2014-2015-1国际结算教学大纲

advertisement

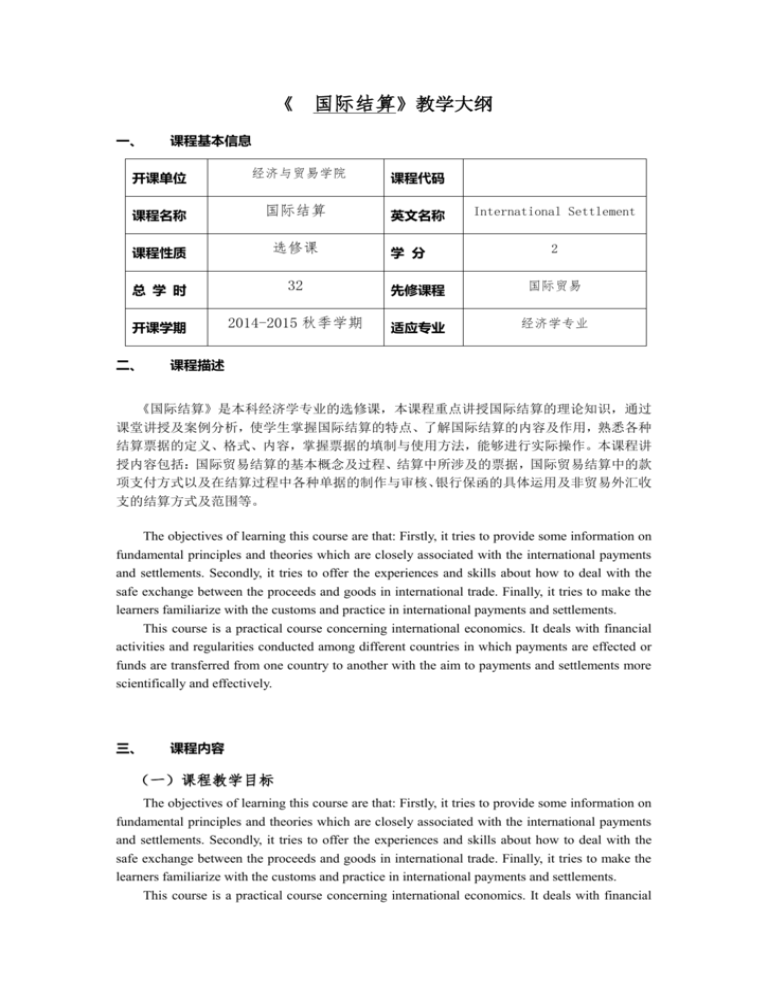

《 一、 国际结算》教学大纲 课程基本信息 开课单位 经济与贸易学院 课程代码 课程名称 国际结算 英文名称 课程性质 选修课 总 学 时 32 先修课程 国际贸易 开课学期 2014-2015 秋季学期 适应专业 经济学专业 二、 学 分 International Settlement 2 课程描述 《国际结算》是本科经济学专业的选修课,本课程重点讲授国际结算的理论知识,通过 课堂讲授及案例分析,使学生掌握国际结算的特点、了解国际结算的内容及作用,熟悉各种 结算票据的定义、格式、内容,掌握票据的填制与使用方法,能够进行实际操作。本课程讲 授内容包括:国际贸易结算的基本概念及过程、结算中所涉及的票据,国际贸易结算中的款 项支付方式以及在结算过程中各种单据的制作与审核、银行保函的具体运用及非贸易外汇收 支的结算方式及范围等。 The objectives of learning this course are that: Firstly, it tries to provide some information on fundamental principles and theories which are closely associated with the international payments and settlements. Secondly, it tries to offer the experiences and skills about how to deal with the safe exchange between the proceeds and goods in international trade. Finally, it tries to make the learners familiarize with the customs and practice in international payments and settlements. This course is a practical course concerning international economics. It deals with financial activities and regularities conducted among different countries in which payments are effected or funds are transferred from one country to another with the aim to payments and settlements more scientifically and effectively. 三、 课程内容 (一)课程教学目标 The objectives of learning this course are that: Firstly, it tries to provide some information on fundamental principles and theories which are closely associated with the international payments and settlements. Secondly, it tries to offer the experiences and skills about how to deal with the safe exchange between the proceeds and goods in international trade. Finally, it tries to make the learners familiarize with the customs and practice in international payments and settlements. This course is a practical course concerning international economics. It deals with financial activities and regularities conducted among different countries in which payments are effected or funds are transferred from one country to another with the aim to payments and settlements more scientifically and effectively. (二)基本教学内容 Chapter 1 Introduction I. The Objective/ Requirements of This Chapter The purpose of this chapter is to induce the general contents of international settlements. In this chapter, we mainly learn the concept and evolution of international payments and settlements, and the purpose of the course . II. Major Contents of This Chapter 1.1. Definition and Implications of International Payments and Settlements 1.2. Key Issues in International settlements 1.2.1. Who Bears the Credit Risk? 1.2.2. What Will Be the Transaction Costs of Payment? 1.2.3. What Will Be the Supervision Mechanism of Performance? 1.2.4. What Are the Roles of Banking in the International Trade Payment? 1.3. The Purpose of Learning This Course 1.4. Prospect of International Trade Payment Chapter 2 Credit Instruments I. The Objective/ Require of This Chapter In this chapter, we will learn the three important negotiable instruments (i.e. bill of exchange, promissory note and check): (1) The functions of a negotiable instrument; (2) The characteristics of each instrument; (3) The essentials of each instrument. It is essential for us to recognize and use them correctly and properly in order that we can facilitate the transfer of credits and do more business with foreigners. II. Major Contents of This Chapter 2.1. Outline Instruments 2.2. Bill of Exchange (Draft) 2.2.1. Definition and Parties of a bill of exchange 2.2.2. Key Elements of a Bill of Exchange 2.2.3 Classification of bill of exchange 2.2.4 Legal Acts of a bill of exchange (1) Issuance (2) Endorsement (3) Presentment (4) Acceptance (5) Payment (6) Dishonor (7) Notice of dishonor (8) Protest (9) Recourse (10) Guarantee 2.2.5. Parties of a bill of exchange 2.3. Promissory Note and 2.3.1.Essentials of a Prossory Note 2.3.2.Difference between a promissory note and a bill of exchange 2.4. Check 2.4.1. The main partes involved in a cheque 2.4.2. Essential elements of a cheque 2.4.3. Cllassification of a cheque Chapter 3 Remittance I. The Objective/ Require of This Chapter This chapter mainly introduces the different methods of fund transfer in international trade. It is important for traders to familiarize with the