probability estimated

advertisement

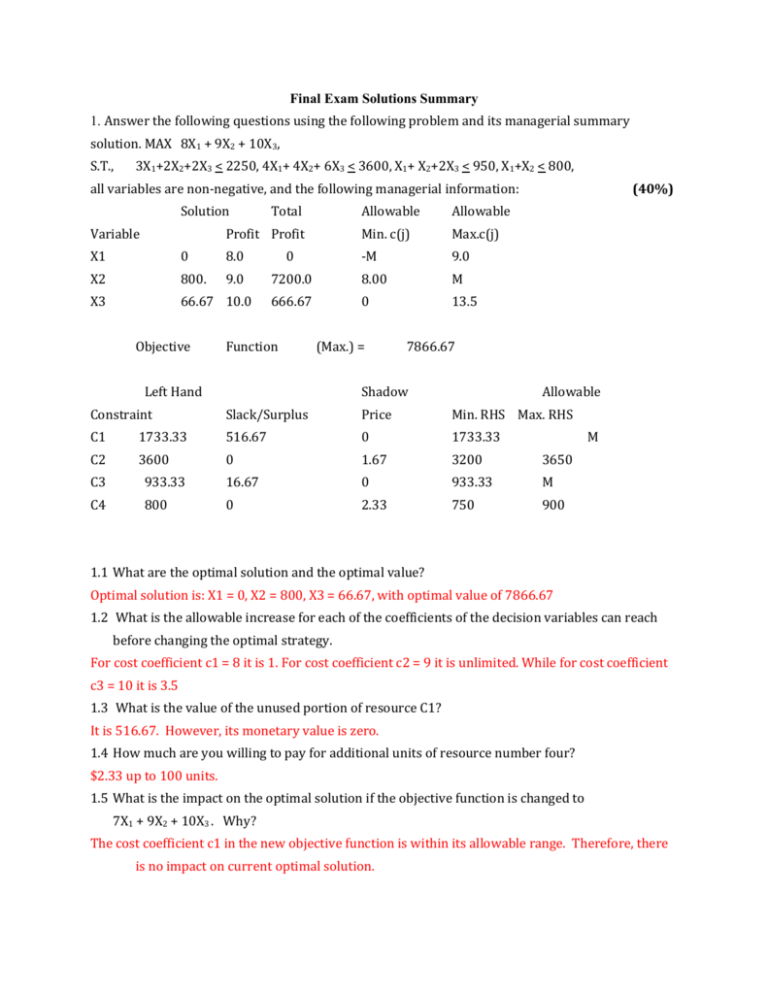

Final Exam Solutions Summary 1. Answer the following questions using the following problem and its managerial summary solution. MAX 8X1 + 9X2 + 10X3, S.T., 3X1+2X2+2X3 < 2250, 4X1+ 4X2+ 6X3 < 3600, X1+ X2+2X3 < 950, X1+X2 < 800, all variables are non-negative, and the following managerial information: Solution Variable Total Allowable Allowable Profit Profit Min. c(j) Max.c(j) -M 9.0 X1 0 8.0 0 X2 800. 9.0 7200.0 8.00 M X3 66.67 10.0 666.67 0 13.5 Objective Function (Max.) = Left Hand (40%) 7866.67 Shadow Allowable Constraint Slack/Surplus Price Min. RHS Max. RHS C1 1733.33 516.67 0 1733.33 C2 3600 0 1.67 3200 3650 M C3 933.33 16.67 0 933.33 M C4 800 0 2.33 750 900 1.1 What are the optimal solution and the optimal value? Optimal solution is: X1 = 0, X2 = 800, X3 = 66.67, with optimal value of 7866.67 1.2 What is the allowable increase for each of the coefficients of the decision variables can reach before changing the optimal strategy. For cost coefficient c1 = 8 it is 1. For cost coefficient c2 = 9 it is unlimited. While for cost coefficient c3 = 10 it is 3.5 1.3 What is the value of the unused portion of resource C1? It is 516.67. However, its monetary value is zero. 1.4 How much are you willing to pay for additional units of resource number four? $2.33 up to 100 units. 1.5 What is the impact on the optimal solution if the objective function is changed to 7X1 + 9X2 + 10X3 . Why? The cost coefficient c1 in the new objective function is within its allowable range. Therefore, there is no impact on current optimal solution. 1.6 Is it profitable to produce a new product with net profit of $11 requiring 2 units of every resource you have? Why? Considering the shadow prices, It take 2(0) + 2(1.67) + 2(0) + 2(2.33) = $8 to produce a unit of the new product. Since 8 <11, therefore it is profitable to produce the new product. 1.7 What is the impact of deleting the first constraint on the optimal solution? Why? The first constraint is not a binding constraint (it has a non-zero slack); therefore deleting this constraint does not have any impact on optimal solution. 1.8 What is the solution to the dual problem? The solution to the dual is the shadow prices 2. Pick up a year of your choice and then write the maximum number of cars manufactured during that year in USA. (5%) The year of your choice could be, say 1875, and the number of cars = 0. 3. The ABC wants to market a new series program, whose success probability was estimated to be 0.90. Suppose a marketing research agency is hired to evaluate the program. The past experience indicates that the agency has 80% of accuracy in predicting a success and 90% of accuracy in predicting a failure. What is the probability that the program is successful given a favorable prediction? What is the probability that the program is a failure