Consumer and Financial Literacy – a Vehicle for

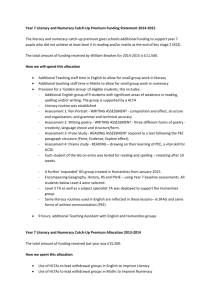

advertisement

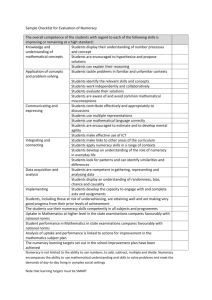

Consumer and Financial Literacy – a vehicle for developing numeracy skills Slide 1 This presentation concerns a topic that is of the utmost importance in these times - consumer and financial literacy. It has always been an important area to teach children about, but with the World Financial Crisis having made such dramatic impacts on all our lives, it has certainly become obvious how essential it is for, not only our students, but in fact all of us, to become more literate in consumer and financial matters. This presentation will focus on how consumer and financial literacy is linked to numeracy and will show how it can enhance your students’ numeracy skills – this is important, as numeracy is one of the General Capabilities that are addressed in the Australian Curriculum. Slide 2 We will look at definitions of numeracy and consumer and financial literacy and talk about why they are so important, and will then see how the two are related. Slide 3 So, let us start by having a look at what we mean when we talk about Numeracy and why there is such a focus on it? We might start by looking at what numeracy is NOT – as there is a bit of confusion about this term. Slide 4 Numeracy is not, as myth would suggest: • the same as Maths • the name used for ‘basic maths’ subjects; or • solely the business of the maths teacher Slide 5 Nor is it what many people who are asked to define it suggest: • Numbers (“doing sums”, arithmetic) • The basic maths people need in order to survive in the real world • The name for primary school maths • The name for the ‘vegie’ maths subject in secondary school Being numerate, in fact, is to use, and to know when to use, mathematics in everyday life; and more than that, to actually want to use it – to have the disposition to use it when it is needed. Slide 6 So what is Numeracy? Let's look at a definition: “To be numerate is to use mathematics effectively to meet the general demands of life at home, in paid work, and for participation in community and civic life. …. In school education, numeracy is a fundamental component of learning … across all areas of the curriculum. It involves the disposition to use, in context, a combination of: • underpinning mathematical concepts and skills from across the discipline; • mathematical thinking and strategies; • general thinking skills; and • grounded appreciation of context”. This definition comes from: Report of the Numeracy Education Strategy Development Conference, Numeracy = Everyone's Business (October 1997) adopted by Australian Association of Mathematics Teachers Slide 7 Merrilyn Goos from the University of Queensland has produced a very comprehensive diagrammatic interpretation of what Numeracy is. She calls this the 21st century version. Merrilyn Goos uses a triangle to illustrate the different parts of the definition. This is particularly useful for our visual learners.: 1. We cannot be numerate in isolation. We need a context to begin with. 2. Then we need to have some mathematical knowledge. That knowledge consists of concepts and skills, it involves estimation and it requires problem solving which dovetails with Ways of Working or Thinking, Reasoning and Working Mathematically. 3. Next we have to have the right disposition to use the maths we know. This means we need to be willing to take a risk with what or how we tackle a problem; we need to show some initiative in obtaining a solution; there needs to be some flexibility in how we go about using the maths we have; and finally we need to be confident to use our maths knowledge in a range of situations. 4. When working mathematically we use a range of tools. We have all the physical aids – such as tape measures, rulers, protractors, compasses, concrete materials. We also have representational tools such as tables, graphs, symbols, pictures. Also, in the modern world we have a broad selection of digital tools, computers, GPS, etc. 5. The contexts in which we may be required to use this knowledge, tools and disposition may include – Personal and Social; Work; Citizenship. NOTE: We can’t teach risk taking, showing initiative or confidence. However, we can encourage, model, foster and demonstrate these traits. This is easier if we have authentic and relevant tasks that involve students working mathematically. This is where consumer and financial literacy come in – particular in the dimensions of Competence and Enterprise. Slide 8 Now that we see how inclusive and all encompassing numeracy is, let’s see why it is so important for our students to become numerate: Slide 9 Research has shown that: “People without numeracy skills suffered worse disadvantage in employment than those with poor literacy skills”. “Poor numeracy skills make it difficult to function effectively in all areas of modern life” Bynner and Parsons (1995 & 2005) Slide 10 Numeracy is everyone’s business as numeracy opportunities or demands are found across the KLAs. So, this means that all teachers become teachers of numeracy: All teachers within a school have a role in supporting their students to • apply their mathematics in order to carry out tasks requiring mathematics, • to ‘make sense’ of their learning area, and • critique the use of maths in their learning area Slide 11 So, while we are teaching we need to identify numeracy moments and consider whether the students possess the mathematical skills and knowledge necessary to access the learning. If the answer is YES, we need to use this numeracy opportunity to link to prior learning. If, however, the answer is NO, we will need to use this numeracy demand as a chance to explain new learning. (it is necessary to learn the mathematics first). An example of this might be in History when looking at graphs or tables to do with immigration trends. When planning your units of work become aware of the numeracy skills – across the curriculum and always look for and articulate opportunities to develop these skills. Slide 12 Now let’s take a look at what Consumer and Financial Literacy is and see why it is so important. The inclusion of financial