leverage

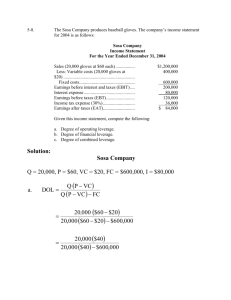

advertisement

BREAK-EVEN ANALYSIS Break-even analysis determine the the level of sales at which the total revenues are equal to total cost. That is, at this point there is no profit or loss. Managers most often focus on the break-even level of sales. However, you might also look at other variables, for example, at how high costs could be before the project goes into the red. Most often, the break-even condition is defined in terms of accounting profits. More properly, however, it should be defined in terms of net present value. We will start with accounting break-even, show that it can lead you astray, and then show how NPV break-even can be used as an alternative. BREAK-EVEN ANALYSIS: Analysis of the level of sales at which the company breaks even. The break-even point for a product is the point where total revenue received equals the total costs associated with the sale of the product (TR=TC). TR=TC P*Q=TFC+V*Q Q= TFC/(P-V) Q= Amount of sales TFC= Total fixed cost V= Unit variable cost P= Unit selling price P-V= Unit Contribution ACCOUNTING BREAK-EVEN ANALYSIS The accounting break-even point is the level of sales at which profits are zero or, equivalently, at which total revenues equal total costs. As we have seen, some costs are fixed regardless of the level of output. Other costs vary with the level of output. When you first analyzed the superstore project, you came up with the following estimates: 1 Notice that variable costs are 81.25 percent of sales. So, for each additional dollar of sales, costs increase by only $.8125. We can easily determine how much business the superstore needs to attract to avoid losses. If the store sells nothing, the income statement will show fixed costs of $2 million and depreciation of $450,000. Thus there will be a loss of $2.45 million. Each dollar of sales reduces this loss by $1.00 – $.8125 = $.1875. Therefore, to cover fixed costs plus depreciation, you need sales of 2.45 million/.1875 = $13.067 million. At this sales level, the firm will break even. More generally, Table below shows how the income statement looks with only $13.067 million of sales. Figure below shows how the break-even point is determined. The 45-degree line shows accounting revenues. The cost line shows how costs vary with sales. If the store doesn’t sell a cent, it still incurs fixed costs and depreciation amounting to $2.45 million. Each extra dollar of sales adds $.8125 to these costs. When sales are $13.067 million, the two lines cross, indicating that costs equal revenues. For lower sales, revenues are less than costs and the project is in the red; for higher sales, revenues exceed costs and the project moves into the black. Is a project that breaks even in accounting terms an acceptable investment? If you are not sure about the answer, here’s a possibly easier question. Would you be happy about an investment in a stock that after 5 years gave you a total rate of return of zero? We hope not. You might break even on such a stock but a zero return does not compensate you for the time value of money or the risk that you have taken. TABLE : Income Statement, break-even sales volume 2 FIGURE: Accounting break-even analysis A project that simply breaks even on an accounting basis gives you your money back but does not cover the opportunity cost of the capital tied up in the project. A project that breaks even in accounting terms will surely have a negative NPV. 3 Let’s check this with the superstore project. Suppose that in each year the store has sales of $13.067 million—just enough to break even on an accounting basis. What would be the cash flow from operations? Cash flow from operations = profit after tax + depreciation = 0 + $450,000 = $450,000 The initial investment is $5.4 million. In each of the next 12 years, the firm receives a cash flow of $450,000. So the firm gets its money back: Total cash flow from operations = initial investment 12 × $450,000 = $5.4 million But revenues are not sufficient to repay the opportunity cost of that $5.4 million investment. NPV is negative. Example: Assume we are selling a product for $2 each. The variable cost associated with producing and selling the product is 60 cents. Assume that the fixed cost related to the product is $1000. What is the break even point? Q= FC/(P-V)= 1000 / (2.00 - 0.60) = 715 units. In this example, the firm would have to sell (1000 / (2.00 - 0.60) = 715) 715 units to break even. OPERATING LEVERAGE A project’s break-even point depends on both its fixed costs, which do not vary with sales, and the profit on each extra sale. Managers often face a trade-off between these variables. For example, we typically think of rental expenses as fixed costs. But supermarket companies sometimes rent stores with contingent rent agreements. This means that the amount of rent the company pays is tied to the level of sales from the store. Rent rises and falls along with sales. The store thus replaces a fixed cost with a variable cost that rises along with sales. Because a greater proportion of the company’s expenses will fall when its sales fall, its break-even point is reduced. Of course, a high proportion of fixed costs is not all bad. The firm whose costs are largely fixed fares poorly when demand is low, but it may make a killing during a boom. Let us illustrate. 