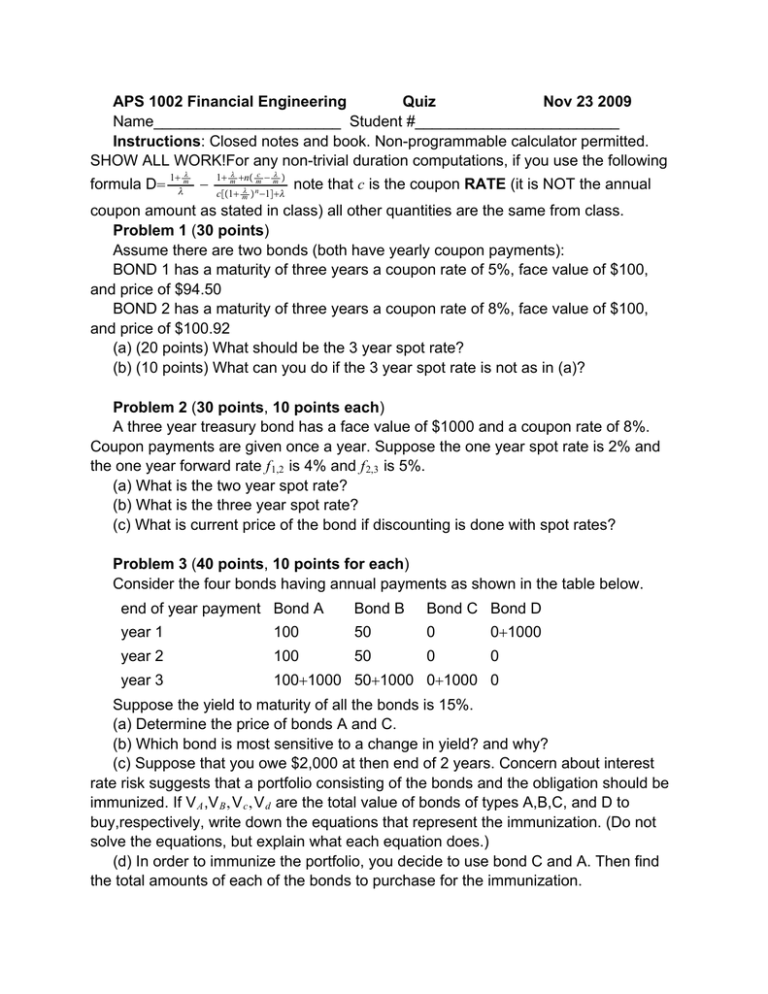

APS 1002 Financial Engineering Quiz Nov 23 2009

advertisement

APS 1002 Financial Engineering

Quiz

Nov 23 2009

Name______________________ Student #________________________

Instructions: Closed notes and book. Non-programmable calculator permitted.

SHOW ALL WORK!For any non-trivial duration computations, if you use the following

formula D

1 m5

5

"

1 m5 n mc " m5 c¡1 m5 n "1¢5

note that c is the coupon RATE (it is NOT the annual

coupon amount as stated in class) all other quantities are the same from class.

Problem 1 (30 points)

Assume there are two bonds (both have yearly coupon payments):

BOND 1 has a maturity of three years a coupon rate of 5%, face value of $100,

and price of $94.50

BOND 2 has a maturity of three years a coupon rate of 8%, face value of $100,

and price of $100.92

(a) (20 points) What should be the 3 year spot rate?

(b) (10 points) What can you do if the 3 year spot rate is not as in (a)?

Problem 2 (30 points, 10 points each)

A three year treasury bond has a face value of $1000 and a coupon rate of 8%.

Coupon payments are given once a year. Suppose the one year spot rate is 2% and

the one year forward rate f 1,2 is 4% and f 2,3 is 5%.

(a) What is the two year spot rate?

(b) What is the three year spot rate?

(c) What is current price of the bond if discounting is done with spot rates?

Problem 3 (40 points, 10 points for each)

Consider the four bonds having annual payments as shown in the table below.

end of year payment Bond A

Bond B

Bond C Bond D

year 1

100

50

0

01000

year 2

100

50

0

0

year 3

1001000 501000 01000 0

Suppose the yield to maturity of all the bonds is 15%.

(a) Determine the price of bonds A and C.

(b) Which bond is most sensitive to a change in yield? and why?

(c) Suppose that you owe $2,000 at then end of 2 years. Concern about interest

rate risk suggests that a portfolio consisting of the bonds and the obligation should be

immunized. If V A ,V B , V c , V d are the total value of bonds of types A,B,C, and D to

buy,respectively, write down the equations that represent the immunization. (Do not

solve the equations, but explain what each equation does.)

(d) In order to immunize the portfolio, you decide to use bond C and A. Then find

the total amounts of each of the bonds to purchase for the immunization.

?'ob\e^L

(or.,s+,u.f A o-r,r;po\

X = #-uY\r{s .f

(il

It l

b Or,n"

cfi,

DondL

gon,A

oS

=+u^i{s

:1

eq b - O

X!+

J

=

+t

[oo

too

xtoo

;*s

n

r3

-:

\;

3

ng

---'F'

l-

t?

IltsO

+ (::(too*1il

J

)-sL

-'--

d- 168*2_ =

!3.8

h ornJ

43,!

S-5 =

=

to()

Ct+sil

q 06O6

3,8 -" to u

_-"*f

e-35s

cJ,Scre fc?l

e;{

o(

C6r{\P1Urtal

ry

6,o6 nlo

uf

Co,rti\ oo

Co'nPou^d *i

1Proutr",^..

t lfi

t he bo*rotSL q^d\L

1+

*re

co mpsf1 *r

J ro^

C t5

{r"^

r'r-orhcf s i h*n

b ( VTL

(\ovtal

/A

'o+" +"/ l b{ f '

|

<P('l

n'^(Kc-l

It

^'k^t

yta+- 4E ft'

S Pt''tral< t(

C*rhA

'lor)

f,A

Ct't, {uot't€'wl

&*'cr{

^*-{ t'o^e(*f,q,fq-

h

,o, i"c

N-L '|

rclt.-1 \

P

fnb

{o

arQ

nvaf7'e

il*^-{ oH-#

ct^-a { b;"t '^1f

P rdb \e nc\L

wq-

tt

k

5rL

\t

5o

"or,n-/

(\ + s)'

-

Ct.kq)

WE

J

,t'

Sr=

CI

K nc'r^.|

\N L

(\ +sf

=

\rf.,3

(t usi

s{

rr'|-C\

(l+

\

lt'3

|

(

1,+t)t=

3

SoS3=

=3

c\-#

(t+*r.,)f\+5)t

I

!rl

'6-'l

I

.o$ (l,oz1?5^)' I

=

? o3 gS1

P.ablurt. L

ca

gO

80

=

l-ricc- ( L;; t**r9*

o

go+-roOo

" ai, Gfr

"3