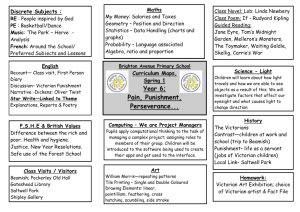

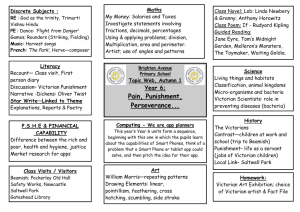

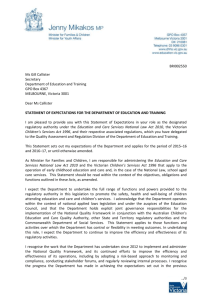

Victorian skill needs in 2011 - Department of Education and Early

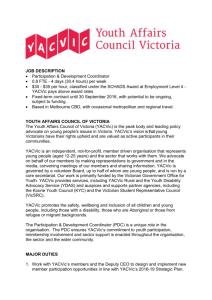

advertisement