurisdiction” as “the legal authority which a court or administrative agency has over particular persons and over certain types of cases, usually in a defined geographical area. Also, a term used to signify a geographic location such as a State or Tribe with a tribunal that exercises such authority.” Proposed amendments throughout the chapter also replace “paternity” with the term “parentage,” when referring to the establishment of a parent child relationship. N.J.S.A. 9:17-39 defines the “parent child relationship” as “... the legal relationship existing between a child and child’s natural or adoptive parents, incident to which the law confers or imposes rights, privileges, duties, and obligations. It includes the mother and child relationship and the father and child relationship.” The term “paternity” remains in the chapter, when it refers to the establishment of a father and child relationship, through administrative or judicial process, for unmarried individuals, or when it refers to a specific Federally-mandated paternity establishment function under Title IV-D of the Social Security Act. Many states, including New Jersey, have passed laws recognizing the legality of domestic partnerships (Domestic Partnership Act, N.J.S.A. 26:8A-1 et seq.) and civil unions (Civil Union Law, N.J.S.A. 37:1-1 et seq.) affording same sex couples the rights and protections of traditionally married couples. The use of the term “parentage” recognizes that non-biological parents are entitled to the establishment of parental rights equal to those of biological parents. The proposed amendment at N.J.A.C. 10:110-1.2(f) adds the New Jersey Child Support Institute (NJCSI), as an entity that the OCSS oversees in the delivery of child support training. NJCSI provides comprehensive training for professionals who work in New Jersey’s Child Support Program to ensure that children and their families obtain the financial and medical security they deserve. The proposed amendment at N.J.A.C. 10:110-1.4(a)1 clarifies the types of medical support services provided by the Child Support Program to WFNJ/TANF, WFNJ/GA, Title XIX Medicaid applicants, and Title IV-E DYFS referrals. The proposed amendment at N.J.A.C. 10:110-1.7(a)1 deletes the reference to “Title IV-F” of the Social Security Act. Title IV-F of the Social Security Act, also known as the Job Opportunities and Basic Skills Training Program, was replaced by TANF under PRWORA. Additionally, reference to 42 U.S.C. §§301 et seq. and §653 and §663 has been deleted since it is redundant. All Titles of the Federal Social Security Act are already cited at the end of the paragraph (42 U.S.C. §§301 et seq.). The proposed amendment at N.J.A.C. 10:110-1.7(d) clarifies that Title IV-D and Internal Revenue Code rules concerning the confidentiality of child support and Federal tax information prevail, if there are conflicting rules used by any persons, agencies or organizations that provide direct or indirect services to implement Title IV-D requirements. The proposed amendment at N.J.A.C. 10:110-1.8(b) corrects an Administrative Code cross-reference. N.J.A.C. 10:110-1A.1, containing the definitions of terms used throughout this chapter, has been amended as follows: The proposed amendment to the definition of “Indian Tribe” adds reference to “subsections (e) and (1) of section 4 of the Indian Self-Determination and Education Act.” The reference to “P.L. 93-638” is replaced with the U.S.C. cite to comport with the Federal definition. A definition of “New Jersey Child Support Institute (NJCSI)” has been added. A definition of “Parentage” has been added to mean the legal relationship between a child and a parent of the child. - 6 The proposed amendments at N.J.A.C. 10:110-3.4(a) provide clarification as to OCSS’ responsibilities for monitoring the Administrative Office of the Courts (AOC), not the entire Judiciary. The proposed amendment at N.J.A.C. 10:1103.4(a)1 clarifies that any standard operating procedures, practices and forms developed by the AOC must comport with Title IV-D of the Social Security Act. The proposed amendment at N.J.A.C. 10:110-3.4(a)2 provides that the distribution of payments accepted at the probation divisions is not the responsibility of the AOC. The probation divisions will accept payments in certain circumstances, but the distribution of payments accepted at the probation divisions must be performed by the State Disbursement Unit (SDU). The amendment aligns this paragraph with N.J.A.C. 10:110-1A.1 (definition of AOC) and text throughout the chapter concerning AOC’s responsibilities. The proposed deletion of N.J.A.C. 10:110-3.4(a)9 is proposed as the State disbursement unit, not AOC, distributes the collections of child support funds in accordance with Federal requirements of the Child Support State Plan and 45 CFR 302.32. The proposed amendment at N.J.A.C. 10:110-5.4(b)2 eliminates reference to the “CS022.” The CS022 is the designated document identifier for the ”Notice of Delinquency” document on the current child support automated system that is produced and sent to an obligor, when support payments are not made in accordance with a court ordered support obligation, and arrears accrue. The automated child support system is in the process of being reengineered. While the automatic production of the Notice of Delinquency will be incorporated into the reengineered system, the designated identifier may change or be eliminated. A general reference to the document will eliminate the need for future amendments. The proposed amendment renames Subchapter 7 to incorporate the new rule concerning the $25.00 annual fee mandated by the