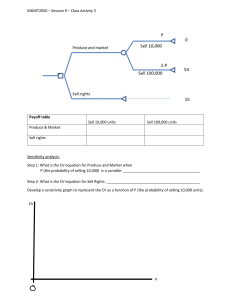

Chapter 3

advertisement

Chapter 3

Decision Analysis

Decision Theory

• Decision theory is the analytic and

systematic approach for making the

best decision.

Features of Decision Making

• Decision making is for __________.

a. past

b. future

c. both past and future

• A decision is about a (an) _________.

a. status

b. action

c. condition

• The process of making decision is a process

of __________.

a. producing b. manufacturing c. creating

d. cooking

e. selecting

f. fabricating

Components in Decision

Making (1 of 2)

• Alternatives of a decision

– A list of choices, one of which will be selected

as the decision by the decision maker.

• States of Nature

– Possible conditions that may actually occur

in the future, which will affect the outcome

of your decision but are beyond your

control.

Components in Decision

Making (2 of 2)

• Payoffs

– a payoff is the outcome of a decision

alternative under a state of nature. The

larger the payoff the better.

• The decision alternatives, states of nature

and payoffs are organized in a decision

table.

Decision Table for the Thompson

Lumber Example

States of Nature

Decision Alternatives

Favorable

Market

Unfavorable

Market

Build a large plant

$200,000

-$180,000

Build a small plant

$100,000

-$20,000

Doing nothing

$0

$0

Types of Decision Making

• Decision making under certainty

– The outcome of a decision alternative is

known (i.e., there is only one state of nature.)

• Decision making under risk

– The outcome of a decision alternative is not

known, but its probability is known.

• Decision making under uncertainty

– The outcome of a decision alternative is not

known, and even its probability is not

known.

Decision Making under

Uncertainty

• The outcome of a decision alternative is

not known, and even its probability is not

known.

• A few criteria (approaches) are available

for the decision makers to select

according to their preferences and

personalities.

Criterion 1: Maximax (Optimistic)

• Step 1. Pick maximum payoff of each

alternative.

• Step 2. Pick maximum of those

maximums in Step 1; its corresponding

alternative is the decision.

• “Best of bests”.

Maximax Decision

for Thompson Lumber

States of Nature

Row

Decision

Favorable Unfavorable Maximum

Alternatives

market

market

Large plant

200,000

–180,000

200,000

Small plant

100,000

–20,000

100,000

Do nothing

0

0

0

Max(Row max’s) = Max(200,000, 100,000, 0) = 200,000.

So, the decision is ‘Large plant’.

For Whom?

• MaxiMax is an approach for:

– Risk taker who tends not to give up

attractive opportunities regardless of

possible failures, or

– Optimistic decision maker in whose eyes

future is bright.

Criterion 2: Maximin (Pessimistic)

• Step 1. Pick minimum payoff of each

alternative

• Step 2. Pick the maximum of those

minimums in Step 1, its corresponding

alternative is the decision

• “Best of worsts”

Maximin Decision

for Thompson Lumber

States of Nature

Row

Decision

Favorable Unfavorable Minimum

Alternatives

market

market

payoffs

Large plant

200,000

–180,000

–180,000

Small plant

100,000

–20,000

–20,000

Do nothing

0

0

0

Max(Row Min’s) = Max(–180,000, –20,000, 0) = 0.

So, the decision is ‘do nothing’.

For Whom?

• MaxiMin is an approach for:

– Risk averter who tends to avoid bad

outcomes despite of some possible

attractive outcomes; or

– Pessimistic decision maker in whose eyes

future is obscure.

Criterion 3: Hurwicz (Realism)

• Step 1. Calculate Hurwicz value for

each alternative

• Step 2. Pick the alternative of largest

Hurwicz value as the decision.

Hurwicz Value

• Hurwicz value of an alternative

= (row max)() + (row min)(1-)

where (01) is called coefficient of

realism.

