FAIS - BankSETA

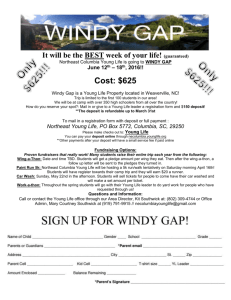

advertisement

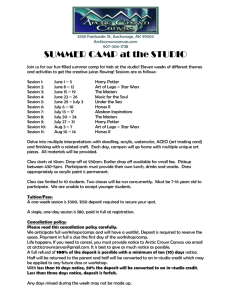

FAIS LEARNING GUIDE MODULE 3 LESSON 3 Inter-Bank Compliance Training Project Sponsored by BANKSETA Specific Code of Conduct for Short-term Deposit Business Topics: 1 The role players affected by the Specific Code of Conduct 2 Key areas of the Specific Code of Conduct 3 The responsibilities within each key area B A N K S E T A S p o n s o r e d P r o j e c t Specific Code of Conduct for Short-term Deposit Business Module 3: Lesson 3 INTRODUCTION Link This Specific Code applies to Short-term Deposit Business not exceeding 12 months. A general guide is that a short-term deposit allows clients to access funds within a twelve month period. Learning outcomes This lesson focuses upon the following learner outcomes: Specify the role players affected by the Specific Code Describe the key areas of the Specific Code List the responsibilities of each key area. Page 2 Learner guide Developed by Gray Training 011 472 3516 Jan 2004 B A N K S E T A S p o n s o r e d P r o j e c t Specific Code of Conduct for Short-term Deposit Business Module 3: Lesson 3 L/O #1 ROLE PLAYERS AFFECTED BY SPECIFIC CODE L/O #1 Specify the role players affected by the Specific Code. Specific code This Specific Code is aimed at FSPs who conduct short-term (less than 12 month) deposit business in relation to clients ie banks. It applies to every aspect of providing a service of short-term (less than 12 months) deposit taking. Individuals affected by the Specific Code are: The FSP The Representative working for the FSP The client. Page 3 Learner guide Developed by Gray Training 011 472 3516 Jan 2004 B A N K S E T A S p o n s o r e d P r o j e c t Specific Code of Conduct for Short-term Deposit Business Module 3: Lesson 3 L/O #2 KEY AREAS OF SPECIFIC CODE L/O #2 Identify the key areas of the Specific Code. Key areas The Specific Code makes provision for a number of key areas: 1. General duties of FSPs 2. Confidentiality and privacy 3. Advertising 4. Complaint resolution 5. Miscellaneous. 1 2 Key Area General duties of FSPs Confidentiality and privacy Description This deals with three areas of FSP duties. These areas are: Unsolicited contacting of clients General duties of the FSP Other information and explanations. Confidentiality deals with: When you may disclose information about your client and their affairs to other parties The circumstances under which marketing information may be provided to the client. 3 Advertising This deals with concentrating on the restrictions for written and telephonic advertising of the financial service or product. 4 Complaint resolution This deals with: Basic principles of systems and procedures Resolution of complaints Specific obligations (of the complaints procedures and the FSP). 5 Miscellaneous: Waiver of rights This deals with the waiver of rights. Page 4 Learner guide Developed by Gray Training 011 472 3516 Jan 2004 B A N K S E T A S p o n s o r e d P r o j e c t Specific Code of Conduct for Short-term Deposit Business Module 3: Lesson 3 L/O #3 RESPONSIBILITIES OF EACH KEY AREA L/O #3 List the responsibilities within each key area. Key area #1: General duties: Unsolicited contact An unsolicited contact is any visit or call on the client that is not originated by the client. If... The Representative makes unsolicited contact with a client Then the Representative must… Right at the start of the contact, explain the purpose of this contact, visit or call. Act honourably, professionally and accepting of the convenience of the client. Any further Act honourably, professionally and communications and accepting of the convenience of dealings occur as a result the client. of the unsolicited contact. Page 5 Learner guide Developed by Gray Training 011 472 3516 Jan 2004 B A N K S E T A S p o n s o r e d P r o j e c t Specific Code of Conduct for Short-term Deposit Business Module 3: Lesson 3 L/O #3 RESPONSIBILITIES OF EACH KEY AREA – cont. Key area #1.2 General duties: General When you offer a financial service, you must ensure that you meet these requirements in your interaction with the client: Act fairly and reasonably, promoting trust and confidence, without compromising your integrity Comply with the Specific Code of Conduct in any contract that you conclude with your client Make this Code of Conduct available to the