ACCT 284 Worksheet Chapter 10(part 2)

advertisement

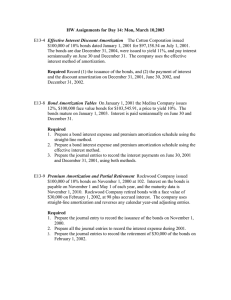

ACCT 284 Worksheet Chapter 10(part 2 1). A company issued $10,000,000 of 6%, 10-year bonds for $10,772,020, which resulted from a market rate of 5%. Interest is paid to the bondholders annually. How much is interest expense for the first year using the effective interest method? A) $600,000 B) $500,000 C) $646,321 D) $538,601 2). Which one of the following statements regarding bonds payable is true? A) When bonds are issued at a discount, the carrying value of the bonds will increase each year until maturity. B) When bonds are issued at a premium, the amount of total interest expense will be greater than the total amount of cash interest paid to the bondholders. C) A premium on bonds payable is shown as a current asset on the balance sheet. D) Bonds selling at 102 are selling at a discount. 3). On January 1, 2013, Blake Corporation sold a five-year, $10,000, 7% bond. The interest is payable annually each December 31. The issue price was $9,668 based on an 8% market rate. Assuming effective-interest amortization is used, the amortization of the discount for 2014 would be (to the nearest dollar. A. $ 79. B. $ 180. C. $ 773. D. $9,820. THE REST OF THE TIME WE ARE GOING TO DO THE BOND PRACTICE THAT POSTED ON YOUR BLACKBOARD