MKT 722-02 ST Sec Doors 4/8REV3

advertisement

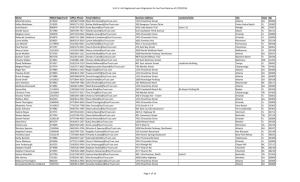

Opportunities Unlimited Opportunities in all SunTrust regions and surrounding areas. Atlanta, Georgia Baltimore, Maryland Chattanooga, Tennessee Ft. Lauderdale, Florida Jacksonville, Florida Knoxville, Tennessee Nashville, Tennessee Norfolk, Virginia Orlando, Florida Richmond, Virginia Roanoke, Virginia Sarasota, Florida Savannah, Georgia Tampa, Florida Washington, DC SunTrust Banks, Inc. and its subsidiaries are equal opportunity and affirmative action employers and do not discriminate in recruitment, training, promotion, or other employment practices for reasons of race, color, religion, national origin, citizenship, sex, marital status, age, disability, veteran status or sexual orientation. Opportunities Unveiled Welcome to a system designed to open the door to your success. SunTrust Securities has unlimited opportunities for investment professionals. Are you a sales-focused, entrepreneurial self-starter who enjoys client development? Or do you see yourself partnering with SunTrust’s branch referral network to serve SunTrust bank clients? Either way, you can go a long way at SunTrust, one of the nation’s largest financial services organizations. If you are entrepreneurial-driven, we will support you in building and managing your own book of business. If you are more relationship-oriented, you may prefer the satisfaction of helping clients who are referred from SunTrust banking locations throughout the Southeast and Mid-Atlantic. No matter what opportunity you choose, you will be supported by all the tools you need to help leverage the growth of your business. You will also have access to a host of products, from fee-based wrap accounts and wealth transfer planning to equity research and money-management accounts. They are all designed to help cement you in your role as your client’s primary investment advisor. Our recent acquisitions and innovations demonstrate that SunTrust’s senior management strongly believes that investment services are critical for our success in the wealth management, retail, and institutional markets. In joining SunTrust Securities, you will be instrumental in advancing our vision to become a primary revenue source of non-interest income, and to be recognized as one of the industry’s leading regional brokerage firms. I am confident you will find that SunTrust Securities offers one of the best mixes of resources, products and market opportunities available. We are looking for quality people who can help us attain that success while achieving their own career goals. Does the idea of unlimited opportunities excite you? If so, SunTrust is ready to open some doors for you. Peter Bielan Chief Executive Officer SunTrust Securities, Inc. Opportunities Unparalleled National strength. Local services. An opportunity to enter the best of both worlds. SunTrust Securities benefits from the favorable combination of being affiliated with SunTrust Banks, Inc., while also providing the entrepreneurial approach and culture of a leading brokerage firm. For you, this represents the best of both worlds. Established market franchise with strong name recognition. Headquartered in Atlanta, SunTrust Banks, Inc., is one of the nation’s largest and strongest financial holding companies, located in some of the highest-growth markets in the United States. We reach our 3.7 million customers through 1,200 branches, and connect with them through delivery channels such as ATMs, Telephone Banking, and Internet Banking. In our marketing communications to customers, we highlight the benefits of national resources with local personal service. The SunTrust brand is nationally known and enjoys strong recognition and respect throughout our market areas of Alabama, Florida, Georgia, Maryland, South Carolina, Tennessee, Virginia and the District of Columbia. A reputation for active community involvement. SunTrust has a solid track record in community reinvestment and a long history of corporate philanthropic and employee involvement programs. Committed to meeting the needs of the communities we serve, we provide financial support to local development efforts through an extensive contributions program, including investments and lending activities. Over 190 years of experience. 