QUANTITATIVE MODULE A

advertisement

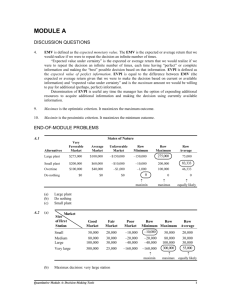

A Decision-Making Tools QUANTITATIVE MODULE DISCUSSION QUESTIONS 1. The purpose of this question is to make students use a personal experience to distinguish between good and bad decisions. A “good” decision is one that is based on logic and all available information. A “bad” decision is one that is not based on logic and all available information. It is possible for an unfortunate or undesired outcome to result from a “good” decision (witness a patient expiring after open-heart surgery). It is also possible to have a favorable or desirable outcome result from a “bad” decision (you win at Blackjack, even though you drew a card when you already held an “18”). 2. An alternative is a course of action over which we have control. A state of nature is an event or occurrence over which we have no control. An example of a choice between alternatives is our decision as to whether or not to carry an umbrella to work today. The relevant state of nature is whether or not it will rain. 3. A decision table for Jenine Duffey might look like the following: Recession Inflation Recession and Inflation Invest in Process #1 Invest in Process #2 Invest in Process #3 4. EMV is defined as the expected monetary value. The EMV is the expected or average return that we would realize if we were to repeat the decision an infinite number of times. “Expected value under certainty” is the expected or average return that we would realize if we were to repeat the decision an infinite number of times, each time having “perfect” or complete information and making the “best” possible decision based on that information. EVPI is defined as the expected value of perfect information. EVPI is equal to the difference between EMV (the expected or average return given that we were to make the decision based on current or available information) and “expected value under certainty” and is the maximum amount we would be willing to pay for additional (perhaps, perfect) information. Determination of EVPI is useful any time the manager has the option of expending additional resources to acquire additional information and making the decision using currently available information. 5. Decision trees are most useful when the decision maker faces sequential decisions. They are also very helpful in visualizing the options available. 6. Expected value assumes that the decision is made over and over many times. The “expected” or average outcome then has meaning. For a one-time decision, the criterion can be very misleading. 7. Decision trees are used in such areas as capacity planning (Chapter 7), new product analysis (Chapter 5), location analysis (Chapter 8), scheduling (Chapter 15), and maintenance (Chapter 17). Quantitative Module A: Decision-Making Tools 335 8. The basic difference between decision making under certainty, risk, or uncertainty is based on the nature and amount of chance or risk that is involved in making the decision. Decision making under certainty assumes that we know with complete confidence the outcomes that result from our choice of each alternative. Decision making under risk implies that we do not know the specific outcome that will result from our choice of a particular alternative, but that we do know the set of possible outcomes, and that we are able to objectively measure or estimate the probability of occurrence of each of the outcomes in the set. Decision making under uncertainty implies that we do not know the specific outcome that will result from our choice of a particular alternative; we know only the set of possible outcomes and are unable to objectively measure or estimate the probability of occurrence of any of the outcomes in the set. 9. Maximax is the optimistic criterion. It maximizes the maximum outcome. 