BUY-SELL AGREEMENTS

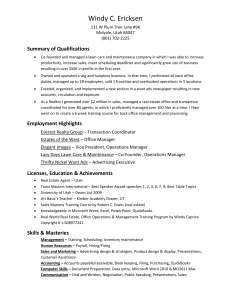

advertisement

BUY-SELL AGREEMENTS ESTABLISHING A VALUE FOR A CLOSELY HELD BUSINESS INTEREST LAKE COUNTY ESTATE PLANNING COUNCIL BARRY P. SIEGAL Barry P. Siegal Stahl Cowen Crowley Addis LLC 55 W. Monroe, Suite 1200 Chicago, IL 60603 312-377-7860 312-423-8178 (fax) 633 Skokie Boulevard Suite 480 Northbrook, Illinois 60062 Tel: 847-480-4638 Fax: 847-509-9263 bsiegal@stahlcowen.com 1 Scca/99999.008/Doc#82/Speech for Lake County Estate Planning Council A. INTRODUCTION 1. Business Succession Planning is a critical element to the survival of closely-held businesses. It is estimated that fewer than one-third (1/3rd) of familyowned businesses survive through the second generation and less than ten percent (10%) through the third. One of the primary reasons for this is inadequate planning for the owner’s death or retirement. 2. One of the principal tools which is utilized in insuring the continuation of the closely-held business in the Shareholders Agreement, in the case, of a corporation, or the operating agreement, with buy-sell provisions, in the case of a limited liability company. 3. Why is the need for a buy-sell agreement as an integral part of a succession plan so obvious? A buy-sell agreement, if it is openly and intelligently negotiated provides a framework for determining the manner in which an ownership interest in a closely held business is transferred to family members or co-owners in the event of a triggering event. If there is a “buy-in” by all interested parties, then it will minimize any wrangling or arm twisting upon the occurrence of a “triggering event.” “Triggering Events” can include death, disability, retirement or termination of employment of an owner or a proposed voluntary or involuntary transfer of an ownership interest. B. ESTABLISHING A PURCHASE PRICE 1. Once the parties to the buy-sell agreement agree that some form of buy-out of an owner’s interest is required, the most difficult issue which they face is determining the purchase price for the owner’s shares. 2. Business owners, especially in family-owned business settings have in the past attempted to use buy-sell agreements as a means of transferring a controlling interest in the business to younger family members by establishing an arbitrarily low buy-out price upon the death of the senior family member. 3. Historically, the purchase price established by a Shareholders Agreement with respect to the purchase of shares from a deceased Shareholder’s estate established the market value for Federal Estate Tax purposes if certain conditions were met. 2 Scca/99999.008/Doc#82/Speech for Lake County Estate Planning Council a. If the Agreement restricted the sale of stock during lifetime and at death and was between unrelated individuals, the agreed purchase price was normally binding on Internal Revenue Service. See Broderick v. Gore (55-2 USTC ¶ 11, 555). b. Treasury Regulations (§ 20.2031-2(h)) also provide that the agreement must be a bona fide business arrangement and not a device for passing the decedent’s shares to the natural object of his bounty for less than adequate and full consideration. c. In St. Louis County Bank v. U.S., (82-1 USTC 13,459) the shares of a closely held corporation were owned by Mr. Sloan (265 shares) and his children (201 shares). The agreement provided for a right of first refusal in the event of a voluntary lifetime transfer as well as an option to purchase the shares of a deceased Shareholder at a formula price equal to ten times the average annual net earnings for the previous five years. At the date of Mr. Sloan’s death, the average annual net earnings for the prior five years was $0. The Corporation exercised its option to repurchase the Shares for $0. Although the District Court held that the Agreement had a valid business purpose and provided for a reasonable price, the Court of Appeals held that under the circumstances presented, including the health of the testator at the time of the agreement and the discrepancy between the purchase price and book value, “a reasonable inference could be drawn that the agreement was testamentary in nature and a device for the avoidance of estate taxes.” The decision was, therefore, reversed and remanded. 