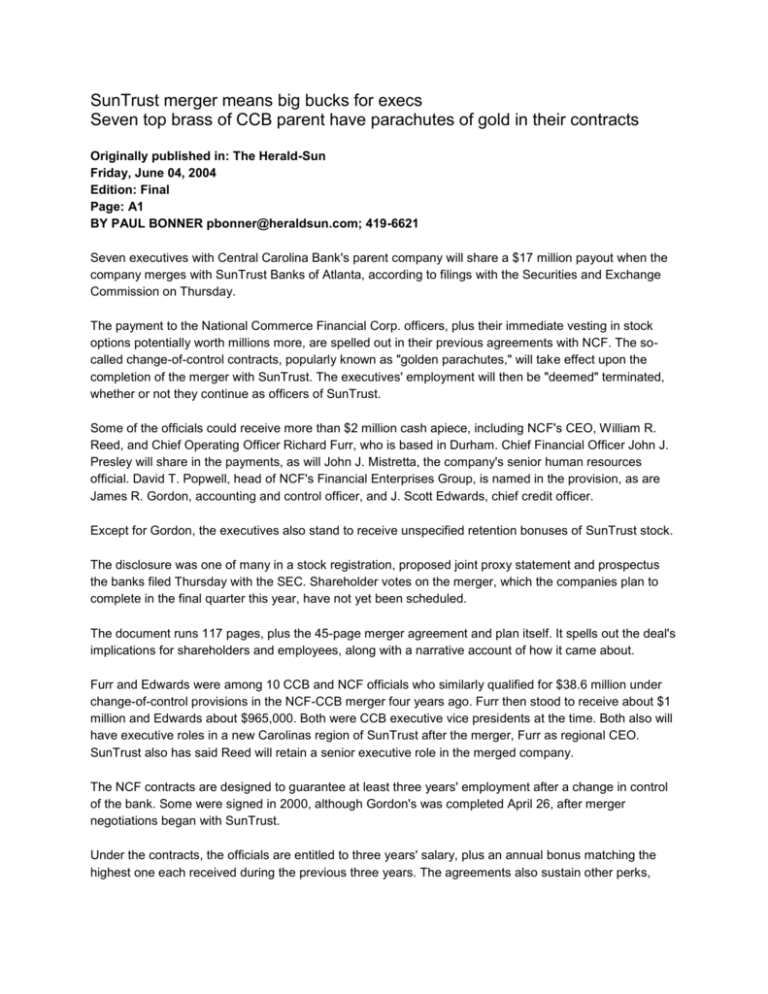

SunTrust merger means big bucks for execs

Seven top brass of CCB parent have parachutes of gold in their contracts

Originally published in: The Herald-Sun

Friday, June 04, 2004

Edition: Final

Page: A1

BY PAUL BONNER pbonner@heraldsun.com; 419-6621

Seven executives with Central Carolina Bank's parent company will share a $17 million payout when the

company merges with SunTrust Banks of Atlanta, according to filings with the Securities and Exchange

Commission on Thursday.

The payment to the National Commerce Financial Corp. officers, plus their immediate vesting in stock

options potentially worth millions more, are spelled out in their previous agreements with NCF. The socalled change-of-control contracts, popularly known as "golden parachutes," will take effect upon the

completion of the merger with SunTrust. The executives' employment will then be "deemed" terminated,

whether or not they continue as officers of SunTrust.

Some of the officials could receive more than $2 million cash apiece, including NCF's CEO, William R.

Reed, and Chief Operating Officer Richard Furr, who is based in Durham. Chief Financial Officer John J.

Presley will share in the payments, as will John J. Mistretta, the company's senior human resources

official. David T. Popwell, head of NCF's Financial Enterprises Group, is named in the provision, as are

James R. Gordon, accounting and control officer, and J. Scott Edwards, chief credit officer.

Except for Gordon, the executives also stand to receive unspecified retention bonuses of SunTrust stock.

