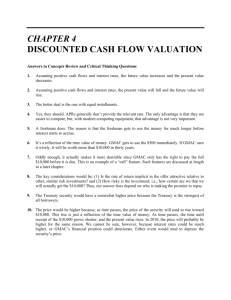

Chapter 4 homework

advertisement

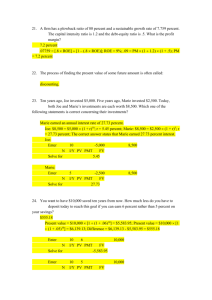

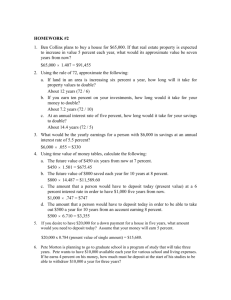

Fin 3322 Time Value of Money Homework 1. Your local travel agent is advertising an extravagant global vacation. The package deal requires that you pay $5,000 today, $15,000 one year from today, and a final payment of $25,000 on the day you leave two years from today. What is the cost of this vacation in today’s dollars if the discount rate is 6%? 5,000 + 15,000/1.06 + 25,000/1.06^2 = 41,400.85 2. The tax rates are as shown. Your firm currently has taxable income of $79,000. How much additional tax will you owe if you increase your taxable income by $30,000? Taxable Income Tax Rate $ 0 - 50,000 15% 50,001 - 75,000 25% 75,001 - 100,000 34% 100,001 - 335,000 39% Income will be $109,000 (100,000-79,000) = 21,000 * 0.34 = 7,140 (109,000 – 100,000) = 9,000 * 0.39 = 3,510 Tax obligation = 7,140 + 3,510 = 10,650 3. You are the beneficiary of a life insurance policy. The insurance company informs you that you have two options for receiving the insurance proceeds. You can receive a lump sum of $50,000 today or receive payments of $641 a month for ten years. You can earn 6.5% on your money. Which option should you take and why? N = 12 * 10 I/Y = 6.5% / 12 PV =? PMT = 641 FV =0 PV = 56,451.91 Take the payment option as it has a higher present value 4. Your employer contributes $25 a week to your retirement plan. Assume that you work for your employer for another twenty years and that the applicable discount rate is 5%. Given these assumptions, what is this employee benefit worth to you today? N = 52 * 20 I/Y = 5% / 52 PV =? PMT = 25 FV =0 PV = 16,430.54 5. You retire at age 60 and expect to live another 27 years. On the day you retire, you have $464,900 in your retirement savings account. You are conservative and expect to earn 4.5% on your money during your retirement. How much can you withdraw from your retirement savings each month if you plan to die on the day you spend your last penny? N I/Y PV PMT FV = 12 * 27 = 4.5% / 12 = 464,900 =? =0 PMT = 2,481.27 6. The Robertson Firm is considering a project which costs $123,900 to undertake. The project will yield cash flows of $4,894.35 monthly for 30 months. What is the rate of return on this project? N I/Y PV PMT FV = 30 =? = -123,900 = 4,894.35 =0 I/Y = 1.1325% But this is a monthly interest rate to get the Stated Annual Rate 0.11325 * 12 = 13.59% 7. Your insurance agent is trying to sell you an annuity that costs $100,000 today. By buying this annuity, your agent promises that you will receive payments of $384.40 a month for the next 40 years. What is the rate of return on this investment? N = 40 * 12 I/Y =? PV = -100,000 PMT = 384.40 FV =0 I/Y = 0.2875% But, this is a monthly interest rate to get the Stated Annual Rate 0.002875 * 12 = 3.45% 8. What is the future value of the following cash flows at the end of year 3 if the interest rate is 6%? The cash flows occur at the end of each year. Year 1 Year 2 Year 3 $5,180 $9,600 $2,250 5,180 * 1.06^2 + 9,600 * 1.06 + 2,250 = 18,246.25 9. What is the future value of the following cash flows at the end of year 3 if the interest rate is 9%? The cash flows occur at the end of each year. Year 1 Year 2 Year 3 $9,820 $0 $4,510 9,820 * 1.09^2 + 0 * 1.09 + 4,510 = 16,177.14 10. What is the future value of the following cash flows at the end of year 3 if the interest rate is 7.25%? The cash flows occur at the end of each year. Year 1 Year 2 Year 3 $6,800 $2,100 $0 6,800 * 1.0725^2 + 2,100 * 1.0725 + 0 = 10,073.99 11. The Bluebird Company has a $10,000 liability it must pay three years from today. The company is opening a savings account so that the entire amount will be available when this debt needs to be paid. The plan is to make an initial deposit today and then deposit an additional $2,500 a year for the next three years, starting one year from today. The account pays a 3% rate of return. How much does the Bluebird Company need to deposit today? N I/Y PV PMT FV =3 =3 =0 = 2,500 =? FV =7,727.25 The payments amount to 7,725.25 of the 10,000 needed in three years the remaining 2,272.75 (10,000-7,725.25) must come from the initial deposit. N I/Y PV PMT FV =3 =3 =? =0 = 2,272.75 PV = 2,079.89 12. If the stated rate of interest is 12% and it is compounded monthly, what is the effective annual interest rate? EAR = ((1 + 0.12/12)^12)-1 = 12.68% 13. Aunt Clarisse has promised to leave you an perpetuity that will pay $60 next year and grow at an annual rate of 4%. The payments are expected to go on indefinitely and the interest rate is 9%. What is present value of this promise? PV = 60/(0.09-0.04) = 1,200 14. You would like to have enough money saved to receive a growing perpetuity, growing at a rate of 4% per year, the first payment being $60,000, after retirement so that you and your family can lead a good life. How much would you need to save in your retirement fund to achieve this goal (assume that the growing perpetuity payments start one year from the date of your retirement. The interest rate is 8%)? PV = 60,000/(0.08-0.04) = 1,500,000 15. You would like to have enough money saved to receive a growing perpetuity, growing at a rate of 5% per year, the first payment being $100,000, after retirement so that you and your family can lead a good life. How much would you need to save each month if you plan on working an additional 15 years? Assume that the retirement contributions start next month, and that the first perpetuity payment occurs a year after retirement. The interest rate is 10%. First, we need the value of the perpetuity at retirement PV = 100,000/(0.10-0.05) = 2,000,000 Second, we need the payments that give us this future value N = 12 * 15 I/Y = 10 / 12 PV =0 PMT =? FV = 2,000,000 PMT =4,825.44