10. Maximin is the pessimistic criterion. It maximizes the minimum outcome. END-OF-MODULE PROBLEMS A.1 States of Nature Alternatives Very Favorable Market Average Market Large plant $275,000 Small plant Overtime Unfavorable Market Row Minimum Row Maximum $100,000 –$150,000 –150,000 275,000 75,000 $200,000 $60,000 –$10,000 –10,000 200,000 83,333 $100,000 $40,000 –$1,000 –1,000 100,000 46,333 $0 $0 $0 0 0 0 Do nothing maximin A.2 (a) (b) (c) Large plant Do nothing Small plant (a) Market Size of First Station Good Market Fair Market Poor Market Small Medium Large 50,000 80,000 100,000 20,000 30,000 30,000 –10,000 –20,000 –40,000 –10,000 Very large 300,000 25,000 –160,000 (b) (c) (d) A.3 336 maximax Row Row Minimum Maximum Row Average equally likely Row Average –160,000 50,000 80,000 100,000 300,000 20,000 30,000 30,000 55,000 maximin maximax equally likely –20,000 –40,000 Maximax decision: very large station Maximin decision: small station Equally likely decision: very large station EMV (large stock) 0.322 + 0.512 + 0.22 12.2 EMV (average stock) 0.314 0.510 0.26 10.4 EMV (small stock) 0.39 0.58 0.24 7.5 Maximum EMV is large inventory $12,200 Instructor’s Solutions Manual t/a Operations Management A.4 EVPI $13,800 12,200 $1,600 where: $13,800 0.322 + 0.512 + 0.26 A.5 EMV (assembly line) 0.4$10,000 0.6$40,000 $28,000 EMV (plant) 0.4 $100,000 0.6$600,000 $320,000 EMV (nothing) 0 Select the new plant option. A.6 EVPI $364,000 $320,000 $44,000 A.7 (a) (b) A.8 EMV (Alt. 1) 0.480 0.3120 0.3140 32 36 42 110 max. EMV EMV (Alt. 2) 0.490 0.390 0.390 36 27 27 90 EMV (Alt. 3) 0.450 0.370 0.3150 20 21 45 86 EVPI 117 110 7 Expected cost of hiring full-timer 0.2300 + 0.5500 + 0.3 700 $60 + 250 + 210 $520 Expected cost of part-timer 0.2 0 + 0.5350 + 0.31,000 $0 + 175 + 300 $475 Thus, use part-time lawyers. A.9 Large has EMV = $75,000 ; small has EMV = $83,333 ; overtime EMV = $46,333 ; and do nothing $0 A.10 EMV (major expansion) 150,000* EMV (minor expansion) 50,000 EMV (do nothing) 0 * Therefore, the company should do the major expansion. A.11 (a) Stock 11 cases Stock 12 cases Demand 11 Cases P 0.45 385 Demand 12 Cases P 0.35 385 Demand 13 Cases P 0.20 385 EMV $385.00 385 420 420 $379.05 420 455 $341.25 56 329 Stock * (b) 13 cases 385 112 56 273 364 The recommended course of action, based on the expected monetary value criterion, is to stock 11 cases. It should be intuitively obvious that if no loss due to overstocking is involved, one should always carry the maximum stock. This observation is confirmed by the following table. Stock 11 cases Stock 12 cases Stock 13 cases * Demand 11 Cases P 0.45 385 385 385 Demand 12 Cases P 0.35 385 420 420 Demand 13 Cases P 0.20 385 420 455 EMV $385.00 $404.25 $411.25 The recommended course of action, based on the expected monetary value criterion, is to stock the maximum of 13 cases. Quantitative Module A: Decision-Making Tools 337 A.12 Profit from each case sold: $95 $45 $50 . Loss from each case produced but not sold: $45. Production (Cases) 6 Demand (Cases) 7 8 P 0.3 P 0.5 300 300 6 P 0.1 300 300 7 9 P 0.1 300 EMV $300.00 350 350 350 $340.50 350 400 400 $352.50 400 450 $317.00 45 255 8 9 * 300 90 45 210 305 300 135 350 90 45 165 260 355 She should manufacture eight cases per month A.13 Note: All dollar values in 1,000s Build $155 Pilot works (0.5) $155 Work (0.9) $171 200 – 10 190 Fail (0.1) –$16 –150 – 10 –160 –10 Work (0.2) $38 