Chapter 9 - Washington State University

advertisement

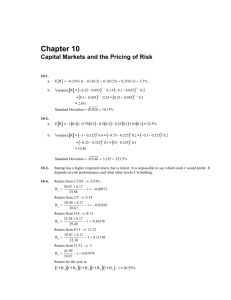

Characterizing Risk and Return Chapter 9 Fin 325, Section 04 – Spring 2010 Washington State University 1 Introduction Safe investments, risky investments (Savings account; Stocks) Based on what do financial managers and investors make investment decisions? (Expectations about future risk and return) The relationship between risk and return is fundamental to finance theory 2 Historical Returns Computing Returns Dollar Return = (Capital gain or loss) + Income = (Ending Value – Beginning Value) + Income Percentage Returns PercentageReturn Ending Value - BeginningValue Income BeginningValue 3 Consider an investment in stock. The income would be dividends. We can break this equation into two parts to reflect the capital gains yield and the dividend yield PercentageReturn Ending Price- BeginningPrice Dividend BeginningPrice BeginningPrice PercentageReturn CapitalGains Yield DividendYield 4 Example: You held 250 shares of Hilton Hotel’s common stock. The company’s share price was $24.11 at the beginning of the year. During the year, the company paid a dividend of $0.16 per share, and ended the year at a price of $34.90. What is the dollar return, the percentage return, the capital gains yield, and the dividend yield for Hilton? 5 Dollar return = 250 x ($34.90-$24.11+$0.16) = $2,737.50 Percent return = ($34.90-$24.11+$0.16)/$24.11 = 45.42% Capital gains yield = ($34.90 - $24.11)/$24.11 = 44.75% Dividend yield = $0.16/$24.11 = 0.66% 6 Average Return The arithmetic average return provides an estimate for how an investment has performed over long periods of time N AverageRet urn Ret urn t t 1 N 7 Performance of Asset Classes Over long periods of time, how do stocks, bonds, and cash securities (e.g. T-bills) perform? Historically, stocks have earned higher returns than either bonds or cash [insert Table 9.2] 8 Historical Risks When you purchase a U.S. Treasury bill, you know exactly what your returns are going to be, i.e. there is no uncertainty, or risk (risk-free rate) On the other hand, when you invest in stocks you do not know what your returns will be, i.e. stock investing is risky It is useful to be able to quantify the uncertainty of various asset classes 9 Volatility High volatility in historical returns are an indication that future returns will be volatile One popular way of quantifying volatility is to compute the standard deviation of percentage returns Standard deviation is the square root of the variance Standard deviation is a measure of total risk A large standard deviation indicates greater return variability, or high risk N Standard Deviation 2 (Return Average Return) t t 1 N -1 10 Example: Using the following returns, calculate the average return, the variance, and the standard deviation for Acme stock. Year 1 2 3 4 5 Acme 10 % 4% -8 % 13 % 5% 11 Average Return=(10% +4% - 8% + 13% + 5% )/5 = 4.80% σ2Acme = [(10% – 4.8%)2 + (4% – 4.8%)2 (- 8% – 4.8%)2 + (13% – 4.8%)2 + (5% – 4.8%)2 ] / (5 - 1) σ2Acme = 0.02588 / 4 = 0.006470 σAcme = (0.00647)1/2 =0.0804= 8.04% 12 Risk of Asset Classes The volatility of stocks is much higher than the volatility of bonds and T-bills While the stock market as averaged a 13.2% return since 1950, that return comes with high volatility, with a standard deviation of 17.0% 13 Risk vs. Return There is a tradeoff between risk and return One way to measure this risk-return relationship is the coefficient of variation Standard Deviation Coefficient of Variation AverageReturn A smaller CoV indicates a better risk-return relationship 14 Modern Portfolio Theory Formalized in the 1950s by Harry Markowitz. He eventually won the Nobel Prize (1990) in Economics for his work. Diversification reduces risk! Risk reduction occurs when securities are combined. That is, portfolio as a whole could be less risky than the individual stocks in it. 15 Diversification Reduces Risk A stock’s total risk has two components: Firm specific risk (diversifiable risk) Market risk (systematic risk) Total Risk = Firm Specific Risk + Market Risk Firm specific risk is specific to the company and common to other companies in the same industry Market risk affects all firms 16 How does diversification lower risk? Investment in only one stock is very risky (its value rises and falls based on what happens to the firm). When stocks are added to the portfolio, the companies’ firm-specific risk (or unique risk, idiosycratic risk, diversifiable risk, unsystematic risk) tends to offset each other. As investors add stocks to their portfolio, the firm- specific portion of the risk declines. After a portfolio is fully diversified, the portfolio carries only market risk (or systematic risk, undiversifiable risk). 17 18 Modern Portfolio Theory In addition to showing how risk reduction occurs when securities are combined, Markowitz’s modern portfolio theory also describes how to combine stocks to achieve the lowest total risk possible for a given expected return. This is called an optimal portfolio. 19 20 Portfolios with the highest return possible for each risk level are called efficient portfolios If we added all available securities to the graph in Figure 9.3, then all of the efficient portfolios of those securities form the efficient frontier Efficient frontier portfolios dominate all other possible stock portfolios 21 How Does Diversification Work? Diversification comes when stocks are subject to different kinds of events such that their returns differ over time, i.e. the stock’s returns are not perfectly correlated. Their price movements often counteract each other If two stocks are perfectly positively correlated, diversification has no effect on risk. 22 Correlation measures the tendency of two stock’s returns to move together, and is represented by A,B -1.0 +1.0 Perfect positive correlation means A,B = +1.0 – Returns from two stocks are perfectly in sync Perfect negative correlation means A,B = -1.0 – Returns from two stocks move exactly opposite Perfect positive correlation gives no risk reduction Correlation between -1.0 and +1.0 gives some, but not all, risk reduction 23 Portfolio Return A portfolio return is a weighted average of the returns of the individual components of the portfolio Weighted by the proportion invested in each security R p (w1 R1 ) (w2 R 2 ) ..... (wn R n ) n R p w i Ri i 1 24 Example: At the beginning of 2007 you owned $5,000 of Disney stock, $10,000 of Bank of New York stock, and $15,000 of IBM stock. In 2007, the three company's returns were -4.8 percent, 19.4 percent, and 12.8 percent respectively. What is your portfolio return? 25 Stock Amount invested Weight Calculation Weight Disney $5,000 5,000/30,000 0.1667 Bank of New York $10,000 10,000/30,000 0.3333 IBM $15,000 15,000/30,000 0.50 Rp = [0.1667 * (-4.8%)] + (0.3333 * 19.4%) + (0.50 * 12.8%) Rp = 12.07 % 26