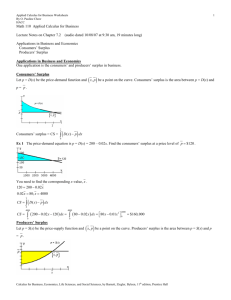

Gains from Trade--Partial Equilibrium Analysis

advertisement

Dr. Mitchell/ECO 329/Fall 2000 Lecnote4 1 Gains from Trade--Partial Equilibrium Analysis How can we see gains from trade in a demand & supply framework? Consumers' Surplus The value to consumers from consuming a particular quantity of a good, less the amount consumers pay for the good. Graphically, it's the area under D curve, above price. P A P0 B D Q0 Q A + B = value to consumers - B = amount consumers pay A = consumers' surplus Producers' surplus Revenue received from selling a particular quantity of a good less the minimum amount required to supply that quantity. Graphically, it's the area above S curve, below price. Dr. Mitchell/ECO 329/Fall 2000 Lecnote4 2 P S P0 C D Q0 ' Q C + D = Revenue - D = Min amt required to supply C = Producers' surplus Efficiency A measure of efficiency in a market in the sum of CS & PS (& gov't revenue, if applicable). Graphically, it's the area in between D & S. P S A P0 C D Q0 Q Trade and Surplus Suppose this good is available internationally at a lower price, PW, than that which would otherwise be the domestic price. Dr. Mitchell/ECO 329/Fall 2000 Lecnote4 Gains from International Trade Identify Consumers' surplus Producers' surplus Reallocation of producer to consumer surplus Nature of Gains C = gain in CS due to lower opp cost of units QS - Q0. D = gain in CS due to additional units consumed. Relaxing Assumptions of Simple Models of Comparative Advantage Dynamic Effects The models we have studied are static models. How is time likely to change trading equilibria? Changing Tastes Ex: Ostrich farms in Oatsdorn (sp?), South Africa Scale and Specialization Sometimes increased scale of production leads to lower average costs. This is related to the idea of hysteresis in trade patterns and "creating" comparative advantage. (Once an industry takes hold in a place, it gets a cost advantage that others cannot easily match.) The reduction in costs may come about from econs of scale in provision of an important input, or from an increased availability of specialized inputs such as labor that reduce costs. 3 Dr. Mitchell/ECO 329/Fall 2000 Lecnote4 4 Changing Factor Endowments In the long run, countries will gain and loose supplies of factors due to population changes, discovery (or exhaustion) of natural resources, increasing saving leading to increased capital stock, etc. Comparative advantage will not be static, as a result. Ex: US became rich exporting goods that used a high proportion of natural resources and capital. As it became richer, invested more in physical and human capital. Now exports goods using lots of these and nat resources not as important. Many Products, Many Countries Relaxing the 2 x 2 assumptions, we find that for every country there are goods they are sure to import, some they are sure to export, and many "in the middle" which they might import or export based on current goods and factor prices. Transport Costs Transport costs drive a "wedge" between the price the seller gets and the price the consumer pays. Factors affecting transport costs: distance from trading partner, weight of product relative to value, underlying cost of transporting goods. When transport costs are high relative to the value of the good, the goods will not be traded (internationally). Services were traditionally considered to be mostly "nontraded" goods. Improvements in communications technology have changed this. (exceptions?) Weight of traded goods and transport costs have fallen tremendously. Ocean freight charges in the 1990s were just 25% of what they were in the 1920s. (p. 71.)