Please make changes in yellow highlight

advertisement

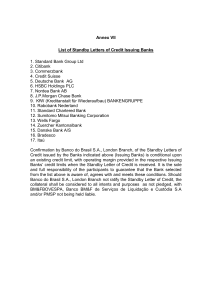

Rebuilding Trust with Your Customers Daniel Llambias CEO Banco de Galicia y Buenos Aires S.A. Our company, our bank, as any financial system, was greatly affected by the crisis of 2001, 2002, which was clearly a very particular crisis that affected Argentina alone and not global markets. The banks had to rebuild their relationship with the customer. The customer saw the bank as an enemy, as someone who was only after taking away part of their savings or their earnings; that whatever one left in the bank would be appropriated and never returned. Therefore, two things had to be done. First, we had to regain credibility with the public that banks were safe, that they were well prepared to receive savings without any problems. Second, we had to reinforce the image of the brands and start to show that banks too effectively give back what their customers give the banks, which is what customers expected from the banks. Hence, in 2003 we started working energetically towards the repositioning of our brand. Luckily—and due to the bank’s history at that time of almost 100 years since its opening in Argentina with the very same capital, with the same majority shareholders—we had a strong national presence, by which this brand was perhaps easier to redeem in the marketplace. What we sought was not just to help reposition the brand, but to help with real actions. Therefore, we started doing something that was perhaps unheard of in other parts of the world, and that still today might be unheard of elsewhere, and which in Argentina worked very well to generate a new empathy between the customer and the bank. It was through credit cards that we started to befriend the customers, offering instant and tangible benefits. When a customer in Argentina would pay via credit card at selected stores, for selected items, or in certain segments within the economy, he would receive a discount or the opportunity to finance his purchase through installments without interest. This plan obviously had a cost to the bank’s income, but frankly, we were compensated by gains in two respects: first, in reinforcing and enhancing the brand’s image—today our bank has one of the highest reputations in Argentina—and second, by making the client feel that having a credit card from our bank is an added benefit; that it has the same benefits as any card from the other banks, but it has a few more too. That little bit extra is what we converted over the last few years into our advertising slogans, which end with ‘a little more every day’; meaning, give back more to the customer every day. That brought about a very important growth in customer-base. Today, the bank has approximately 2 million customers. At the end of the crisis we had around eight or nine hundred thousand customers. Hence, these were successful plans which perhaps at another time would not have been applied, but which, in extreme circumstances such as that crisis, were forcefully put forward and had remarkable success. What is the lesson to be learned? To break off from archaic traditions. Even today, when one speaks to any banker from another part of the world, he’d say, “That is illogical for one to give back or to offer discounts on purchases made by customers.” Yes, it is illogical, but we have proved that this definitely improves the entire relationship with the customer, that the bond between the customer and the bank was reinforced, and that the bank’s income was much better and much larger.