Products - Karnataka Bank

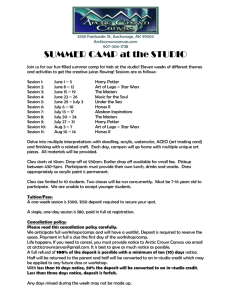

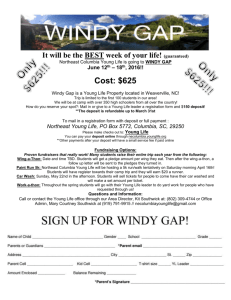

advertisement

DEPOSIT PRODUCTS – MAXIMIZING YOUR EARNINGS Karnataka Bank’s basket of financial product is redefining customer-centric banking practices across India. Life is one big journey of discovery especially when you're just starting out. In your personal finances, as in life, it is important to make astute decisions when you face new challenges. And we can help you get off to a good start. We aim to help you build on a strong foundation by maximizing returns on your investments and increasing your assets. As our privileged customer, you can make use of our customized products to take care of your specific banking needs. You can find one product that is just right for you and your Family. Abhyudaya Cash Certificate A growth oriented scheme with maximum returns. Money invested multiplies after the specified period. The minimum period of deposit is 6 months and the maximum period is 120 months. Fixed Deposits A high interest deposit scheme for specified periods ranging from 15 days to 10 years with interest payments made monthly, quarterly, half-yearly or yearly as required by the depositor. Ready Money Deposit A unique term deposit cum overdraft account, whereby a minimum deposit of Rs.10,000/- enables you to withdraw upto 75% of the amount by cheque without presentation of the deposit receipt. Soulabhya Deposit A flexible ‘twin gain’ Deposit Scheme that allows withdrawal of deposits in units of Rs.1,000/- each in case of need, without affecting the interest payable on the remaining units. Minimum amount of deposit is Rs.5,000/- and in multiples of Rs.1,000/thereto. Cumulative Deposit A monthly deposit scheme whereby a fixed amount is to be contributed monthly for a minimum period of 6 months and a maximum of 10 years. This is an ideal scheme to save a fixed amount for future plans such as education, buying a home etc. Platinum Lakhpathi A recurring deposit scheme wherein a fixed monthly amount deposited over a period of 45 months to 120 months in multiples of 15 months, becomes over a lakh of rupees at the end of it. Insurance linked Savings Bank Deposit Free accident insurance coverage with your savings account! By maintaining a stipulated minimum balance in SB account, you become entitled to free accident insurance coverage of upto Rs.2 lakh and Rs.10,000/- towards reimbursement of hospitalisation expenses arising out of accidents. K-Flexi Deposit Savings Account that provides Fixed Deposit Interests! A facility for all existing account holders that maximises the returns on surplus funds in the account. The stipulated level at present is Rs.10,000/-. Whenever the balance in the SB a/c surpasses this amount, the excess amount gets transferred to a term deposit in multiples of Rs.5,000/- for a specified period and earns interest applicable to a term deposit of that period. Resident Foreign Currency (Domestic) Account Foreign currency in USD, GBP and Euros may be deposited. This account can be opened as a current account only. The account carries no interest with it and there is no minimum amount for opening the account. Foreign exchange acquired in the form of currency notes, travellers cheques, gifts, honorarium received outside India, gifts received from relatives and earnings through the export of goods and services, can be credited to this account. NRI Services Wide range of Deposit schemes for Non-Resident Indians. It includes Non Resident Rupee Account (NRE), Foreign Currency Non- Resident (Bank) Scheme (FCNR[B]) and Non Resident (Ordinary) Account (NRO) with very attractive and competitive rates. Resident Foreign Currency (RFC) (Domestic) Account for returning Indians is also available. Senior Citizens Deposit Scheme Respecting our elders through additional interests for their savings and other benefits. Contact our nearest Branch and we shall be happy discuss a savings plan that’s just right for you and your family.