Deficit Reduction Act of 2005 (DRA) (P.L. 109-171) at N.J.A.C. 10:110-7.3. Proposed new N.J.A.C. 10:110-7.3 incorporates the provisions of Section 7310 of the DRA. That section requires states to impose an annual fee of $25.00 on families who have never received TANF assistance, if collections of at least $500.00 have been made in their child support case. The DRA provisions amend 42 U.S.C. §654(6)(B). The proposed technical amendments at N.J.A.C. 10:110-10.3 and 11.2(l)1 change “Division of Motor Vehicles” to “Motor Vehicle Commission,” and “Department of Labor” to “Department of Labor and Workforce Development.” The proposed amendment at N.J.A.C. 10:110-15.2(a)4i incorporates the authority the OCSS has to enter into cooperative arrangements with other states for the purpose of obtaining financial institution data match (FIDM) information. Under State and Federal statutes, the OCSS has the authority to administratively identify financial assets of non-custodial parents owing past due child support that are held in financial institutions. Being able to enter into cooperative agreements with other states enhances the ability of the OCSS to identify and seize these assets. The proposed deletion of N.J.A.C. 10:110-15.2(a)4i(1) is proposed as the definitions for “accounts,” “financial institutions,” “selection criteria,” and “exemption from levy” are addressed in N.J.A.C. 10:110-1A.1. The proposed amendment at N.J.A.C. 10:110-15.2(a)4i(2) (recodified as (a)4i(1)) provides that financial institutions doing business in more than one state may elect to provide the match data to OCSE for subsequent transmission to OCSS under the “Multistate Finacial Institution Data Match (MSFIDM)” program. Under MSFIDM, the State enters into an agreement with the Federal OCSE to act as its agent, and OCSE enters into agreements with every multistate financial institution electing to match through the FPLS. By participating in MSFIDM, the Department is not - 7 required to enter into separate agreements with each multistate financial institution doing business in the State. The proposed amendment at N.J.A.C. 10:110-15.2(a)4i(4) (recodified as N.J.A.C. (a)4i(3)) provides that there is an exception for multistate financial institutions reporting directly to the Federal OCSE. The proposed amendment at N.J.A.C. 10:110-15.2(a)4ii(2)(B) clarifies that the financial institution shall remit the funds as directed in the “Notice of Levy” currently used, or other “notice” or “letter” produced in the future, for this purpose. The proposed deletion of N.J.A.C. 10:110-15.2(a)4ii(2)(C) is proposed as this provision has been incorporated in the proposed amendment at N.J.A.C. 10:110-15.2(a)4ii(2)(B). The proposed amendment at N.J.A.C. 10:110-15.2(a)4iii(1)(F) adds extreme hardship as an additional reason for an accountholder to contest the levy in writing and request an administrative contest review. Extreme hardship has been included as a reason to contest a levy in the “Notice of Levy” since the inception of the FIDM program. Social Impact The Child Support Program is a Federal mandate of the Social Security Act established in Title IV, Part D (42 U.S.C. §§651 et seq.). States are authorized through the completion of a Child Support State Plan, submitted by the state’s child support agency to the Federal OCSE, to maintain a Program consistent with Federal mandates and to obtain eligibility for block grant funds under the Federal TANF Program. Since 1975, New Jersey has maintained a Child Support Program. The OCSS, in DFD, DHS, is the State’s designated IV-D Agency. This Office is responsible for the administration of the Program and accomplishes the operation of the Statewide Program through cooperative agreements/arrangements with the CWAs and components of the Judiciary that are involved in the Title IV-D Child Support Enforcement Program, including the Administrative Office of the Courts, Probation Division, Family Division, Finance Division, and through other contractual agreements. Child support payments can make a significant contribution to reducing economic deprivation of the State’s children. Non-welfare single parents need better access to child support services to maintain self-sufficiency and to maintain the economic well-being of children. With the stringent work requirements and time-limited benefits of the WFNJ Program, the Child Support Enforcement Program has become a critical means of economic support for single parents. For WFNJ recipients to achieve self-sufficiency it is essential that child support payments be timely and consistently received. WFNJ/TANF and Medicaid applicants/recipients and foster care children are required to cooperate with the Child Support Program, both to establish parentage when necessary, and to establish, modify and enforce child support orders. Stressing Program cooperation for children on public assistance follows the long-standing belief, since the establishment of the Child Support Program for that purpose in 1975, that child support is a positive tool as a welfare cost recovery mechanism. Through that recovery process, collections are paid to the government to reimburse assistance granted and, as such, have exceeded the costs of government to run the Child Support Program. As of the previous readoption in Federal fiscal year (FFY) 2002, the number of children in receipt of public assistance was 63,807. As of FFY 2006, the most recent year the Federal OCSE has prepared a preliminary report of Child Support Enforcement, that number has increased five percent to 66,953 children. - 8 When the composition of the Child Support Program caseload is