4 Finefodder has a policy of hiring long-term employees who will not be laid off except in the most dire circumstances. For all intents and purposes, these salaries are fixed costs. Its rival, Stop and Scoff, has a much smaller permanent labor force and uses expensive temporary help whenever demand for its product requires extra staff. A greater proportion of its labor expenses are therefore variable costs. Suppose that if Finefodder adopted its rival’s policy, fixed costs in its new superstore would fall from $2 million to $1.56 million but variable costs would rise from 81.25 to 84 percent of sales. Table below shows that with the normal level of sales, the two policies fare equally. In a slump a store that relies on temporary labor does better since its costs fall along with revenue. In a boom the reverse is true and the store with the higher proportion of fixed costs has the advantage. If Finefodder follows its normal policy of hiring long-term employees, each extra dollar of sales results in a change of $1.00 – $.8125 = $.1875 in pretax profits. If it uses temporary labor, an extra dollar of sales leads to a change of only $1.00 – $.84 = $.16 in profits. As a result, a store with high fixed costs is said to have high operating leverage. High operating leverage magnifies the effect on profits of a fluctuation in sales. We can measure a business’s operating leverage by asking how much profits change for each 1 percent change in sales. The degree of operating leverage, often abbreviated as DOL, is this measure. For example, Table below shows that as the store moves from normal conditions to boom, sales increase from $16 million to $19 million, a rise of 18.75 percent. For the policy with high fixed costs, profits increase from $550,000 to $1,112,000, a rise of 102.2 percent. Therefore, 5 , OPERATING LEVERAGE Degree to which costs are fixed. DEGREE OF OPERATING LEVERAGE (DOL) Percentage change in profits given a 1 percent change in sales. TABLE: Astore with high operating leverage performs relatively badly in a slump but flourishes in a boom (figures in thousands of dollars) Now look at the operating leverage of the store if it uses the policy with low fixed costs but high variable costs. As the store moves from normal times to boom, profits increase from $550,000 to $1,030,000, a rise of 87.3 percent. Therefore, Because some costs remain fixed, a change in sales continues to have a magnified effect on profits but the degree of operating leverage is lower. In fact, one can show that degree of operating leverage depends on fixed charges (including depreciation) in the following manner: This relationship makes it clear that operating leverage increases with fixed costs. 6 LEVERAGE AND CAPITAL STRUCTURE The Capital Structure Question How should a firm go about choosing its debt-equity ratio? Here, as always, we assume that the guiding principle is to choose the course of action that maximizes the value of a share of stock. However, when it comes to capital structure decisions, this is essentially the same thing as maximizing the value of the whole firm, and, for convenience, we will tend to frame our discussion in terms of firm value. The WACC (Weighted Average Cost of Capital) tells us that the firm’s overall cost of capital is a weighted average of the costs of the various components of the firm’s capital structure. When we described the WACC, we took the firm’s capital structure as given. Thus, one important issue that we will want to explore is what happens to the cost of capital when we vary the amount of debt financing, or the debt-equity ratio. A primary reason for studying the WACC is that the value of the firm is maximized when the WACC is minimized. The WACC is the discount rate appropriate for the firm’s overall cash flows. Since values and discount rates move in opposite directions, minimizing the WACC will maximize the value of the firm’s cash flows. Thus, we will want to choose the firm’s capital structure so that the WACC is minimized. For this reason, we will say that one capital structure is better than another if it results in a lower weighted average cost of capital. Further, we say that a particular debt equity ratio represents the optimal capital structure if it results in the lowest possible WACC. This optimal capital structure is sometimes called the firm’s target capital structure as well. CONCEPT QUESTIONS • What is the relationship between the WACC and the value of the firm? • What is an optimal capital structure? The Effect of Financial Leverage In this section, we examine the impact of financial leverage on the payoffs to stockholders. As you may recall, financial leverage refers to the extent to which a firm relies on debt. The more debt financing a firm uses in its capital structure, the more financial leverage it employs. 7 As we describe, financial leverage can dramatically alter the payoffs to shareholders in the firm. Remarkably, however, financial leverage may not affect the overall cost of capital. If this is true, then a firm’s capital structure is irrelevant because changes in capital structure won’t affect the value of the firm. THE IMPACT OF FINANCIAL LEVERAGE We start by illustrating how financial leverage works. For now, we ignore the impact of taxes. Also, for ease of presentation, we describe the impact of leverage in terms of its effects on earnings per share, EPS, and return on equity, ROE. These are, of course, accounting numbers and, as such, are not our primary concern. Using cash flows instead of these accounting numbers would lead to precisely the same conclusions, but a little more work would be needed. TABLE B.3 Current and proposed capital structures for the Trans Am Corporation Financial Leverage, EPS, and ROE: An Example The Trans Am Corporation currently has no debt in its capital structure. The CFO, Ms. Morris, is considering a restructuring that would involve issuing debt and using the proceeds to buy back some of the outstanding equity. Table above presents both the current and proposed capital structures. As shown, the firm’s assets have a market value of $8 million, and there are 400,000 shares outstanding. Because Trans Am is an all-equity firm, the price per share is $20. The