4. Applicability of IRC Section 2703. a. Purpose of this provision was to prevent a business owner from creating an artificially low value for estate tax purposes by providing for a purchase price in the Shareholders Agreement that was lower than the actual market value. b. Section 2703 will apply (and buy-sell value will be disregarded) unless the agreement: 3 Scca/99999.008/Doc#82/Speech for Lake County Estate Planning Council (i) (ii) (iii) is a bona fide business arrangement; is not simply a device to transfer stock to natural objects of bounty for less than full and adequate consideration; its terms (including valuation determination) are comparable to similar arrangements entered into by persons in an arms-length transaction. c. Bona fide business arrangement. To satisfy the “bona fide business arrangement” test, the arrangement must bear some nexus to a business and not be motivated simply by estate tax transfer savings. Courts have held hat maintaining control and management of the business in the existing owners is a legitimate business purpose. d. Device to transfer business. (i) The second test is related to the first test and depends on the circumstances surrounding the execution of the agreement. Clearly, this test applies predominately when the parties to the agreement are related and the purchase price and/or terms of payment for the older parties shares in the event of death are more favorable than what unrelated parties might agree upon. (ii) The lead case on the topic is Estate of Lauder v. Comm. TC Memo 1992-736(1992). There the decedent, Joseph Lauder, who along with his wife, Estee Lauder, and founder of the world famous cosmetic company, was subject to a Shareholders Agreement which restricted the transfer of shares during lifetime and required the estate of a deceased Shareholder to sell his or her shares back to the Company at a price set by a formula based on book value, with certain adjustments, in particular the exclusion of any factor for intangibles, including the company name. When the taxpayer died the estate valued his shares on the basis of the Agreement which resulted in a date of death value of $29,000,000. The IRS disagreed on the basis that the Agreement was not binding and established a value of $89,500,000. The Tax Court agreed with the Service and held that the Agreement was a device for transferring the business to family members at a discount. Critical to the court’s decision was the fact that the purchase price was arrived 4 Scca/99999.008/Doc#82/Speech for Lake County Estate Planning Council at without any negotiation (and indeed, by one of Joseph’s sons without Joseph’s input) and without a formal appraisal. e. Comparable to arms length transaction. (i) A right or restriction is treated as comparable to similar arms-length transactions if “the right or restriction is one that could have been obtained in a fair bargain among unrelated parties in the same business dealing with each other at arms length.” Treas. Reg. §25.27031(b)(4). Whether the agreement is comparable requires consideration of such factors as the term of the agreement, market value, and adequacy of any consideration given in exchange for the rights. (ii) Perhaps it can be said, where Shareholders are not related, the terms of a buy-sell agreement can be presumed to constitute a bona fide business arrangement and to be the result of armslength negotiations, if the methodology for determining the purchase price is reasonable. (iii) In Estate of Blount v. Comm. TC Memo, 2004-116 (May 12, 2004) the Tax Court rejected the purchase price established under a Shareholders Agreement entered into by two brothersin-law, each of whom owned 50% of a closely-held business. The Agreement provided for a right of first refusal during lifetime and required a purchase of the shares of a deceased shareholder at a price set by the Agreement. The decedent during his lifetime had acquired a controlling interest in the Company and had along with the Company changed the price and terms of a redemption at death. The Eleventh Circuit Court of Appeals affirmed the Tax Court decision in rejecting the testimony of an independent appraiser since he failed to take into consideration “non-economic factors that would lead to truly comparable transactions.” (iv) In the Estate of Amlie V. Comm, TC Memo 2006-76 (April 17, 2006) the decedent left her estate equally to her daughter and her two sons, but allocated a certain portion of her stock in First American Bank Group to a trust established for her son, Rod. In addition, Rod’s trust was given the right to buy the balance of the bank stock. The taxpayer became incapacitated 5 Scca/99999.008/Doc#82/Speech for Lake County Estate Planning Council and in 1991 her conservator entered into a Shareholders Agreement, prohibiting a lifetime sale to a third party without offering the shares to the Company. The Agreement also established: (i) put options so the Shareholder at death at book value and (ii) call options in the company for one year after death at the same price. Subsequently, in 1995 the Agreement was modified and an adjustment to the price was established by the Court in a Family Settlement Agreement at $118 per share. However, a subsequent Agreement between Rod’s trust and the Company obligated the Company to buy the trusts shares for $217.50 share upon