pretest3 - Eastern Illinois University

advertisement

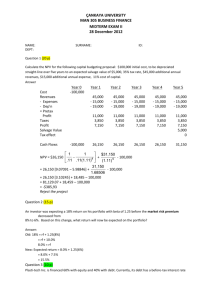

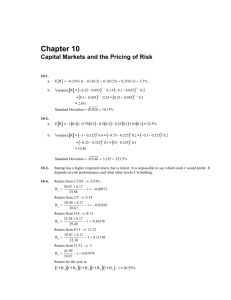

EASTERN ILLINOIS UNIVERSITY BUS 3710 Name: ____________________________ Row No.: _____ Cohorst Carp is considering the purchase of a carp-tenderizing machine. The company is evaluating the 007 Carp Packer. Costs and projected cash flows are shown in the following table: Year 0 1 2 3 007 Carp Packer -40,000 16,804 17,184 18,842 1) What is the Net Present Value for the 007 Carp Packer assuming the company requires a 6% rate of return on the project? 2) Is the Internal Rate of Return for the 007 Carp Packer greater than 6%? ___ Yes ___ No 3) Breedlove Buckles’ beta is 1.2, the risk-free rate of return is two percent and required rate of return in the company’s market is 11%. What is the required rate of return using the CAPM approach? 4) If the actual required rate of return for Breedlove Buckles is 10.5%, the stock is: Over priced Under priced 5) Based on the information, calculate the expected return for Kepley Kangaroos: Askew Ants Kepley Kangaroos Probability Return Probability Return 20% -20% 10% -10% 40% 10% 30% 0% 40% 20% 60% 8% 6) 7) 8) Based on the information above, what would be the expected return for a portfolio invested 30% in Askew Ants and 70% in Kepley Kangaroos? Which stock has the highest standard deviation? Askew Ants ___ Kepley Kangaroos ___ Assume the stocks listed below trade in an inefficient market. Based on the information available concerning risk and reward, which stock should you purchase? Zizzo Zebras Bronge Brats Woods Waffles 9) Expected Return 14.0% 19% 9% Beta .7 1.0 0.5 Investing in large cap stocks for a long period of time tends to: Increase standard deviation Decrease standard deviation 10) Should a bright art history major invest in efficient markets or inefficient markets? 11) Investors in mutual funds tend to increase their investments in the stock market when: ___ prices are falling ___ prices are increasing 12) The common stock of Stout Straws has provided an annual return of 11% with a standard deviation of 20%. What range of returns would you expect to see 99% of the time for this stock? 13) If Worst Worms common stock had an average return of 13% during the last decade and inflation averaged 3%, what was the real rate of return? 14) Under a worst case scenario analysis a project will have a: ___ negative NPV ___ NPV of $0 | ___ positive NPV 15) In general, how many stocks should a portfolio contain to achieve diversification? 1 16) Your cousin, Spatula Sperry, age 24, informs you at Easter dinner she has decided to invest her $11,000 retirement funds entirely in Treasury bills. She believes Treasury bills are the best investment for her since they are “risk free”. As a bright finance student, what advice would you have for your cousin? Include in your answer two concepts you have learned in this class to support your conclusions. 17) If you constructed a $10,000 portfolio with $2,000 invested in Treasury bills, $4,000 in Russell Rags and $4,000 in Brown Cows, what would be the beta for the portfolio? Russell Rags common stock Brown Cows common stock Treasury bills Beta 1.5 .5 18) Why do investors tend to have returns less than the returns of the mutual funds they invest in? 19) What is the January effect? 20) Caterpillar announces today earnings per share for the company’s most recent year decreased 10% to $1.63. The financial markets had anticipated earnings per share would decrease to $1.51. What will be the impact on the price of Caterpillar’s stock and the S&P 500 (the overall stock market)? Caterpillar’s stock price will: _____ increase ______ not change based on this news The S&P 500 index will: _____ increase ______ not change based on this news _____ decrease _____ decrease 21) A decrease in inflation will generally lead to: ____ an increase in stock prices _____ a decrease in stock prices. 22) If investors’ decrease the rate of return they demand for small cap stocks, the price of small cap stocks will _____ increase _____ decrease. 23) Which has a greater impact on the returns of a portfolio: Selection of investments within an asset class Allocation among asset classes in a portfolio 24) Based on the following information, which of the following stocks would be most likely to have a negative beta? Young Yaks Johnson Jam Probability Return Probability Return Bust 40% -17% Bust 40% 19% Boom 60% 22% Boom 60% -8% 25) The standard deviation is 19.11% for Young Yaks and 13.23% for Johnson Jam. The standard deviation for a portfolio invested 50% in each company will be: __ less than 16.17% ___ equal to 16.17% ___ more than 16.17% 26) Utilizing a required rate of return for a project that is too low based on the risk of the project will lead to: __ not doing a project which actually ___ investing in a project which ___ the worst case scenario having a has a positive NPV actually has a negative NPV negative NPV 27) YoYo Yilmaz, general manager of the Chicago Flubs, has determined the most important variable which will determine whether the team’s new baseball stadium will have a positive NPV is the number of goats that the team will be able to graze in the outfield during October (when the stadium is never used). This is an example of: __ sensitivity analysis ___ forecasting risk ___ worst case scenario analysis 28) What is the current risk-free rate of return? 29) Patterson Pork paid a dividend of $2.15 in 2011. The price of the stock at the beginning of 2011 was $89 and at the end of 2011 was $97. Calculate the dividend yield and the capital gains yield for the stock in 2011. 30) Race Rackets sold a racket rachet for $13,415. The company had purchased the machine three years ago for $27,000. The machine is seven year property under MACRS. If the company’s tax rate is 35%, what is the amount of federal income tax on the sale of the machine? 31) Over the last seventy years, which asset class has provided the highest rate of return? ___ Treasury bills ___ Large cap stocks ___ Treasury bonds 2 3