client Make all relevant information available to clients in plain language Assist a client to choose the correct deposit fitting his needs o Remember that this includes traditional banking products such as current accounts, savings and transmission accounts and credit cards Assist a client to fully understand the financial implications of the product chosen by him/her Never ask a client to sign any incomplete documentation. This applies regardless of whether the document is completed by the staff member on behalf of the client or by the client Take care that the relevant services relating to deposits are safe and secure Ensure that your relevant staff members comply with this Code. Page 6 Learner guide Developed by Gray Training 011 472 3516 Jan 2004 B A N K S E T A S p o n s o r e d P r o j e c t Specific Code of Conduct for Short-term Deposit Business Module 3: Lesson 3 L/O #3 RESPONSIBILITIES OF EACH KEY AREA – cont. Key area #1.3 General duties: Contractual terms A FSP is required to ensure that contractual terms and conditions: Are fair Clearly distinguishable from marketing and promotional material Set out all rights and responsibilities of the client Avoid unclear technical or legal language and are supported by proper explanations. Representatives must carefully assess clients’ needs and objectives so that their needs can be matched to an appropriate product. The Code provides clear guidelines for this process: Consider the client’s circumstances and the type of deposit during the process of providing advice. Key area #1.4 General duties: Giving information about the product Representatives have a duty to provide clear and helpful information to the client. The Code specifies what information you should share with the client: Specific information about the product Key features of the deposit How the deposit account will operate How funds can be withdrawn How the deposit earns interest How interest is paid Full details of all fees and charges including whether they are negotiable Applicable interest rates, how interest is calculated and when it is paid or deducted How funds may be dealt with at maturity Any penalties for early termination or withdrawals. Page 7 Learner guide Developed by Gray Training 011 472 3516 Jan 2004 B A N K S E T A S p o n s o r e d P r o j e c t Specific Code of Conduct for Short-term Deposit Business Module 3: Lesson 3 L/O #3 RESPONSIBILITIES OF EACH KEY AREA – cont. Key area #1.5 General duties: Giving information about banking in general The Code indicates the information that should be shared with clients about banking in general. Clients need to understand Cooling off periods The difference between debit and stop orders Special procedures and safeguards that ensure safe business. Key area #1.6 General duties: Giving information about changing circumstances The changing circumstances of the client of the FSP may result in changes, which will influence the status of the product. The Code indicates that the following information should be shared with the client: Additional charges or interest that apply in cases of early withdrawal or cancellation Possible changes to interest rates Possible future changes to the terms and conditions of a contract and the circumstances under which the changes may adversely affect the deposit. These might include: The rights of the client to access personal information held by the Provider Information on what is required for client identification when opening an account Information on the availability of unique identification methods using PINS and passwords during the relationship. Other information that may need to be shared with the client at various times includes: Information on the closing of branches, outlets, ATMs of the Provider Information on any set-off between the credit balance of any deposit and any other business debt that may be affected by the Provider in its capacity as a bank or mutual bank. Page 8 Learner guide Developed by Gray Training 011 472 3516 Jan 2004 B A N K S E T A S p o n s o r e d P r o j e c t Specific Code of Conduct for Short-term Deposit Business Module 3: Lesson 3 L/O #3 RESPONSIBILITIES OF EACH KEY AREA – cont. Key area #1.7 General duties: Giving information about closing an account Clients also need to be informed about what happens should the FSP close a client’s deposit account. The account may only be closed after