Math 1090 Quiz 6 April 20, 2015

advertisement

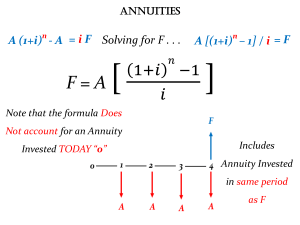

Math 1090 Quiz 6 April 20, 2015 Answer the following questions in the space provided. Time: 15 minutes Name: UID: 1. Suppose you invest a fixed amount $1, 000 at the end of each year for 3 years in an account that pays 10% compounded annually. (a) How much does each of the $1, 000 contribute to the final value of the account? • Fist $1, 000: Solution: The first $1, 000 will contribute S1 = 1000(1 + 0.1)2 (they are invested at the end of the first year, so they earn interest for 2 years. • Second $1, 000: Solution: The second $1, 000 will contribute S1 = 1000(1 + 0.1) (they are invested at the end of the second year, so they earn interest for 1 year. • Third $1, 000: Solution: The third $1, 000 will contribute S1 = 1000(1 + 0.1)0 = 1000 (they are invested at the end of the third year, so they don’t earn any interest. 3 −1 (b) After 3 years, the value of the account is 1000 (1+0.1) 0.1 your answers in (a)? . How does this follow from Solution: The value of the account after 3 years will be the sum of the three quantities we obtained in (a), namely S = S1 + S2 + S3 = 1000 · 1.12 + 1000 · 1.1 + 1000 This is the sum of the first 3 terms in a geometric sequence with a1 = 1000 and 3 −1 3 = 1000 1.10.1−1 . d = 1.1, which is precisely S = a1 dd−1 2. A lottery prize worth $1, 800, 000 is awarded in payments of $10, 000 at the beginning of each month for 15 years. Suppose money is worth 6.6% monthly. (a) What formula will you use to compute the real value the prize (today)? Solution. We are being asked to compute the present value of an annuity due, so we we need to use the expression R(1 + rc ) 1 − (1 + rc )−N r S= , rc = , N = nt rc n (b) What does every parameter mean in that formula? Solution. The parameters in the above formula stand for the following: (i) (ii) (iii) (iv) (v) S: present value of the annuity. R: regular payments that we receive. r: interest rate of the account. n: number of times that interest is compounded each year. t: number of years during which we receive payments. (c) What is the real value of the prize? (You don’t need to use your calculator: it suffices to write down the expression that you would type). Solution. It suffices to plug the problem data into the formula above 0.066 −12·15 0.066 −N · 1 − 1 + 10, 000 · 1 + R(1 + rc ) 1 − (1 + rc ) 12 12 S = = 0.066 rc 12 = $1, 147, 026.9 Formulas n −1 i If a1 , a2 · · · is a geometric sequence where at = dat−1 , a1 + a2 + · · · + an = a1 dd−1 . ii Simple interest: S = P (1 + rt). r nt iii Compound interest: R = P 1 + n . r n r iv AP Y = 1 + n − 1 or AP Y = e − 1. R((1+rc )N −1) r v Future value of an ordinary annuity S = , where rc = n , N = nt. rc h i N +1 (1+rc ) −1 r vi Future value of an annuity due: S = R − R, where rc = n , N = nt. r c vii Present value of an ordinary annuity: S = R(1−(1+rc )−N ) , rc −N viii Present value of an annuity due: S = R(1+rc )(1−(1+rc ) rc Page 2 ) where rc = r , n , where rc = N = nt. r , n N = nt.