1811 1893 1934 1985 Farmer’s Bank of Alexandria (Va.), a Crestar predecessor, is granted a charter by Congress on February 16, 1811. (SunTrust acquires Crestar in 1998.) The Commercial Travelers’ Savings Bank changes its name to “Trust Company of Georgia,” (TCG). In the early days, TCG concentrated on trust and investment banking needs. Sun Bank moves south to establish the First National Bank in Orlando, which quickly emerges as Central Florida’s leading financial institution. With the merger of Trust Company of Georgia and SunBanks, Inc., in Florida, SunTrust emerges as one of the first major super-regional U.S. banking companies. At the time, this is the largest banking merger ever in the Southeast. 1891 1939 Trust Company of Georgia becomes the first The Georgia General Assembly grants a charter for Southern bank with a factoring department. the Commercial Travelers’ Savings Bank on 1919 September 21, 1891. A group headed by Ernest Woodruff, then president of Trust Company, purchases The Coca-Cola Company for $25 million. For its underwriting services in taking the company public, Trust Company receives shares of Coca-Cola stock, which were valued at $110,000. Through splits and stock dividends, each original 1919 share has multiplied 4,608 times. After the 2-for-1 split in 1996, SunTrust owns more than 48 million shares. The only written copy of the Coca-Cola formula is in the SunTrust safe deposit vault at the Atlanta Main Office. Expertise that covers a wide spectrum of client needs. SunTrust’s five lines of business encompass an array of financial services: Private Client Services1 With over $160 billion in investment assets, SunTrust is one of the largest money managers in the Southeast, providing investment, fiduciary, and related services to high-net-worth individuals and institutions. Trusco Capital Management2, our institutional investment management subsidiary, is the advisor to the STI Classic Funds3, cited by Barron’s as one of the nation's top mutual fund companies. Retail Banking Through traditional and non-traditional delivery channels, we provide deposit and loan accounts, insurance, business banking, and private banking services to 3.7 million clients and small businesses. Our goal at SunTrust Securities is to reach every one of these clients who has investment needs with our investment products and services – an opportunity with tremendous potential. Mortgage Services SunTrust Mortgage maintains correspondent and broker relationships in 48 states, and services mortgages nationally. Corporate and Investment Banking A financial partner to more than 1,000 of America’s top corporations, SunTrust provides traditional credit facilities, factoring, leasing, treasury management, and capital markets alternatives. SunTrust Robinson Humphrey, a division of SunTrust Capital Markets, offers corporations, institutions, and public entities innovative ways to raise capital, combined with specialized investment choices and advisory services. Commercial Banking For commercial clients with sales or budgets of $5 million to $250 million, SunTrust offers commercial real estate financing, correspondent banking, institutional and government services, receivables capital management, and specialized investment and financings. 1986 1989 1994 1998 2002 SunTrust Securities becomes operational. SunTrust also moves into Tennessee by purchasing one of the state’s largest bank holding companies, Third National Corporation. SunTrust Capital Management is formed. SunTrust Capital Markets is formed to broaden the range of services available to business clients. SunTrust acquires Crestar Financial Corporation, headquartered in Richmond, Virginia. The combined organization becomes the tenth largest U.S. banking company. SunTrust acquires the Florida banking franchise of Huntington Bancshares. The acquisition provides a net addition of 59 new branches, 300 ATMs, 250,000 clients and $4.4 billion in deposits. 1988 SunTrust Banks, Inc. (STI) is added to the S&P 500. 1992 SunTrust creates a proprietary mutual fund family, the STI Classic Funds. 1997 SunTrust acquires Equitable Securities Company, enabling the underwriting of debt and equity offerings for business clients. 2001 SunTrust acquires the institutional business of the Robinson Humphrey Company, LLC, creating the SunTrust Robinson Humphrey Capital Markets division of SunTrust Capital Markets. SunTrust acquires Asset Management Advisors, a specialized wealth management firm based in Jupiter, Florida. The company continues to operate under its own name and management. SunTrust announces the creation of Alexander Key, a full-service retail brokerage division of SunTrust Capital Markets, to provide comprehensive personal investment services for business owners, executives, and other high-net-worth individuals. 