200 – 10 190 –150 – 10 –160 Do not build $72.5 Try pilot Build –$90 Pilot fails (0.5) –$10 Fail (0.8) –$128 Do not build Decide now –$10 $0 $0 Do not build –10 Work (0.4) $80 $200 Fail (0.6) –$90 –$150 $0 The recommended strategy (EMV = 72.5) is Try pilot If pilot is success: build plant If pilot is failure: do not build plant 338 Instructor’s Solutions Manual t/a Operations Management Note: All costs/revenues have been entered at the end of the branches of the tree. Although this procedure is not required in this example due to an implicit assumption of linear utility, it is required when using a more general representation of utility. A.14 Note: All dollar values are in 1,000s. Favorable (0.4) $160 (a) Build large –20 400 –$20 Unfavorable (0.6) –$180 –300 Favorable (0.4) $32 Build small 26 80 $26 Unfavorable (0.6) –$6 –10 Favorable (0.4) $0 Do not build 0 0 $0 Unfavorable (0.6) –$0 (b) (c) Based on the expected monetary value criterion, Penny should elect to build a small plant. We can find the EVPI from the following: Expected value under certainty = (0.4) (400,000) + 0.6 (0) = $160,000 Maximum EMV = $26,000 EVPI = $160,000 $26,000 = $134,000 1% Defective (0.7) –50 3% Defective (0.2) –150 5% Defective (0.1) –250 –113 1% Defective (0.3) –50 +37 saving Buy from B –150 3% Defective (0.4) –150 5% Defective (0.3) –250 A.15 (a) Buy from A –90 –90 (b) 0 Switches should be purchased from supplier A. Quantitative Module A: Decision-Making Tools 339 A.16 (a) (b) Maximum EMV = $11,700 EVPI =13,200 11,700 =1,500 A.17 Note: All dollar values are in 1,000s. Grow (a) 150 Build large Stable –85 Grow 60 Build small Stable –45 Grow 0 Do not build Stable (b) 0 Build large wing Build small wing Do not build Population Trend Growth Stable 150 –85 60 –45 0 0 Build large wing Build small wing Do not build Population Trend Growth P 0.5 Stable P 0.5 150 –85 60 –45 0 0 (c) a f a f EMV $32.50 $7.50 $0.00 Based on the expected monetary value criterion with the assumption that the states of nature are equally likely, she should build the large wing. (d) Population Trend Growth P 0.6 Stable P 0.4 150 –85 60 –45 0 0 a Build large wing Build small wing Do not build f a f EMV $56.00 $18.00 $0.00 Based on the expected monetary value criterion, she should build the large wing. 340 Instructor’s Solutions Manual t/a Operations Management Favorable A.18 Small shop Unfavorable Favorable Survey says favorable Large shop Unfavorable No shop Favorable Use survey Small shop Unfavorable Favorable Survey says unfavorable Large shop Unfavorable No shop Favorable Small shop Unfavorable Favorable Decide now Large shop Unfavorable No shop Quantitative Module A: Decision-Making Tools 341 A.19 Small shop Survey says favorable market (0.6) +$45 Large shop Favorable (0.9) $21 Unfavorable (0.1) Favorable (0.9) $45 Unfavorable (0.1) No shop Use survey $25 $25 Survey says unfavorable market (0.4) –$5 Small shop Large shop Decide now $10 Large shop No shop –10 – 5 = –15 60 – 5 = 55 –40 – 5 = –45 0 – 5 = –5 Favorable (0.12) –$10.2 Unfavorable (0.88) Favorable (0.12) –$33 Unfavorable (0.88) No shop Small shop 30 – 5 = 25 30 – 5 = 25 –10 – 5 = –15 60 – 5 = 55 –40 – 5 = –45 0 – 5 = –5 Favorable (0.5) $10 Unfavorable (0.5) Favorable (0.5) $10 Unfavorable (0.5) 30 –10 60 –40 0 The optimal strategy is to use the survey. If the survey indicates a favorable market, then build a large shop. If the survey does not indicate a favorable market, then do nothing. 