the client has been given reasonable prior written notice The written notice must be delivered to the last address provided by the client It must be without any prejudice to the legal rights of the client. However, if the law requires it, the account may be closed without any prior notice to the client. Key area #1.8 General duties: Account operations Account information can be presented in any of the following ways: Orally In writing Telephonically As otherwise agreed with the client. The Code requires information to be presented on: Charges for account statements The procedures the client must follow to avoid the automatic rollover (re-deposits) of deposits where the client does not want this to happen The procedures the client must follow when there is a change in personal identification or address The safeguards and essential precautions that must be implemented, followed or taken when using telephonic or electronic banking procedures for deposit accounts The procedure the client must follow to request correction of statement errors. Page 9 Learner guide Developed by Gray Training 011 472 3516 Jan 2004 B A N K S E T A S p o n s o r e d P r o j e c t Specific Code of Conduct for Short-term Deposit Business Module 3: Lesson 3 L/O #3 RESPONSIBILITIES OF EACH KEY AREA – cont. Key area #2: Confidentiality and privacy Confidentiality means not disclosing information about the client’s affairs to other parties. As a rule the FSP or Representative may not disclose ANY information about a client to any other person. This rule is waived only under clearly identified circumstances. The Specific Code of Conduct states that you may not disclose a client’s private information to any other person, unless: The client requests it or gives their written consent The law compels it The disclosure is in the public’s interest The Provider’s interest requires it. The FSPs must: Inform the client of the recording of any telephone conversations with the client Give the client the reasons for this recording Only market other financial products to clients with their consent. Not pressure the client to agree to the provision of other services. Key area #3: Advertising This Code provides principles that need to be followed for advertisements. “advertisement”, in relation to a FSP, means any written, printed, electronic or oral communication (including a communication by means of a public radio service), which is directed to the general public, any section thereof, to any client on request. by any such person, which is intended merely to call attention to the marketing or promotion of short term-deposit taking business offered by the FSP, and which does not purport to provide detailed information regarding any such financial services; and “advertising” or “advertises” has a corresponding meaning…” Page 10 Learner guide Developed by Gray Training 011 472 3516 Jan 2004 B A N K S E T A S p o n s o r e d P r o j e c t Specific Code of Conduct for Short-term Deposit Business Module 3: Lesson 3 L/O #3 RESPONSIBILITIES OF EACH KEY AREA – cont. Key area #3.1 Advertising If an advertisement contains: Performance data including awards and rankings Illustrations, forecasts or hypothetical data It must also contain: References to their source and date. Support in the form of basic assumptions including: o Performance o Returns o Costs o Charges A statement that they are not guaranteed and are there for illustrative purposes only Clear indications of any dependence for returns and benefits on the performance of underlying assets or other market factors. A warning statement about risks involved in buying or investing in a deposit A warning statement prominently rendered or displayed regarding the risks involved. Information about past performance A warning that past performance is not an indicator of future performance. Information about a deposit whose investment value is not guaranteed A warning that no guarantee is provided. Page 11 Learner guide Developed by Gray Training 011 472 3516 Jan 2004 B A N K S E T A S p o n s o r e d P r o j e c t Specific Code of Conduct for Short-term Deposit Business Module 3: Lesson 3 L/O #3 RESPONSIBILITIES OF EACH KEY AREA – cont. Key area #3.2 Public radio service advertising Where a financial service is advertised on a public radio service, the advertisement must include the business name of the FSP. Key area #4.1 Complaints: