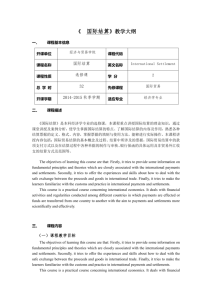

Revised sylabus for International Settlements and Payments

advertisement

《国际结算(英)》教学大纲 一、课程基本信息 课 程 号 0603622 编 其 它 中 文 名 称 课 程 英 文 名 称 课 程 类 别 适 用 专 业 先 修 课 International Payments and Settlements 专业选修课(Elective course) 金融学、财务管理、会计学、国际经济与贸易、经济学 国际贸易实务,金融英语 程 学 分 学 时 2 学分, 共 32 学时,其中理论课 30 学时,实验 2 学时 考 核 方 式 Close-book examination Participation and attendance 10%,final exam 80%, Practice 10% 大纲撰写人及日期 叶文琴于 2006 年 3 月修订 成绩评定方法 课 程 简 建 议 教 参 考 This course is one of the important courses of international banking practice. It will introduce the evolvement of the international payments and settlements, the principles of draft, documentary collections, letters of credit, forfeiting 介 and factoring and their usage in international payments and settlements as well as the international rules and regulations regarding international trade finance payments and especially introduce UCP 500 and the upcoming UCP600. Shen Jincang, International Payments and Settlements. (first 材 edition).上海外语教育出版社,1996 [1] 顾宏远.跟单信用证与国际惯例—UCP500 详解.杭 州大学出版社,1994 [2] 顾宏远.国际贸易结算. (第 1 版).浙江大学出版社, 2006 [3] 苏宗祥.国际结算. (第 1 版).中国金融出版社,2004 书 [4] James E. Byrne and Christopher S. Byrnes LC Survey 2002, LC Survey 2003, LC Survey 2006 Institute of International Banking Law & Practice, Inc. [5] Professor James E. Byrne, LC Rules $ Laws Critical Texts, 2003,Institute of International Banking Law & Practices, Inc. 二、The feature and students of the course The course is open for the students majoring in International Finance, Accounting and International Trade. It will provide the students with a comprehensive overview of bank practices in international payments and settlements and introduce various techniques in international trade finance. 三. The aim and requirements of the course Aim of the course:The overall aim of this course is to develop the students’ understanding in international payments and settlements and to increase the students’ ability to conduct international banking practices. The students will develop a better understanding of the advantages as well as the risks involved in using these payments methods. By the end of the course, the students will be able to understand the documentation, international rules and regulations regarding international trade finance; to understand the principles of letter of credit, documentary collections, drafts, etc.; to understand the different types of letters of credit and their usages in practice. This course will also keep the students well informed of the latest developments in international finance. Requirements:In the course, the students are required to be able to draw a draft, issue and examine documents under a letter of credit, and apply the terms of UCP 500 and the upcoming UCP600 to analyze cases. 四、Method of teaching This course is mainly delivered by lectures and incorporates the use of exercises, cases and discussions. 五、Content of the course and time allocation Chapter One Introduction Class hour :1 Requirements:This chapter will make a general introduction of the course , the rough content of the international trade finance and its evolvement. The students are required to be familiar with the characteristics of the course and the main terms of trade such as in intercom 2000. Priority: feature of the international payments and settlements Content: 1.What are international payments and settlements 2.Evolution of international payments and settlements 3.Basic points for attention in international payments and settlements 4.Characteristics of modern international payments and settlements Chapter Two Credit Instruments Class hour: 1 Requirements:to understand the features, function and the parties of the negotiable instruments and to have a good grasp of the principle of the negotiable instruments. Priority:negotiation of instrument Content : 1.Characteristics of a negotiable instrument 2.Functions of a negotiable instrument 3.Parties to a negotiable instrument Chapter Three Bill of Exchange---Definition, Acts Class hour: 2 Requirements:to learn the definition, principle and acts of the draft. Priority:feature of a bill of exchange Content: 1.What is a bill of exchange: As defined in the Bills of Exchange Act 1882 of the United Kingdom, a bill of exchange is an unconditional order in writing addressed by one person to another, signed by the person giving it, requiring the person to whom it is addressed to pay on demand or at a fixed or determinable future time a sum certain in money to or to the order of a specified person or to bearer. 2.Acts of a bill of exchange Issue Endorsement Presentment Acceptance Payment Dishonour Notice of dishonour Protest Right of recourse Acceptance for honour supra protest Payment for honour supra protest Guarantee Chapter Four Bill of Exchange---Lost Bill, Discounting, Accepting and Forfaiting a Bill, Classification Class hour:1.5 Requirements:to grasp the discounting and acceptance of a draft and identify various types of draft. Priority:discounting and acceptance of a bill of exchange Content: 1.Lost bill of exchange 2.Discounting, accepting and forfeiting a bill of exchange 3.Classification of a bill of exchange Chapter Five Class hour: 0.5 hour Promissory Note Requirements:have a better understanding of the feature of a promissory note and distinguish the difference of promissory note and draft. Priority: difference from bill of exchange Content: 1.What is a promissory note 2.Characteristics of a promissory note 3.Essentials to a promissory note 4.Difference between a bill of exchange and a promissory note Chapter Six Cheque Class hour: 1 Requirements:to understand the feature of a cheque and distinguish it from a draft. Priority:feature of a cheque Content: 1.What is a cheque 2.Essentials to a cheque 3.Features of a cheque 4.Countermand of payment 5.Wrongful dishonour of a cheque 6.Crossed cheques 7.Difference between a bill of exchange and a cheque Chapter Seven Correspondent Banking Relationships Class hour: 1 Requirements : to realize the importance and necessity of establishing correspondent relationship. Priority:control documents Content: 1.Correspondent