REFERENCES

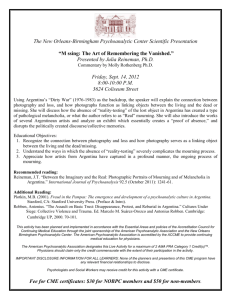

advertisement