reviewed, however, a different trend is revealed concerning the use of child support services. Of the nearly 16 million cases reported in FFY 2006 nationwide, only about 3 million, or 19 percent, represent families with children currently receiving public assistance. Through the years, the mantle of child support has expanded to include services to families that have never before received assistance. In fact, approximately 38 percent of those served by the Program have no past or present connection to the welfare program. New Jersey’s statistics are similar in that its never assisted caseload is approximately 37 percent of its total caseload. The composition of the family structure has changed in the United States and throughout the world. An increasing number of children are now living in one-parent situations, placing a greater need on ensuring that both parents remain in the lives of their children. The United States Census Bureau reports that in the Spring of 2007, an estimated 12.9 million parents nationwide had custody of 22.6 million children under 21 years of age whose other parent lived somewhere else. Of all such custodial parents, 81 percent were mothers and 19 percent were fathers, a fact that has remained statistically stable since 1994. Within this milieu, the Child Support Program becomes ever more imperative for those children living in single-parent households and especially for those children on public assistance when considering the financial stability of such families in leaving welfare. The gap in income, for both never-assisted and public assistance families, must be made up through a variety of resources for the economic support of the children. This is where child support becomes one of the most important Programs available to families of New Jersey, and where it has clearly shown itself to be a critical contributor to family financial constancy and strength. The total nationwide caseload of Title IV-D cases has been decreasing slightly in number since 1998, and as reported for the FFY ending September 30, 2006, that number is approximately 15,900,000 cases. New Jersey’s total Title IV-D caseload for that same period is 359,530 cases representing 346,375 children and affecting over one million families. According to nationwide statistical information collected by the Federal OCSE, data for FFY 2006 shows that the Program continues to collect and distribute money for more than three-fourths of the child support orders that it was charged to enforce. That represents an impressive improvement, since that doubled the 38 percent of orders that resulted in a collection in FFY 1997. In FFY 2002, New Jersey made a collection on a total of 222,025 cases in its caseload of 267,107 cases with orders, and in FFY 2006, a collection was obtained on 234,043 cases in a total caseload of 294,424 cases with orders. This represents a five percent increase in collections for New Jersey’s children, since FFY 2002. However, while the percentage of collections appears to have improved considerably, those collections do not represent a payment received by all children in the caseload. Similar gains have occurred in the area of orders establishment. Nationally, over three-fourths of parents (77 percent) who sought help getting child support actually got a court order mandating the payment of that support. This too represents a continuing advance over the 70 percent success rate of four years ago. New Jersey’s order establishment rate is five percent above the national average at 82 percent. A third measure relative to child support activity progress concerns paternity establishments for children born out of wedlock. State paternity establishments showed an approximate three percent increase from FFY 2002 to FFY 2006 with 77 percent of those establishments being voluntary acknowledgements of paternity. The readoption of this chapter provides for continued provision of child support services to families of New Jersey and to those families living out-of-State who have a non-custodial parent residing within New Jersey. - 9 The proposed amendment at N.J.A.C. 10:110-1.2(f) dealing with NJCSI will have a positive impact. The New Jersey Child Support Program is constantly developing initiatives to improve the delivery of child support services to its customers. NJCSI was developed to be the entity that provides comprehensive uniform Statewide child support training from case initiation through establishment and enforcement of child support orders, to all agencies involved in the delivery of services. NJCSI will have a positive social impact on the staff that provides the services and the customers that benefit from those services. An educated and knowledgeable staff is best prepared to meet the needs of the families that rely on the payment of child support to develop or maintain self-sufficiency. Economic Impact The following Program operational areas illustrate the economic achievements that have occurred in the Title IV-D Program in a four-year period in several key resource areas. Income Withholding results for FFY 2002 yielded $554.9 million in collections. FFY 2006, those collections increased to $683.7 million showing an overall increase of 19 percent. Intercepts from the Federal Income Tax totaled $29.1 million in FFY 2002. 