given an unfavorable prediction? (15%) Positive States of Nature Prior Probability Successful .90 Unsuccessful .10 Conditional Probability .80 .0.1 Joint Probability .72 .01 .73 Posterior Probability .99 .01 Negative States of Nature Prior Probability Successful .90 Unsuccessful .10 Conditional Probability .20 .90 Joint Probability .18 .09 .27 Posterior Probability .67 .33 4. A manager is considering marketing (M) a product or not marketing (NM). But he is not sure whether the market is good (g) or nor good (ng). His estimated payoff matrix is shown as follows. M NM g 34,000 0 ng –9,000 0 p(.) 0.4 a. b. According to the Min-expected regret criterion, what is the manager's decision? (10%) Now the manager wants to have additional information for his decision making. How much should he pay at most for the additional information? (5%) 0.6 Payoff table M M1 G 34000 0 G1 -9000 0 G 0 34000 G1 9000 0 Regret M M1 ER(M) = 0 (.40) + 9000 (.60) = 5,400 ER(M1) = 34000 (.40) + 0 (.60) = 13,600 a. M = 5,400 Min-expected regret b. Since in general EVPI = EOL, the EVPI is $5,400. Alternatively, EVPI can be computed directly, as follow: EREV 34000(.40) + -9000 (.60) = 8,2000 EREV 0 (.40) + 0 (.60) = 0 b. 13,600 – 8,200 = 5,400 3. Buzzy-B Toys must decide the course of action to follow in promoting a new whistling yo-yo. Initially, management must decide whether to market the yo-yo or to conduct a test marketing program. After test marketing the yo-yo, management must decide whether to abandon it or nationally distribute it. A national success will increase profits by $500,000, and a failure will reduce profits by $100,000. Abandoning the product will not affect profits. The test marketing will cost Buzzy-B a further $10,000. If no test marketing is conducted, the probability for a national success is judged to be 0.45. The assumed probability for a favorable test marketing result is 0.50. The conditional probability for national success given favorable test marketing, is 0.80, for national success given unfavorable test results, it is 0.10. Construct the decision tree diagram and perform backward induction analysis to determine the optimal course of action. (25%) Net Payoffs Success, 0.80 $490,000 Market Failure, 0.20 -$110,000 Favorable, 0.50 Abandon Test market -$10,000 Success, 0.10 Unfavorable, 0.50 $490,000 Market Failure, 0.90 -$110,000 Abandon Don't test market Success, 0.45 -$10,000 $500,000 Market Failure, 0.55 Abandon $-100,000 $0 Net Payoffs $370,000 $370,000 Success, 0.80 $490,000 Market Failure, 0.20 // Favorable, 0.50 $180,000 Test market $180,000 -$110,000 Abandon -$10,000 -$50,000 Unfavorable, 0.50 // -$10,000 Market \\ Success, 0.10 Failure, 0.90 -$110,000 Abandon Don't test market $170,000 Market $490,000 Success, 0.45 -$10,000 $500,000 Failure, 0.55 $170,000 Abandon $-100,000 $0 Optimal Strategy: Test the market If Favorable, Market Otherwise Abandon.