Decision by Hurwicz Value

=0.8

Decision

Alternatives

Large plant

Small plant

Do nothing

for Thompson Lumber

States of Nature

Favorable Unfavorable

market

market

200,000 –180,000

100,000

–20,000

0

0

Hurwicz

values

124,000

76,000

0

Max(Hurwicz values) = Max(124,000,76,000,0) = 124,000.

So, the decision is ‘large plant’.

For Whom?

• Hurwicz method can be used by

decision makers with different

preferences on risks.

– For a person who tends to take risk, a larger

is used;

– For a person who tends to be conservative, a

smaller is used.

• What if = 1?

• What if = 0?

Criterion 4: Equally Likely

• Step 1. Calculate the average payoff for

each alternative.

• Step 2. The alternative with highest

average if the decision.

Decision by Equally Likely

for Thompson Lumber

Decision

Alternatives

Large plant

Small plant

Do nothing

States of Nature

Favorable Unfavorable

market

market

200,000 –180,000

100,000

–20,000

0

0

Row

Average

10,000

40,000

0

Max(Row avg’s) = Max(10,000, 40,000, 0) = 40,000.

So, the decision is ‘small plant’.

For Whom?

• Equally Likely method is for the

decision maker who does not have

particular preference on taking or

avoiding risks.

Criterion 5: Minimax Regret

• Step 1. Construct a ‘regret table’,

• Step 2. Pick maximum regret of each

row in regret table,

• Step 3. Pick minimum of those

maximums in Step 2, its corresponding

alternative is the decision.

Regret

• Regret is amount you give up due to

not picking the best alternative in a

given state of nature.

• Regret = Opportunity cost =

Opportunity loss

Payoff Table for Thompson Lumber

and Column Maximums

States of Nature

Decision

Alternatives

Favorable

Unfavorable

market

market

Large plant

$200,000

$100,000

$0

$200,000

-$180,000

-$20,000

$0

$0

Small plant

Doing nothing

Column Max

Regret Table for Thompson Lumber

States of Nature

Decision

Alternatives

Favorable

Unfavorable

market

market

Large plant

$0

$100,000

$200,000

$180,000

$20,000

$0

Small plant

Doing nothing

Minimax Regret Decision

for Thompson Lumber

Regret Table

Decision

Alternatives

Large plant

Small plant

Do nothing

States of Nature

Favorable Unfavorable

market

market

0

180,000

100,000

20,000

200,000

0

Row

Maximum

180,000

100,000

200,000

Min(Row max’s) = Min{180,000, 100,000, 200,000}

= 100,000.

So, the minimax regret decision is ‘small plant’.

For Whom?

• MiniMax Regret is an approach for the

decision maker who hates the feeling

of having regrets.

Decision Making under Risk

• The outcome of a decision alternative

is not known, but its probability is

known.

Max EMV Approach

• Step 1. Calculate EMV for each

alternative.

• Step 2. Pick the alternative with

highest EMV as the decision.

EMV – expected monetary value

• EMV of an alternative is the expected value of

possible payoffs of that alternative.

• EMV

n

X

i 1

i*

P( X i )

n=number of states of nature

P(Xi)=probability of the i-th state of nature

Xi=payoff of the alternative under the i-th state of

nature

Example of Thompson Lumber

States of Nature

Decision

Alternatives

Favorable Unfavorable

market

market

0.5

0.5

Large plant

$200,000 -$180,000

Small plant

$100,000 -$20,000

Doing nothing

$0

$0

EMV

10,000

40,000

0

Minimum EOL Approach

Step 1. Generate the opportunity loss table.

Step 2. Calculate the expected value (EOL)

for each alternative in the opportunity loss

table.

Step 3. Pick up the alternative with the

minimum EOL.