342 Instructor’s Solutions Manual t/a Operations Management A.20 (0.9) 8,500 (0.1) Info favorable (0.5) 8500 12000 –23000 (0.9) 500 (0.1) 2000 –13000 –3000 Gather more information 2750 (0.4) –9,000 (0.6) Info unfavorable (0.5) –3000 12000 –23000 (0.4) –7,000 (0.6) 2000 –13000 –3000 (0.7) 4,500 (0.3) Do not gather more information 4500 15000 –20000 (0.7) 500 (0.3) 5000 –10000 0 Your advice should be to not gather additional information and to build a large video section. A.21 (a) 5,000 Minor 10,000 Market favorable (0.5) Market unfavorable (0.5) Do nothing (b) (0.5) Market unfavorable (0.5) Major 10,000 Market favorable 100,000 –90,000 40,000 –20,000 0 EMV (major renovation) 5,000 EMV (minor renovation) 10,000* * best decision is minor renovation Quantitative Module A: Decision-Making Tools 343 Good (1/3) A.22 Small Fair (1/3) 20,000 Poor (1/3) Good (1/3) Medium Fair (1/3) 30,000 Poor (1/3) 50,000 20,000 –10,000 80,000 30,000 –20,000 55,000 Good (1/3) Large Fair (1/3) 30,000 Poor (1/3) Good (1/3) Very large Fair (1/3) 55,000 Poor (1/3) 344 100,000 30,000 –40,000 300,000 25,000 –160,000 Instructor’s Solutions Manual t/a Operations Management CASE STUDIES NIGEL SMYTHE’S HEART BY PASS OPERATION No By pass Surgery 1 year 2 years 5 years 8 years Prob. Years Expected Rate 0.50 1 0.50 0.20 2 0.40 0.20 5 1.00 0.10 8 0.80 2.70 years Surgery 0 years 1 year 5 years 10 years 15 years 20 years 25 years Prob. Years Expected Rate 0.05 0 0.00 0.45 1 0.45 0.20 5 1.00 0.13 10 1.30 0.08 15 1.20 0.05 20 1.00 0.04 25 1.00 5.95 years Expected survival rate with surgery (5.95 years) exceeds the nonsurgical survival rate of 2.70 years. Surgery is favorable. Other factors might include the particular doctor and hospital used and care received. STARTING RIGHT CORP. This is a decision-making-under-uncertainty case. There are two events: a favorable market (event 1) and an unfavorable market (event 2). There are four alternatives, which include do nothing (alternative 1), invest in corporate bonds (alternative 2), invest in preferred stock (alternative 3), and invest in common stock (alternative 4). The decision table is presented below. Note that for alternative 2, the return in a good 5 market is $30,000 1 0.13 $55,273 . The return in a good market is $120,000 4 $30,000 for alternative 3, and $240,000 8 $30,000for alternative 4. a f Quantitative Module A: Decision-Making Tools 345 Alternative 1 (not invest) Alternative 2 (bonds) Alternative 3 (preferred) Alternative 4 (common) Event 1 0 55,273 120,000 240,000 Event 2 0 –10,000 –15,000 –30,000 Solutions: Equally Likely Alternative Expected Value 1 0.0 2 22,636.5 3 52,500.0 4 105,000.0 best Maximin Alternative Expected Value 1 0 best 2 –10,000 3 –15,000 4 –30,000 Maximax Alternative Maximax Payoff 1 0 2 55,273 3 120,000 4 240,000 best Probability of 0.11 of Success Alternative Payoff 1 0.00 2 –2,819.97 3 –150.00 4 –300.00 best 1. Sue Pansky is a risk avoider and should use the maximin decision approach. She should do nothing and not make an investment in Starting Right. 2. Ray Cahn should use a success probability of 0.11. The best decision is to do nothing. 3. Lila Battle should eliminate alternative 1, doing nothing, and apply the maximin criterion. The result is to do nothing. 4. George Yates should use the equally likely decision criterion. The best decision for George is to invest in common stock. 5. Pete Metarko is a risk seeker. He should invest in common stock. 6. Julia Day can eliminate the preferred stock alternative and still offer alternatives to risk seekers (common stock) and risk avoiders (doing nothing or investing in corporate bonds). 