2006, those monies increased to $37.2 million. In In FFY The FIDM became operational in August 2000. As of FFY 2006, the total amount collected through this process is approximately $41.8 million: $18.9 million in non-direct collections and $22.9 million in direct collections. State Tax intercepts in FFY 2002 totaled $7.3 million. That figure decreased by 26 percent for a total of $5.4 million received for FFY 2006. A vital measure of success concerns distributed collections. In FFY 2002, $820.2 million was distributed, including monies on current and past-due support to families and other entities. An increase of 18.7 percent in distributed collections in FFY 2006 totaled $1.09 billion. As of 2007, New Jersey’s total Title IV-D caseload is 354,195 cases representing 336,589 children and affecting over one million families. The Title IV-D Program’s cost-benefit ratio is 4.56, that is, for every dollar that is spent in the administration of the Child Support Program, a resulting $4.56 in revenue is produced for families. Expenditures for FFY 2002 were $169,876,122. for FFY 2007 were $229,992,759. It is estimated that expenditures Proposed new N.J.A.C. 10:110-7.3 concerning the $25.00 annual fee, is not expected to have an economic impact on clients. In order to comply with the provision, states have four options: (1) retain the fee from collected support; (2) charge the individual applying for services; (3) recover the fee from the absent parent; or (4) pay the fee out of State funds. In order to eliminate any adverse economic impact to the clients, the Department has opted to pay the fee out of State funds. In 2007, there were approximately 83,417 cases that met the criteria of never receiving TANF and at least $500.00 in payments per year. It is estimated that paying the fee with State funds will increase Program costs by approximately $1.0 million annually. There is a potential negative impact on the non-custodial parent, if there are no Federal incentive dollars available to pay the $25.00 annual fee because the State Title IV-D agency would have to collect the annual fee from the non-custodial parent. The proposed amendment at N.J.A.C. 10:110-15.2(a)4 concerning cooperative agreements with other states, will have a positive economic impact on the families that rely on the receipt of child support to develop and maintain selfsufficiency. Being able to enter into cooperative agreements with other states enhances the ability of the OCSS to identify and seize these assets. - 10 Proposed N.J.A.C. 10:110-15.2(a)4iii(1)(F), which adds extreme hardship as a reason to contest a levy, will have a positive impact on the accountholder. If the accountholder can contest the levy due to extreme hardship, the levy may be released and the account would not be seized. Federal Standards Statement The rules proposed for readoption with amendments and a new rule contain standards, which do not exceed those imposed by Federal law under the Personal Responsibility and Work Opportunity Reconciliation Act of 1996 (PRWORA), P.L. 104-193 as amended by P.L. 105-34, the Taxpayer Relief Act of 1997 and P.L. 105-149, the Balanced Budget Act of 1997, and as those laws amended the Social Security Act in applicable sections of the Act (42 U.S.C. §§601 and 651 through 669B), and applicable sections of the Code of Federal Regulations (45 CFR 260.50 through 260.59 and 301 through 310). Jobs Impact The rules proposed for readoption with amendments and a new rule will not result in the generation or loss of jobs. Agriculture Industry Impact The rules proposed for readoption with amendments and a new rule have no impact on the agriculture industry. Regulatory Flexibility Statement The rules proposed for readoption with amendments and a new rule have been reviewed with regard to the Regulatory Flexibility Act, N.J.S.A. 52:14B-16 et seq. The rules proposed for readoption with amendments and a new rule impose no reporting, recordkeeping, or other compliance requirements on small businesses because these rules govern public entities; therefore, a regulatory flexibility analysis is not required. The rules govern a public assistance program designed to certify eligibility for the WFNJ Program and child support services to a lowincome population by a governmental agency rather than a private business establishment. Smart Growth Impact The rules proposed for readoption with amendments and a new rule have no impact on the achievement of smart growth and implementation of the State Development and Redevelopment Plan. Housing Affordability Impact The rules proposed for readoption with amendments and a new rule will have no impact on housing affordability because the rules govern a public assistance program designed to certify eligibility for the Child Support program to a lowincome population by a governmental agency rather than a private business establishment. Smart Growth Development Impact The rules proposed for readoption with amendments and a new rule will have no impact on smart growth development in Planning Areas 1 or 2 because the rules govern a public assistance program designed to certify eligibility for the Child Support program to a low-income population by a governmental agency rather than a private business establishment. Full text of the rules proposed for readoption may be found in the New Jersey Administrative Code at N.J.A.C. 10:110. - 11 Full text of the proposed amendments and new rule follows (additions indicated in boldface thus; deletions indicated in brackets [thus]): SUBCHAPTER 1. GENERAL PROVISIONS OF THE CHILD SUPPORT PROGRAM 10:110-1.2 Child Support Program administration (a)-(e) (No change.) (f) The OCSS shall operate the New Jersey Child Support Institute (NJCSI) to train staff of all entities providing IV-D child support services. Attendance at new hire training shall be mandatory for all new staff within six months of their hiring dates. 10:110-1.3 Child support services (a) (No change.) (b) Child support services shall include, but not be limited to, the following services: 1. (No change.) 