the death of a Shareholder. Upon the decedent’s death, the estate reported the stock at a value of 118 per share or $993,000. The shares were, in fact sold back to the Company for $1,447,000. The balance of the funds received by Rod’s trust was reported as a capital gain. The Tax Court held that the 1995 Agreement established the fair market value for the shares. It stated that it met the requirements of Section 2703, and in particular, its terms were comparable to similar arrangements entered into by person’s in an arms length transaction. Although the estate’s expert merely pointed to an earlier “arms length” agreement between the decedent’s conservator and the Bank, the court held that this was sufficient. It stated that the terms reached in the earlier agreement was based on a survey of comparables and that the conservator had sought professional advice from a valuation specialist. C. APPROACHES FOR DETERMINING PURCHASE PRICE. 1. No one valuation formula is equally appropriate for all businesses. 2. Appraised Value (as of the triggering event). a. This approach may eliminate future disagreement regarding the methodology the determining value but lacks predictability. Therefore, it is difficult to prefund the purchase price. 6 Scca/99999.008/Doc#82/Speech for Lake County Estate Planning Council b. If this approach is utilized, it is important to carefully set for the parameters for determining value; i.e.: how many appraisers, qualifications, what factors to consider, etc. 3. Periodic Agreed Value. a. Under this approach the Shareholders agree on a set price, either as a result of an independent appraisal or some enunciated formula, and agree to meet annually to redetermine value of shares. b. This approach allows for a meeting of the minds, provided that parties actually review the value on a periodic basis. c. If the parties are related, it is imperative that the basis for the valuation be set forth in writing. d. Main problem is when owners either don’t meet or fail to agree on a new value. If there is no fall-back position, then most recent value applies which probably doesn’t reflect the true value of the Company. 4. Formula Approach. This is most practical approach if the formula used is realistic. a. Book Value (i) Book value per share is determined by dividing the entity’s net worth (assets less liabilities) into the number of outstanding shares or units; (ii) Book value approach has limited appeal since “book value” is a historic not actual figure, unless assets are adjusted to current value (e.g. marketable securities and real estate should be adjusted to actual value); (iii) Book value normally does not take into consideration good will; (iv) Book value is normally not a realistic approach for S corporations and limited liability companies since 7 Scca/99999.008/Doc#82/Speech for Lake County Estate Planning Council earnings may be distributed to owners and book value remain static even with growing company. b. 5. Capitalized Earnings or Cash Flow. (i) Determined by multiplying the average earnings or cash flow for a given period by a specified capitalization rate; (ii) Adjustments to earnings are necessary for extraordinary items and excess compensation to owners; (iii) Formula is usually based on a weighted average of cash flow to take into account trend of increased or decreased earnings; (iv) Abnormal or non-recurring items such as changes in accounting methods, unusual gains or losses, or heavy retirement plan contributions must be considered. (v) The capitalization rate is the most important aspect of this approach. It is based on the rate of return a hypothetical investor would expect. Typically, the best guide to determining a cap rate is the sales price for comparable companies. This may be difficult to determine. Combination Approach. a. one alternative is the last agreed value unless there has been no agreement for given period of time (e.g.: 12 months), then use last value plus or minus change in Company’s net worth as fall-back to formula approach. b. another possibility is a hybrid of the above methods, such as book value plus X times average cash flow for the prior five years. D. IMPORTANCE OF PERIODIC APPRAISALS. 1. The owner of a business typically does not have adequate information to provide realistic value. 8 Scca/99999.008/Doc#82/Speech for Lake County Estate Planning Council 2. If shareholders are unrelated and they can agree on a valuation approach, appraisal may not be necessary, although appraisal provides an objective approach to fixing the purchase price or setting the formula. 3. realistic. Appraisal need not be done every year – 3-5 years usually more 4. Use of periodic appraisal may help satisfy the requirements of Sec 2703(b)(1). 9 Scca/99999.008/Doc#82/Speech for Lake County Estate Planning Council