General rules The Representative must: Assist any client who has a complaint to lodge it in writing Use the existing system to keep a record of all complaints for 5 years Deal with complaints from clients in good time and in a fair manner Start the complaint investigation and respond promptly Tell the client what further steps to take under FAIS or any other law if the client is not satisfied with the resolution offered. Key area #4.2 Complaint resolution : Minimum requirements These are the minimum requirements to ensure effective and fair resolution of complaints: Availability of adequate manpower and other resources Adequate training of all relevant staff Clear responsibilities for processing routine and serious complaints Follow up procedures to avoid repeat complaints and to improve service. Key area #4.3 Complaint resolution: Specific obligations The FSP is also required to meet very specific criteria in resolving complaints. You will find these listed in Appendix 3.2 Specific Code of Conduct for Short-term Deposit Business. Key area #5 Waiver of rights The law is clear. You may not, under any circumstances, request a client to waive any of the rights specified in the Code. If a client wants to waive his/her rights, you may not accept it. Waiver of rights is not acceptable under any circumstances. Page 12 Learner guide Developed by Gray Training 011 472 3516 Jan 2004 B A N K S E T A S p o n s o r e d P r o j e c t Specific Code of Conduct for Short-term Deposit Business Module 3: Lesson 3 L/O #3 RESPONSIBILITIES OF EACH KEY AREA – cont. Activity 1 This final activity gives you a chance to review what you have learnt about: Complaints Waiver of rights. Match the statement in the left column to the appropriate comments in the right column. A. The complaints procedure needs to be transparent. 1 A client should be able to lodge a complaint using any communication system. B. Clients may want to waive their rights. 2 Clients will know exactly how their complaints will be resolved. C. Complaints systems need to be easy to use. 3 Waiver of rights is not acceptable under any circumstances. Page 13 Learner guide Developed by Gray Training 011 472 3516 Jan 2004 B A N K S E T A S p o n s o r e d P r o j e c t Specific Code of Conduct for Short-term Deposit Business Module 3: Lesson 3 L/O #3 RESPONSIBILITIES OF EACH KEY AREA – cont. Check your thinking – Activity 1 A–2 B–3 C–1 Page 14 Learner guide Developed by Gray Training 011 472 3516 Jan 2004 B A N K S E T A S p o n s o r e d P r o j e c t Specific Code of Conduct for Short-term Deposit Business Module 3: Lesson 3 CONSOLIDATION Consolidation exercise This lesson has given you a high level view of the key areas. Jot down everything you remember about the key areas on the mind map below. Miscellaneous Complaint resolution General duties of FSPs SPECIFIC CODE Confidentiality and privacy Advertising Page 15 Learner guide Developed by Gray Training 011 472 3516 Jan 2004 B A N K S E T A S p o n s o r e d P r o j e c t Specific Code of Conduct for Short-term Deposit Business Module 3: Lesson 3 ASSESSMENT Test your knowledge & understanding Answer these short questions to test your knowledge and understanding of this material. Choose the right answer. Statement 3.3.1 3.3.2 3.3.3 3.3.4 3.3.5 True/False? The Specific Code for Short-Term Deposit Business relates to products not exceeding 12 months. The Specific Code for Short-Term Deposit Business only deals with the basic principles of the complaints systems. Clients are granted certain rights by the provisions of the Specific Code for Short-Term Deposit Business. You may ask a client to waive those rights. John Radebe decides that it would be convenient if he contacts his clients before 08:00 in the morning, as he does not have time to do this once the branch opens. This is an acceptable practice. Contact Centres do not have to tell their clients that they record all calls. Question 3.3.6 Individuals affected by the Specific Code for Short-Term Deposit Business are: a The Financial Service Provider b The Representative working for the Short-Term Deposit FSP c The Client. 3.3.6.1 All of the choices are true 3.3.6.2 Choice (a) and (b) are true 3.3.6.3 Choice (b) and (c) applies 3.3.6.4 Choice (a) is true 3.3.6.5 Choice (b) is true 3.3.6.6 None of the choices are true. Page 16 Learner guide Developed by Gray Training 011 472 3516 Jan 2004