Multiple Choice (3 Points each) - Cal State LA

advertisement

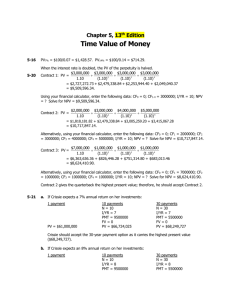

Fin 403 Sample Midterm 1 Multiple Choice (4 Points each): Suppose, two years ago, you purchased a 10-year a coupon bond paying 7% interest annually with a face value of $1000. It is now two years later and you just received an interest payment yesterday (the bond matures in exactly eight years). 1) You look in the paper and the yield on comparable debt is 6%, what is the bond currently worth? a) 1062$ b) 1073$ c) 1000$ d) 1063$ e) None of the above 2) If you bought it a Par value, did you have a capital gain or loss? Also, if the yield increased to 8%, would you have a Capital Gain or Loss, or could you tell? a) Capital Gain, Capital Gain b) Capital Gain, Capital Loss c) Capital Loss, Capital Gain d) Capital Loss, Capital Loss e) No Gain or Loss 3) What is the Current Yield? a) Less than 6% b) 6% to < 6.5% c) 6.5% to < 6.8% d) 6.8% to < 7% e) 7% or more C=7%=$70 FV=$1,000 Purchased at par value $1,000 2 years ago. There are 8 years to maturity and the yield is 6%, this bond pays coupon annually. 8 70 1,000 $1,062.10 i 1.068 i 1 1.06 Pr ice End Mode P/YR = 1 N=8 I/YR = 6 PMT = 70 FV = 1000 PV Under this assumption we have a capital gain, because our selling price higher than our purchase price, additionally we have received 2 coupons for $70 each. The current yield is 70 6.59% 1,062.10 Fin 403 Sample Midterm 1 Suppose that instead of buying the coupon bond, you invested in a ten-year zero-coupon bond with a face value of $2000. 4) If the bond was originally cost $1100, what was the yield on the bond when you originally purchased it? a) Less than 6% b) 6% to < 6.5% c) 6.5% to < 7% d) 7% to < 7.5% e) 7.5% or more 5) Suppose that today (two years later) comparable bonds are yielding 9%, if you sold the bond today, would you have a capital gain or loss? a) Capital Gain > $100 b) Capital Gain < $100 c) Capital Loss > $100 d) Capital Loss < $100 FV=$2,000 Price=$1,100 10 years to maturity. 1 2,000 2,000 10 1,100 ( 1 ytm ) ytm 6.16% (1 ytm) 10 1,100 After 2 years the yield (ytm) rise to 9%. We have just 8 years to maturity. 2,000 1,003.73 1.09 8 We get a capital loss because our selling price is $94.27 lower than our purchase price. Pr ice End Mode P/YR = 1 N=10 PV = 1,100 PMT = 0 FV = 2000 I/YR End Mode P/YR = 1 N=8 I/YR = 9 PMT = 0 FV = 2000 PV Fin 403 Sample Midterm 1 Compare the two bonds (the par versus the zero): 6) Assuming that the yields on the bonds are perfectly correlated (the yields move up and down together), which is more sensitive to a change in interest rates, and why? a) The par bond, because the coupon is smaller b) The par bond, because it makes a single payment c) The discount bond, because it has a higher yield d) The discount bond, because it makes several payments e) None of the above The lower the coupon, the more sensitive a bond is to changes in yield. The zero-coupon bond (assuming equal maturity) is the most sensitive because the entire weight of the bond is subject to the highest discount factor. 7) Which portfolio would be most sensitive to a change in interest rates A) five $1000, 5-year annual coupon bonds with a 10% coupon, B) a $5000, 5-year semi-annual coupon bond, with 10% coupons, or C) a $5000, 3-year annual coupon bond with a 10% coupon? a) A b) B c) C d) Can’t Tell 8) Which of these three portfolios is less sensitive then the bond described in question 1? (Sensitivity always refers to percentage change in value to a change in the interest rate, not total dollar change.) a) A only b) B only c) C only d) Two of these bonds e) All three A 10% coupon annual 5 years to maturity B 