What is Direct Deposit

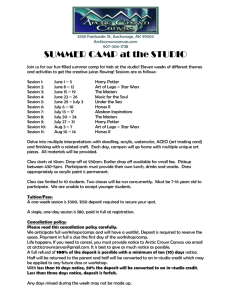

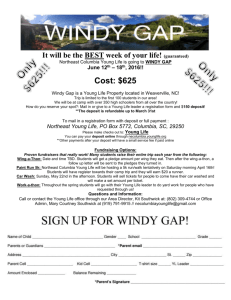

advertisement

Session #303 What is Direct Deposit? Direct Deposit is the most widely used electronic payment. In 2005, 4.4 billion payments were made using Direct Deposit, a 5.1 percent increase over the previous year. As many as 145 million Americans use Direct Deposit to receive their pay or government benefits. More than half of federal tax refunds are received through Direct Deposit (52 million in 2005, a 7 percent increase over 2004). And close to 80 percent receive their Social Security benefits through Direct Deposit. Did you know that Direct Deposit has been around for almost 40 years? It has a proven record of success - 97% of people who get paid via Direct Deposit are satisfied with it. How does Direct Deposit work? 1. Sign Up - Sign up for Direct Deposit. Complete an enrollment form to authorize a company to make a Direct Deposit into one or more of your accounts. Authorization forms may vary slightly from company to company, but the required information is the same. 2. Test - The company making the Direct Deposit may perform a test run with no dollar amount to make sure the account numbers have been recorded correctly. 3. Process - The company processes the payment by Direct Deposit - in banking terms, this is known as an ACH transaction. 4. Post - Your financial institution credits your account and the transaction is reported on your monthly account statement. 5. Confirm and Verify - The company will provide a paper or electronic confirmation of the Direct Deposit. This will confirm the date of the deposit and will include deductions and the net payment amount. If you want further information or a confirmation of your deposit from your financial institution, you may call them or go online, as you would for any banking transaction. 1 Fast Facts about Direct Deposit Direct Deposit is the electronic transfer of a payment from a company or organization into an individual's checking or savings account. Direct Deposit is ideal for more than just payroll and can be used for expense reimbursements, tax refunds, pensions, dividends and bonuses. Most large companies (500+ employees) offer Direct Deposit, and it has become a staple in today's employee benefit packages. Businesses of any size can offer Direct Deposit. Businesses of less than 100 employees still can save more than $5,000 per year by offering Direct Deposit to their employees (Tinucci 2003). Many payroll software packages, as well as independent processors, provide a Direct Deposit feature. Employees who use Direct Deposit can access their pay in their accounts at their financial institution's opening of business on payday - there is no waiting for checks to clear. For income tax refunds, the government often makes refunds via Direct Deposit within days of receiving returns. Problems with Direct Deposit are very rare. The chance of having a problem with a check is much greater than with Direct Deposit. Many more people see a check increasing the chances of check fraud or identity theft. Ninety-seven percent (97%) of those who use Direct Deposit are very satisfied with it. Three out of four employees who have Direct Deposit available use it. In 2005, 68 million taxpayers e-filed their taxes and more than 52 million received their refunds by Direct Deposit. Businesses can save anywhere from $0.50 to $1.25 per payment by using Direct Deposit instead of checks. Many financial institutions offer free checking or other account benefits to consumers who use Direct Deposit. Direct Deposit uses the same levels of security that companies and the government use to transfer funds to each other - your money is safer with Direct Deposit. 2 Setting up Direct Deposit in “The Construction Manager” 1. Go to the General Ledger module a. Work on Bank Accounts b. Choose you bank account. (This must be your actual bank account number in order for Direct Deposit to work correctly from this account) 3 2. 3. 4. 5. 6. 7. 8. c. You need to check the box used for Direct Deposit d. Then you must enter a number in Starting Advice (It does not matter what number you enter at this time it can be changed at the time payroll is run) Now go to the System module Set up Tab Work on Companies Work on Company Information Payroll Setup Go to the Options Tab Check Companies uses Direct Deposit 4 9. 10. Then go to the Direct Deposit Tab Fill in the required information. (The transit number is your bank routing #) 11. Choose your template format. This is the NACHA file format that your bank uses. This information has to be provided by the bank. You may need to 5 12. refer to your AMSI support rep (either Tampa or your VAR/Reseller) for assistance in choosing which template fits your banking institution. Now you are ready to setup your employees for Direct Deposit. a. Go to Payroll b. Setup Tab c. Work on Employees d. Work on Employees Information e. Choose an employee f. Go to the Pay Tab g. Put a check mark in the Direct Deposit box. 13. Then go to the Direct Deposit Tab 6 14. Choose “New” 15. Now fill in the Employees banking information. a. Type is either Checking or Savings b. Calc Method is either Amount, Percentage or Balance c. You can have multiple distributions of a pay check d. RE: $50 or 10% to savings and balance to Checking e. Please note calc order for the balance is 99 it is always the last item 7