bank, branch, representative office, agency, banking subsidiary and affiliate 2.Why establish correspondent banking relationship 3.Which banks should become the correspondents 4.How to establish correspondent banking relationship 5.Control documents 6.Expanding international banking business with the aid of foreign correspondents Chapter Eight Remittance Class hour: 1 Requirements:to understand the principle of remittance and the practices. Priority:advantage and disadvantage of remittance Content : 1.Parties related to a remittance 2.Accounts between international banks 3.Ways of transfer 4.Methods of reimbursement 5.Cancellation of the remittance 6.Advantages and disadvantages of different ways of transfer Chapter Nine Terms and Methods of Payment in International Trade---Payment in Advance, Open Account Business, Factoring, Collection Class hour:2 Requirements:have a better understanding of various methods of payment. Priority:factoring and collection Content : 1.Payment in advance 2.Open account business 3.Factoring 4.Collection What is a collection Parties to a collection Types of collections: Documents against payment (D/P) Documents against acceptance (D/A) Collection procedure Risks and advantages of collection method Liability and responsibility of the banks doing collection business Chapter Ten Terms and Methods of Payment in International Trade -----Letters of Credit(L/C) Class hour: 6 Requirements:to understand the principle of the letters of credit, to be acquainted with the rights and obligations of various parties of the L/C. to understand the features of different types of letters of credit and the procedure of issuing and usage of a credit and the practice of amendment of a credit. Priority:Characteristics of a letter of credit Content: 1.What is L/C 2.Characteristics of a letter of credit 3.Functions, advantages and disadvantages of a letter of credit 4.Parties to a letter of credit 5.Contents of a letter of credit 6.Classification of letters of credit Documentary credit: Irrevocable credit Confirmed credit Unconfirmed credit Sight credit Usance or time credit Payment credit Deferred payment letter of credit Acceptance letter of credit Negotiation credit Revolving credit Transferable credit Back to back letter of credit 7.Procedures of letter of credit operations 8.Amendment under a letter of credit Chapter Eleven Terms and Methods of Payment in International Trade---Letters of Guarantee Class hour: 1 Requirements:to understand the feature of a letter of guarantee, and its difference from a letter of credit. To be familiar with various types of letters of guarantee. Priority:nature of a letter of guarantee Content: 1.Nature of demand guarantee 2.Parties to a letter of guarantee 3.Contents and clauses under a guarantee 4.Types of guarantees 5.Points for attention in establishing a letter of guarantee 6.Forms of a letter of guarantee 7.Difference between a letter of guarantee and a letter of credit 8.Cancellation of a guarantee 9.Standby letter of credit Chapter Twelve Documents-Draft, Invoice, Insurance Policy Class hour: 1 Requirements:to understand the feature of various documents, content and their functions and learn to make and examine various documents. Priority:to draw a draft Content: 1.Draft 2.Invoice 3.Insurance policy or certificate Chapter Thirteen Documents---Air Waybill, Road Waybill, Cargo Receipt, Parcel Post Receipt, Bill of Lading Class hour: 3 Requirements: to understand the three functions of ocean B/L and distinguish it from other transport documents. Priority: Characteristics of the ocean B/L Content: 1.Air waybill 2.Road waybill, consignment note 3.Cargo receipt, railway bill 4.Courier receipt and post receipt 5.Bill of lading What is a bill of lading The functions of a bill of lading Parties to a bill of lading Types of bill of lading (1)Shipped on board bill of lading (2)Received for shipment bill of lading (3)Direct bill of lading (4)Transshipment bill of lading (5)Straight bill of lading or named consignee bill of lading (6)Order bill of lading, or negotiable bill of lading (7)Clean bill of lading and unclean bill of lading (8)Stale bill of lading Chapter Fourteen Documents—Combined Transport Documents, Miscellaneous Documents Class hour: 2 Requirements:to understand multi-mode transportation documents and various export documents. Priority:combined transport documents and the difference between CTD and ocean B/L Content: 1.Combined transport documents 2.Miscellaneous documents Consular invoice Certificate of origin and A GSP Certificate of origin Form A Customs invoice Inspection certificate Packing list Beneficiary’s statement Chapter Fifteen Documents examination and Reimbursement Class hour: 2 Requirements:learn to examine documents against L/C and learn how to handle discrepant documents so as to better understand and apply UCP500 or upcoming UCP600. Priority:to grasp the skill of examining documents Content: 1.General principle 2.Examining a draft 3.Examining a commercial invoice 4.Examining a certificate of origin 5.Examining Marine Insurance Documents 6.Examining a bill of lading 7.Examining other documents 8.Most common discrepancies 9.Bank’s common practice if the documents presented do not meet the credit requirement 10.Payment refused by the issuing bank 11.Payment and reimbursement under a letter of credit Chapter Sixteen Supplementary material: Uniform Customs and Practice for Documentary Credits-----1993 Revision (Publication No. 500) Class hour: 4 Requirements: In order to be familiar with the international regulations and uniform practices, we require the students to understand the mains articles of UCP 500 and learn application of the terms in banking practice. Content: all the articles of UCP 500 and introduction of upcoming UCP 600 六. Practice and case discussion Requirements: In order to let students have an real experience in bank’s documentary credit operation, we’ll organize the students to issue a set of shipping documents according to an L/C and examine the documents. Finally the students will have a seminar dealing with cases of L/Cs subject to UCP 500. Class hour: 2 hours