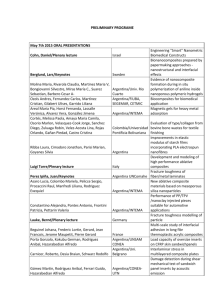

Argentina

advertisement

Country Playbook Region: Americas Country: Argentina August 2015 Any US tax advice contained herein was not intended or written to be used, and cannot be used, for the purpose of avoiding penalties that may be imposed under the Internal Revenue Code or applicable state or local tax law provisions. These slides are for educational purposes only and are not intended, and should not be relied upon, as accounting advice. This material has been prepared for general informational purposes only and is not intended to be relied upon as accounting, tax, or other professional advice. Please refer to your advisors for specific advice. Region – Americas Country – Argentina 1. Country Currency/Abbreviation Argentina Peso – ARS – AR$ 2. Tax Year Designation Calendar – Year Start 1/1; Year End 12/31 3. Minimum Pay Frequency Pay frequency can be mandated as hourly, daily, weekly, or monthly dependent on the nature of work performed. 4. National Minimum Wage AR$ 4716.00 Per Month; AR$ 23.58 per hour 5. Workday/Workweek Basic workday 8 hours; maximum 48 hours per week; mandated shift differential surcharge at 35% of the regular rate. 6. Overtime Considerations Hours over 8 per day paid at 1.5 times regular rate. Double time is paid for any hours worked after 1 p.m. on Sunday, Saturday or Holidays. 7. Employment Contracts * Argentina does not mandate labor contracts, but it is common practice for parties to enter into labor contracts. There are seven designations of labor contracts in Argentina. 1. Undetermined-Term: All labor relationships are considered indefinite unless a fixed term is specified within a labor contract. 2. Fixed-Term: If a labor relationship has a fixed term a labor contract is required, BU must adhere to special considerations when preparing the contract. If all fixed term contract terms/conditions are not addressed, the contract is null and the relationship becomes indefinite. 3. Labor Contract for Extraordinary/Special Service: Terms of this type of contract center on labor for a specific service and the burden of proving this contractual relationship is the responsibility of the employer. 4. Seasonal Labor Contract: Defined by an undetermined term contract with seasonal periods of activity. 5. Contract of Apprenticeship: For persons between the ages of 16 and 28, a labor period of more than 3 months and less than one year, and participation in the capacitation program. This type of contract must be in writing. 6. Part-time Labor Contract: Employees under this designation cannot work more than two thirds of the full time work schedule and cannot work any overtime. 7. Student Trainee Programs: Internships are regulated under a different set of laws, but if those considerations are satisfied the relationship is not considered employer-employee. The student can receive compensation for services and the employer is not required to comply with normal payroll regulations. 8. Social Security Program * Although there is no standard social security program, employers and employees are required to contribute to health and unemployment programs. 9. Income Tax Withholding * N/A 10. Unemployment Taxes * Employers and employees in Argentina are required to contribute to the unemployment tax system. 11. Termination Notes * In many cases, if there is no just cause for termination the employer is required to pay the associate severance. 12. Other Special Payroll Considerations * Argentine employees are entitled to two semi-annual bonuses that summed should be equivalent to one month wages (Aguinaldo). Remuneration statements are required and must include name and address of employer, hours worked or units completed, tax ID’s of employer and employee, deductions taken for the gross pay, and hire date. Employers must contribute 6% of employee wages to health programs on behalf of the employee while also withholding 3% of the employee’s wages from the employee. Employers must contribute 17-21% of employee wages to unemployment/pension programs on behalf of the employee while also withholding 14% of the employee’s wages from the employee. 13. Summary Analysis/Recommendation Country Labor Climate: Although labor contracts are not required in Argentina, it is considered best practice. In the event there is no written contract, labor dispute resolutions will favor the individual rather than the employer/company. Employment Status Recommendation: The decision tree should be used as a foundation for determining employment status. If there is any ambiguity of status, BU should craft employment contracts that specify a fixed term length or specify the completion of a project or task, as these contracts reduce the risk associated with determining the individual is not an employee. Independent Contractor Payments: If BU determines the individual is an independent contractor, there is medium to low risk of making payments through accounts payable. There are circumstances in which the Argentine government requires the company to establish permanent business presence even in circumstances in which the company only has a relationship with an independent contractor. If this determination is made, the company will face penalties and fines for not establishing presence, so this must be considered. Recommendation: 1. If BU has business presence within Argentina and the labor relationship is determined to be independent contractor status, there is extremely low level of risk of making payments through AP. 2. If BU does not have business presence within Argentina and the labor relationship is determined to be independent contractor status, there is moderate to low level of risk of making payments through AP. Employee Payments: When making the determination of risk and cost of establishing an internal payroll program, numerous factors must be taken into consideration. Within this document, sections denoted with an asterisk “*” are some of the basic components of that analysis. Once an individual is identified as an employee, there are many requirements inherited by the employer. Those requirements range from social benefit programs to employer related taxes directly attributed to headcount. Factors such as risk of being out of compliance, the capital cost associated with being in compliance, and additional administrative costs to establish and maintain the programs associated with the requirements are key components of determining the best solution for paying employees. Recommendation: 1. Due to the extensive requirements related to payroll processing in Argentina, the recommendation is to seek a 3rd party vendor to administer this program. 2. If possible, the best solution is to contract with an in country staffing entity that will hire employees and own employeremployee requirements for a negotiated fee.