literacy in the curriculum has come at a time when our young people are facing increasingly complex financial decisions, such as, a growing range of non-cash payments; the easy availability of credit and a rise in the cost of living. Financial Literacy is more that the ability to recognize coins or calculations involving money. It is an essential life skill, a behavioural outcome, which enhances their ability to make effective choices and become more financially responsible. Slide 13 For our definition we will go to the National Consumer and Financial Literacy Framework that was created in 2005 and revised in 2009. Consumer and financial literacy is the application of knowledge, understandings, skills and values in consumer and financial contexts and the related decisions that impact on self, others, the community and the environment. National Consumer and Financial Framework, MCEETYA, 2005 So, already we can see a link to Numeracy in that it is the application of knowledge, skills and values, while in numeracy it is the - use of mathematics effectively to meet the general demands of life at home, in paid work, and for participation in community and civic life. So it is that real life context we are talking about. Slide 14 So why is Consumer and Financial Literacy so important? Slide 15: Rationale behind the Framework Every day, across the world, consumers, businesses and governments exchange goods and services. In a climate of changing global, national, community and family economic circumstances, the form and complexity of these transactions continue to change. The world of consumers is becoming increasingly complex (eg superannuation, personal investments, a more complex tax system, and increased applications of new technologies) and research indicates that levels of consumer and financial literacy among adults, parents and young people alike are insufficient to cope with many of these complexities. For individuals, effective decision making is related to consumer behaviours and literacy. Consumer and financial literacy is important for all young people to empower them to make informed consumer decisions and to manage effectively their personal financial resources. Young people increasingly influence household spending and should understand the financial consequences of satisfying their needs and wants. Recent research indicates the economic benefits for the entire community of increased levels of consumer and financial literacy and of addressing youth debt. Slide 16 Now, have a look at this - a bit scary isn’t it? Wouldn’t it be wonderful if we could turn this upside down – well, with an increasingly consumer and financially literate population that might be a possibility!! Slide 17 and 18 Fortunately, young people themselves see the need for this in their education Slide 19 So, how can we go about teaching Consumer and Financial Literacy? The Framework gives us very clearly set out sequential Descriptions of Learning for Yrs 3, 5, 7 and 9 These can be found to address 4 dimensions: Knowledge and understanding is about the nature and forms of money, how it is used and the consequences of consumer decisions. Competence is the application of consumer and financial knowledge and skills in a range of changing contexts. Enterprise is the opportunity to use initiative, build financial capabilities and manage risk-taking when making consumer and financial decisions. Responsibility is appropriate consumer and financial decisions that display care for self, others, the community and the environment. At this point I might just differentiate between consumer literacy and financial literacy – the former relates to issues such as consumer behaviour, consumer protection, scams, ethical and sustainable consumption, E-commerce, financial institutions and advertising, while the latter is more to do with understanding money, personal finance and money management – budgeting, use of credit cards etc. Again the links to numeracy are obvious in these areas – Remember being numerate is to use mathematics effectively to meet the general demands of life at home, in paid work, and for participation in community and civic life. Slide 20 So, how are these two things – numeracy and consumer and financial literacy linked and how can teaching consumer and financial literacy strengthen our students’ numeracy skills? Slide 21 Well, let’s go back to the triangle diagram to make these links. As we saw before we can not be numerate in isolation. We need a context to work in and then we need to be competent and confident in the three components of numeracy found on the corners of the triangle – mathematical knowledge, tools and dispositions. These are all related to each other. So how does consumer and financial literacy fit into them? We will start in the centre – with the contexts – because these will give us the real life aspect that makes consumer and financial literacy such an engaging area for students to work in while giving them the opportunity to develop their numeracy skills. We need to be numerate in different contexts to be able to live and act confidently in the world. According to Merrilyn’s diagram there are three main contexts where numeracy is needed. Slide 22 Out of the three, it is the Personal and Social context where there are probably the most opportunities to teach consumer and financial literacy and thereby increase students’ numeracy skills in schools. This area includes controlling personal finance, personal health and travel. Slide 23 So, in personal finance you can look at budgeting, distinguishing between needs and wants and then prioritising them, saving, use of credit cards, responsible use of mobile phones, advertising – critically analysing the presentation and the influence of it, mortgages, interest rates, financial institutions and so on. Slide 24 In personal health, again, there are a myriad of topics you can explore and here is a good opportunity to link with Health and Physical Education as well. You can look at food, exercise and leisure activities. In food and exercise you can do activities like: comparing costs of junk food versus healthy food; going shopping for a healthy lunch; creating an exercise plan on a