parties, procedures, advantages and disadvantages of remittance, as well as the function of remittance in international trade. II. Major Contents of This Chapter 3.1. Parties of Remittance 3.2. Types of Remittance 3.2.1 T/T 3.2.2 M/T 3.2.3 D/D 3.2.4 Comparisons between T/T, M/T and T/T 3.3. Reimbursement of the remittance cover Chapter 4 Collections I. The Objective/ Require of This Chapter In this chapter, we will learn: (1)Definition, parties and types of collection; (2)Procedure of various kinds of documentary collection used in international trade; (3)Risk protection and financing under collection methods. This chapter tries to make learners be familiar with the major contents mentioned above. II. Major Contents of This Chapter 4.1 Outline of collections 4.2 The main parties involved in collection 4.3 Basic documentary collection procedure 4.4 The liability of parties involved in collections 4.5 Classification of collections 4.6 Three terms of release of documents 4.7 The practice of the documentary collection 4.8 Advantages and disadvantages of collections to the importers/ exporters 4.9 Financing under Collections Chapter 5 Letter of Credit I. The Objective/ Require of This Chapter In this chapter, we will learn: (1)Outline of L/C; (2) The Essential Contents of Letter of Credit; (3). The Legal Relationship of Parties Concerned; (4) Classification of Letters of Credits. To familiarize with the characteristics, benefits, procedure, and classifications of documentary credits would be helpful for us to do business with foreigners. II. Major Contents of This Chapter 5.1 Outline of documentary credits 5.1.1 definition 5.1.2 the feature common to all kinds of L/C 5.1.3 Main parties to documentary credit 5.1.4 the basic procedure of Letter of Credit 5.1.5 Effects of L/C 5.2 The Essential Contents of Letter of Credit 5.3 The Legal Relationship of Parties Concerned 5.3.1 Applicant 5.3.2 Issuing bank 5.3.3 Beneficiary 5.3.4 Advising bank 5.3.5 Negotiating bank 5.3.6 Confirming bank 5.3.7 Paying bank 5.3.8 Reimbursing bank 5.4 Classification of Letters of Credits varies with different points of view 5.4.1 According to the revocability of credit 5.4.2 According to the adding of confirmation 5.4.3 According to the availability of payment 5.4.4 The transferable credit 5.4.5 The Back-to-Back Credit 5.4.6 Red clause credit 5.4.7 Revolving credit 5.4.8 Standby credit Chapter 6 Documents I. The Objective/ Require of This Chapter This chapter illustrates the importance and key elements of various documents used in international trade. In this chapter, we will learn:(1) The importance of documents in international settlements; (2) Some major documents used in documentary credits; (3) Sample documents. II. Major Contents of This Chapter 6.1 Commercial Invoice 6.1.1 Definition 6.1.2 Effects of Commercial Invoice 6.1.3 Key elements 6.1.4 Cautions and notes 6.2 Insurance Documents 6.2.1 Classifications of Insurance Documents 6.2.2 Cautions & Notes 6.3 Transport Documents 6.3.1 Classification of Transport Documents 6.3.2 Marine/Ocean bill of lading (B/L) 6.4 Other relative documents 6.4.1 Packing/Weight/ Measurement List 6.4.2 Inspection Certificate 6.4.3 Certificate of Origin 6.5 Draft under documentary letter of credit 6.5.1 definition 6.5.2 Key elements Chapter 7 Practice of Inward and Outward L/C I. The Objective/ Require of This Chapter This chapter really illustrates the essence of documentary credit operation in international trade. Through many case study, it is not difficult to find that to use L/C settlement properly will be the key to success of business between the buyer and the seller. II. Major Contents of This Chapter 7.1 Practice of Inward Letter of Credit 7.2 Practice of Outward Letter of Credit 7.3 Practical case 四、 考核方式 (一)日常考查(含课堂考勤及课堂参与、书面作业) (二)平时考试(含两次平时测验和期中考试) (三)期末考试 总评成绩 = 日常考查成绩 + 平时考试成绩 + 期末考试成绩 (百分制) 五、 (20%) (30%) (50%) 教材及参考书 教材: 《国际结算》 ( 《International Settlement》 ) 邵新力主编, 机械工业出版社,2012 年 参考书:1.《国际结算理论实务案例》 (《International Settlement》 ) 蒋琴儿主编,清华 大学出版社,2007 年; 2.《国际结算》 苏宗祥主编 中国金融出版社 1998 年; 3.《国际结算惯例与案例》 石玉川 对外经济贸易大学出版社 1998 年; 4.国际商会出版物: (1) Uniform Customs and Practice for Documentary Credits 500 (2) Uniform Rules for Collections 522. 六、授课手段 课堂多媒体演示讲解;课程案例和讨论;小班课讨论和练习