10% coupon semi annual 5 years to maturity C 10% coupon 3 years to maturity Portfolio A is the most sensitive. Portfolio B has the same coupon and maturity, but pays semiannually, thus it is less sensitive than Portfolio A (some of the coupon payments are subject to lower discounting exponents). Portfolio C has the same coupon, but a shorter maturity, therefore is less sensitive. Because the bond in question 1 has a lower coupon than all three (7%) and greater maturity than all three (8 years), all three bonds are less sensitive. Fin 403 Sample Midterm 1 Suppose that you wish to buy a new Mitsubishi Eclipse that will cost you $22,000. If you must put $5000 down, and will finance the rest at 6% APR for the next 60 months, paid at the beginning of each month. 9) What will your monthly payments be? a) 328.66 b) 283.33 c) 283.75 d) 327.02 e) None of the above 10) Suppose that you find out that given your credit, you should have only been charged an EAR of 5%, how much did you overpay because of dealer financing? a) Less than $350 b) 350 to 400 c) 400 to 450 d) 450 to 500 e) More than $500 11) Suppose that the dealer offers to lease you the car for $299/mo. for 60 months with $3,000 down, lease payments due at the beginning of the month. Assume that if you buy the car, the estimated value in five years will be $5,000. Should you lease or buy, and how much of an advantage does it provide you? (Assume that an APR rate of 6% is correct.) a) Buy, > $500 b) Buy, < $500 c) Lease, > $500 d) Lease, < $500 e) Doesn’t matter, the costs differ by less than $100. 12) How about if you should be charged 5% EAR? (Assume that the dealer is still offering the same payment terms above)? a) Buy, > $500 b) Buy, < $500 c) Lease, > $500 d) Lease, < $500 e) Doesn’t matter, the costs differ by less than $100. Fin 403 Sample Midterm 1 Note: solution using your calculator is explained for both P/YR = 1 and 12. Whenever P/YR > 1, the calculator divides I/YR by P/YR (therefore treating I/YR as an APR rate). Therefore, if you are using the EAR, you must first convert it to an APR rate. Answers: 9-12 Price of the car: $22,000, Down payment: $5,000 Period: 60 monthly payments at the beginning of each month. Rate: 6% APR (nominal, this means that the monthly rate is 6/12=0.5% per month) Therefore, the loan principal will be $17,000. Begin Mode 59 or: P/YR = 1 N=60 PV = 17,000 I/YR = .5 FV = 0 PMT PMT t t 0 1.005 17,000 The monthly payment will be $327.02 Begin Mode P/YR = 12 N=60 PV = 17,000 I/YR = 6 FV = 0 PMT 1 For a 5% EAR, the corresponding monthly rate is: rmonthly 1.0512 1 .00407 The present value of your annuity due payments at a 5% EAR is: Begin Mode 59 PV t 0 327.02 17,448.64 1.005t You Paid $22,448.64. The dealer made an extra $448.64 through financing. Lease vs. Buy at 6% APR: The PV of the lease at 6% APR is: 59 $299 $18,543.27 t t 0 1.005 PVLease 3,000 The PV of Purchasing is: $5,000 PVBuy 22,000 $18,293.14 1.00560 The PV of buying the car is $250.13 less. Since PMT = 0, it doesn’t matter whether you use the Begin or End mode—the begin mode only accelerates the PMT’s, it leaves the FV in place. Lease vs. Buy @ 5% EAR: The PV of the lease at 5% EAR: 59 $299 $18,951.74 t t 0 1.00407 PVLease 3,000 The PV of purchasing is: $5,000 PVBuy 22,000 $18,082.37 1.00407 60 The PV of buying the car is $869.37 less. or: P/YR = 1 N=60 PMT = 327.02 I/YR = .40712… FV = 0 PV Begin Mode P/YR = 12 N=60 PMT = 327.02 I/YR = 12×.40712… FV = 0 PV Begin Mode P/YR = 1 N=60 PMT = 299 I/YR = .5 FV = 0 PV Begin Mode P/YR = 12 N=60 PMT = 299 I/YR = 6 FV = 0 PV or: Begin/End Mode or: Begin/End Mode P/YR = 1 P/YR = 12 N=60 N=60 PMT = 0 PMT = 0 I/YR = .5 I/YR = 6 FV = 