346 Instructor’s Solutions Manual t/a Operations Management INTERNET CASE STUDIES ARCTIC, INC. No probabilities have been included in this case study. As an initial analysis, we expect students to input the data and run Excel OM or POM for Windows. Student analysis would be to determine something about the expected values. Because the probabilities are not known, a first try might be to assign equal probabilities—say, 0.1666. The best expected value is given by “building new,” with a value of nearly 2. However, note that this value is not that much greater than the value for “expanding” the plant. “Purchasing” has a terrible expected value of (0.35) and can be eliminated. “Sole sourcing” also has a low expected value and can possibly be eliminated from consideration. The question that remains is this: How sensitive are the results to the scenario probabilities? This is where the power of a computer comes in handy. Students can try many different probability combinations and look at the expected values. We are primarily concerned with expanding, building new, subcontracting, and expanding and subcontracting. As “drop” is the worst scenario, try probabilities of 0.125, 0.125, and 0.25 for grow, stable, and drop, respectively. In this case, “expand” or “expand and subcontract” are better options. To determine the effects of growth, reverse the probabilities. This brings “building new” to the forefront. It is impossible to give an exact answer on what option to choose. The analysis shows that building a new plant can be very profitable, but this strategy can also be very risky. It might be more prudent to focus on the two expansion strategies. TOLEDO LEATHER COMPANY 1. Machine 1 (Semiautomated) Capacity = 5 days wk 50 wks yr L M N Machine 2 (Automated) Capacity = 5 days wk 50 wks yr O P Q L M N 1 640 (640) = 140,000 yr . 8 800 O P Q 1 (800) = 150,000 units yr . 4 Sales price = $6 / unit Sales price = $6 / unit T.C./case = $1.50 (material) T.C./case = $1.50 af a T.C./casea with overtimef= $1.50 + $2.50 v.c. $4 no overtime used + $2.50 $1.20 = $5.20 f af a + $1.75 v.c. $3.25 no overtime used a f T.C./case with overtime = $1.50 + $1.75 $0.90 = $4.15 Cost of machine = $250,000 Cost of machine = $350,000 Cost to modify = $15,000 Cost to modify = $20,000 Volume 120k 130k 140k (capacity) 150k (overtime) 150k (modify) 160k (overtime) 160k (modify) Profit ($6 4)(120k) = $240k ($6 4)(130k) $260k ($6 4)(140k) = $280k $280k + (80¢ overtime unit) (10k) = $288k ($6 4)(150k) $15k = $285k $280k + (80¢ unit)20k $296k ($6 4)(160k) $15k = $305k Quantitative Module A: Decision-Making Tools f Volume 120k 130k 140k 150k (capacity) Profit ($6 3.25)(120k) = $330k ($6 3.25)(130k) = $357.5k ($6 3.25)(140k) = $385k ($6 3.25)(150k) = $412.5k 160k (overtime) 160k (modify) $412.5k + (6 4.15)(10k) = $431k ($6 3.25)(160k) $20 k = $420k 347 2. Payoff Matrix Alternative Machine 1 Machine 2 $120k 240 330 States of Nature—Payoff in $1,000s $130k $140k $150k (OT) 260.0 280 288.0 357.5 385 412.5 (a) Maximax: $296k $250k = $46k $431k $350k = $81k maximax (Machine 2) (b) Maximin: $240k $250k = $10k maximin (Machine 1) $330k $350k = $20k (c) Equally likely: Machine 1 = $272.8k 250k = $22.8k Machine 2 = $383.2k 350k = $33.2k (Machine 2) Volume = 120,000 (0.15) V = 130,000 (0.25) $21,450 (Machine 1) Semiautomated $250,000 cost $271,450 V = 140,000 (0.40) V = 150,000 (0.15) Overtime Modify V = 160,000 (0.5) Overtime $26,300 Modify Volume = 120,000 (0.15) V = 130,000 (0.25) $26,300 (Machine 2) Automated $350,000 cost $376,300 V = 140,000 (0.40) V = 150,000 (0.15) V = 160,000 (0.05) Overtime Modify 348 $160k (OT) 296 431 $240k $260k $280k $288k $285k $296k $305k $330k $357.5k $385k $412.5k $431k $420k Instructor’s Solutions Manual t/a Operations Management