2. Establishment of [paternity] parentage or filiation proceedings; 3.-5. (No change.) (c) (No change.) 10:110-1.4 Eligibility for services (a) Individuals residing in New Jersey who receive WFNJ/TANF, WFNJ/GA, Title XIX Medicaid assistance or who are referred as Title IV-E foster care cases are eligible for child support services. 1. WFNJ/TANF and WFNJ/GA applicants and recipients, Title XIX Medicaid applicants and recipients, and Title IV-E DYFS referrals shall accept child support services, including medical support establishment and enforcement, as a condition of eligibility for public assistance, unless good cause is found in accordance with N.J.A.C. 10:110-9.2 through 9.5 or 10:90-16.2 through 16.5 for not providing these services. 2.-4. (No change.) (b)-(c) (No change.) 10:110-1.5 Delivery of service Title IV-D services provided by the county agency child support units to WFNJ/TANF applicants/recipients also shall be provided to non-public assistance applicants/recipients in both intrastate and interstate cases (including, but not limited to cases originating from another state, from an Indian Tribe/Tribal organization child support enforcement agency, from foreign reciprocating [countries] jurisdictions in accordance with 42 U.S.C. [§ 659A] §659A, from U.S. citizens living abroad, and from non-resident aliens who apply or have applied directly to a state for child support enforcement services). - 12 10:110-1.7 Confidentiality and privacy (a) Unless further restricted by Federal or State law, the use or disclosure of information concerning applicants or recipients of child support services, including the child(ren); legal guardians; putative fathers; and non-custodial parents; and other individuals for whom information may be in the record (such as, but not limited to grandparents, other siblings or dependents in the home or outside the home), shall be limited, based on the right and need to know the information, to purposes directly connected with: 1. The administration of the State plan or Program approved under parts A, B, D, or E[, or F] of Title IV or under Titles I, II, III, X, XIV, XVI, XIX, XX, or XXI of the Federal Social Security Act [(42 U.S.C. §§ 301 et seq. and § 653 and § 663)] or the Supplemental Security Income Program established under Title XVI of the Federal Social Security Act (42 U.S.C. [§§ 301] §§301 et seq.); 2.-4. (No change.) (b)-(c) (No change.) (d) The confidentiality and privacy safeguards of the Child Support Program shall be in compliance with all applicable Federal and State laws, regulations, Court rules and as described [herein] in this chapter. If court rules or regulations of a program other than the IV-D Program conflict with these safeguards, the confidentiality and privacy safeguards required by Title IV-D shall control. These confidentiality and privacy safeguards shall be binding on DHS, its subordinate agencies, and on all persons, agencies and organizations that contract with the DHS to provide IV-D services, directly or indirectly; or under any agreements or other instruments used for such purposes by the Department or its designees in implementing Title IV-D requirements. 1.-5. (No change.) (e) (No change.) 10:110-1.8 Requests for information (a) (No change.) (b) Information concerning the non-custodial parent shall be released to consumer credit agencies upon their request in accordance with N.J.A.C. 10:110-[15.2(a)9]15.2(a)8. (c)-(d) (No change.) SUBCHAPTER 1A. DEFINITIONS 10:110-1A.1 Definitions The following words and terms, used within this chapter, shall have the following meanings unless the context clearly indicates otherwise: ... "Arrearage" means the amount of unpaid support that is past due under a court order or an administrative order from a [state] jurisdiction, for support of a child or of a child and the custodial parent. - 13 ... "Automated Administrative Enforcement of Interstate Cases (AEI)" means the State’s ability to locate, place a lien on, and seize financial assets of delinquent obligors upon request of another state or Indian Tribe/Tribal organization child support enforcement agency, or foreign reciprocating [country] jurisdiction. ... "Child support" means the amount required to be paid under a judgment, decree, or order, whether temporary, final or subject to modification, issued by the Superior Court, Chancery Division, Family Part or a court or administrative agency of competent jurisdiction of another [state] jurisdiction, for the support and maintenance of a child, or the support and maintenance of a child and the parent with whom the child is living, which provides monetary support, health care coverage, any arrearage or reimbursement, and which may include other related costs and fees, interest and penalties, income withholding, attorney's fees and other relief. ... "Child support order" means a support order for a child, including a child who has attained the age of majority under the law of the issuing [state] jurisdiction. ... "Court order" means an order of the court or an order from an administrative or judicial tribunal in another [state] jurisdiction or of an Indian Tribe/Tribal organization child support enforcement agency that is competent to enter or modify orders for [paternity] parentage or child support. ... "Foreign reciprocating [country] jurisdiction" means any country, or political subdivision thereof, having an authorized declaration or international agreement for purposes of child support establishment and enforcement with the United States in accordance with 42 U.S.C. [§ 659A] §659A; and