Decision Theory Part-1

advertisement

Graduate Program in Business Information Systems

Decision Analysis

Part 1

Aslı Sencer

Analytical Decision Making

Can Help Managers to:

Gain deeper insight into the nature of

business relationships

Find better ways to assess values in such

relationships; and

See a way of reducing, or at least

understanding, uncertainty that

surrounds business plans and actions

2

Steps to Analytical DM

Define problem and influencing factors

Establish decision criteria

Select decision-making tool (model)

Identify and evaluate alternatives using

decision-making tool (model)

Select best alternative

Implement decision

Evaluate the outcome

3

Models

Are less expensive and disruptive than experimenting

with the real world system

Allow operations managers to ask “What if” types of

questions

Are built for management problems and encourage

management input

Force a consistent and systematic approach to the

analysis of problems

Require managers to be specific about constraints and

goals relating to a problem

Help reduce the time needed in decision making

4

Limitations of the Models

They may be expensive and timeconsuming to develop and test

Often misused and misunderstood (and

feared) because of their mathematical and

logical complexity

Tend to downplay the role and value of

nonquantifiable information

Often have assumptions that oversimplify

the variables of the real world

5

The Decision-Making Process

Quantitative Analysis

Problem

Logic

Historical Data

Marketing Research

Scientific Analysis

Modeling

Decision

Qualitative Analysis

Emotions

Intuition

Personal Experience

and Motivation

Rumors

6

Displaying a Decision Problem

Decision trees

Decision tables

Outcomes

States of Nature

Alternatives

Decision Problem

7

Types of Decision Models

Decision making under uncertainty

Decision making under risk

Decision making under certainty

8

Fundamentals of Decision Theory

Terms:

Alternative: course of action or choice

State of nature: an occurrence over

which the decision maker has no control

Symbols used in a decision tree:

A decision node from which one of several

alternatives may be selected

A state of nature node out of which one

state of nature will occur

9

Decision Table

States of Nature

Alternatives

State 1

State 2

Alternative 1

Outcome 1

Outcome 2

Alternative 2

Outcome 3

Outcome 4

10

Getz Products Decision Tree

Favorable market

A state of nature node

1

Unfavorable market

Favorable market

A decision node

Construct

small plant 2

Unfavorable market

11

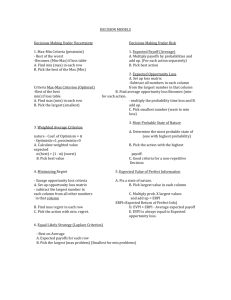

Decision Making under Uncertainty

Maximax - Choose the alternative that

maximizes the maximum outcome for every

alternative (Optimistic criterion)

Maximin - Choose the alternative that

maximizes the minimum outcome for every

alternative (Pessimistic criterion)

Equally likely - chose the alternative with

the highest average outcome.

12

Example:

States of Nature

Alternatives Favorable Unfavorable Maximum Minimum

Construct

large plant

Construct

small plant

Do nothing

Market

$200,000

$100,000

$0

Row

Market

in Row

in Row Average

-$180,000 $200,000 -$180,000 $10,000

-$20,000 $100,000

$0

Maximax

-$20,000 $40,000

$0

Maximin

$0

$0

Equally

likely

13

Decision criteria

The maximax choice is to construct a large plant.

This is the maximum of the maximum number within

each row or alternative.

The maximin choice is to do nothing. This is the

maximum of the minimum number within each row or

alternative.

The equally likely choice is to construct a small plant.

This is the maximum of the average outcomes of

each alternative. This approach assumes that all

outcomes for any alternative are equally likely.

14

Decision Making under Risk

Probabilistic decision situation

States of nature have probabilities of

occurrence

Maximum Likelihood Criterion

Maximize Expected Monitary Value

(Bayes Decision Rule)

15

Maximum Likelihood Criteria

Maximum Likelihood: Identify most likely event,

ignore others, and pick act with greatest payoff.

Personal decisions are often made that way.

Collectively, other events may be more likely.

Ignores lots of information.

16

Bayes Decision Rule

It is not a perfect criterion because it can

lead to the less preferred choice.

Consider the Far-Fetched Lottery decision:

EVENTS

Head

Tail

Probability

.5

.5

ACTS

Gamble

Don’t Gamble

+$10,000

-5,000

$0

0

Would you gamble?

