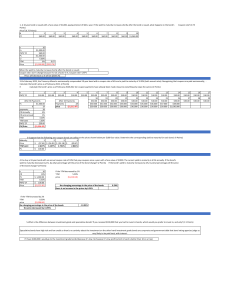

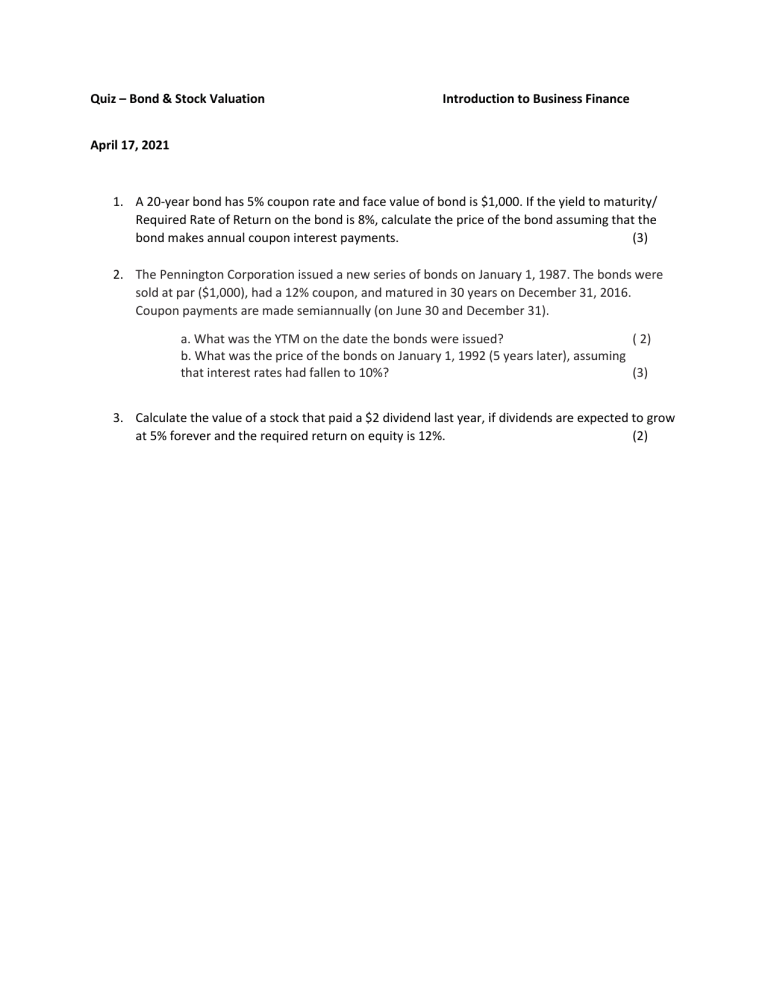

Quiz – Bond & Stock Valuation Introduction to Business Finance April 17, 2021 1. A 20-year bond has 5% coupon rate and face value of bond is $1,000. If the yield to maturity/ Required Rate of Return on the bond is 8%, calculate the price of the bond assuming that the bond makes annual coupon interest payments. (3) 2. The Pennington Corporation issued a new series of bonds on January 1, 1987. The bonds were sold at par ($1,000), had a 12% coupon, and matured in 30 years on December 31, 2016. Coupon payments are made semiannually (on June 30 and December 31). a. What was the YTM on the date the bonds were issued? ( 2) b. What was the price of the bonds on January 1, 1992 (5 years later), assuming that interest rates had fallen to 10%? (3) 3. Calculate the value of a stock that paid a $2 dividend last year, if dividends are expected to grow at 5% forever and the required return on equity is 12%. (2)