5,000 FV = 5,000 PV PV Begin Mode or: P/YR = 1 N=60 PMT = 299 I/YR = .40712… FV = 0 PV Begin/End Mode P/YR = 12 N=60 PMT = 0 I/YR = 12×.40712… FV = 5,000 PV Begin/End Mode or: Begin/End Mode P/YR = 1 P/YR = 12 N=60 N=60 PMT = 0 PMT = 0 I/YR = .40712… I/YR = 12×.40712… FV = 5,000 FV = 5,000 PV PV Fin 403 Sample Midterm 1 Suppose that you are 35 years old, and making retirement plans. You are starting to contribute $300 per month to your retirement account at the end of each month. You intend to do so until age of sixty, and then stop the contributions. You will retire at age 67 and want to know how much you’ll have saved. You receive a 12% APR compounded monthly on this account. 13) How much will you have if you allow interest to accrue to age 67? (K means 1000’s) a) < 1,280K b) 1,280-1,290K c) 1,290-1,300K d) 1,300-1,310K e) > 1,310K 14) Starting at age 67, what could you withdraw in terms of a monthly annuity until age 97, assuming you can get the same 12% APR on your money? a) < 12,500 b) 12,600-12,800 c) 12,800-13,000 d) 13,000-13,200 e) > 13,200 15) What could you withdraw in terms of a monthly perpetuity? a) < 12,500 b) 12,600-12,800 c) 12,800-13,000 d) 13,000-13,200 e) > 13,200 16) How about if you want an annual perpetuity, what could you withdraw at the end of each year? a) < 154,000 b) 154,000-157,000 c) 157,000-160,000 d) 160,000-163,000 e) > 163,000 17) If you wanted an annual perpetuity of $200,000, how much per month should you have originally computed? a) < $343 b) $ 343-350 c) $ 350-355 d) $ 355-360 e) >$ 360 Fin 403 Sample Midterm 1 Answers: 13-17 (35-0) 0 … 1 2 $300 $300 (60-0) 300 301 … $300 (67-0) 384 385 386 -PMT -PMT … -FV67 Since you can receive 12% APR compounded monthly, this corresponds to1% per month. Step 1: Compute the future value of your monthly annuity (25 years worth of pmts): 300 FV60 300 1.01t 563,653.99 t 1 Step2: Compute the value at age 67: FV67 1.0184 563,653.99 1,300,193.47 P/YR = 1 N=84 PMT = 0 I/YR = 1 PV = 563,653.99 FV Step 3: Compute the payments for a 30 year monthly annuity: 360 1,300,193.47 t 1 End Mode or: End Mode P/YR = 1 P/YR = 12 N=300 N=300 PMT = 300 PV = 300 I/YR = 1 I/YR = 12 PV = 0 PV = 0 FV FV PMT 1.01t P/YR = 1 N=360 PMT = 0 I/YR = 1 PV = 1,300,193.47 FV PMT = $13,373.95 Step 4: Compute the payments for a corresponding perpetuity: PMT .011,300,193.47 $13,001.93 Step 5: Compute the payments for an annual perpetuity, assuming 12% APR, monthly compounding: EAR 1.0112 1 .126825 PMT .126825 1,300,193.47 $164,897.07 (17) I am asking you to work the problem backward. For a perpetuity of $200,000 per year starting at age 67 (end of year), you need to have the following savings: PV67 200,000 $1,576,975.77 .126825 Present valuing to age 60, and computing the corresponding payments: $1,576,975.77 PV60 683,643.40 1.0184 300 PMT 1.01 t t 1 683,643.40 , or PMT 363.86 P/YR = 1 N=300 PV = 0 I/YR = 1 FV = 683,643.40 PMT P/YR = 1 N=84 PMT = 0 I/YR = 1 FV = 1,576,975.77 PV Fin 403 Sample Midterm 1 Assume that you are using the dividend discount model (the Gordon Model) to value stock. The stock currently pays no dividends, but expected to begin paying dividends $5 per share in five years. 