17

The Far-Fetched Lottery

Decision

ACTS

Gamble

Don’t Gamble

EVENTS

Probability

Payoff × Prob.

Payoff × Prob

Head

.5

+$5,000

$0

Tail

.5

-2,500

0

$2,500

$0

Expected Payoff:

Most people prefer not to gamble!

That violates the Bayes decision rule.

But the rule often indicates preferred choices even

though it is not perfect.

18

Expected Monetary Value

N: Number of states of nature

k: Number of alternative decisions

Xij: Value of Payoff for alternative i in state

of nature j, i=1,2,...,k and j=1,2,...,N.

Pj: Probability of state of nature j

EMV ( Ai ) j 1 X ij P j

N

19

Example:

States of Nature

Alternatives

Construct

large plant

Construct

small plant

Do nothing

Favorable

Unfavorable

Market

Market P(0.5)

P(0.5)

$200,000

-$180,000

$100,000

-$20,000

$0

$0

Expected

value

$10,000

$40,000 Best choice

$0

20

Decision Making under Certainty

What if Getz knows the state of the

nature with certainty?

Then there is no risk for the state of

the nature!

A marketing research company

requests $65000 for this information

21

Questions:

Should Getz hire the firm to make

this study?

How much does this information

worth?

What is the value of perfect

information?

22

Expected Value With

Perfect Information (EVPI)

EVPI = Expected Payoff - Maximum expected payoff

under Certainty

with no information

Let N: Number of states of nature and k: Number of actions,

N

Expected Payoff under Ceratinty=

(Max {X

i

ij}).Pj

j1

Maximum expected payoff with no information=Max {EMVi; i=1,..,k}

EVPI

places an upper bound on what one would pay for additional information

23

Example: Expected Value of

Perfect Information

S ta te o f N a tu r e

A lte r n a tiv e

Favorable Unfavorable

Market ($) Market ($)

EMV

Construct a

large plant

Construct a

small plant

200,000

-$180,000

$10,000

$100,000

-$20,000

$40,000

Do nothing

$0

$0

$0

P r o b a b ilitie s

0.50

0.50

24

Expected Value of Perfect

Information

Expected Value Under Certainty

=($200,000*0.50 + 0*0.50)= $100,000

Max(EMV)= Max{10,000, 40,000, 0}=$40,000

EVPI = Expected Value Under Certainty - Max(EMV)

= $100,000 - $40,000

= $60,000

So Getz should not be willing to pay more than $60,000

25

Ex: Toy Manufacturer

How to choose among 4 types of

tippi-toes?

Demand for tippi-toes is uncertain:

Light demand: 25,000 units (10%)

Moderate demand: 100,000 units

(70%)

Heavy demand: 150,000 units

(20%)

26

Payoff Table

ACT (choice)

Event

(State of

nature)

Gears and Spring

Action

Probability levers

Weights and

pulleys

Light

0.10

$25,000

-$10,000

-$125,000

Moderate

0.70

400,000

440,000

400,000

Heavy

0.20

650,000

740,000

750,000

27

Maximum Expected Payoff Criteria

ACT (choice)

Gears and

levers

Expected

Payoff

Spring

Action

$412,500 $455,500

Weights and

pulleys

$417,000

Maximum expected payoff occurs at Spring Action!

28

Decision Trees

Graphical display of decision process, i.e., alternatives,

states of nature, probabilities, payoffs.

Decision tables are convenient for problems

with one set of alternatives and states of nature.

With several sets of alternatives and states of nature

(sequential decisions), decision trees are used!

EMV criterion is the most commonly used criterion in

decision tree analysis.

29

Softwares for Decision Tree

Analysis

DPL

Tree Plan

Supertree

Analysis with less effort.

Full color presentations for managers

30

Steps of Decision Tree Analysis

Define the problem

Structure or draw the decision tree

Assign probabilities to the states of nature

Estimate payoffs for each possible

combination of alternatives and states of

nature

Solve the problem by computing expected

monetary values for each state-of-nature

node

31

Decision Tree

State 1

1

State 2

State 1

2

Decision

Node

State 2

Outcome 1

Outcome 2

Outcome 3

Outcome 4

State of Nature Node

32

Ex1:Getz Products Decision Tree

EMV for node 1 = $10,000

1

Payoffs

Favorable market (0.5)

Unfavorable market (0.5) -$180,000

Favorable market (0.5)

Construct

small plant 2

$200,000

Unfavorable market (0.5)

$100,000

-20,000

EMV for node 2 = $40,000

0

33

A More Complex Decision Tree

Let’s say Getz Products has two

sequential decisions to make:

Conduct a survey for $10000?

