S - Texas Legislature Online

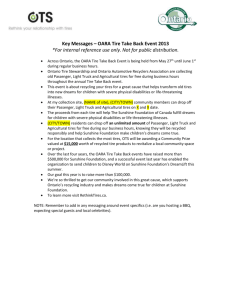

advertisement