those existing reciprocity agreements that states had previously made with foreign governments, which have not been declared reciprocating [countries] jurisdictions under Federal law under the continuing authority granted to states under 42 U.S.C. [§ 659A(d)] §659A(d). ... "Indian Tribe" means, for purposes of the Child Support Enforcement Program in accordance with section 455(f) of the Social Security Act (42 U.S.C. [§ 655(f)] §655(f)), any Indian Tribe, as defined in accordance with subsections (e) and (1) of section 4 of the Indian Self-Determination and Education Assistance Act [(P.L. 93-638)] (25 U.S.C. §450b), band, nation, pueblo, village or community, or other organized group or community, including any Alaska Native village or regional or village corporation as defined in or established pursuant to the Alaska Native Claims Settlement Act (43 U.S.C. [§§ 1601] §§1601 et seq.) that the Secretary of the interior acknowledges to exist as an Indian Tribe, and Tribes meeting this definition that function as political entities exercising governmental authority, and included in the most current list of Federally recognized Indian Tribal governments pursuant to P.L. 103-454 (25 U.S.C. [§ 479a] §479a) with a recognized government-togovernment relationship with the United States. ... - 14 "Interstate cases" means child support cases processed in accordance with the Uniform Interstate Family Support Act (UIFSA), P.L. 1998, c.2, or its predecessor law, where a non-custodial parent lives in a different state than his or her child and the custodial party, or where two or more states are involved in some case activity, including, but not limited to cases where "state" means originating from another state; from an Indian Tribe/Tribal organization child support enforcement agency; from a foreign reciprocating [country] jurisdiction in accordance with 42 U.S.C. [§ 659A] §659A; from a U.S. citizen living abroad; and from a non-resident alien who applies or has applied directly to a state for child support enforcement services. ... “New Jersey Child Support Institute (NJCSI)” means the entity operated by OCSS to provide customized training programs for State, county, and judiciary employees who work in New Jersey's Child Support Program. ... "Parentage" means the legal relationship between a child and a parent of the child. The term includes the mother-child relationship and the father-child relationship. ... "Reciprocity" means a relationship between states, as defined herein, or [countries] jurisdictions, whereby recognition of child support paternity and enforcement policies and procedures is granted by one to the other, and returned one to the other (that is, state-to-state; country-to-country). ... "Support order" means a judgment, decree or order, whether temporary, final, or subject to modification, for the benefit of a child, a spouse, or a former spouse, which provides for monetary support, health care coverage, arrearages, or reimbursement, and may include related costs and fees, interest, income withholding, attorney's fees, and other relief. A support order shall be issued by the court or a court or administrative agency of another [state] jurisdiction. SUBCHAPTER 2. CHILD SUPPORT ADMINISTRATION 10:110-2.2 Reciprocal agreements with foreign reciprocating [countries] jurisdictions A request for IV-D services by a foreign reciprocating [country] jurisdiction [, as defined,] shall be treated as a request by another state. 10:110-2.3 Full faith and credit In accordance with N.J.S.A. 2A:17-56.23a, full faith and given to orders, either administrative or court, of this [states] jurisdictions that comply with the laws of that shall be fully enforceable and entitled as a judgment to credit and shall be a judgment by operation of law on or is due. credit shall be State or other jurisdiction and full faith and after the date it 10:110-2.4 Uniform Interstate Family Support Act (UIFSA), P.L. 1998, c.2 - 15 (a) Interstate cases shall be processed in accordance with the Uniform Interstate Family Support Act (UIFSA), P.L. 1998, c.2, utilizing the Federally mandated forms. 1. Interstate cases include, but are not limited to, cases originating from another state, from an Indian Tribe/Tribal organization child support enforcement agency, from foreign reciprocating [countries] jurisdictions in accordance with 42 U.S.C. [§ 659A] §659A, from U.S. citizens living abroad, and from non-resident aliens who apply or have applied directly to a state for child support enforcement services. (b) (No change.) SUBCHAPTER 3. RESPONSIBILITIES IN THE DELIVERY OF SERVICES 10:110-3.1 OCSS’ responsibilities in IV-D cases as the IV-D Agency (a)-(r) (No change.) (s) The OCSS shall ensure that reciprocity agreements are maintained with foreign reciprocating [countries] jurisdictions established by the State through "Letters of Agreement" signed by the Administrative Director of the Courts as the State IV-D Central Registry, in accordance with 42 U.S.C. [§ 659A(d)] §659A(d), until or unless such [country] jurisdiction is declared a reciprocating [country] jurisdiction of the U.S. in accordance with 42 U.S.C. [§ 659A] §659A; and ensure that any requests from those [countries] jurisdictions for child support services are handled in accordance with Federal and State provisions. (t)-(u)(No change.) 