Opportunity Loss Table

• Opportunity loss = Regret = Opp. cost

• Opportunity loss table = Regret Table

Payoff Table for the Thompson

Lumber Example

States of Nature

Decision Alternatives

Favorable

Market

Unfavorable

Market

Build a large plant

$200,000

-$180,000

Build a small plant

$100,000

-$20,000

Doing nothing

$0

$0

Opportunity Loss table and EOL

for Thompson Lumber

States of Nature

Decision

Alternatives

Favorable Unfavorable

market

0.5

Large plant

$0

Small plant

$100,000

Doing nothing $200,000

market

0.5

$180,000

$20,000

$0

EOL

Expected Value of Perfect

Information (EVPI)

• It is value of additional information for

better decision making.

• It is an upper bound on how much to pay

for the additional information.

Calculating EVPI

• EVPI

= (Exp. payoff with perfect information) –

(Exp. payoff without perfect information)

= EVwPI

– EVw/oPI

EVw/oPI

• EVw/oPI is the average payoff you

expect to get based only on the

information given in the decision

table without the help of

additional information.

• EVw/oPI = Max (EMV)

EVw/oPI = Maximum EMV

States of Nature

Decision

Alternatives

Favorable Unfavorable

market

market

0.5

0.5

Large plant

$200,000 -$180,000

Small plant

$100,000 -$20,000

Doing nothing

$0

$0

Since Max EMV = 40,000,

EVw/oPI = 40,000.

EMV

10,000

40,000

0

EVwPI

• EVwPI is the average payoff you can get

if following the perfect information about

the state ofn nature in the future.

• EVwPI bi Pi

i 1

where n=number of states of nature

bi=best payoff of i-th state of nature

Pi=probability of i-th state of nature

EVwPI for the Example of Thompson

States of Nature

Decision

Alternatives

Favorable Unfavorable

market

market

0.5

0.5

Large plant

$200,000 -$180,000

Small plant

$100,000 -$20,000

Doing nothing

$0

$0

bi

$200,000

$0

EVwPI = 200,000*0.5+0*0.5 = 100,000

EMV

10,000

40,000

0

EVPI for Thompson Lumber

• EVwPI = 200,000*0.5 + 0*0.50 = $100,000

• EVw/oPI = Maximum EMV = $40,000

• EVPI = EVwPI – EVw/oPI

= $100,000 – $40,000

= $60,000

EVPI is a Benchmark in Purchasing

Additional Information

• EVPI is the maximum $ amount the

decision maker would pay to

purchase the additional information

about the states of nature (from a

consulting firm, for example).

What if Information Is Not

Perfect?

• In most cases, information about future

is not “perfect”. We need to discount

EVwPI properly in those cases.

• If you have 80% of confidence on the

information, then

Expected Value of Additional

Information = EVAI

= EVwPI * 80% - EVw/oPI

Maximum EMV, Minimum

EOL, and EVPI

• The decision selected by the Maximum

EMV approach is always the same as

the decision selected by the Minimum

EOL approach. (why?)

• The value of EVPI is equal to the value

of minimum EOL. (why?)

An Example

Land on ‘Head’ Land on ‘Tail’

Guess ‘Head’

$100

- $60

Guess ‘Tail’

- $80

$150

• You can play the game for many times.

• Someone offers you perfect information about

“landing” at the price of $65 per time. Do you

take it? If not, how much would you pay?

• (See the handout of class work)

In the Tossing Coin Example

•

•

•

•

•

•

EMV for “guess Head” = $20.

EMV for “guess Tail” = $35* (Max EMV).

EOL for “guess Head” = $105

EOL for “guess Tail” = $90* (Min EOL)

EVwPI = $125, EVw/oPI=$35

EVPI = $90

$

Maximum average payoff per game

average

payoff

35

average

payoff

20

EMV

EOL

regret

EOL

regret

125

EMV

Alt. 2,

Guess “Tail”

Alt. 1,

Guess “Head”

Alternatives

How to Set Up a Decision Table

• A decision table is set up by the decision

maker.

• Determine decision alternatives and states

of nature.

• Determine the payoffs of each alternative

under the states of nature.

• See case “Garden Salad” in class work.