1. The principal advantages to a lessee in leasing rather than

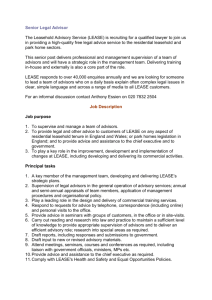

advertisement