10:110-3.4 Monitoring of the Administrative Office of the Courts' (AOC) responsibilities (a) The OCSS shall be responsible for monitoring the activities included in the Cooperative Agreement between the Division and AOC, which shall include, but is not limited to, the following activities: 1. Developing standard operating procedures, practices and forms, which shall be reviewed by the Department prior to adoption and implementation to ensure compliance with requirements under Title IV-D of the Social Security Act; 2. Enforcement [and collection] of support payments in all Title IV-D cases [and collection of income withholding payments in non-IV-D cases]; 3.-8. (No change.) [9. Distributing collections, with the exception of Federal tax offset collections, within two business days of receipt, if sufficient identifying information is provided;] Recodify existing 10. and 11. as 9. and 10. (No change in text.) SUBCHAPTER 5. DELIVERY OF CHILD SUPPORT SERVICES 10:110-5.3 Administrative enforcement (a) (No change.) - 16 (b) Administrative enforcement shall be used, to the same extent as used for intrastate cases, in response to a request made by another state, Indian Tribe/Tribal organization child support enforcement agency, or any foreign reciprocating [country] jurisdiction to enforce a support order. 1. Neither of the involved entities (that is, state-to-state, state to Indian Tribe/Tribal organization child support enforcement agency, or state to foreign reciprocating [country] jurisdiction and vice-versa) shall consider the case to be transferred to the caseload of the other. 2. (No change.) (c) A request for assistance in enforcing a support order through the use of administrative enforcement shall be transmitted to another [state] jurisdiction or other aforementioned entity via the Federally mandated forms. (d) (No change.) 10:110-5.4 Work activities (a) (No change.) (b) In cases where a child is receiving assistance under a State program funded under TANF, and the following provisions concerning the obligor are met, the Department is authorized to petition the court for issuance of an order against the obligor as stipulated [at] in (a) above: 1. (No change.) 2. The obligor shall be noticed in the "Notice of Delinquency" [(the CS022)] of the work requirements program, the existing notice issued when the obligor has made no regular payment for the past 45 days; and 3.-4. (No change.) (c) (No change.) SUBCHAPTER 7. APPLICATION AND FEES 10:110-7.3 Annual fee (a) Any IV-D case in which the State IV-D agency has collected at least $500.00 on behalf of an individual or a child receiving child support services, who has never received public assistance, shall be assessed an annual fee of $25.00. (b) The State IV-D agency has the authority to: 1. Pay the fee using Federal incentive dollars as available; or 2. The State IV-D agency shall exercise its option under the Deficit Reduction Act of 2005 (P.L. 109-171) and its implementing regulations to collect the fee from the non-custodial parent when Federal incentive dollars are not available. SUBCHAPTER 8. CASE ACTION PROCEDURES AND CASE RECORD ESTABLISHMENT 10:110-8.1 Investigative interview/case action - 17 (a) (No change.) (b) Case action procedures are as follows: 1. (No change.) 2. For a non-public assistance applicant/recipient, if sufficient information is provided from the applicant and other relevant sources as required by the court, then assistance in establishing [paternity] parentage in accordance with N.J.A.C. 10:110-12.2 shall be attempted, or help in filing a complaint for [paternity] parentage and/or support shall be provided. 10:110-10.3 Diligent efforts to serve process in establishment and enforcement actions Diligent efforts to serve process in establishment and enforcement actions means making inquiries that may include, but are not limited to, the U.S. Postal Service, the [Division of Motor Vehicles in the Department of Transportation] Motor Vehicle Commission, the Department of Labor and Workforce Development, the Department of Corrections, and the Division of Taxation in the Department of the Treasury, to obtain adequate identifying information and other information to attempt service of process or the periodic repeating of service of process attempts, in cases in which previous attempts to serve process have failed. 10:110-11.2 Location sources (a)-(k) (No change.) (l) In accordance with N.J.A.C. 10:110-1.7, the OCSS shall have access, including automated access when feasible, to the following resources, if appropriate, for child support enforcement purposes: 1. Records of other state and local government agencies including, but not limited to: i.-v. (No change.) vi. Records of the Department of Labor and Workforce Development; vii. (No change.) viii. Records of the [Division of Motor Vehicles in the Department of Transportation] Motor Vehicle Commission; ix. (No change.) 2. (No change.) (m)-(o) (No change.) SUBCHAPTER 12. PATERNITY ESTABLISHMENT 10:110-12.4 Genetic testing (a)-(e) (No change.) - 18 (f) In order for a county to receive Federal reimbursement for genetic testing fees, it must choose a laboratory from the list of laboratories awarded a contract by the State to perform [paternity] parentage testing. This list shall be provided to the county CWA/CSUs by the OCSS. The county shall use the State contract with the chosen laboratory and may only negotiate with that laboratory for a lower cost than that specified in the State contract. After choosing a laboratory, the county agency will be responsible for carrying out the terms of the contract. SUBCHAPTER 13. ESTABLISHING SUPPORT OBLIGATIONS 10:110-13.1 General statement (a) In cases where there is no order for child support and health care coverage within no more than 90 calendar days of determining the location of the non-custodial parent, an order for support shall be established or service of process completed as necessary to commence proceedings to establish an order. 