2003 SunTrust acquires Hilton Head Island, SC-based Lighthouse, marking SunTrust’s focus on high-growth markets. Opportunities Undeniable This is the way to full-service brokerage capabilities, boundless success and unlimited income. If you are a resourceful self-starter who enjoys consultative selling and client development, we have everything you need to maximize your compensation as a Private Financial Advisor. Equipped with products that allow you to meet unique client needs, you will have virtually unlimited potential to grow your book of business. For Investment Consultants, our branch referral network allows you to enjoy business-building benefits and personal growth opportunities that are not available at most large or independent broker/dealers. The credibility of a full-service brokerage. Your opportunities for prospecting will be enhanced by SunTrust’s excellent brand reputation. Whether you are located in an urban market or a smaller community, the SunTrust name will help you open doors to more business. Support that helps you focus on clients. We want you to concentrate on helping clients. So we provide full in-house support – including research and technology. We will also help your clients with essential needs like deposit, credit, trust services, mortgage banking, credit-related insurance, asset management and capital market services. Building your clients’ long-term loyalty can lead to greater retention, expanded relationships, and new referrals. We provide a workplace where people willingly join together to create client satisfaction – and are inspired by their colleagues to strive for personal excellence. Career development and payout potential. Our organizational breadth provides almost limitless opportunities for personal growth. Whether you stay in investment services or move into a different area, you will confront challenges that allow you to blend your experience with new knowledge. And to encourage focus on client needs instead of on the calendar, our payout structure does not re-set each month or quarter. Our compensation package is extremely competitive – and for top producers, extremely rewarding. “The benefits of being an Investment Consultant in a banking environment include a concrete referral base, the support of a well-established management team, and the staff support needed to excel. In my opinion, as a Financial Advisor, there is no better place to work than a bank, and there is no better bank than SunTrust.” Louis Glaser Private Financial Advisor, SunTrust Securities Nashville, TN “SunTrust has been a wonderful place for me to build an ever-growing book of business. The constant support and emphasis on Private Client Services and SunTrust Securities has enabled me to achieve double-digit revenue growth every year. I started at SunTrust at 1998.” Matt Otto Private Financial Advisor, SunTrust Securities Sarasota, FL Opportunities Uncommon Looking to solve your clients’ every need? You just found the way. Our diversified product lineup helps you meet almost any client need, simple or sophisticated. SunTrust Securities offers a broad array of products and services, including: Investment Management and Advisory Services Cash Management Accounts Common and Preferred Stock Exchange Funds Equity Options Fee-based Investment Advisory Programs Fixed and Variable Annuities Government, Corporate and Municipal Fixed Income Life, Disability, and Long-Term Care Insurance Margin Loans Mutual Funds Mutual Fund Asset Allocation Accounts Restricted Stock Trading Retirement Accounts, including 401(k)s Separate Accounts Stock Option Exercise Service Syndicated IPOs and Secondaries Unit Investment Trusts 529 Plans Solutions that are comprehensive, integrated, innovative. As part of SunTrust’s Private Client Services team, and through other internal partners, you will also be able to provide the following solutions to clients: Cash Management Trusts Charitable Giving Customized Credit Solutions Deferred-Compensation Arrangements Deposit Services Equity Hedging Solutions Estate Planning and Settlement Executorship Services Family Limited Partnerships Liquidity and Diversification Strategies Mortgage and Real Estate Lending Multi-Manager Advisory Services Succession Planning Tax-Advantaged Strategies Trust and Investment Advisory Services “I’m not just building business for SunTrust, but I’m also building me. This is my home. SunTrust provides me with the tools and continuing training that help me help my clients achieve their goals.” John Taitague Investment Consultant, SunTrust Securities Richmond, VA “I feel fortunate to represent SunTrust. I have been here for 6 years and every day I have a sense of pride about not only the bank’s reputation, but also about the impressive list of financial