- Mabry Calvin

advertisement

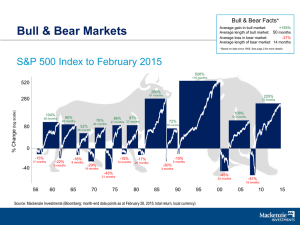

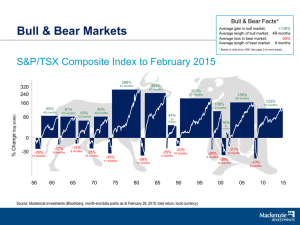

M A B R Y - C A L V I N “Duck Test...” “If it looks like a duck, swims like a duck, and quacks like a duck, then it probably is a duck.” Dear Clients and friends: No, we are not referring to the Aflac superstar who seemingly has surpassed Daffy, Donald and even Kim Kardashian in fame and name recognition. Instead, we are referring to the ancient “smell test” often used to help one identify an unknown or unrecognized thing by observing its characteristics. For our “Duck Test” we have examined the market pullback of last year and we reach an interesting and, perhaps, important conclusion. As always, we use the S&P 500 for our example. The current bull market recovery from the March 2009 low has been remarkably broad and strong. Using price-only intraday information the S&P 500 has risen from the bottom (666.79) on March 6, 2009, to its most recent high (1422.38) on April 2, 2012. This represents roughly a 113% increase over approximately 3 years and one month. This has been a good recovery without a doubt but not extraordinary considering the tremendous decline which preceded it (down in excess of 50% over the prior 1 year and four months.) Bull markets and bear markets are measured a variety of ways by a number of different institutions. The data and conclusions rarely match but they are quite similar. Having served in this business for over 25 years we have learned that finding investment advisors to agree on most any subject or data point is as difficult as herding cats. However most do agree on two important facts: 1) bear markets are defined as a decline of at least 20% at some point during the downturn and 2) that the data used for the bear market calculation must be based on closing prices and not intra-day prices. This from Sam Stovall of S&P IQ… “By the standard definition of a bear market – a 20% decline from a high on a closing basis – the recent S&P 500’s summer pullback didn’t qualify.” You see, according to Sam, on a closing basis, the index fell only 19.4% from April 29, 2011 to October 3, 2011. This also from Sam… “I emphasize closing basis because the S&P 500 did decline more than 21% on an intraday basis from late April 2011 through early October 2011, but if you’re going to use hard and fast rules, you go with the closing basis. So we experienced a very severe correction.” Therefore, by industry standards, the stomach-churning, heart-sinking, bileproducing market drop of last year which actually exceeded 20% was not a bear market. Rather, it was a severe correction. Only in the illogical “Catch 22” cubicle of the most hardened bureaucratic bean counter – does this make sense…. 1 M A B R Y - C A L V I N But why does any of this matter? If it looks like a duck, swims like a duck, quacks like a duck, it is a duck. So what? Well, to us, the reason it matters is clear. If last year’s drop was only a correction, then we are perilously close to the end of this great 2009 market recovery and, perhaps, on the verge of the next bear market. It means the current bull is long in the tooth. This has the Doom and Gloom crowd nervously wringing their hands. They are absolutely petrified because they haven’t participated in the recent bull market and their client’s have not recovered their losses from the previous bear market. Our client’s, on the other hand, have been wise. Because you held firm and did not panic out of the market, your portfolios have recovered and, in most cases, are whole again. But if this is the beginning of the end – will we give it all back? We think not. In fact, we suggest that last year’s drop was a bear market and that we just might be entering a new bull market cycle. 2 M A B R Y - C A L V I N Why? Well, there are a couple of clues in addition to some very large structural issues in the background that may bode well for the equity markets in the future. First the clues: 1) Typically, when bull markets cycles begin, the leading stocks are cyclical, financials, and technology. This was the case in 2009 and it has been the case since the October lows of last year. 2) The best performing stocks in the last year of a bull market cycle are most often, healthcare, utilities, consumer staples and other defensive issues. Those stocks were the leaders last year and are the laggard’s year-to-date 2012. 3) The first year of a new bull market is typically stronger than the last year of the previous cycle. Last year, the S&P finished up a paltry 2.1%. This year the S&P 500 is up 12.6% in the first quarter. 4) Since World War II, there have been 25 times in which the S&P 500 rose in both January and February (like it has this year). The market ended up for the full year 24 out of the 25 times and was flat once. The average gain for all 25 years exceeded 20% annually. As for the positive structural issues: 1) Corporations are sitting on their largest cash piles in fifty years. They are buying back their own shares at record rates. As with all markets, the law of supply and demand rules. Fewer shares of stocks available will help to lift prices. 2) Advances in technologies and telecommunications serve to increase or hold steady profit margins. Greater profitability lifts stock prices. 3) Growth in emerging markets is forecasted to exceed 6% per year over the coming decades. Even as developed economies slow, the third-world markets create a vast new demand for products and services each year. 4) The S&P 500 trades at roughly 13 times forward earnings. The average PE multiple over the last 30 years is north of 16. However, historically, the S&P trades at even higher multiples when interest rates are low. 5) Recently, the average dividend yield on the S&P 500 exceeded the average interest rate on the ten year Treasury bond. This hasn’t happened often but has been a very bullish indicator in the past. 6) Interest rates in general are generationally low. When and if rates rise, the price of bonds will decline. The 30-plus year bull market in bonds will end and bond buyers will be forced to reexamine equities. 7) World population is at 7 billion and rising. Every second of every day new consumers and investors are being added. 8) Every extended period in which our stock markets generated flat to negative returns (what we have experienced since 1999) have been followed by decades of average to above average returns. 3 M A B R Y - C A L V I N The lists could go on and on and on but we will save those for another day. We conclude by reminding you that our unique experience and creative services are what sets up apart from most of the other investment firms out there. If you are happy with your results and the services that we work so hard to provide, please tell your friends. If we cannot help them find solutions to their investment problems, we may be able to steer them in a good direction. As always, we appreciate your business and your continued trust. Best regards, Dirk Calvin Charlotte Mabry 4