1. (No change.) 2. If [paternity] parentage is acknowledged and/or support and health care coverage are agreed upon, the consent order shall be forwarded to the appropriate court for review and approval by the court. 10:110-14.3 Triennial reviews in interstate cases (a) When a request for a triennial review is received in an interstate case and New Jersey is the controlling order [state] jurisdiction, the matter shall be reviewed by the appropriate CWA/CSU in accordance with N.J.S.A. 2A:17-56.9(a) and the Child Support Guidelines. (b) When a request for a triennial review is received in an interstate case and it is determined that the controlling order is in another [state] jurisdiction, a request for review shall be sent to the responding jurisdiction via the appropriate Federally mandated standard interstate child support enforcement forms. 10:110-15.2 Child support enforcement remedies (a) Available enforcement remedies shall include, but are not limited to: 1.-3. (No change.) 4. Financial institution data match (FIDM) provisions are as follows: i. The OCSS, in accordance with N.J.S.A. 2A:17-56.53 and 2A:17-56.57 et seq., shall conduct both in State and [multi state] multistate financial institution data matches (FIDM) to identify assets of non-custodial parents held in financial institution accounts[, as defined herein,] or in accordance with this subsection and Federal law at 42 U.S.C. [§ 666(a)(17)] §666(a)(17). The OCSS has authority to enter into cooperative alliances with other states for purposes of obtaining FIDM information. [(1) Accounts subject to levy through FIDM are those accounts, as defined herein, held in a financial institution as defined in these rules, that meet the selection criteria of this subsection and that do not satisfy any exemption from levy factors described herein.] - 19 [(2)] (1) Each financial institution doing business in the State shall enter into agreement with the Department or its designee for purposes of child support financial institution data matches. However, any financial institution doing business in more than one state can elect to provide its match data to the Federal Office of Child Support Enforcement (OCSE) for subsequent transmission to OCSS under the Multistate Financial Institution Data Match program (MSFIDM). [(3)] (2) (No change in text.) [(4)] (3) Pursuant to an agreement entered into with the Department, information from a financial institution doing business in this State (except for multistate financial institutions reporting directly to the Federal OCSE as permitted in (a)4i(1) above) can be provided by: (A)-(C) (No change.) Recodify existing (5)-(7) as (4)-(6) (No change in text.) ii. Provisions concerning action to be taken where there is a match as identified under (a)4i above are as follows. (1) (No change.) (2) All the levies for accounts at a particular financial institution shall be sent to the financial institution by OCSS . (A) (No change.) (B) The financial institution shall remit the funds as directed in the Notice of Levy to Financial Institution, or other appropriate notices or letters that the financial institution may receive from OCSS. [(C) The financial institution shall remit those monies in the levied account as of the date the "Notice to Remit" is received by the financial institution, up to the amount of the levy as directed.] [(D)] (C) (No change in text.) iii. Notice of intent to levy an account and the right to challenge the levy shall be provided by OCSS to the accountholder at the address of record on the automated child support system and to the financial institution customer address of record. (1) The accountholder shall have 30 calendar days following the notice's postmark date to contest the levy by writing to the OCSS to request an administrative contest review for limited circumstances as follows: (A)-(C) (No change.) (D) Joint account issues; [or] (E) Because litigation of support has been filed and is pending resolution in the appropriate court of jurisdiction[.]; or (F) Extreme hardship. (2)-(3) (No change.) - 20 iv.-v. (No change.) 5.-14. (No change.) SUBCHAPTER 20. CASE CLOSURE 10:110-20.2 Retention of case records (a) (No change.) (b) Retention periods are as follows: 1. All case records shall be retained for a period of three and one-third years after agency action, court action, and/or all arrears have been satisfied, and: i.-iv. (No change.) v. When in interstate cases in which the IV-D Agency, as the responding [State] jurisdiction, lacks jurisdiction to work a case, and the initiating [State] jurisdiction has not responded to a request for additional information or case closure. 2. (No change.) (c) (No change.) 10:110-20.3 Case closure criteria (a)-(b) (No change.) (c) Circumstances under which a case could be closed shall meet at least one of the following criteria: 1.-11. (No change .) 12. The IV-D Agency as the responding [State] jurisdiction on an interstate case documents failure by the initiating [State] jurisdiction or Indian Tribe/Tribal organization child support enforcement agency to take an action, which is essential for the next step in providing services. (d) In cases meeting the criteria in (c)1 through 6 and 10 through 12 above, the IV-D Agency must notify the recipient of services, or in an interstate case meeting the criteria for closure under (c)12 above the initiating [State] jurisdiction, in writing, 60 calendar days prior to closure of the case of the State's intent to close the case. 1. (No change.) S:\WORKING2\Les\ADOPTIONS\CHILD SUPPORT\2008 Re-Adoption\FOR INTERNET\ChildSupportReAdoption10-062008.doc