proposed debt issue would raise $4 million; the interest rate would be 10 percent. Since the stock sells for $20 per share, the $4 million in new debt would be used to purchase $4 8 million/20 = 200,000 shares, leaving 200,000 outstanding. After the restructuring, Trans Am would have a capital structure that was 50 percent debt, so the debt-equity ratio would be 1. Notice that, for now, we assume that the stock price will remain at $20. To investigate the impact of the proposed restructuring, Ms. Morris has prepared Table below, which compares the firm’s current capital structure to the proposed capital structure under three scenarios. The scenarios reflect different assumptions about the firm’s EBIT. Under the expected scenario, the EBIT is $1 million. In the recession scenario, EBIT falls to $500,000. In the expansion scenario, it rises to $1.5 million. To illustrate some of the calculations in Table below, consider the expansion case. EBIT is $1.5 million. With no debt (the current capital structure) and no taxes, net income is also $1.5 million. In this case, there are 400,000 shares worth $8 million total. EPS is therefore $1.5 million/400,000 = $3.75 per share. Also, since accounting return on equity, ROE, is net income divided by total equity, ROE is $1.5 million/8 million = 18.75%. With $4 million in debt (the proposed capital structure), things are somewhat different. Since the interest rate is 10 percent, the interest bill is $400,000. With EBIT of $1.5 million, interest of $400,000, and no taxes, net income is $1.1 million. Now there are only 200,000 shares worth $4 million total. EPS is therefore $1.1 million/200,000 = $5.5 per share versus the $3.75 per share that we calculated above. Furthermore, ROE is $1.1 million/4 million = 27.5%. This is well above the 18.75 percent we calculated for the current capital structure. EPS versus EBIT The impact of leverage is evident in Table below when the effect of the restructuring on EPS and ROE is examined. In particular, the variability in both EPS and ROE is much larger under the proposed capital structure. This illustrates how financial leverage acts to magnify gains and losses to shareholders. In Figure below, we take a closer look at the effect of the proposed restructuring. This figure plots earnings per share, EPS, against earnings before interest and taxes, EBIT, for the current and proposed capital structures. The first line, labeled “No debt,” represents the case of no leverage. This line begins at the origin, indicating that EPS would be zero if EBIT were zero. From there, every $400,000 increase in EBIT increases EPS by $1 (because there are 400,000 shares outstanding). 9 TABLE Capital structure scenarios for the Trans Am Corporation The second line represents the proposed capital structure. Here, EPS is negative if EBIT is zero. This follows because $400,000 of interest must be paid regardless of the firm’s profits. Since there are 200,000 shares in this case, the EPS is –$2 per share as shown. Similarly, if EBIT were $400,000, EPS would be exactly zero. The important thing to notice in Figure is that the slope of the line in this second case is steeper. In fact, for every $400,000 increase in EBIT, EPS rises by $2, so the line is twice as steep. This tells us that EPS is twice as sensitive to changes in EBIT because of the financial leverage employed. Another observation to make in Figure is that the lines intersect. At that point, EPS is exactly the same for both capital structures. To find this point, note that EPS is equal to EBIT/400,000 in the no-debt case. In the with-debt case, EPS is (EBIT – $400,000)/200,000. If we set these equal to each other, EBIT is: EBIT/400,000 = (EBIT – $400,000)/200,000 EBIT =2 * (EBIT – $400,000) EBIT = $800,000 10 When EBIT is $800,000, EPS is $2 per share under either capital structure. This is labeled as the break-even point in Figure; we could also call it the indifference point. If EBIT is above this level, leverage is beneficial; if it is below this point, it is not. There is another, more intuitive, way of seeing why the break-even point is $800,000. Notice that, if the firm has no debt and its EBIT is $800,000, its net income is also $800,000. In this case, the ROE is $800,000/8,000,000 = 10%. This is precisely the same as the interest rate on the debt, so the firm earns a return that is just sufficient to pay the interest. EXAMPLE: BREAK-EVEN EBIT The MPD Corporation has decided in favor of a capital restructuring. Currently, MPD uses no debt financing. Following the restructuring, however, debt will be $1 million. FIGURE Financial leverage: EPS and EBIT for the Trans Am Corporation 11 The interest rate on the debt will be 9 percent. MPD currently has 200,000 shares outstanding, and the price per share is $20. If the restructuring is expected to increase EPS, what is the minimum level for EBIT that MPD’s management must be expecting? Ignore taxes in answering. To answer, we calculate the break-even EBIT. At any EBIT above this the increased financial leverage will increase EPS, so this will tell us the minimum level for EBIT. Under the old capital structure, EPS is simply EBIT/200,000. Under the new capital structure, the interest expense will be $1 million * .09 = $90,000. Furthermore, with the $1 million proceeds, MPD will repurchase $1 million/20 = 50,000 shares of stock, leaving 150,000 outstanding. EPS is thus (EBIT – $90,000)/150,000. Now that we know how to calculate EPS under both scenarios, we set them equal to each other and solve for the break-even EBIT: EBIT/200,000 = (EBIT – $90,000)/150,000 EBIT =(4/3) * (EBIT – $90,000) EBIT = $360,000 Verify that, in either case, EPS is $1.80 when EBIT is $360,000. Management at MPD is apparently of the opinion that EPS will exceed $1.80. 12