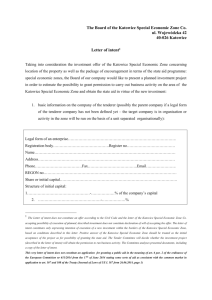

Regulations of Katowice Special Economic Zone

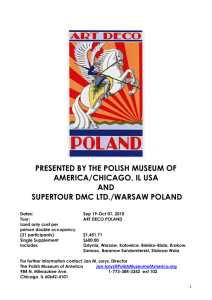

advertisement

Regulations of Katowice Special Economic Zone Pursuant to article 10 item 2 of the Act of October 20th 1994 on special economic zones ((Journal of Laws of 1996 No. 123, item 600, No. 106 item 496 and of 1997 No. 121 item 770.) the present Regulation effective within the territory of Katowice Special Economic Zone is issued. Section 1 General articles § 1. 1. Regulations define methods of performing management over Katowice Special Economic Zone, hereinafter called the ”Zone”, by Katowice Special Economic Zone Co. with its registered office in Katowice, hereinafter called “Manager”. 2. The word “Act” used in the Regulation refers to the Act on special economic zones quoted above. 3. “Subzone” refers to the group of plots as per the Appendix to the ordinance of the Council of Ministers of June 18th 1996 on establishment of the special economic zone in the Province of Katowice. (Journal of Laws, No. 88, item 397 and 1997 No. 28 item 155.) § 2. Regulation is effective on the whole territory of the Katowice Special Economic Zone consisting of the four subzones Gliwice subzone Jastrzębie-Żory subzone Sosnowiec-Dąbrowa subzone Tychy subzone Section 2 Competence and responsibilities of Manager §3 1. Manager is authorized specifically to: 1) Carry out tenders or negotiations with entrepreneurs applying for a permit to conduct business activity on the territory of the Zone, and perform audits aiming at verification of compliance of the activity performed by the entities with the conditions defined in the permit, pursuant to the regulation issued in accordance with article 17 of the Act, 2) issuing, on behalf of Minister of Economy, the permit for conducting business activity within the territory of the Zone and performing the audit of the entities, which hold the permit, according to the Regulation of the Minister of Economy of May 6th, 1997 on authorizing Katowice Special Economic Zone Co. to grant the permits for conducting business activity and performing the audit of the operation of the companies on the territory of the Katowice Special Economic Zone and defining the scope of these audits (M.P. - Official Gazette of the Republic of Poland No. 30, item 285.) 3) issuance of the opinions for the Minister of Economy about the entities applying for permit for conducting business activity within the Zone, in cases defined in the article 17, section 2 of the Act. 4) Issuance of the opinion prior to publishing the decision by Minister of Economy on withdrawing or altering the permit in accordance with article 16 section 6 of the Act. 5) Property right and perpetual usufruct pre-emption for the territories located within the Zone, as per article 8 section 2 of the Act, 6) Keeping the record of the companies operating in the Zone. 2. By means of separately concluded agreements Manager can run the tenders to sell, let for perpetual usufruct or lease the properties located within the Zone, and not being owned by Manager. Manager charges provision for this activity. § 4. 1. Keeping the record of the companies conducting business activity within the Zone, in accordance with § 3, section 1, point 6 is aimed specifically at: a) monitoring the location of the companies b) keeping and updating the location plans of the Zone c) maintaining the information services on the Zone d) calculating and collecting all the relevant charges on account of Manager’s costs, as per § 12 and 13 of the hereto regulation. 2. Owners or amenable owners of the properties located within the Zone are obliged to report the intention of starting any business activity not included in the permit to the record. 3. The record of the companies is the basis for concluding the agreements with these companies for services and administrative functions performed by the Manager in the Zone and defining the costs related to the administration within the Zone and maintaining the general infrastructure. § 5. 1. Manager defines the directions of development of the Zone. In order to do this Manager: 1) Gathers and provides the geodesic information aimed at helping the potential investor in making the decision about location of the business activity in the Zone, 2) Runs the information system supporting investors’ choice in terms of relevant economic partners in investments carried in the zone, 3) Provides support and facilitates the contacts between the companies and owners of the infrastructure in order to gain access to the utilities. Section 3. Use of utilities and other infrastructure items. §6 1. Business entities operating within the Zone gain access to such utilities as: electric energy, natural gas, water, heating, dialup access, and access to the disposal facilities for sewage, industrial and municipal waste, and to other items of infrastructure, as per the conditions defined in the contracts with utilities suppliers. 2. The contracts for access to the utilities as per section 1, can require the relevant infrastructure to be constructed, with respect to the investment location. Contracts for disposal of sewage, industrial and municipal waste, can require the sewage treatment plant or other similar facility to be constructed, based on water supply and sewage disposal consent. 3. Unless the contract between the supplier and the entrepreneur states otherwise, the entrepreneur is charged with the costs of providing the infrastructure connection. §7 Infrastructure development planning and land development concept, including architectural designs of buildings, in which the business activity is to be conducted, are presented to the Manager for acceptation. Section 4 Natural environment and Zone territory protection §8 1. Manager evaluates the entrepreneurs’ motions to issue the decision about the acceptable atmospheric pollution emission, to be submitted to the public administration organs. 2. Entrepreneur operating in the Zone which holds the decision about the acceptable atmospheric pollution emission, is obliged present this decision to the Manager. 3. Violation of the provisions of the decision mentioned in point 2 can become grounds for withdrawal of the permit for conducting business activity in the Zone. §9 1. Any owner, perpetual user or leaser of the lands within the Zone, on premises of which the roads, yards, pedestrian routes and greenstones are located, are obliged to maintain these in the appropriate condition. 2. Safeguard and security of the plots and facilities located within the Zone is within the responsibility of the owners, perpetual users or amenable owners. § 10. In case the lease or perpetual usufruct contract of the plot located in the Zone is annulled, the entrepreneur who terminates the business activity in the Zone is obliged to repair the damages being the result of the entrepreneur’s activity and to reclaim the land as defined in separate regulations. This obligation also applies to any owner of the property located within the Zone. Section 5. Costs related to administration of the Zone and maintaining its infrastructure § 11. 1. Entrepreneurs and entities which own or have other rights to the land located within the Zone is obliged to pay the costs incurred by the Manager or other entity, to which the services related to administration of the Zone and maintenance of general infrastructure of the Zone were subcontracted. 2. Participation in costs is defined by the Manger, with respect to the size occupied by the entrepreneur, type of activity performed, level of employment, turnover and freight traffic. § 12. Costs related to Zone administration include: 1. running the record of companies and location decisions 2. maintaining the information service 3. monitoring the companies’ activities compliance with the relevant permits 4. costs of other activities related to the general administrative service § 13. Costs defined in § 12 do not include costs of expertise, appraisals, analyses, documentations, preparation and updating of the land maps, prepared in response to the individual needs of the entrepreneurs operating in the Zone. § 14. Charges on account of costs as defined in § 12 and 13 are collected in advance quarterly. First payment is established based on the investor’s declaration and is settled after the first period of investor’s operation. Section 6 Final provisions § 15 Regulation of September 5th 1996 determines. § 16 Present regulation comes into force once approved by the Minister of Economy.