DOC

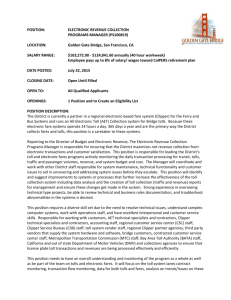

advertisement