18) Compute the value of a stock paying no dividends today, but that is expected to pay annual dividends of $5 starting in 5 years. At that time dividends are expected to grow at a constant rate of 10%, and the firm’s cost of equity is 15%. a) < $60 b) $65-70 c) $70-75 d) $75-80 e) >$80 19) If instead, the firm’s stock was to pay a constant annual dividend of $5 starting in year 5, how would you value that stock? a) < $10 b) $10-14 c) $14-18 d) $18-22 e) >$22 20) Suppose the stock is expected to grow at a rate of 30% for the first two years that it pays dividends, than slows to a long-term growth rate of 10%, how much is that stock worth today? a) < $60 b) $65-70 c) $70-75 d) $75-80 e) >$80 Fin 403 Sample Midterm 1 Answers: 18-20 5 $100 .15 .10 100 $57.17 PV at the firm’s cost of capital to determine its price: P0 1.15 4 (17) First, compute the value of the stock in year 4: P4 5 $33.33 .15 33.33 $19.06 Likewise, discounting at the firm’s cost of capital: P0 1.15 4 (18) If the stock is paying a constant dividend: P4 (19) A stock growing at 30% for the first two years, and 10% thereafter will pay the following dividends: 0 1 2 3 4 5 5.00 6 6.50 7 8.45 8 9 1 8.45(1.1) 8.45(1.1) 10 2 … The first step is to present value the growing annuity which begins in year 8, back to year 7. Then, combining it with the period 7 dividend, present-value the remaining CF’s: 8.451.10 P7 $185.90 .15 .10 P0 5.00 6.50 8.45 185.90 78.36 1.155 1.156 1.157 Using the Cash-Flow Function: P/YR = 1 CFj = 0 Nj = 5 CFj (5) = 5.00 CFj (6) = 6.50 CFj (7) = 194.35 I/YR = 15 NPV (Otherwise, PV the cash-flows individually) Fin 403 Sample Midterm 1 Compute an amortization schedule for a $50,000, 10 year annual amortization loan, paying 10%. Payments are to be made at the end of each year. 21) How much interest will you pay in the second year? a) < 4,500 b) 4,500-4,550 c) 4,550-4,600 d) 4,600-4,650 e) > 4,650 22) Suppose that you in the second year, you are only able to pay $6,000. How much principle will remain after that payment? a) < 45,500 b) 45,500-46,000 c) 46,000-46,500 d) 46,500-47,000 e) > 47,500 23) If as in the previous question, you paid only $6,000 in the second year, and the loan is restructured at an 11% rate so that it still amortizes by the 10th year, what will your remaining eight payments be? a) < 7,500 b) 7,500-8,000 c) 8,000-8,500 d) 8,500-9,000 e) > 9,000 24) If instead the loan was originally structured with a $20,000 balloon payment in the tenth year, what would be the remaining nine payments? a) < 6,500 b) 6,500-6,800 c) 6,800-7,100 d) 7,100-7,400 e) > 7,400 25) How much of that 10th year balloon payment would be principle? a) < 8,000 b) 8,000-10,000 c) 10,000-12,000 d) 12,000-14,000 e) > 14,000 Fin 403 Sample Midterm 1 Answers: 21-25 First, solve for payments: 10 PMT 50,000 i i 1 1.10 PMT = $8,137.27 N = 10 I/YR = 10 PV = 50,000 FV = 0 PMT (21) Amortization Table (first 4 of 10 payments) Beginning Balance Interest Principle Payment Remaining Balance 1 2 3 4 50,000.00 (5,000.00) (3,137.27) ($8,137.27) $46,862.73 (4,686.27) (3,451.00) ($8,137.27) $43,411.73 (4,341.17) (3,796.10) ($8,137.27) $39,615.64 (3,961.56) (4,175.71) ($8,137.27) $46,862.73 $43,411.73 $39,615.64 $35,439.93 (22) If in year 2, only $6,000 is paid, then only 6,000 – 4,686.27 = 1,313.73 in principle is paid, and the remaining balance is 46,862.73 – 1,313.73 = 45,549. (23) To restructure the loan to fully amortize over the same period: 8 N=8 PMT 45,549 I/YR = 11 i PV = 45,549 i 1 1.11 FV = 0 PMT = 8,851.12 PMT (24) A balloon payment cannot be put into FV because your calculator computes PMT assuming a PMT is added to it. Therefore, you must first compute the PV of the balloon payment, subtract it from the original principle and compute the remaining nine payments. $20,000 PV 7,710.87 1.1010 10 50,000 7,710.87 i 1 PMT 1.10 i PMT=6,882.36 (25) Since your amortization function doesn’t work for this situation, just use logic. If the final payment is $20,000, then at the beginning of year 10 (end of year 9), there must have been an amount of principle that would grow to $20,000 at the end of the year. Therefore, principle is: $20,000 PV9 $18,181.82 1.10