Build a large or small plant or not

build?

34

Ex1:Getz Products Decision Tree

$49,200

$106,400

2nd decision point

1st decision

point

2

$63,600

3

-$87,400

1

$2,400

4

$2,400

5

$10,000

$40,000

$49,200

$106,400

6

$40,000

7

Fav. Mkt (0.78)

$190,000

Unfav. Mkt (0.22)

-$190,000

Fav. Mkt (0.78)

Unfav. Mkt (0.22)

Fav. Mkt (0.27)

Unfav. Mkt (0.73)

Fav. Mkt (0.27)

Unfav. Mkt (0.73)

Fav. Mkt (0.5)

Unfav. Mkt (0.5)

Fav. Mkt (0.5)

Unfav. Mkt (0.5)

$90,000

-$30,000

-$10,000

$190,000

-$190,000

$90,000

-$30,000

-$10,000

$200,000

-$180,000

$100,000

-$20,000

$0

35

Resulting Decision

EMV of conducting the survey=$49,200

EMV of not conducting the survey=$40,000

So Getz should conduct the survey!

If the survey results are favourable, build

large plant.

If the survey results are infavourable, build

small plant.

36

Ex2: Ponderosa Record Company

Decide whether or not to market the

recordings of a rock group.

Alternative1: test market 5000 units

and if favorable, market 45000 units

nationally

Alternative2: Market 50000 units

nationally

Outcome is a complete success (all

are sold) or failure

37

Ex2: Ponderosa-costs, prices

Fixed payment to group: $5000

Production cost: $5000 and $0.75/cd

Handling, distribution: $0.25/cd

Price of a cd: $2/cd

Cost of producing 5,000 cd’s

=5,000+5,000+(0.25+0.75)5,000=$15,000

Cost of producing 45,000 cd’s

=0+5,000+(0.25+0.75)45,000=$50,000

Cost of producing 50,000 cd’s

=5,000+5,000+(0.25+0.75)50,000=$60,000

38

Ex2: Ponderosa-Event Probabilities

Without testing P(success)=P(failure)=0.5

With testing

P(success|test result is favorable)=0.8

P(failure|test result is favorable)=0.2

P(success|test result is unfavorable)=0.2

P(failure|test result is unfavorable)=0.8

39

Decision Tree for Ponderosa Record

Company

40

Backward Approach

41

Optimal Decision Policy

Precision Tree provides excell add-ins.

Optimal decision is:

Test market

If the market is favorable, market nationally

Else, abort

Risk Profile

Possible outcomes for the opt. soln.

$35,000 with probability 0.4

-$55,000 with probability 0.1

-$15,000 with probability 0.5

42

Risk Profile

for Ponderosa Record Co.

R isk P r ofile For P onder osa R ecor d C ompany

0.6

P rob a bility

0.5

0.4

0.3

0.2

0.1

0

- 70000

- 60000

- 50000

- 40000

- 30000

- 20000

- 10000

0

10000

20000

30000

40000

50000

Ex p e cte d V a lu e , $

43

Sensitivity Analysis

The optimal solution depends on many

factors. Is the optimal policy robust?

Question:

-How does $1000 payoff change with respect

to a change in

success probability (0.8 currently)?

earnings of success ($90,000 currently)?

test marketing cost ($15,000 currently)?

44

Application Areas of Decision

Theory

Investments in

research and development

plant and equipment

new buildings and structures

Production and Inventory control

Aggregate Planning

Maintenance

Scheduling, etc.

45

References

Lapin L.L., Whisler W.D., Quantitative Decision Making, 7e,

2002.

Heizer J., Render, B., Operations Management, 7e, 2004.

Render, B., Stair R. M., Quantitative Analysis for

Management, 8e, 2003.

Anderson, D.R., Sweeney D.J, Williams T.A., Statistics for

Business and Economics, 8e, 2002.

Taha, H., Operations Research, 1997.

46