Stanley Fishbein, LFC Capital

Stanley S. Fishbein, J.D., LL.M. (Tax),

Managing Director

LFC Capital, Inc.

www.lfccapital.com

A lease is a contract through which an owner of property (Lessor) conveys to another party

(Lessee) the right to use the property for a period of time (Term) in return for a consideration (typically a periodic payment).

A usage agreement.

Not borrowing money (No stated interest rate).

Real or personal property.

Capital Lease or Operating lease

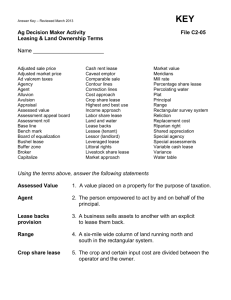

Financial Accounting Standards Board

Statement No. 13 (FASB 13): Capital Lease if:

1. Automatic transfer of title to Lessee at end of lease term.

2. Lease contains a bargain purchase option.

3. Lease term greater than 75% of properties economic useful life.

4. Present value of minimum lease payments equal or greater than 90% of property’s FMV.

FASB and IASB Lease Accounting Proposal

Nontax Lease or Tax Lease (aka true lease)

Who bears the risk of ownership (loss of residual value at end of lease term) ?

100% project cost vs. loan to value limitation

No compensating balances

No restrictive financial covenants

Flexible payment structures, e.g. off season step downs

Preserves existing bank lines

Net benefit of leasing: More cash in hands of

Lessee improves balance sheet ratios and profitability when invested in the business.

Leasing: Will always be a powerful cash management tool!

Equipment vs. Building structural components

Equipment examples: generators, chillers, boilers, energy management systems, lighting.

Structural examples: windows, doors, roof, fascade, plumbing

Capital Leases.

Question #21: Is an applicant who owns eligible energy property eligible to receive payment if the energy property is leased to a non-profit or otherwise ineligible entity?

Answer: Yes. If the owner of the energy property is the applicant and is otherwise eligible, the fact that the property is being leased to an ineligible entity does not impact the eligibility of the owner/applicant provided it is a true lease and not a disguised sale.

Non-Profit Entities

Private schools & colleges

Hospitals

501 (C) 3 Charities

Co-operative housing

Religious organizations

Museums

Government Entities

Public schools & universities

Courthouses

Public buildings

Municipal and county airports

Federal government

State and local government

Year:

System Cost

(300kW)

Electric

Savings

Thermal

Savings

Fuel

Expense

1

0

388,600

215,958

2

400,258

222,437

3

412,266

229,110

4

424,634

235,983

5

437,373

243,063

6

450,494

250,355

-256,968 -264,677 -272,617 -280,796 -289,220 -297,896

Net Savings

Lease

Payments

Net Cash

Flow

Cum Cash

Flow

347,590

-224,652 -224,652 -224,652 -224,652 -224,652 -186,457

122,938 133,366 144,106 155,169 166,564 216,495

122,938

358,018

256,304

368,758

400,410

379,821

555,579

391,216

722,143

402,952

938,638

CHP System Cost: $1,165,150 100%

Nonprofit (501C3, municipality, etc.)

60 @ $18,721 $ 1,123,260 Run Rate: <1.48%>

12 @ 15,538 $ 186,456 IRR: 4.15%

Total Payments $ 1,309,716

Interest $ 144,566

10% Federal energy grant

Obtained by lessor Shared with lessee via rent reduction.

Stanley S. Fishbein, J.D., LL.M. (Tax)

Managing Director

LFC Capital, Inc.

303 E. Wacker Drive, Ste 250

Chicago, IL 60601

Tel: (800-942-6341

Cell: (646) 418-6056 sfishbein@lfccapital.com

www.lfccapital.com