assembly floor analysis

advertisement

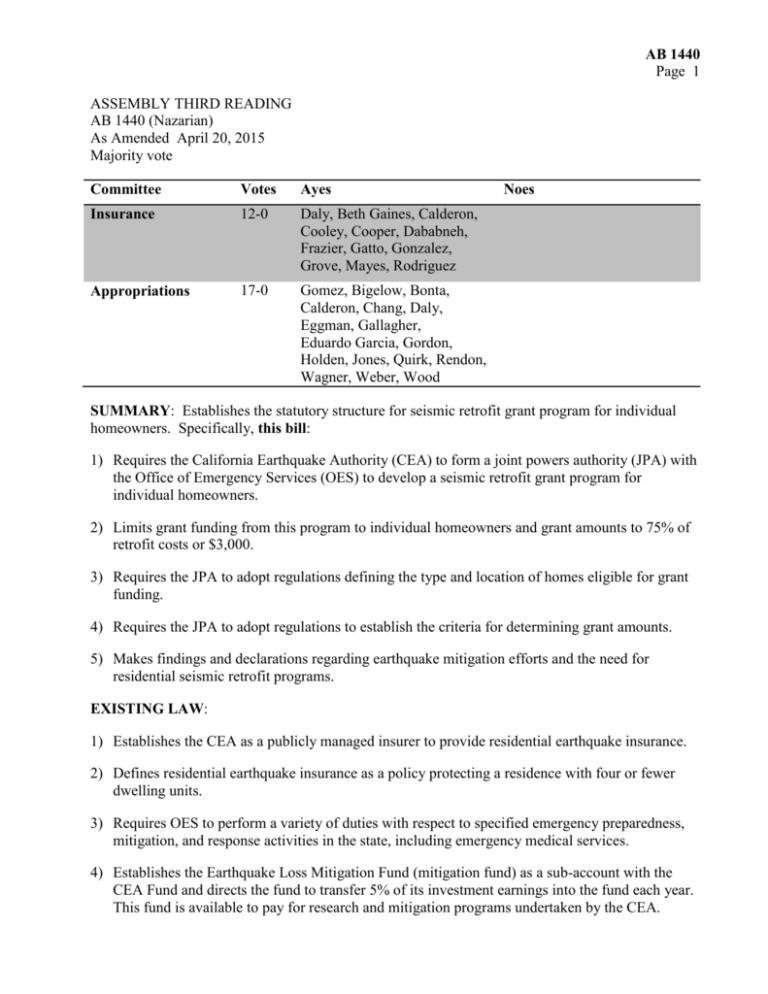

AB 1440 Page 1 ASSEMBLY THIRD READING AB 1440 (Nazarian) As Amended April 20, 2015 Majority vote Committee Votes Ayes Insurance 12-0 Daly, Beth Gaines, Calderon, Cooley, Cooper, Dababneh, Frazier, Gatto, Gonzalez, Grove, Mayes, Rodriguez Appropriations 17-0 Gomez, Bigelow, Bonta, Calderon, Chang, Daly, Eggman, Gallagher, Eduardo Garcia, Gordon, Holden, Jones, Quirk, Rendon, Wagner, Weber, Wood Noes SUMMARY: Establishes the statutory structure for seismic retrofit grant program for individual homeowners. Specifically, this bill: 1) Requires the California Earthquake Authority (CEA) to form a joint powers authority (JPA) with the Office of Emergency Services (OES) to develop a seismic retrofit grant program for individual homeowners. 2) Limits grant funding from this program to individual homeowners and grant amounts to 75% of retrofit costs or $3,000. 3) Requires the JPA to adopt regulations defining the type and location of homes eligible for grant funding. 4) Requires the JPA to adopt regulations to establish the criteria for determining grant amounts. 5) Makes findings and declarations regarding earthquake mitigation efforts and the need for residential seismic retrofit programs. EXISTING LAW: 1) Establishes the CEA as a publicly managed insurer to provide residential earthquake insurance. 2) Defines residential earthquake insurance as a policy protecting a residence with four or fewer dwelling units. 3) Requires OES to perform a variety of duties with respect to specified emergency preparedness, mitigation, and response activities in the state, including emergency medical services. 4) Establishes the Earthquake Loss Mitigation Fund (mitigation fund) as a sub-account with the CEA Fund and directs the fund to transfer 5% of its investment earnings into the fund each year. This fund is available to pay for research and mitigation programs undertaken by the CEA. AB 1440 Page 2 5) Allows public agencies to form JPAs for the exercise of shared powers. FISCAL EFFECT: According to the Assembly Appropriations Committee: 1) The creation of the program in statute, by itself, does not have state costs, as the program would only be operational if the Legislature appropriates funds. The California Earthquake Authority (CEA) is privately funded and the current grant program is funded by a portion of CEA investment income. 2) However, creation of the program in statute, coupled with legislative findings, imply the availability of state funding for the program. COMMENTS: 1) Purpose. According to the author, only 12% California homeowners have earthquake insurance, but there are between 1.2 million to 1.6 million pre-1940s homes with so called "cripple walls," and homes on hillsides, and those with living space over garages that are at serious risk in even a minor quake, let alone a major one. California has an existing seismic mitigation incentive program called Earthquake Brace + Bolt (EBB), which is administered by the California Residential Mitigation Program, but is limited to only 650 homes in the Bay Area, LA County and Napa. The goal of this legislation is to expand on Brace + Bolt and create a statewide earthquake retrofit program to cover tens of thousands of more homes. 2) Brace + Bolt. The EBB program was created by the California Residential Mitigation Program, which is a joint power authority between the California Earthquake Authority and the Governor's Office of Emergency Services. The EBB was developed to help homeowners lessen the potential for damage to their houses during an earthquake. A residential seismic retrofit strengthens an existing house, making it more resistant to earthquake activity such as ground shaking and soil failure, by bolting the house to its foundation and adding bracing around the perimeter of the crawl space. The EBB program provides homeowners up to $3,000 to strengthen their foundation and lessen the potential for earthquake damage. A typical retrofit may cost between $2,000 and $10,000 depending upon the location, the size of the house, and the amount of work involved. 3) California Earthquake Authority. The CEA was formed through legislation in 1995 and 1996 to address an insurance-availability crisis that followed the 1994 Northridge earthquake. After that earthquake, many homeowners found it difficult or impossible to find basic homeowner's insurance. Many others were faced with the prospect of having their homeowners' insurance non-renewed as insurance companies tried to shed their exposure to earthquake risk. Because state law requires insurers to offer earthquake insurance to their applicants and holders of residential policies, the insurers’ retreat from the California market resulted in an availability crisis for both homeowners and earthquake insurance. The Department of Insurance reported in the summer of 1996, at the height of the crisis, that 95% of the homeowners' insurance market had either stopped, or severely restricted, sales of new homeowners' policies. After the CEA began operations in December 1996, the California homeowners' insurance market recovered quickly. A Department of Insurance report noted that at the peak of the availability crisis, 82 insurers had restricted the sale of new homeowners' insurance policies. By October 1997, only three insurers were restricting the sale of new policies. Since that time, the requirement to offer earthquake insurance has not been a factor in restricting the availability of homeowners' insurance. Analysis Prepared by: Paul Riches / INS. / (916) 319-2086 FN: 0000954