budget – exploring the costs of different exercise activities. In leisure activities, you can explore visits to the movies, theme parks and Shows like the Royal Easter Show for example – then you might compare the costs of these; perhaps working out a little budget including travel and food. When planning school excursions or fund raisers this is an ideal opportunity to allow the students to get involved in some real life consumer and financial literacy activities. With the older students you could have a look at another great leisure time activity – that of gambling– pokies, horses, scratchies etc – what a good opportunity to teach about chance and data in a real life context and to explore some of the ethical issues around this as well – this is another excellent opportunity to link in with Health and Physical Education again, particularly when you look at out of control gambling the notion of addictions and so forth. The impact that addictions have on one’s own life, one’s family and the community at large. It could be interesting to let students know that research shows that a large number of our homeless people have stories that attribute addiction to gambling as being responsible for the situation they are in today. Slide 25 Then when we look at travel again the amount of numeracy and consumer and financial literacy that can be taught here is enormous – comparing costs of airfares, accommodation, creating travel brochures, working out itineraries – again if able to link it into a real trip – for example an excursion – all the better. Slide 26 In the work context consumer and financial literacy and numeracy are closely linked – you might recall the slide where it talks about the lack of numerate skills impacting on ones’ employability. In the work context the ability to budget, create financial records, read financial documents such as invoices, statements and financial reports can be very important. If you consider the retail and service industries – where so many of our students start their working lives even when they are still at school again, numeracy demands are great. These worlds have changed dramatically in the last 2-3 decades mainly because of the increased digital technologies and now goes much beyond the basic totalling up of purchases and working out the amount of change to be given. Young people now have to use complicated cash registers where not only do they calculate totals and change, they monitor sales which are used for modelling future sales, they work with bar codes that allow for price fluctuations. The very scale of sales has increased - In supermarkets it is not uncommon to see people with two full trolleys at the check out. Can you imagine working that out with pencil and paper! Slide 27 Finally in the Citizenship context consumer and financial literacy comes into play – paying bills on time; being able to read and understand bills; investing ethically, using credit, saving and budgeting wisely and responsibly. Slide 28 However to be numerate in all the above contexts and to be able to use consumer and financial literacy in these contexts there needs to be competence and confidence in the three corners of the triangle as well – mathematical knowledge, tools and dispositions. So let’s see how consumer and financial literacy links to these areas. Slide 29 Let us start with Mathematical Knowledge. This is a very important area as the students need this to be able to work with their own money. The ability to estimate, for example, is particularly important when dealing with money; as are the skills of estimating, operating and problem solving. This is where knowledge about percentages comes in –their relationships with fractions so that students can work out how much an item will be if there is a 20% sale for example. This is also an area where the concept of decimals can be explored using nice concrete examples – working with cents and dollars. Slide 30 Moving to Tools. This area is also very important when looking at consumer and financial literacy. If we move into areas of enterprise some physical tools might need to be mastered – for example, at a market day, scales, tape measures and perhaps even cash registers or adding up machines might be used. Then there are the representational tools – think of tables for budgets, financial records, graphs showing financial trends, reading, interpreting and creating graphs relating to a multitude of financial trends and issues, symbols and pictures used in advertising and so forth. Finally, when we look at digital tools – a calculator is probably the most basically technological one, while the computer springs to mind here with its capabilities of setting up spread sheets for budgets and keeping financial records, the graph making capabilities, the research into ethical issues such as fair trading, electronic banking, mobile phone payments, bill payments, exploring websites to help with consumer and financial literacy – learning objects for example – simulations of real life financial situations such as The Real Game.. Slide 31 And thirdly it is necessary to have a positive disposition to use all the maths we know. This is where Consumer and financial literacy programs can really come into their own particularly if there is a strong focus on the enterprise areas – e.g. organising fund raising activities – market days, fetes, cake stalls, 24 hour famine. This is that wonderful real life Mathematics that engages students so well. Most schools do these kinds of things, but how many consider it an extracurricular activity rather than building it into a vibrant, rigorous part of their curriculum to support their students in developing their numeracy skills? Slide 32 So where to from here? I hope this presentation has shown you that consumer and financial literacy is a very important area to be addressed in your schools and that it is an excellent vehicle for developing your students’ numeracy skills. I hope it has given you some ideas and a starting point for creating your own school’s program in this important area. Please visit the resources section of this course to find out where to go to access some wonderful free resources to help you in this work. .