AP Micro/Econ Challenge Week 3 - Sept

advertisement

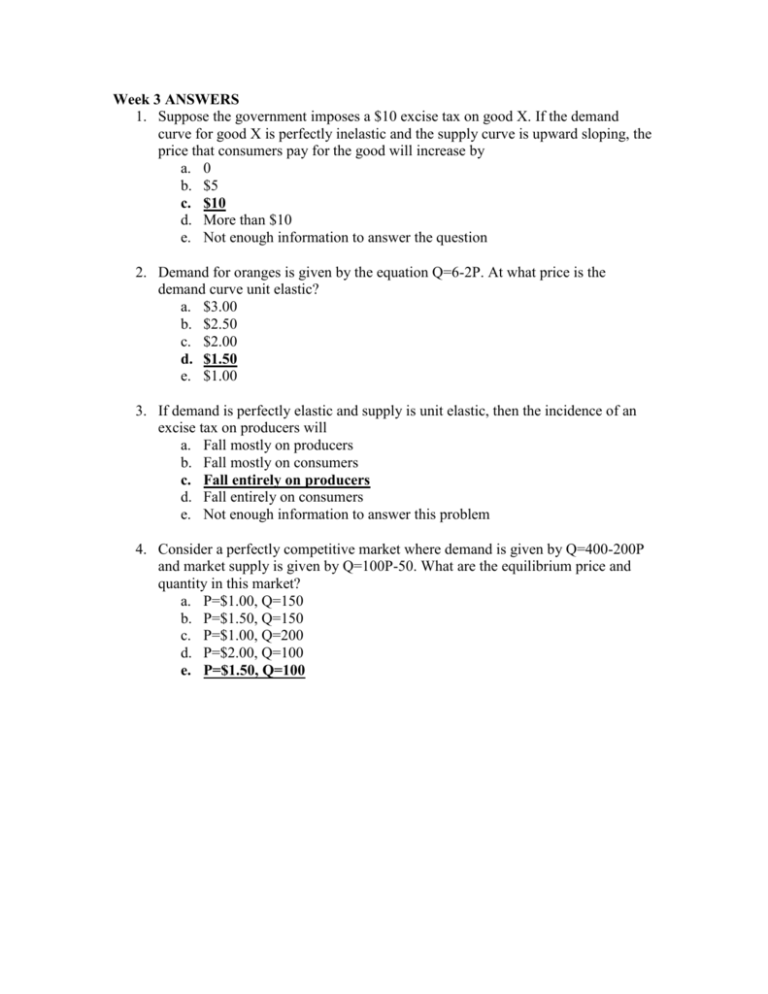

Week 3 ANSWERS 1. Suppose the government imposes a $10 excise tax on good X. If the demand curve for good X is perfectly inelastic and the supply curve is upward sloping, the price that consumers pay for the good will increase by a. 0 b. $5 c. $10 d. More than $10 e. Not enough information to answer the question 2. Demand for oranges is given by the equation Q=6-2P. At what price is the demand curve unit elastic? a. $3.00 b. $2.50 c. $2.00 d. $1.50 e. $1.00 3. If demand is perfectly elastic and supply is unit elastic, then the incidence of an excise tax on producers will a. Fall mostly on producers b. Fall mostly on consumers c. Fall entirely on producers d. Fall entirely on consumers e. Not enough information to answer this problem 4. Consider a perfectly competitive market where demand is given by Q=400-200P and market supply is given by Q=100P-50. What are the equilibrium price and quantity in this market? a. P=$1.00, Q=150 b. P=$1.50, Q=150 c. P=$1.00, Q=200 d. P=$2.00, Q=100 e. P=$1.50, Q=100 Price 13 Supply + taxes Supply A B C F G D 11 E 12 10 Demand 80 100 Quantity 5. The graph shows the market for a good that is subject to a per-unit tax. The letters in the graph represent the enclosed areas. a. Using the labeling on the graph, identify each of the following: i. The equilibrium price and quantity before the tax P=$12, Q=100 ii. The area representing the consumer surplus before the tax A+B+C+F iii. The area representing the producer surplus before the tax D+E+G b. Assume the tax is now imposed. Based on the graph, does the price paid by the buyers rise by the full amount of the tax? Explain. No. The tax is $2 per unit, and price rises by $1 per unit. c. Using the labeling on the graph, identify each of the following after the imposition of the tax. i. The net price received by the sellers $11 ii. The amount of tax revenue $160 (or B+C+D) iii. The area representing the consumer surplus A iv. The area representing the deadweight loss F+G (or $20)