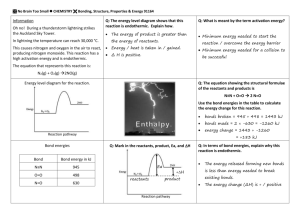

Midterm Exam

Name ______________________ Student ID __________________

Economics 333: Money and Banking

Mid-term Exam

Thursday, October 24 2002

Time: 9:00 A.M – 10:20 A.M.

Multiple Choice [6 points each]

1.

The Bank of East Asia pays $900 to Hang Seng Bank for an Exchange Fund note. This transaction takes place in a.

a secondary market and a capital market. b.

a derivative market and a cash market. c.

a money market and a cash market. d.

a primary market and an over-the-counter market.

2.

Consider a single bond market. The government decides to run a large budget deficit. This will lead to an a.

increase in bond yields and a shift out in the demand for bonds. b.

increase in bond prices and a shift out in the demand for bonds. c.

increase in bond yields and a shift out in the supply of bonds. d.

increase in bond prices and a shift out in the supply of bonds.

3.

An economic forecaster predicts that an economy will soon face a recession.

This prediction is based on the observation of a a.

steep yield curve and a wide default spread. b.

inverted yield curve and a wide default spread. c.

steep yield curve and a narrow default spread d.

inverted yield curve and a narrow default spread.

4.

Inventors in the high tech sector come up with many new inventions. This is perceived to increase the average productivity of new investment. However, the uncertainty created by the new invention is likely to lead to the bankruptcies of some firms. This is predicted to lead to greater risk for bonds relative to other assets. This will lead to a.

a rise in bond prices and an ambiguous effect on the equilibrium quantity of bonds. b.

a fall in bond prices and an ambiguous effect on the equilibrium quantity of bonds. c.

An ambiguous effect on bond prices and a rise in the equilibrium quantity of bonds. d.

An ambiguous effect on bond prices and a fall in the equilibrium quantity of bonds.

5.

There is a simultaneous rise in the US dollar bond yield and a fall in the

Japanese yen bond yield. Assume that these two effects are temporary, so they have no effect on the future Yen-Dollar nominal exchange rate and that uncovered interest parity holds. Think of Hong Kong as the domestic economy. Remember that Hong Kong has a fixed exchange rate with the US dollar. The effect of these two events will be a a.

a rise in the Hong Kong dollar-Japanese yen exchange rate and a rise in the expected Hong Kong dollar returns to investing in Japanese bonds. b.

A fall in the Hong Kong dollar-Japanese yen exchange rate and a rise in the expected Hong Kong dollar returns to investing in Japanese bonds. c.

A rise in the Hong Kong dollar-Japanese yen exchange rate and a fall in the expected Hong Kong dollar returns to investing in Japanese bonds. d.

A fall in the Hong Kong dollar-Japanese yen exchange rate and a fall in the expected Hong Kong dollar returns to investing in Japanese bonds.

Short Answer Questions

6.

A coupon bond with a face value of 100 and a coupon of 10 has a current yield of 8%. Using the implied yield to maturity as the discount factor, calculate the present value of the bond. [10 points]

7.

The yield on bonds is 5%. The ratio of current dividends to current stock prices is .1. What is the implied equity premium when we assume that the growth rate of dividends will be constant and equal to 1%? (i.e. solve the for the constant risk-adjusted discount factor which is equal to the expected return on stocks. Use this to calculate the equity premium) [10 points].

8.

An investor purchases a 2 year discount bond with a face value of 100 and a yield to maturity of 10%. After 1 year the investor sells the bond. At that time, the bond has a yield of 5%. Calculate the price of the bond at the time of the purchase and the time of the sale and the investor’s ex post return [10 points].

9.

The current exchange rate between the Hong Kong dollar and the Euro is .13

(Euros per HK$). The following table gives a list of yields on 1 and 2 year government bonds in the two currencies.

1 Year 2 Year

Hong Kong $

Euros €

1.54% 2.02%

3.64% 3.47% a.

Assume that uncovered interest parity always holds. Calculate the market’s expectation of the exchange rate 1 year from now. [5 points] b.

Assume that the expectations theory of the term structure holds. Calculate the markets expectation of the 1 year yields in both currencies’ bonds in 1 year. [5 points] c.

Combine the results of a. & b. to calculate the market’s expectation of the exchange rate 2 years from today. [5 points]

Name _________________________ Student ID _______________________

10.

Interest rate risk is the risk that the value of financial assets and liabilities will fluctuate in response to changes in market interest rates. [15 points]

An equal change in the interest rate (yield to maturity) of a long-term bond and a short term bond will have a stronger effect on the price of the short-term bond than the long-term bond because

An equal change in the interest rate (yield to maturity) of a long-term bond and a short term bond will have a stronger effect on the price of the long-term bond than the short-term bond because

_______________________________________________________________

In answering question 9 and 10, the student should choose one (and only one) question to complete. The complete answer could require several sentences.

However, the answer should fit in the space available.

11.

The following chart shows the returns on the stocks of Company A and

Company B as well as returns of the market average. [10 points]

18

16

14

12

10

8

6

4

2

94 95 96 97 98 99 00 01 02

Company A Company B MARKET

The CAPM equity pricing model would say that Company A would have a higher expected risk premium than Company B because

The CAPM equity pricing model would say that Company B would have a higher expected risk premium than Company A because