solutions that allow me to meet the ever-changing needs of my clients.” Diane Cook Private Financial Advisor, SunTrust Securities Atlanta, GA Opportunities Uncovered Unlimited access to tools and technology, customized for your fast track to success. As a SunTrust Securities investment professional, you will have access to tools and technology customized to fit your needs. These services help eliminate barriers to selling and help simplify relationship management: Leading Investment Research Private Financial Advisors have access to extensive economic, market, and individual securities research from Credit Suisse First Boston to complement the research from our affiliate, SunTrust Robinson Humphrey. Client Presentation Database We have a web-based library of proposals that you can customize for specific client or business needs, plus extensive information to help educate your clients about all of SunTrust’s capabilities. Anytime Access to Account Holder Information You can access information about account holders at any time with our client management technology. Financial Profiles – Finding the Right Allocation Financial Profiles, our financial planning tool, enables you to meet client needs and preferences more precisely. As a result, you can develop a financial plan to meet the specific needs of any client. In addition, SunTrust Securities has programs that allow you to use hypothetical information about mutual funds in order to test various asset allocation models. Internet Investing This web-based service allows your clients to obtain their account information 24 hours a day. They can view asset and transaction details, review historical market values, sort data in a variety of formats, and download information into their own spreadsheet program. Opportunities Unlocked Ready to grow your business, expand your horizons, and really go somewhere? Stop for a moment and think about the career that lies ahead of you. Would you like to be in a position to take advantage of the best of both worlds? At SunTrust Securities, we offer our employees and clients a unique combination of big bank resources with the service and responsiveness of a regional brokerage firm. Best of all, our high growth markets encompass both smaller and larger cities. We think of it as having all of our doors open. If you view yourself as a top producer of total client satisfaction, SunTrust has many other advantages to offer you: • Client and prospect trust built over more than a century. • Financial solutions to help you meet just about any client need. • Financial and technological tools you can leverage to build your business more efficiently. • An outstanding compensation package. • Virtually unlimited opportunities for growth. To learn more about SunTrust Securities, please visit our web site at www.suntrustsecurities.com. We look forward to seeing how SunTrust can help you. “Our people are all unique individuals, but they are also similar in several ways. They put their clients first, focus on service, take a comprehensive view of client needs, are selfstarters, and are very competitive.” Bill Rogers Executive Vice President SunTrust Private Client Services Securities and Insurance Products 1 Are Not FDIC Insured Are Not Bank Guaranteed May Lose Value SunTrust Private Client Services is a marketing name used by SunTrust Banks, Inc., and the following affiliates. Banking and trust products and services are provided by SunTrust Bank, a member of the FDIC. Securities, insurance and other investment products and services are offered by or through SunTrust Securities, Inc., a registered broker/dealer and a member of the NASD and SIPC, and SunTrust Capital Markets, Inc. a registered broker/dealer and a member of the NYSE, NASD and SIPC, including its division, SunTrust Robinson Humphrey Capital Markets. Investment advisory products and services are offered by or through Trusco Capital Management, Inc. and Asset Management Advisors, L.L.C., investment advisors registered with the SEC. SunTrust Private Client ServicesSM is a service mark of SunTrust Banks, Inc. 2 Trusco is a service mark of Trusco Capital Management, Inc. 3 The STI Classic Funds are advised by Trusco Capital Management, Inc. an affiliate of SunTrust Banks, Inc. www.suntrustsecurities.com SunTrust Securities, Inc. is a registered broker-dealer. Member NASD, SIPC, and an affiliate of SunTrust Banks, Inc. Securities, Insurance and other investment products are offered through SunTrust Securities, Inc., a registered broker/dealer. ©2003, SunTrust Banks, Inc. SunTrust is a federally registered service mark of SunTrust Banks, Inc. mkt 722-02