The disclosure was one of many in a stock registration, proposed joint proxy statement and prospectus

the banks filed Thursday with the SEC. Shareholder votes on the merger, which the companies plan to

complete in the final quarter this year, have not yet been scheduled.

The document runs 117 pages, plus the 45-page merger agreement and plan itself. It spells out the deal's

implications for shareholders and employees, along with a narrative account of how it came about.

Furr and Edwards were among 10 CCB and NCF officials who similarly qualified for $38.6 million under

change-of-control provisions in the NCF-CCB merger four years ago. Furr then stood to receive about $1

million and Edwards about $965,000. Both were CCB executive vice presidents at the time. Both also will

have executive roles in a new Carolinas region of SunTrust after the merger, Furr as regional CEO.

SunTrust also has said Reed will retain a senior executive role in the merged company.

The NCF contracts are designed to guarantee at least three years' employment after a change in control

of the bank. Some were signed in 2000, although Gordon's was completed April 26, after merger

negotiations began with SunTrust.

Under the contracts, the officials are entitled to three years' salary, plus an annual bonus matching the

highest one each received during the previous three years. The agreements also sustain other perks,

including expense accounts, fringe benefits and medical coverage. Besides the stock vesting, the officials

also will be fully vested in NCF's retirement plan, worth another $3.5 million total.

Last year, Reed was paid $419,327 in salary. Furr and Edwards each earned $355,000, Presley earned

$294,499 and Popwell earned $265,000, according to NCF's annual report.

In 2002, Reed, Furr and Edwards each received bonuses of $342,000 or more. That could make Reed's

payout worth at least $2.25 million and the other two men's worth more than $2 million each.

Such contracts are a standard feature of executive compensation, says Michael Bradley, a professor of

corporate finance at Duke's Fuqua School of Business and Law School.

"The theory behind it is to provide incentives to managers to relinquish control to a management team

that believes it can get a higher value out of the firm's existing assets," Bradley said. "Absent the golden

parachute, managers would be unwilling to entertain any change in control."

Regional banks are particularly prone to managers' wanting to retain private benefits from independent

control, he said.

Assuming that a merger improves a firm's prospects and share price, the contracts therefore can provide

a service to stockholders, provided their interests are carefully balanced with managers', Bradley said.

Stock awards and options are therefore usually included, as in this case.

At the merger, 82,700 restricted shares of NCF held by Reed, Furr, Popwell, Presley and Mistretta will be

converted into fully vested SunTrust shares, worth about $1.7 million, based on SunTrust's stock price on

May 26, the proxy says. The seven executives also hold options on more than 3 million shares of NCF

stock ranging in purchase price from $12.84 a share to $27.82, which will also become fully vested.

Based on NCF's closing share price Thursday of $32.20, exercising those options could yield a combined

gain of somewhere between $13 million and $58 million.

The seeds of the merger were planted as early as March, the proxy indicates.

Reed and SunTrust's CEO, Phillip Humann, met and discussed the possibility of a merger on March 19,

seven weeks before an agreement was finalized on May 7.

Later in March, another financial institution approached NCF with a merger proposal, the statement says.

NCF officials met with their counterparts at both suitor banks. NCF executives and directors continued

mulling both overtures through early May, when, through NCF consultants JP Morgan and UBS, they

received formal offers.

Although the proxy doesn't name the other bank, it notes May 6 online stories by several news

organizations about a "bidding war" for NCF. Those articles, citing unnamed sources, identified the other

suitor as Fifth Third Bank of Cincinnati.

On May 7, NCF notified SunTrust that its offer had been approximately matched by the other bank.

SunTrust raised its proposal to the accepted offer of 0.3713 shares of its stock plus $8.625 for each NCF

share. The companies announced the deal two days later, on Mother's Day.

© Copyright 2008. All rights reserved. All material on heraldsun.com is copyrighted by The

Durham Herald Company and may not be reproduced or redistributed in any medium except as

provided in the site's Terms of Use.